Texas Irrevocable trust Distribution of trust property

Description

How to fill out Texas Irrevocable Trust Distribution Of Trust Property?

Get access to quality Texas Irrevocable trust Distribution of trust property templates online with US Legal Forms. Prevent hours of misused time searching the internet and lost money on documents that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get over 85,000 state-specific authorized and tax forms that you could save and submit in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The document will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Find out if the Texas Irrevocable trust Distribution of trust property you’re looking at is appropriate for your state.

- Look at the sample utilizing the Preview option and browse its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by card or PayPal to finish creating an account.

- Choose a preferred format to download the file (.pdf or .docx).

You can now open up the Texas Irrevocable trust Distribution of trust property template and fill it out online or print it and get it done yourself. Consider mailing the document to your legal counsel to make sure everything is filled in properly. If you make a mistake, print and complete sample once again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and access more forms.

Form popularity

FAQ

An irrevocable trust has a grantor, a trustee, and a beneficiary or beneficiaries. Once the grantor places an asset in an irrevocable trust, it is a gift to the trust and the grantor cannot revoke it.To gift assets the estate while still retaining the income from the assets.

As noted above, an irrevocable trust must pay income tax on its earnings.Typically, the beneficiary isn't required to pay income taxes on distributions that come from principal because tax law presumes that the grantor already paid income taxes on it when he placed it in the trust and tries to avoid double taxation.

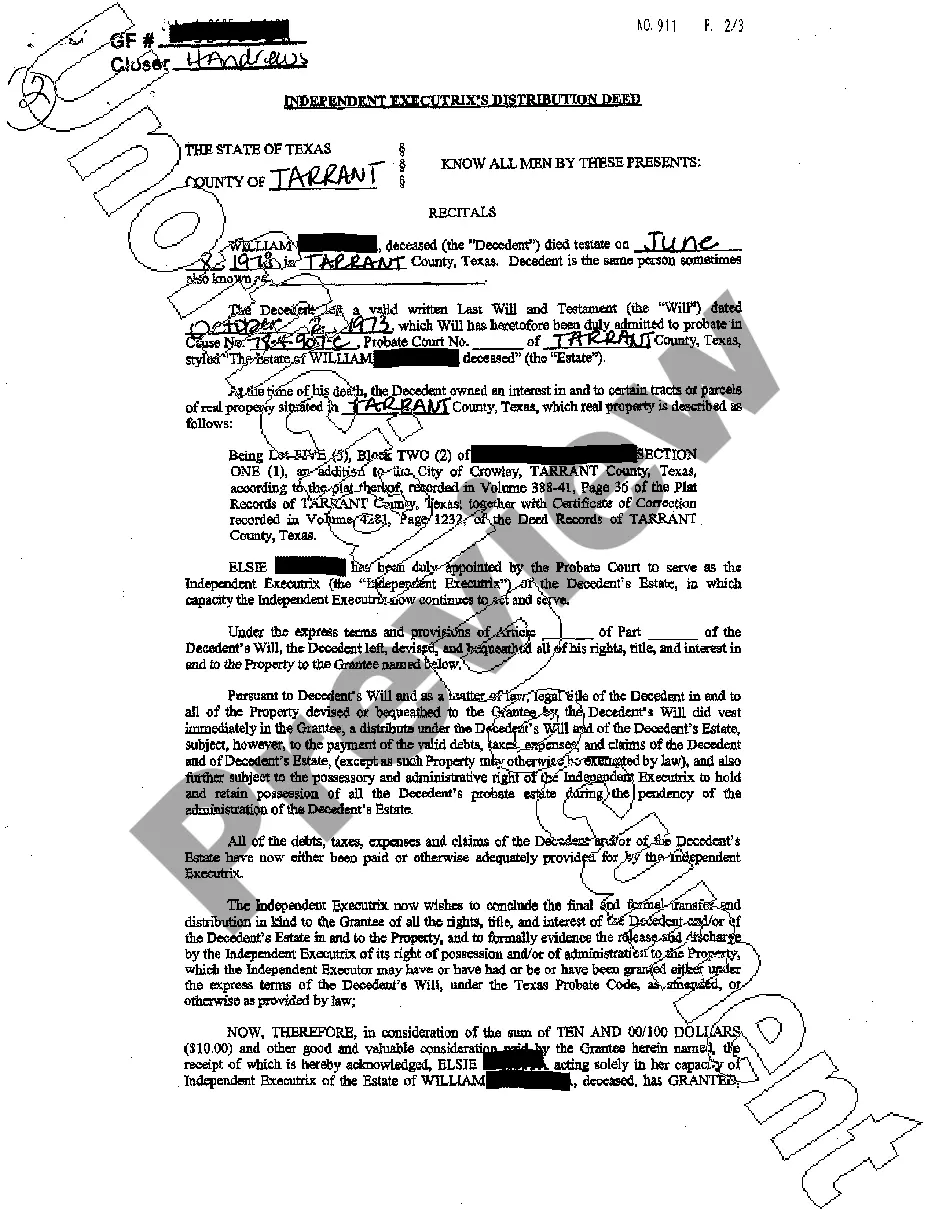

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Distributing assets from an irrevocable trust requires that the assets first be part of the trust's corpus. Tax laws allow trusts to recover the after-tax money locked up in the corpus as tax-free return of principal. Trusts pass this benefit along to their beneficiaries in the form of tax-free distributions.

To transfer cash or securities, the trustee will open an account in the trust's name, and the grantor will instruct his or her bank or broker to move the funds from his or her account to the trust's account. For real estate, a deed is used to transfer legal title of the property from the grantor to the trust.

The trustee of an irrevocable trust can only withdraw money to use for the benefit of the trust according to terms set by the grantor, like disbursing income to beneficiaries or paying maintenance costs, and never for personal use.

Because of the irrevocable trust provision they can either transfer the trust asset to another beneficiary or donate it to a charity. However, you can't transfer assets from an irrevocable trust back to your original estate under any circumstances.

Interest income the trust distributes is taxable to the beneficiary who receives it. The amount distributed to the beneficiary is considered to be from the current-year income first, then from the accumulated principal.Capital gains from this amount may be taxable to either the trust or the beneficiary.