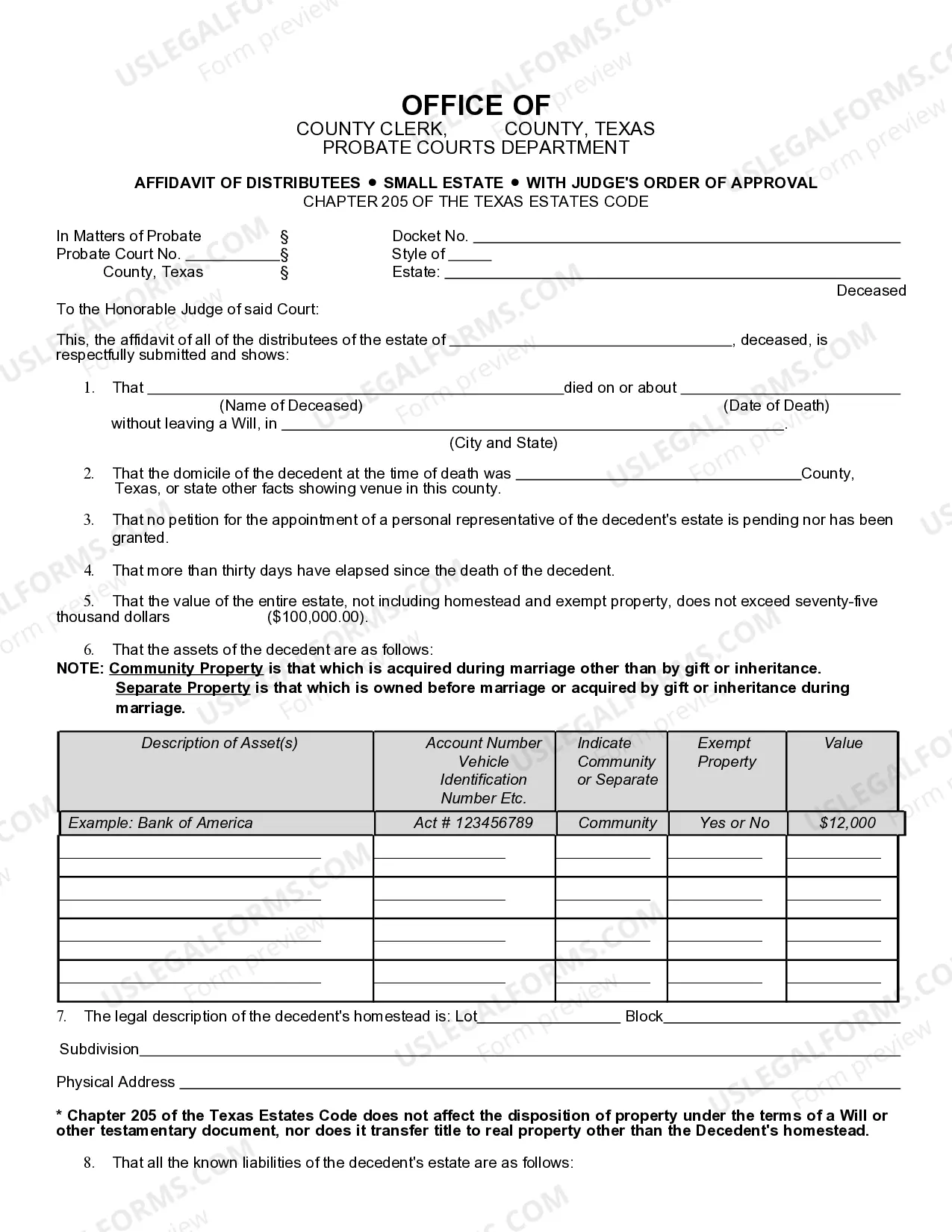

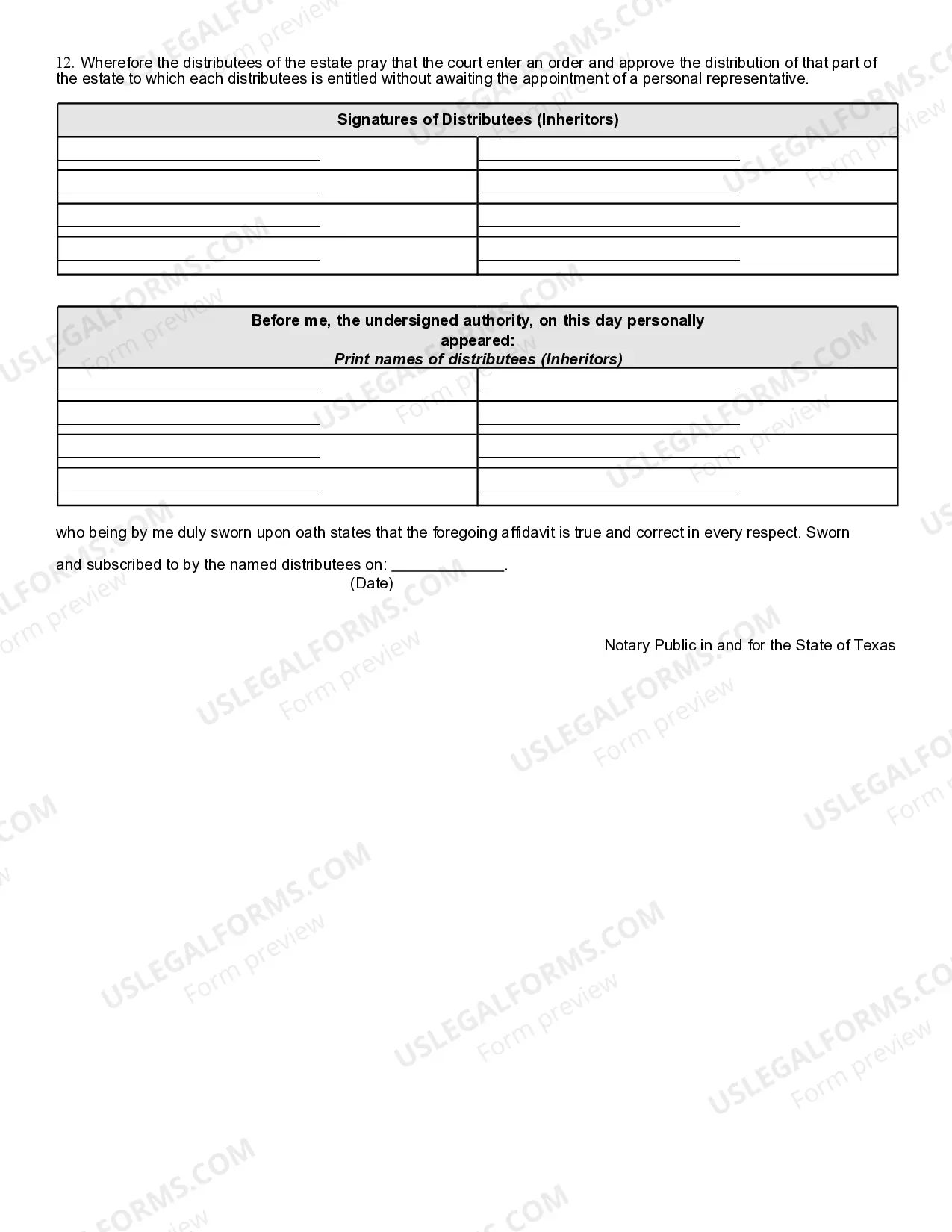

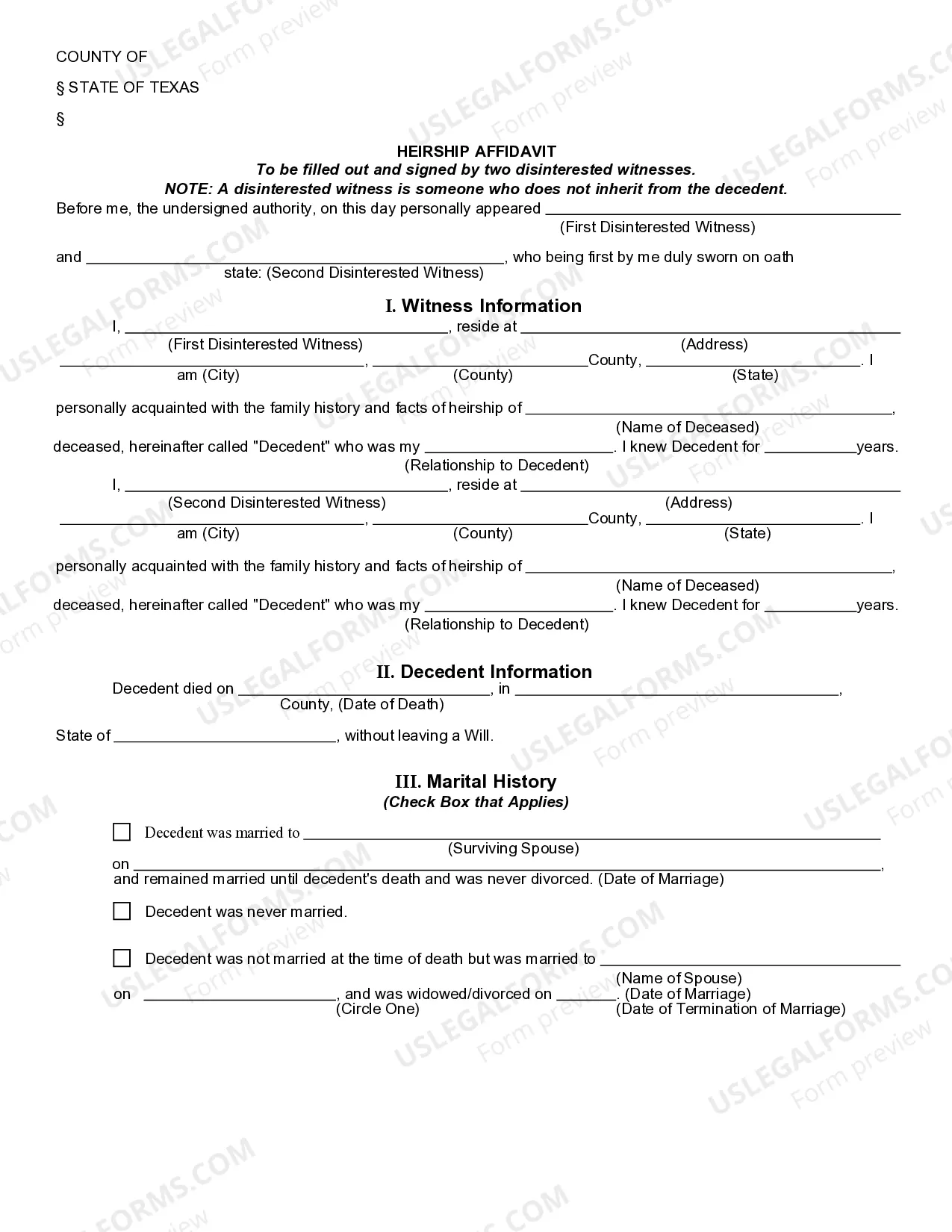

Texas Small Estate Affidavit for Estates

Description

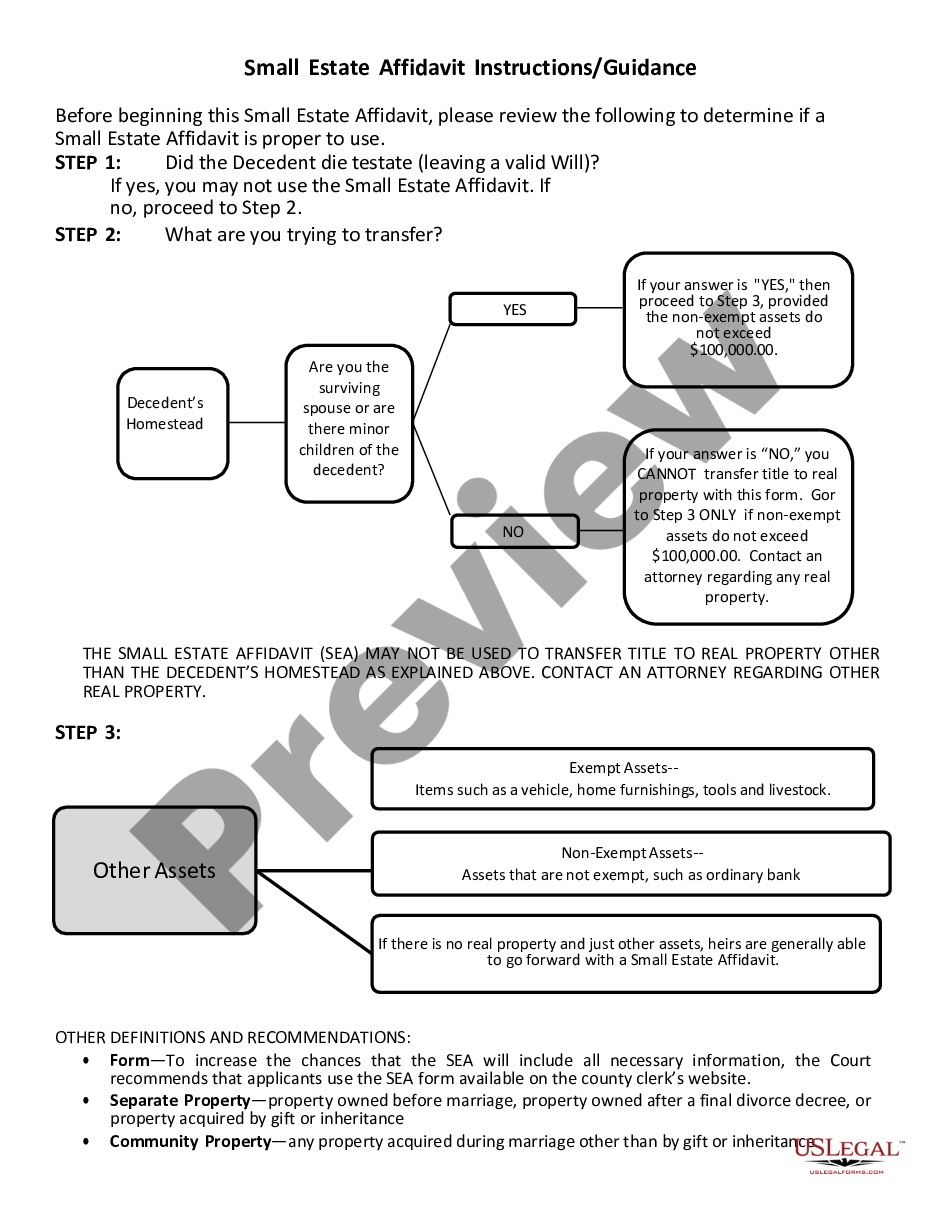

Following death, both the homestead and certain personal property of the decedent is exempt from and therefore passes free from most creditor claims. If the decedent is survived by a spouse, minor child, or adult child living in the home, his or her homestead and up to $100,000 in personal property specified under the Texas Property Code Section 42.002(a)1 passes free from claims of general creditors of the estate. In the event the home is sold, the proceeds of the sale also pass free from claims of general creditors.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.