Texas Notice of Default and Right To Cure

Description

Key Concepts & Definitions

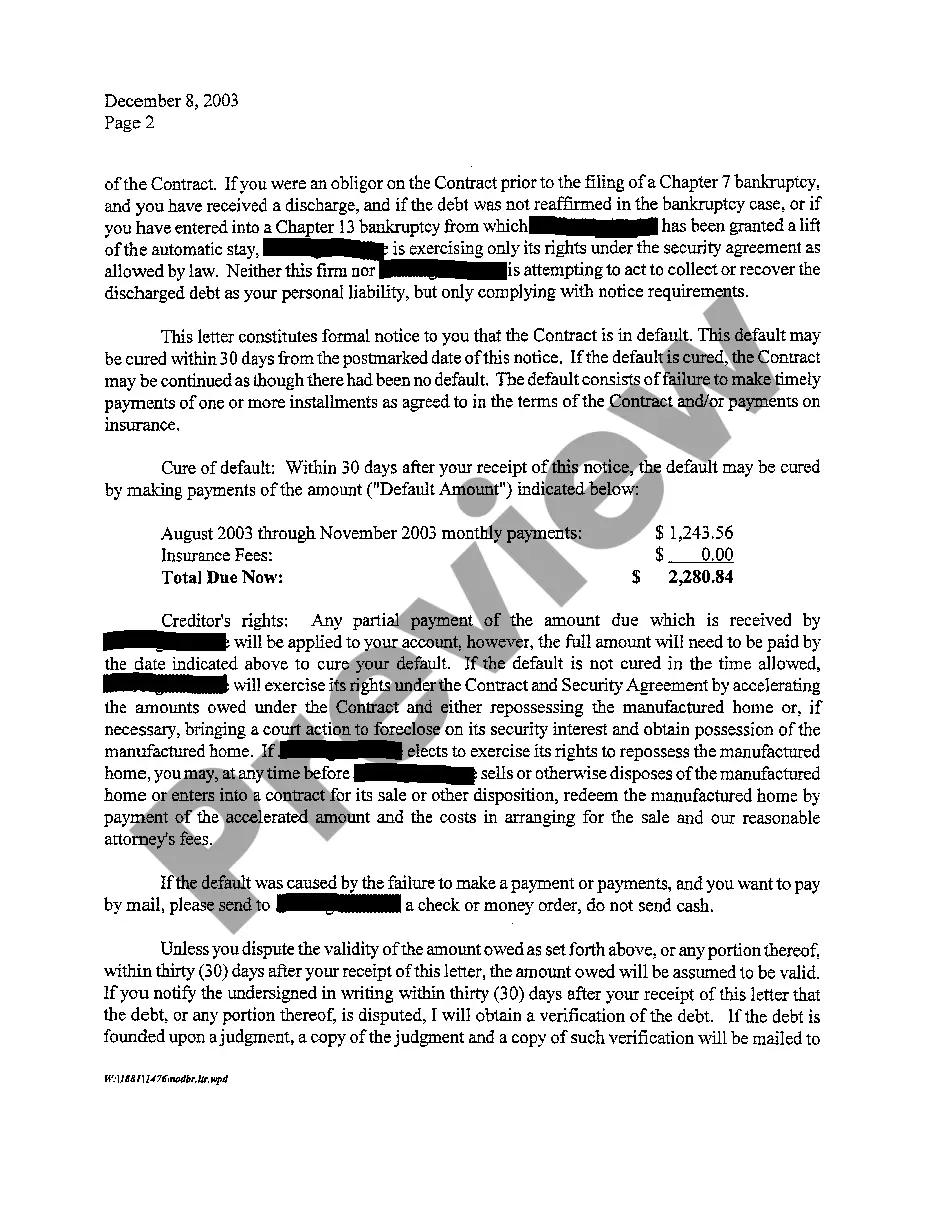

A04 Notice of Default and Right to Cure refers to a formal document issued by a creditor notifying the debtor that they have defaulted on their obligation, typically regarding loans or credit agreements. The notice serves as a warning that legal action may commence if the default is not cured within a specified period.

Step-by-Step Guide

- Identify the Default: Determine the specific term or condition breached by the debtor.

- Assess the Situation: Verify that the breach qualifies as a default under the agreement's terms.

- Draft the Notice: Prepare the A04 Notice including specifics of the default, the cure period, and potential legal consequences.

- Send the Notice: Deliver the notice to the debtor legally, ensuring you adhere to any required communication methods stipulated in the agreement.

- Monitor the Cure Period: Keep records of all communication regarding the default and cure process.

Risk Analysis

Failure to issue an A04 Notice of Default could result in waiving the right to remedy the breach before taking further legal action. Moreover, incorrect handling of the notice process can lead to disputes or litigation, potentially invalidating the default claim.

Best Practices

- Accuracy in Documentation: Ensure all facts and figures mentioned in the notice are accurate and verifiable.

- Timeliness: Issue the notice as soon as the default is identified to commence the cure period promptly.

- Compliance with Laws: Check that the notice complies with all relevant federal and state laws to avoid legal repercussions.

Common Mistakes & How to Avoid Them

- Neglecting Specific Terms: Clearly state specific defaulted terms to avoid ambiguity.

- Ignoring Communication Methods: Adhere strictly to the prescribed methods of communication as stated in the contract.

FAQ

- What is a cure period? The cure period is the time allotted to the debtor to rectify the breach before further action is taken.

- Can a creditor skip issuing this notice? No, issuing this notice is crucial to meet legal requirements and afford the debtor an opportunity to rectify the default.

Summary

The A04 Notice of Default and Right to Cure is essential for maintaining legal integrity during the default resolution process. It ensures that debtors are given a chance to amend breaches, thus potentially avoiding more severe legal actions.

How to fill out Texas Notice Of Default And Right To Cure?

Access to quality Texas Notice of Default and Right To Cure templates online with US Legal Forms. Prevent hours of misused time browsing the internet and lost money on files that aren’t updated. US Legal Forms provides you with a solution to exactly that. Get more than 85,000 state-specific authorized and tax samples that you could save and complete in clicks within the Forms library.

To get the sample, log in to your account and click on Download button. The document is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- Check if the Texas Notice of Default and Right To Cure you’re considering is appropriate for your state.

- Look at the form utilizing the Preview option and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to register.

- Pay out by credit card or PayPal to complete making an account.

- Pick a preferred format to download the document (.pdf or .docx).

You can now open the Texas Notice of Default and Right To Cure example and fill it out online or print it out and get it done yourself. Take into account sending the file to your legal counsel to make sure everything is completed properly. If you make a error, print out and fill application once again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and access far more forms.

Form popularity

FAQ

The process, known as "statutory redemption," allows mortgagors (homeowners) a limited amount of time, often one year, to reclaim (or redeem) the property if they are able to pay what the property sold for at the foreclosure sale.

Anyone Can Grow Up to Be a Repo Man. Know the Terms of Your Loan Agreement. Repossession Can Happen as Soon as You Miss One Payment. The Lender Does Not Require a Court Order to Repossess Your Vehicle. The Repo Man Can Repossess the Vehicle on Your Property. Repo Men Can't Attack or Threaten You.

The notice of default doesn't affect your credit file, but when the account defaults this will be recorded.If the debt is regulated by the Consumer Credit Act, you must be sent a default notice warning letter and have time to act on it before the default is recorded on your credit file.

To redeem, you have to pay off the full amount of the loan before the foreclosure sale.However, Texas law doesn't give borrowers a statutory right of redemption after a foreclosure. Once your Texas home has been foreclosed, you can't redeem it.

What Does Right of Redemption Mean? It is the legal right of a borrower or mortgagor who owns the immovable property to reclaim his or her property once certain conditions have been fulfilled.

The process may take as little as 41 days, depending on the timing between mailing the required notices and the actual foreclosure date. All foreclosure sales in Texas occur on the first Tuesday of the month between 10 a.m. and 4 p.m. The commissioner's court designates the loca- tion.

In Texas, if someone purchases the home at the tax foreclosure sale, the redemption period is generally two years. This redemption period applies to residential homestead properties and land designated for agricultural use when the suit was filed. (Other types of properties have a 180-day redemption period.)

How long does it take to foreclose a property in Texas? Depending on the timing of the various required notices, it usually takes approximately 60 days to effectuate an uncontested non-judicial foreclosure.

The right of redemption arises solely by statutory authority. It gives an incentive to the bidders to purchase the property at its fair market value, thus lessening the chances of the former owner's redeeming it. In Texas, the right of redemption applies only to delinquent tax sales.