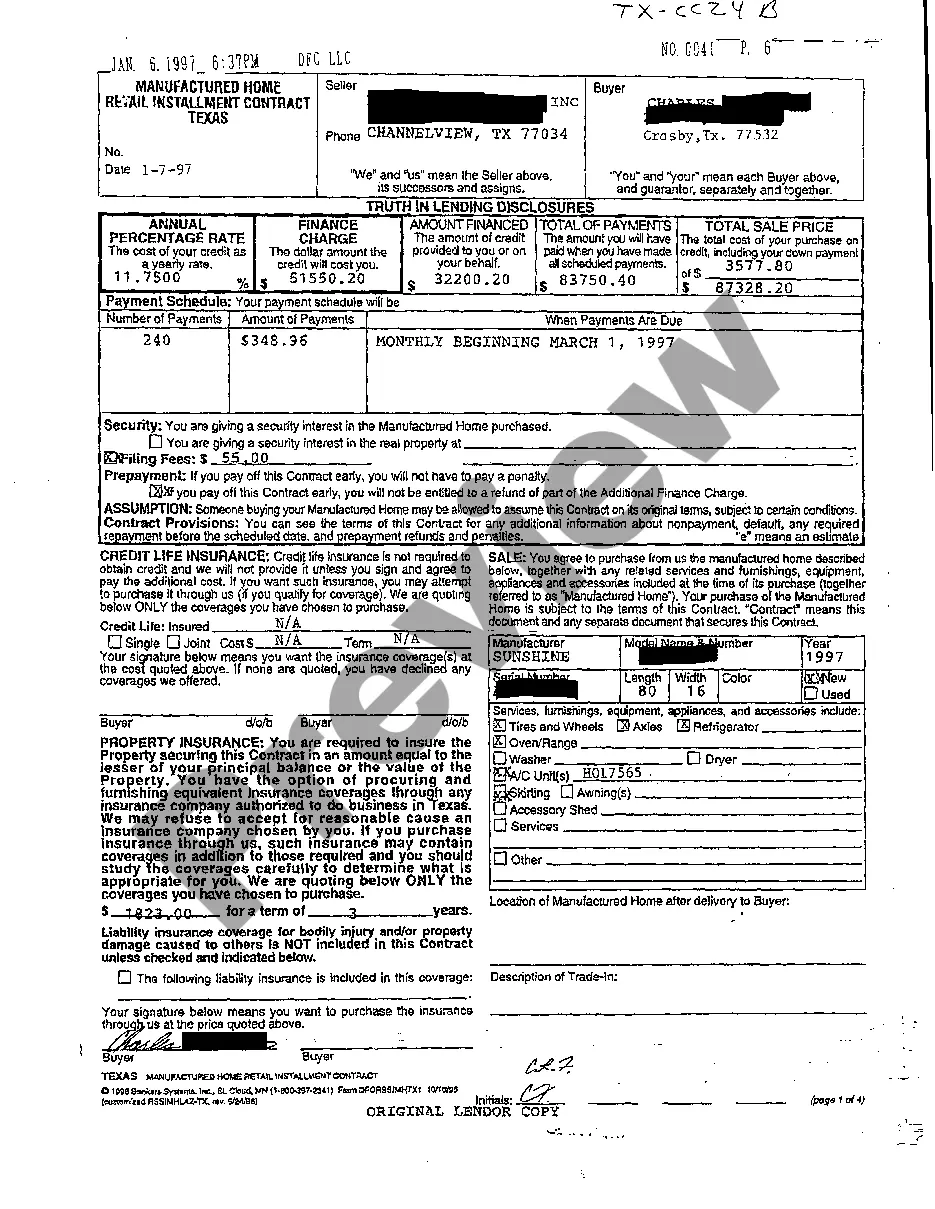

Texas Truth In Lending Disclosures

Description

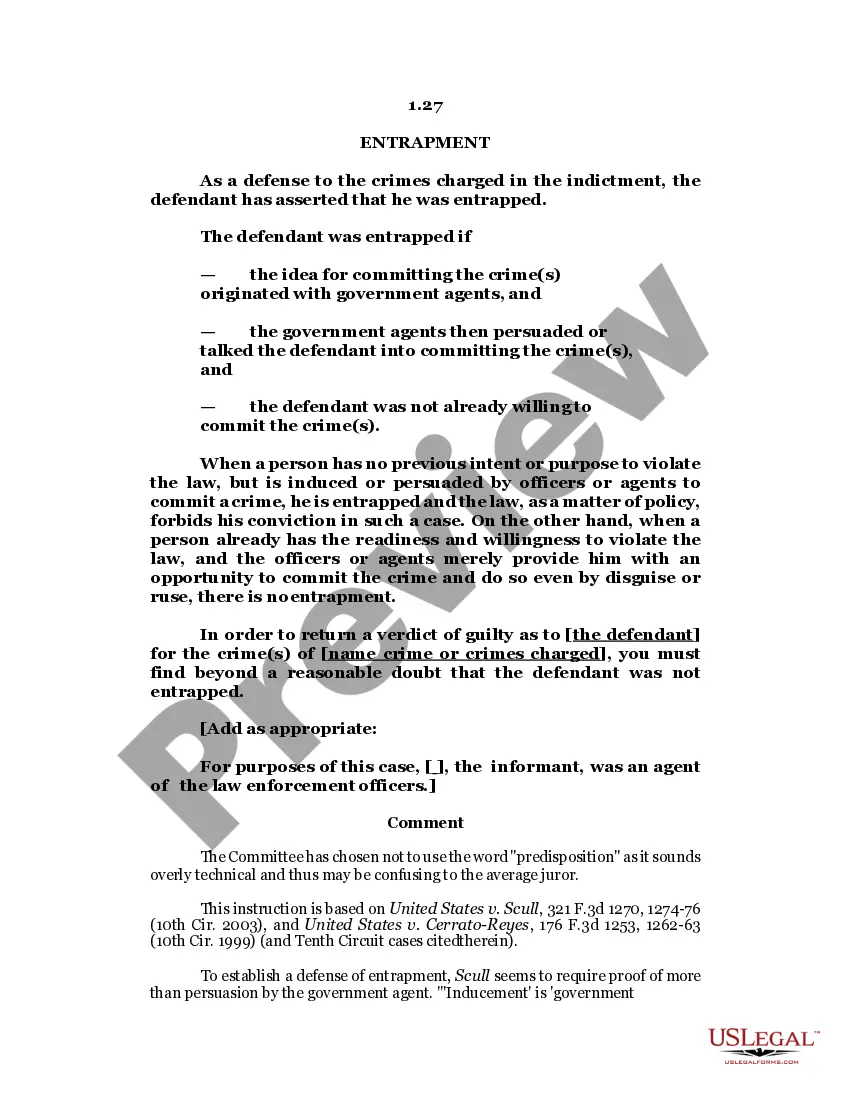

Key Concepts & Definitions of A03 Truth in Lending Disclosures

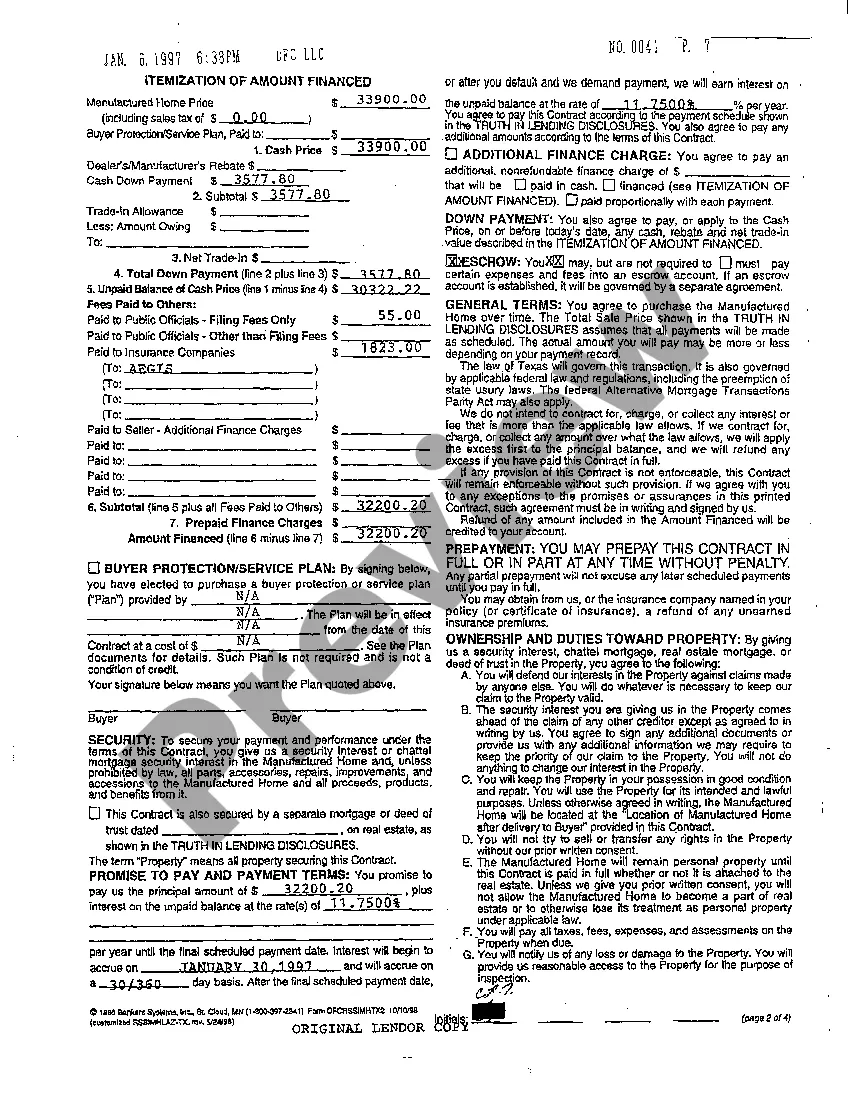

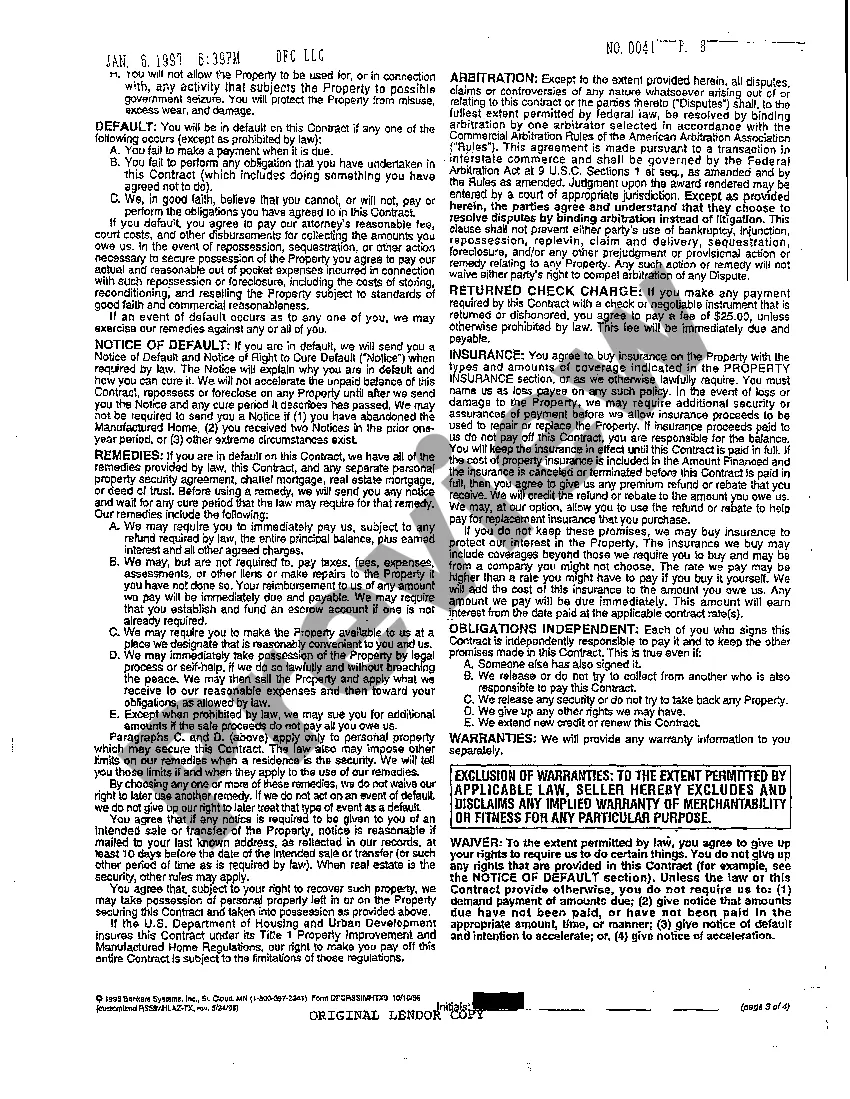

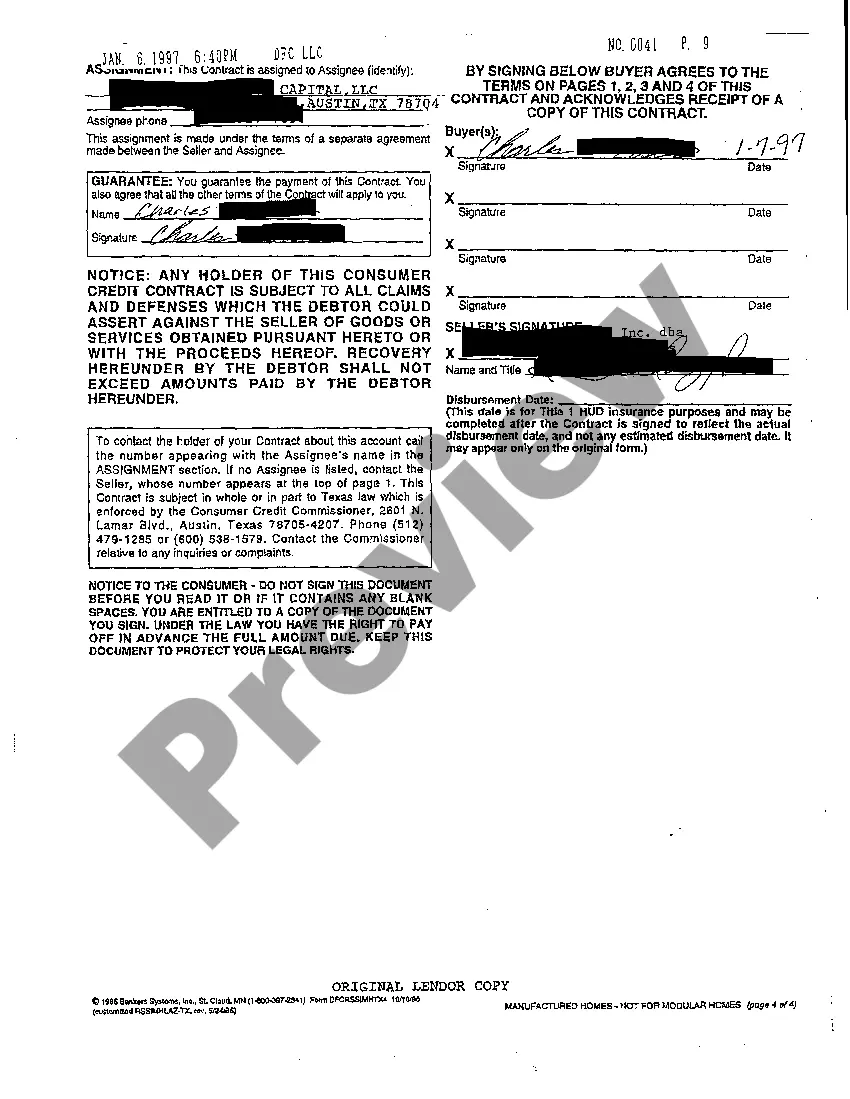

The A03 Truth in Lending Disclosures refer to critical documents that must be provided to borrowers in the United States as part of the loan agreement process under the Truth in Lending Act (TILA). These documents are designed to inform borrowers about the terms, conditions, costs, and fees associated with a loan, allowing them to make informed financial decisions.

Step-by-Step Guide to Understanding A03 Truth in Lending Disclosures

- Review the Annual Percentage Rate (APR): This rate includes not only the interest rate but also other costs related to the loan.

- Study the Finance Charge: This includes all charges, paid directly or indirectly by the person to whom the credit is extended, and which are imposed directly or indirectly by the creditor as an incident to the extension of credit.

- Examine the Amount Financed: This is the total amount of credit provided to the borrower.

- Check the Total of Payments: This represents the total payments the borrower will have made by the time the loan is paid off.

Risk Analysis of Lacking Complete A03 TIL Disclosures

Failing to provide or understand comprehensive A03 Truth in Lending Disclosures can lead to several risks including unexpected debt burdens due to undisclosed charges, legal penalties for lenders failing compliance checks, and potential financial instability for borrowers unaware of the full terms of their loans.

Common Mistakes & How to Avoid Them

- Ignoring APR Differences: Mistaking APR for just the interest rate and not accounting for comprehensive costs.

- Overlooking Total Cost: Focusing only on monthly payments without considering the total repayment amount over time.

- Not Shopping Around: Failing to compare different TIL disclosures from various lenders could result in less favorable loan terms.

FAQ

- What does APR include? APR includes interest rate plus other costs such as broker fees, and certain closing costs.

- Why is the Amount Financed less than the loan amount? This can occur due to prepaid finance charges, which are deducted from the loan amount.

- How often must the A03 disclosures be provided? Initially at the time of application and upon any major changes in the terms before the final agreement.

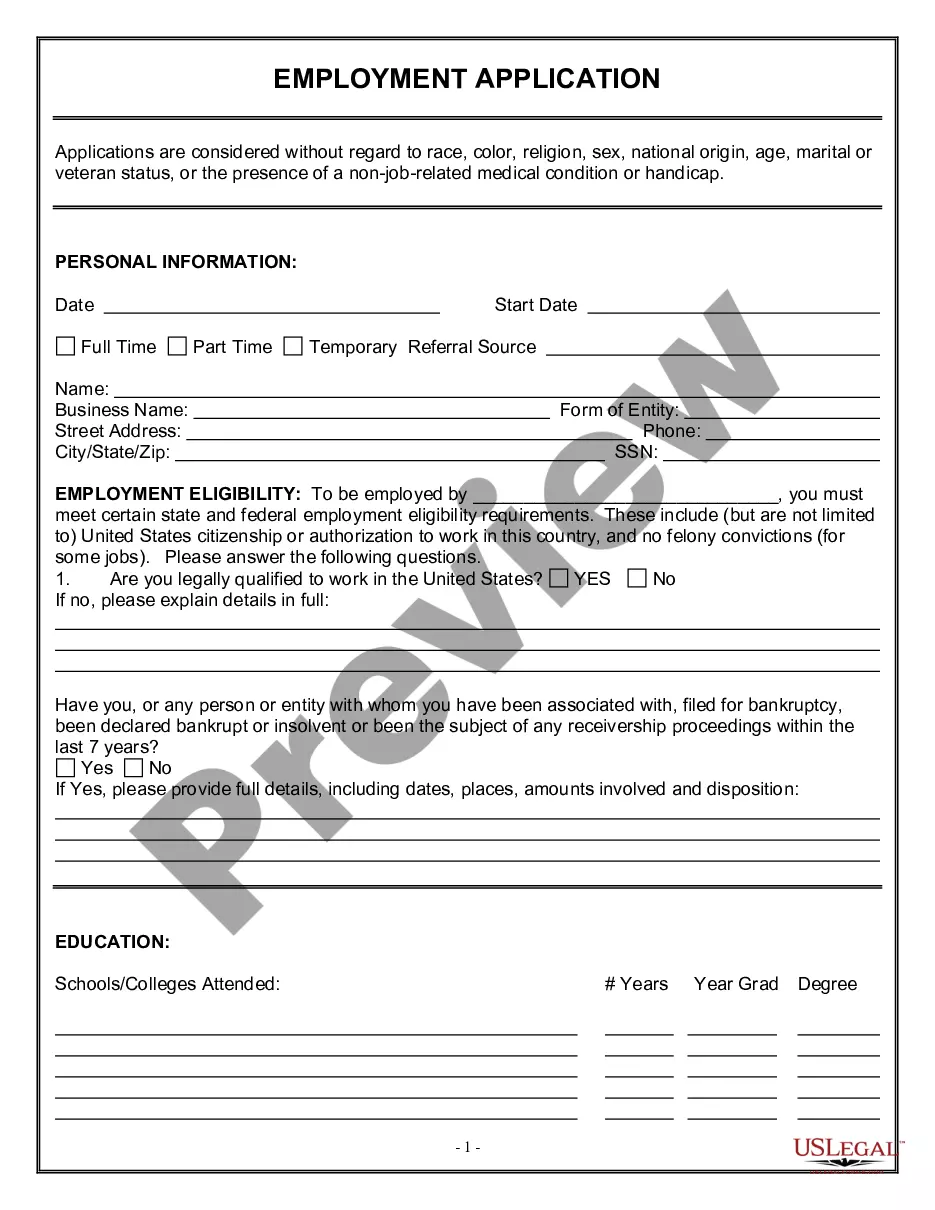

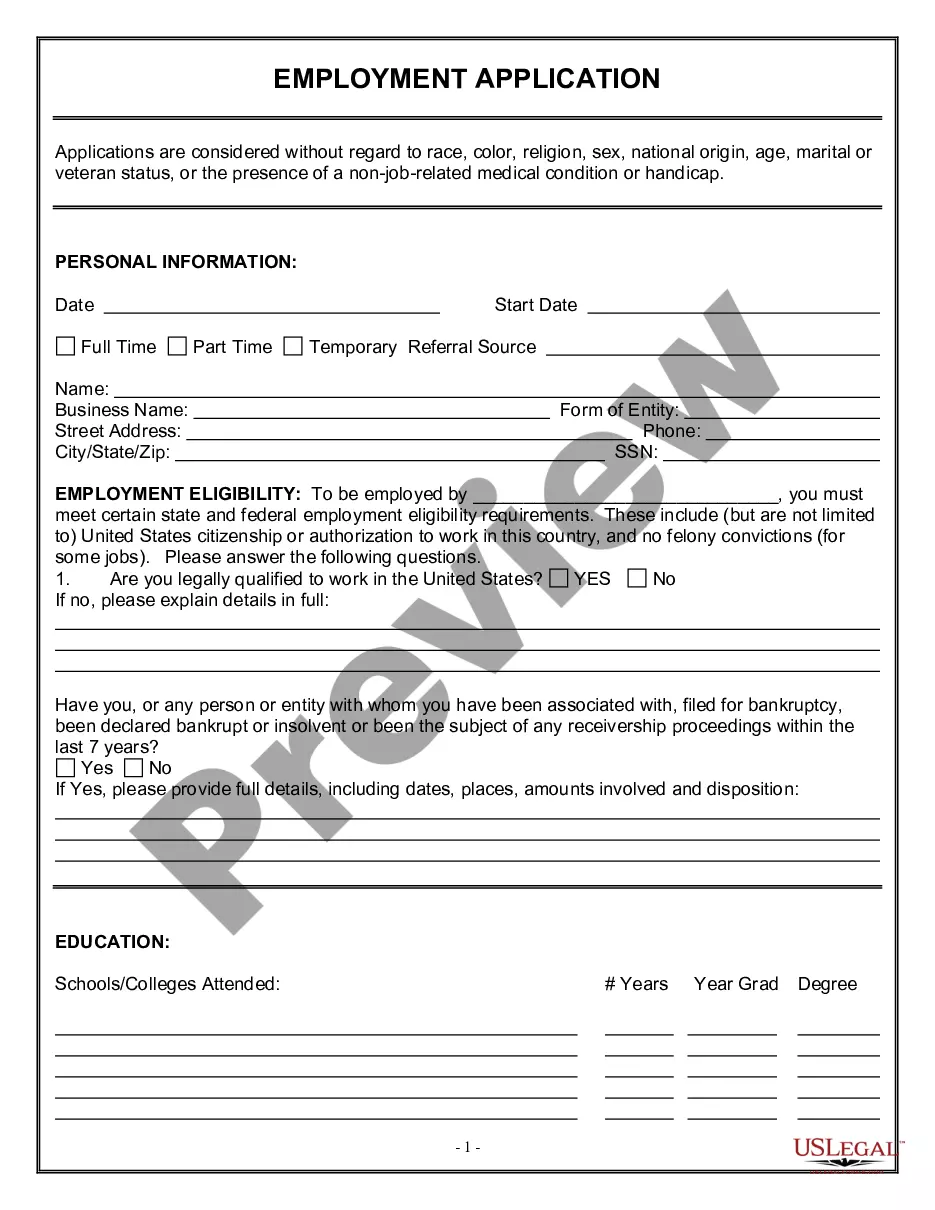

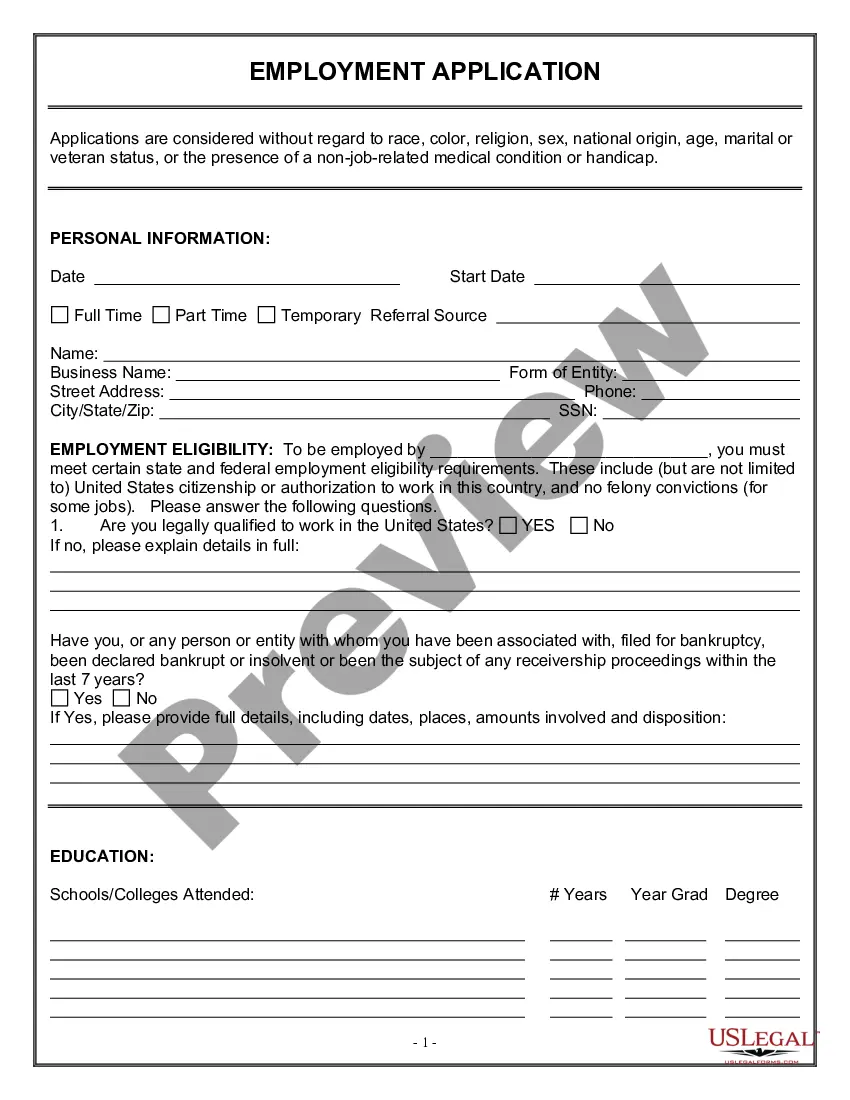

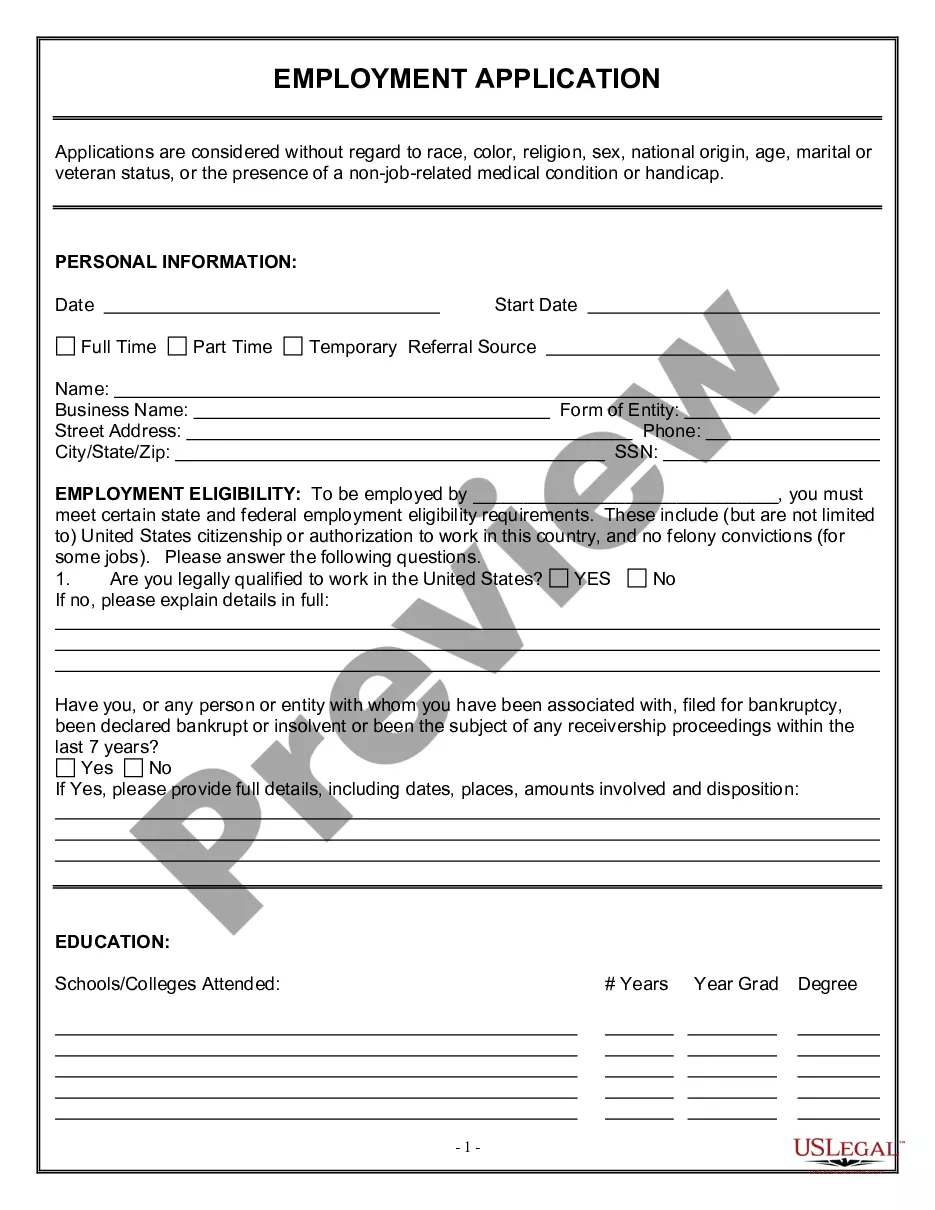

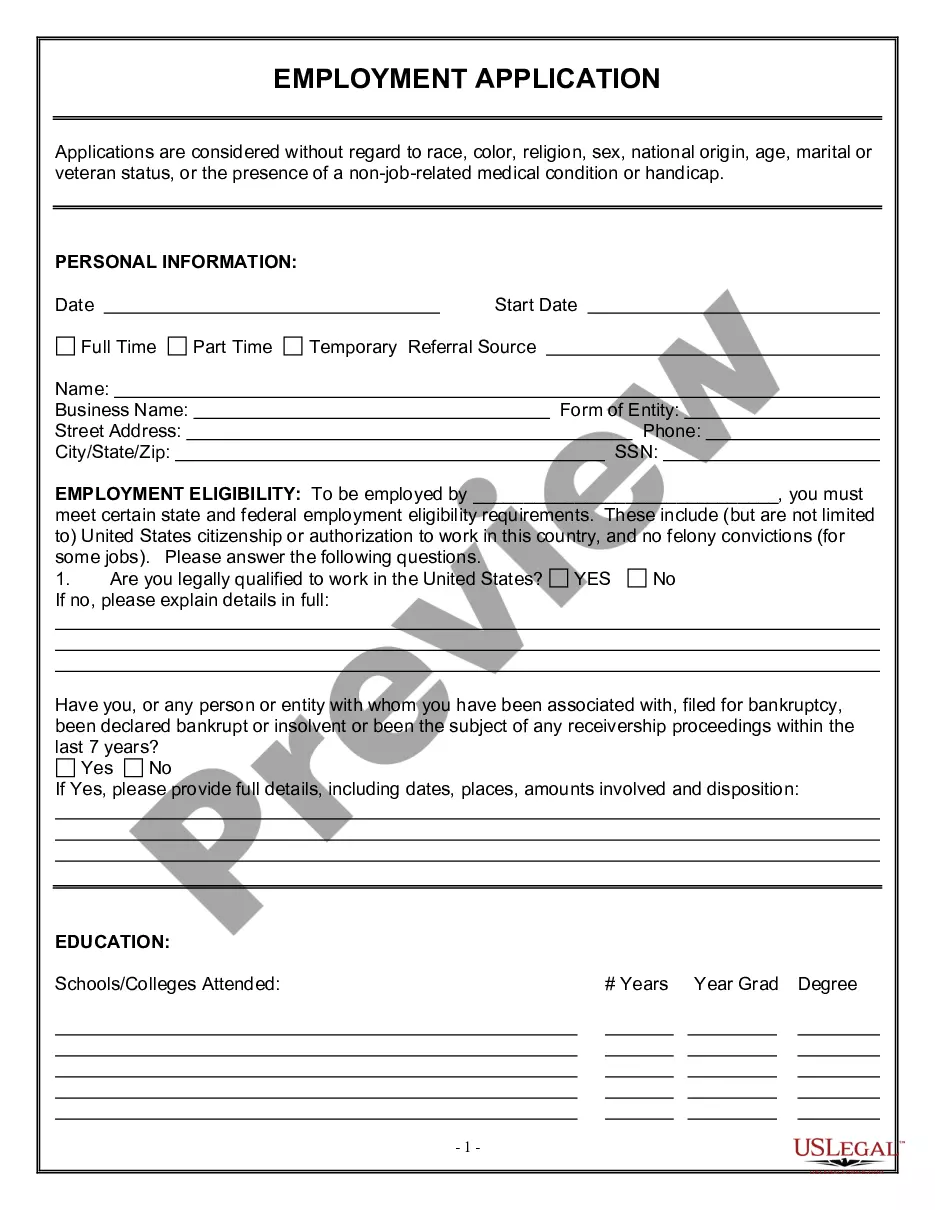

How to fill out Texas Truth In Lending Disclosures?

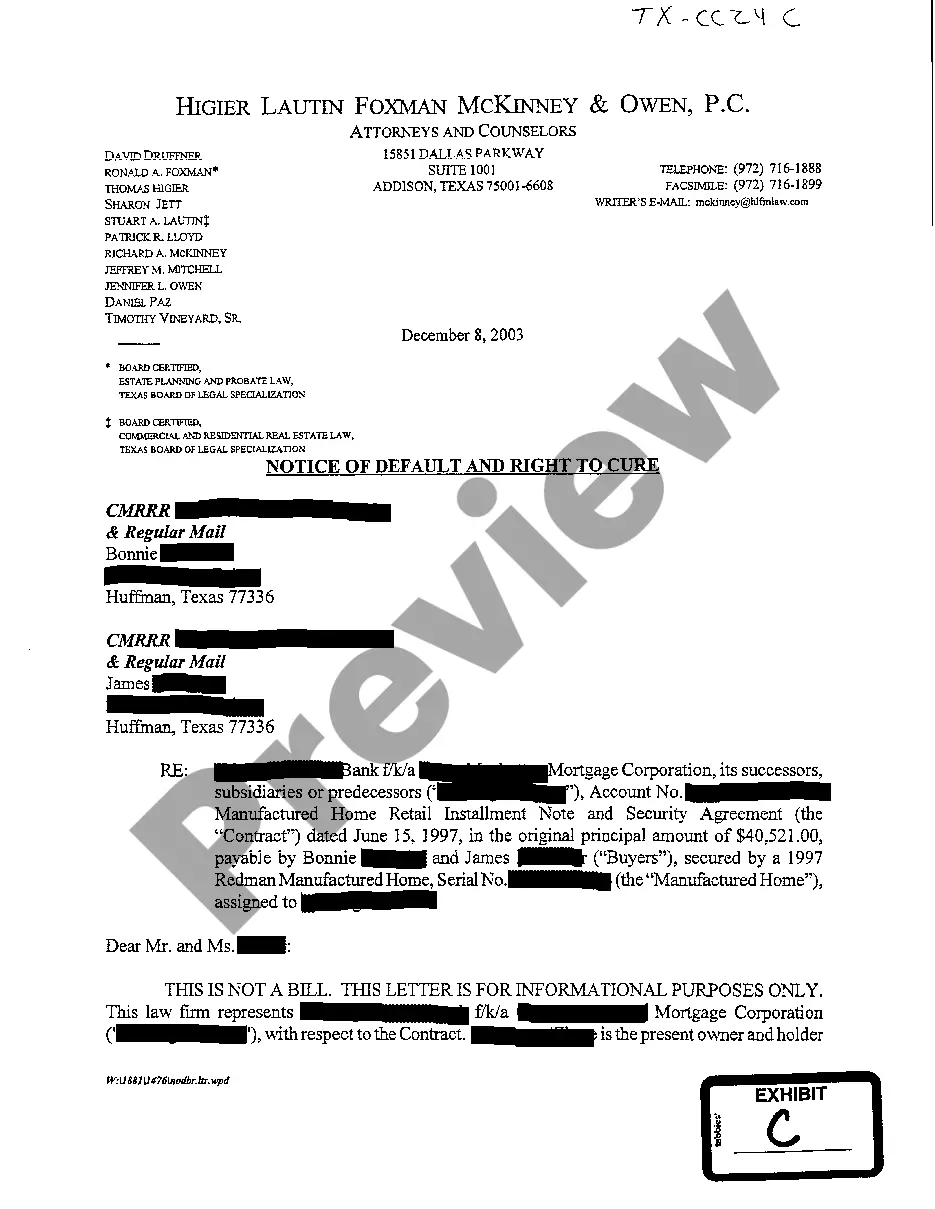

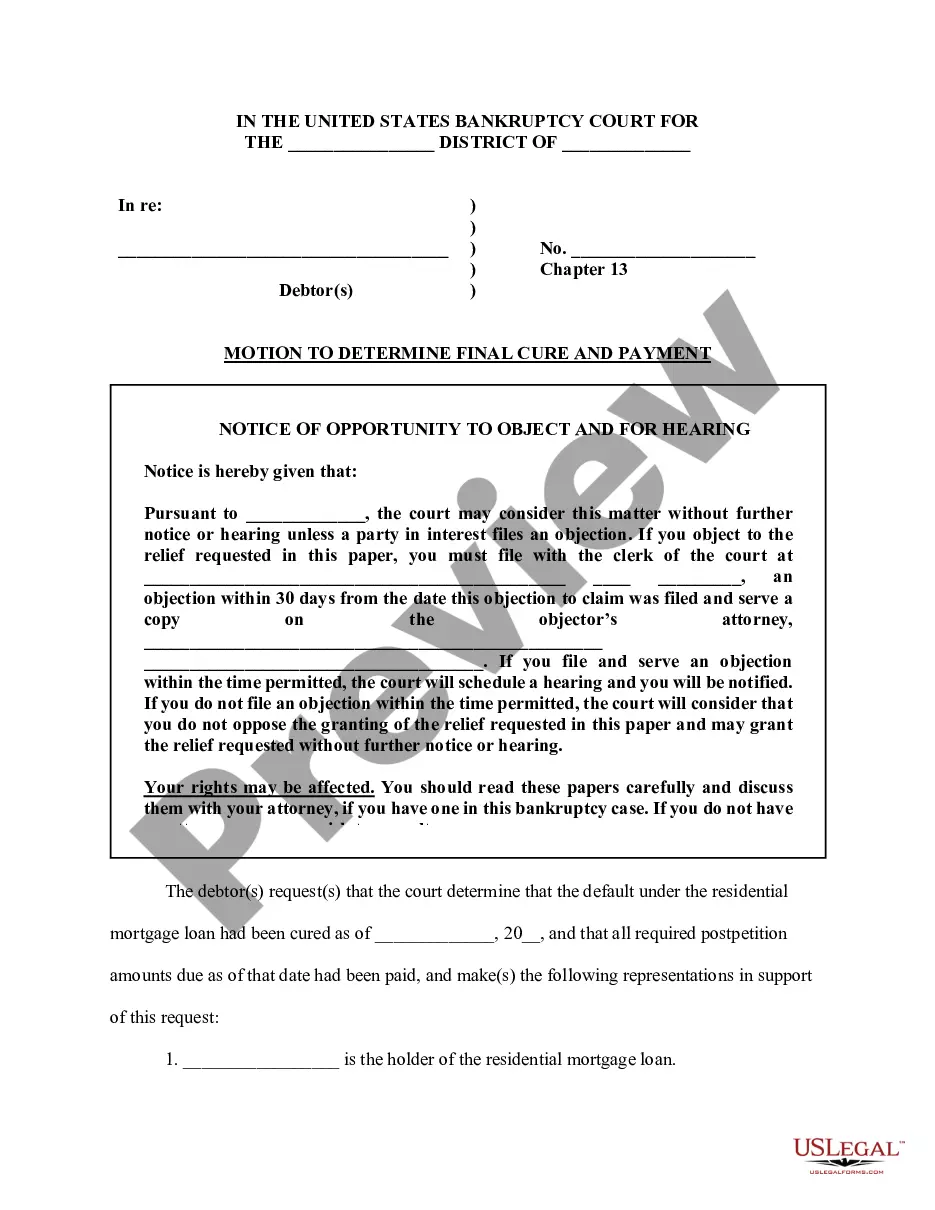

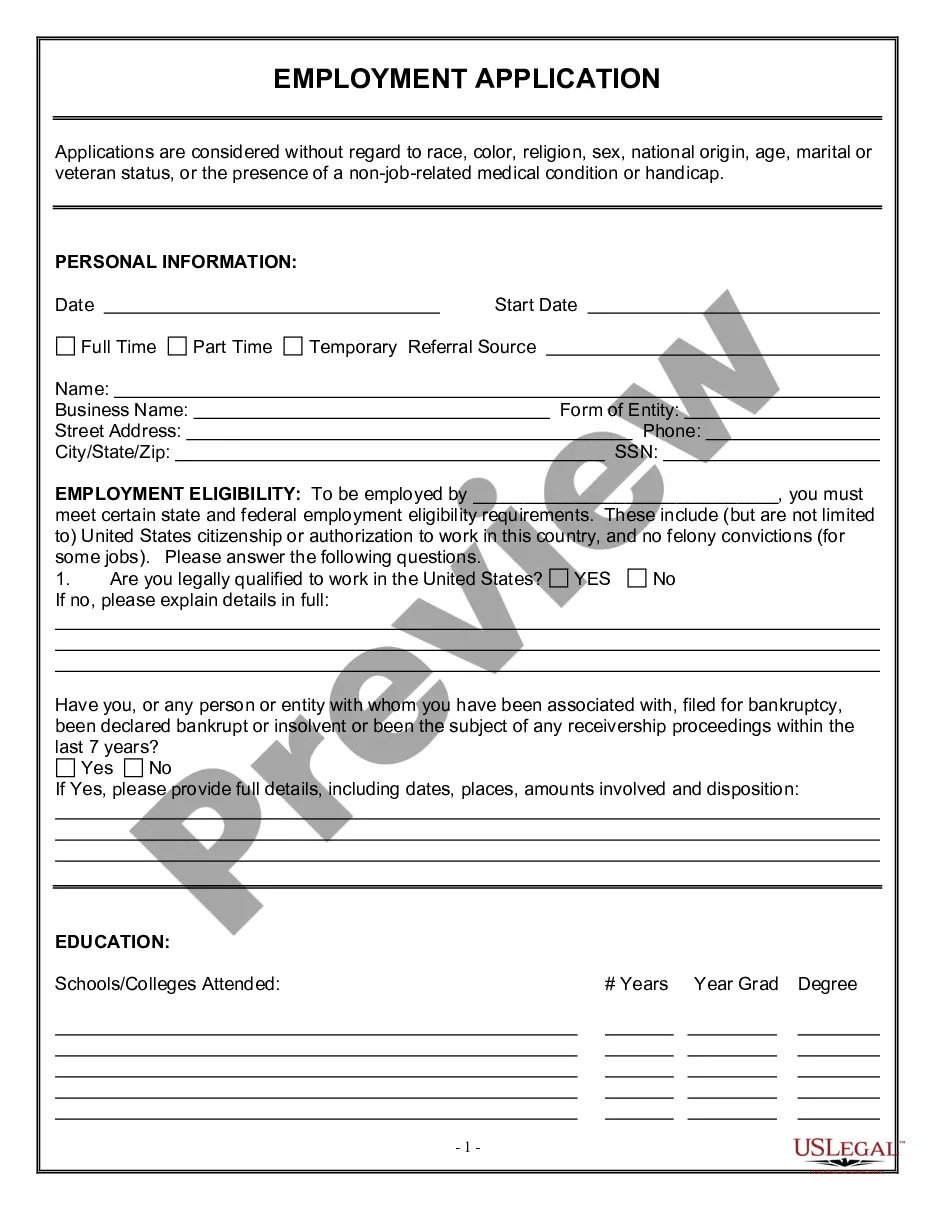

Access to top quality Texas Truth In Lending Disclosures templates online with US Legal Forms. Prevent hours of misused time searching the internet and dropped money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Find above 85,000 state-specific authorized and tax forms that you could save and fill out in clicks in the Forms library.

To find the example, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Verify that the Texas Truth In Lending Disclosures you’re considering is suitable for your state.

- Look at the form making use of the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay out by card or PayPal to complete making an account.

- Pick a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Truth In Lending Disclosures sample and fill it out online or print it out and do it by hand. Take into account sending the file to your legal counsel to make sure things are completed appropriately. If you make a mistake, print and complete application once again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and access far more samples.

Form popularity

FAQ

A Truth in Lending agreement is a written disclosure or set of disclosures provided to the borrower before credit or a loan is issued. It outlines the terms and conditions of the credit, the annual percentage rate (APR), and financing details.

A Truth-in-Lending Disclosure Statement provides information about the costs of your credit.Your Truth-in-Lending form includes information about the cost of your mortgage loan, including your annual percentage rate (APR).

1. The Truth in Lending Act (TILA) requires lenders to disclose important information to borrowers about the cost of a loan before the borrower agrees to the loan. For example, TILA disclosures are required on all car loans and mortgages for houses.

Lenders must provide a Truth in Lending (TIL) disclosure statement that includes information about the amount of your loan, the annual percentage rate (APR), finance charges (including application fees, late charges, prepayment penalties), a payment schedule and the total repayment amount over the lifetime of the loan.

The Truth in Lending Act (TILA) was signed into law in 1968 as a means to protect consumers from unfair and predatory lending practices. It requires lenders and creditors to supply borrowers with clear and visible key information about the credit extended.

Annual percentage rate. Finance charges. Payment schedule. Total amount to be financed. Total amount made in payments over the life of the loan.