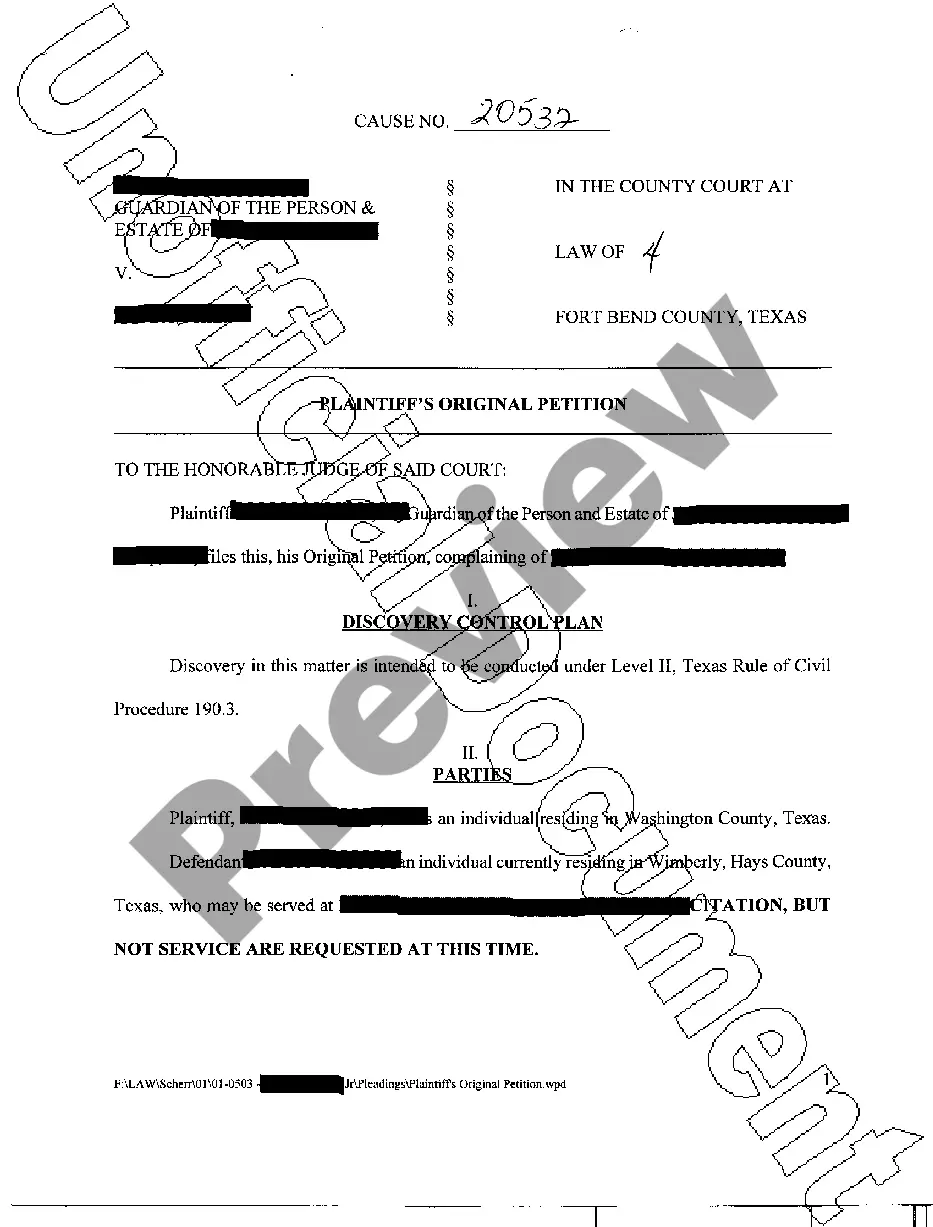

Texas Plaintiffs Original Petition for Foreclosure on Mobile Home

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Plaintiffs Original Petition For Foreclosure On Mobile Home?

Access to high quality Texas Plaintiffs Original Petition for Foreclosure on Mobile Home samples online with US Legal Forms. Steer clear of days of misused time looking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Get above 85,000 state-specific legal and tax samples that you can save and fill out in clicks within the Forms library.

To receive the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Verify that the Texas Plaintiffs Original Petition for Foreclosure on Mobile Home you’re looking at is suitable for your state.

- See the sample using the Preview option and read its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by card or PayPal to finish creating an account.

- Choose a favored file format to download the document (.pdf or .docx).

Now you can open the Texas Plaintiffs Original Petition for Foreclosure on Mobile Home example and fill it out online or print it and get it done yourself. Think about mailing the papers to your legal counsel to make certain things are filled in properly. If you make a error, print and fill sample again (once you’ve registered an account all documents you download is reusable). Create your US Legal Forms account now and get access to more templates.

Form popularity

FAQ

After a repossession order, you have no house, but you may still have the debt. This depends on how much of your mortgage is unpaid. If the mortgage amount due is low, the bank or lender will return you your money after paying all the fees and recovering its debt once the sale is made.

A repossession takes seven years to come off your credit report. That seven-year countdown starts from the date of the first missed payment that led to the repossession. When you finance a vehicle, the lender owns it until it is completely paid off.

-Dallas 2012, no pet.). A plaintiff seeking damages for wrongful foreclosure must show that (1) there was an irregularity in the foreclosure sale and (2) the irregularity caused the plaintiff damages.

Proving Wrongful Foreclosure If you wish to sue the bank for wrongful foreclosure, you must prove the following: The lender owed you, the borrower, a legal duty. The lender breached that duty. The breach of duty caused your injury or loss (damages)

What Happens if the Manufactured Homeowner Defaults on the Loan? If the borrower defaults on loan payments for a manufactured home, the creditor can repossess or foreclose the home.Generally, if the home is personal property, the creditor repossesses the home.

You can pay off the difference of the mortgage right away if you have the cash on hand. You could also take out a loan for less money with a lower interest rate than the mortgage. Another option you have is to short sale your mobile home.

Voluntary repossession. In a voluntary repossession, the homeowner voluntarily surrenders the home to the lender. If a manufactured home is wrapped up with the land as collateral for the loan, the lender will likely forecloseeven if the manufactured home is still classified as personal property.