Texas Correction Deed - Prior Deed from an Individual to an Individual

What is this form?

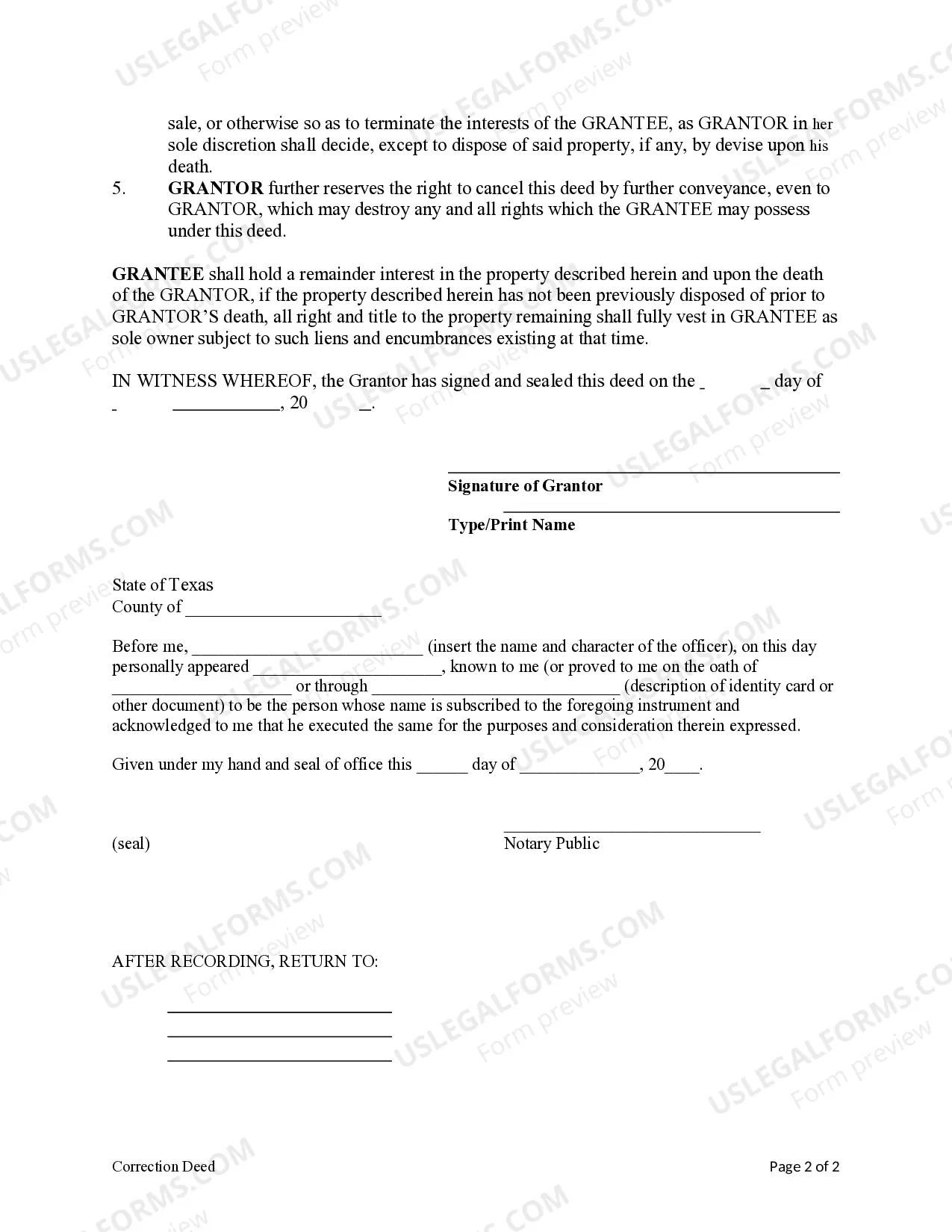

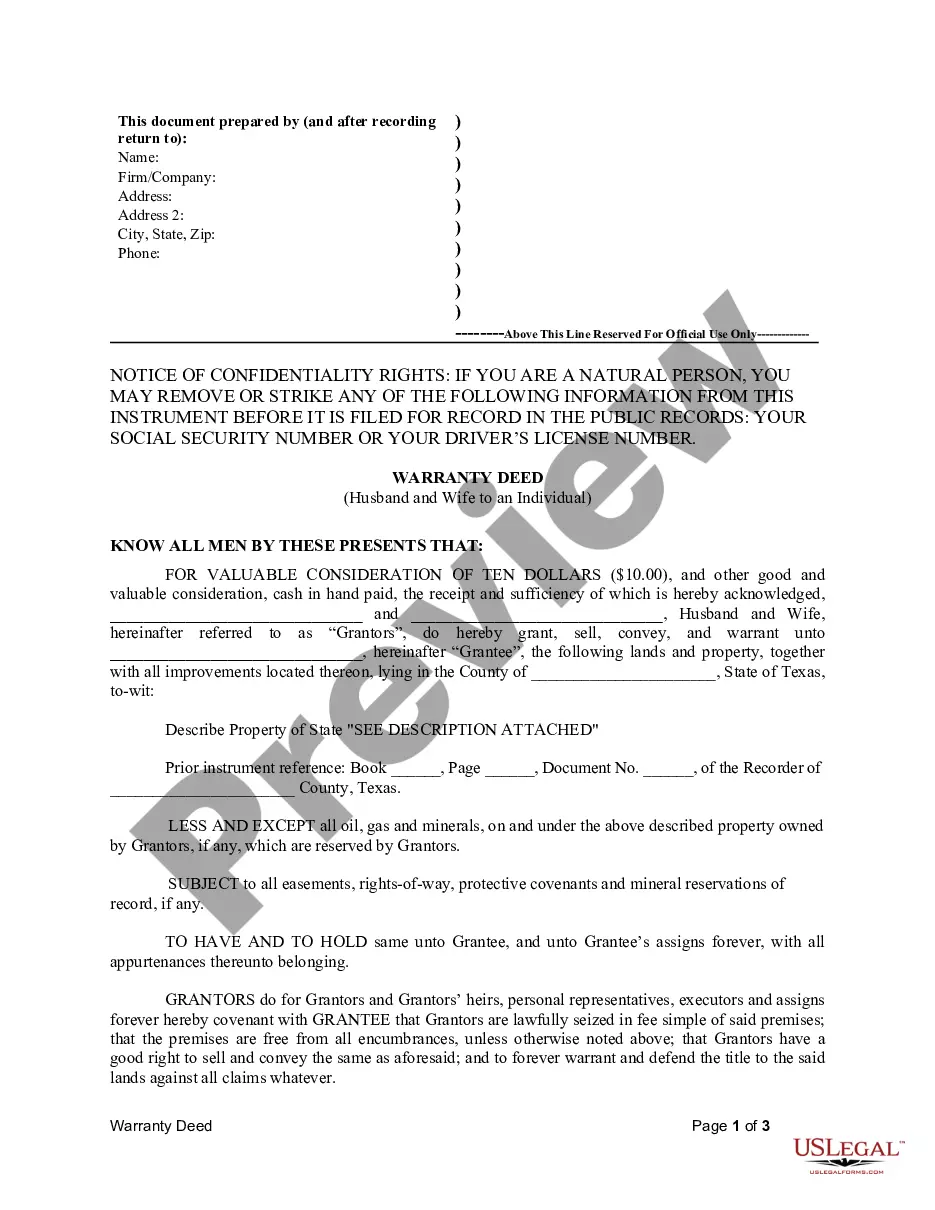

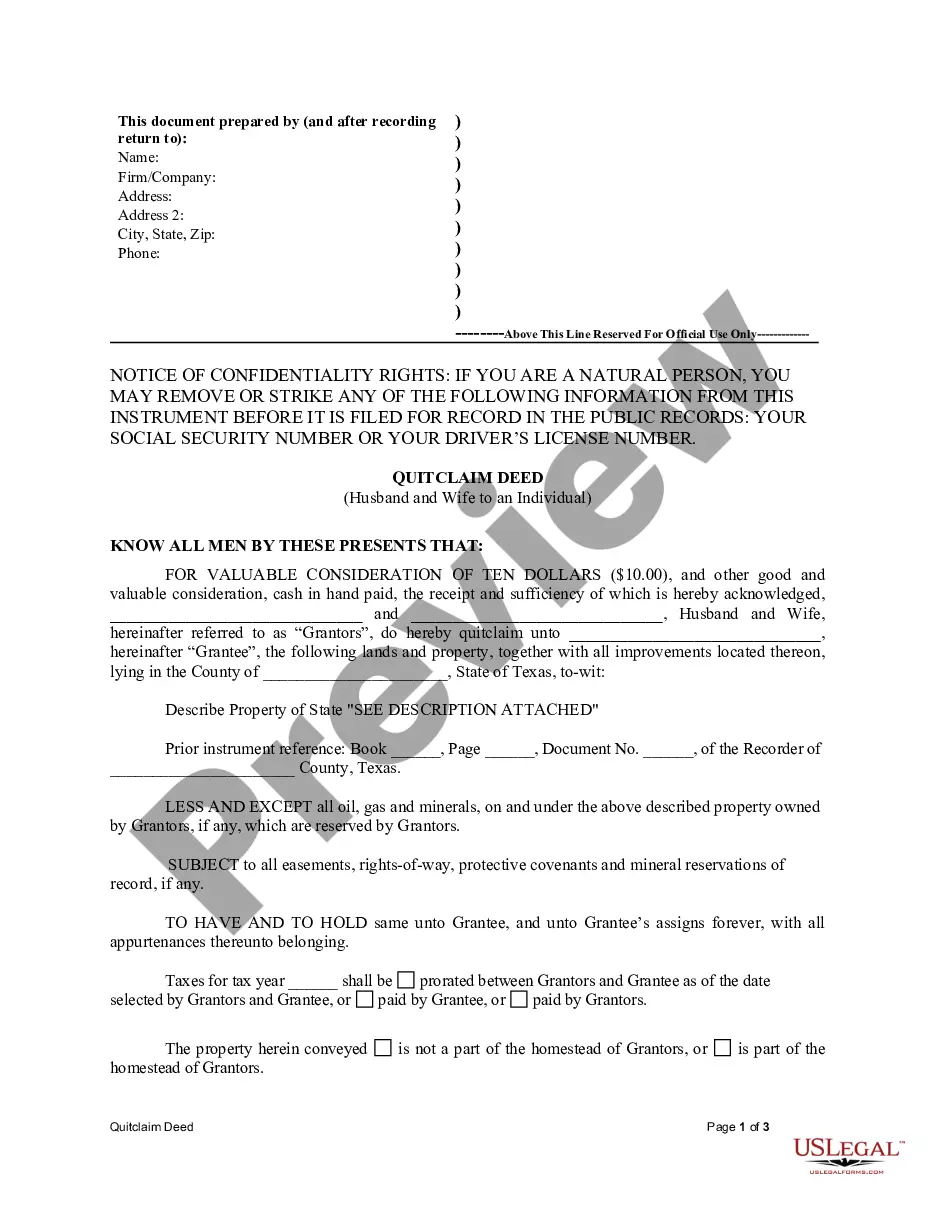

The Correction Deed is a legal document used to rectify errors or mutual mistakes in a prior deed involving the transfer of property from one individual (the Grantor) to another individual (the Grantee). Unlike a regular deed, the Correction Deed does not involve a new transfer but corrects inaccuracies in previously recorded information, ensuring that all property descriptions, interests, or rights are accurate and legally enforceable.

Main sections of this form

- Party information: Identification of the Grantor and Grantee, including names and signatures.

- Property description: Detailed legal description of the property affected by the correction.

- Recitals: Background information explaining the mutual mistake being corrected.

- Conveyance clause: Statement where the Grantor conveys the corrected property interest to the Grantee.

- Reservations section: Details regarding any rights retained by the Grantor, if applicable.

Situations where this form applies

This form should be used when there have been errors in a previously executed deed that need correction, such as incorrect property descriptions, mistakes in the names of the parties, or misstatements of property rights. It can be suitable in situations involving property disputes or when an accurate record of ownership must be established in the public records.

Who this form is for

- Individuals involved in a property transfer who discover a mistake in a prior deed.

- Homeowners or property owners needing to correct public records.

- Real estate agents or attorneys representing clients in property transactions.

- Title companies seeking to resolve discrepancies in property ownership.

Completing this form step by step

- Identify the parties: Fill in the names of the Grantor and Grantee accurately.

- Specify the property: Provide a detailed legal description of the property in question.

- State the mutual mistake: Clearly articulate the nature of the error being corrected.

- Include the conveyance clause: Ensure that the correct property interest is conveyed to the Grantee.

- Sign and date the form: Both the Grantor and Grantee must sign to validate the correction.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to accurately identify all parties involved in the transaction.

- Not providing a complete legal description of the property.

- Missing signatures from one or both parties.

- Using outdated or incorrect versions of the form.

- Not citing the specific error that the deed is correcting.

Why use this form online

- Convenience: Easily fill out and download the form at any time without needing to visit an office.

- Editability: Quickly make changes to the form to suit individual needs.

- Reliability: Access attorney-drafted templates that ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

To be valid, gift deeds in Texas further require the document set forth (1) the intent of the grantor, (2) the delivery of the property to the grantee, and (3) the gift to be accepted by the grantee. The one claiming the gift bears the burden to establish each of the elements.

A rectification deed should be executed after mutual consent of all the parties to the main deed. All parties to the original deed should jointly execute the rectification deed as well. In case the original deed is registered, one should get the rectification deed also registered.

Gift the house When you give anyone other than your spouse property valued at more than $14,000 ($28,000 per couple) in any one year, you have to file a gift tax return. But you can gift a total of $5.49 million (in 2017) over your lifetime without incurring a gift tax.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office.

Check the mortgage. Get a copy of the property title. Fill out a property title transfer form. Submit the title transfer form. Pay the relevant fee. Wait for the processing of the form.

Think about IHT implications potentially exempt transfer Be aware of the rules on gifts with reservation of benefit You will no longer be the legal owner of the property. Risk from outside parties. Don't forget capital gains tax.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

Quitclaim Deeds can be complicated legal documents. They are commonly used to add/remove someone to/from real estate title or deed (divorce, name changes, family and trust transfers).

To sign over property ownership to another person, you'll use one of two deeds: a quitclaim deed or a warranty deed.