Tennessee Terms for Private Placement of Series Seed Preferred Stock

Description

How to fill out Terms For Private Placement Of Series Seed Preferred Stock?

Choosing the right lawful papers template can be quite a struggle. Obviously, there are tons of layouts available on the net, but how will you find the lawful develop you will need? Take advantage of the US Legal Forms web site. The services delivers 1000s of layouts, including the Tennessee Terms for Private Placement of Series Seed Preferred Stock, that you can use for business and personal demands. Every one of the varieties are checked out by specialists and meet up with federal and state specifications.

Should you be already authorized, log in in your bank account and click the Download option to obtain the Tennessee Terms for Private Placement of Series Seed Preferred Stock. Utilize your bank account to appear from the lawful varieties you possess bought formerly. Proceed to the My Forms tab of the bank account and have one more backup of your papers you will need.

Should you be a fresh end user of US Legal Forms, allow me to share basic instructions so that you can adhere to:

- First, ensure you have chosen the correct develop for the area/region. It is possible to check out the form making use of the Preview option and browse the form outline to ensure it will be the best for you.

- In case the develop does not meet up with your needs, utilize the Seach discipline to find the proper develop.

- When you are certain that the form would work, go through the Purchase now option to obtain the develop.

- Opt for the prices plan you would like and enter in the needed information. Create your bank account and pay for your order utilizing your PayPal bank account or credit card.

- Pick the file format and down load the lawful papers template in your system.

- Complete, edit and print out and indication the obtained Tennessee Terms for Private Placement of Series Seed Preferred Stock.

US Legal Forms will be the biggest collection of lawful varieties for which you can see numerous papers layouts. Take advantage of the company to down load appropriately-created files that adhere to state specifications.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

Hear this out loud PauseIn series A, a startup is positioned to develop and refine its offer and processes. During series B, the cash is needed to be able to scale up and reach a much wider market. The fundamental business is already in place at series B, with the barrier to reaching a wider market being the need for investment. What's The Difference Between Series A & Series B Funding? theaccountancycloud.com ? blogs ? series-a-and-s... theaccountancycloud.com ? blogs ? series-a-and-s...

A Series AA Round is a round of startup financing using a class of preferred stock called the ?Series AA Preferred Shares.? Series AA is also known as ?Seed? because it comes before Series A. Series AA terms are usually not as onerous as Series A terms, and the valuation is typically lower.

Hear this out loud PauseSeries A funding comes after there is already a product and obvious traction. Seed funding is usually the first round of funding and raises a small amount of capital. In series A, the startup receives more capital to support future growth. Seed funding vs series A: Navigating the early stage investment rounds productiveshop.com ? seed-funding-vs-series-a-na... productiveshop.com ? seed-funding-vs-series-a-na...

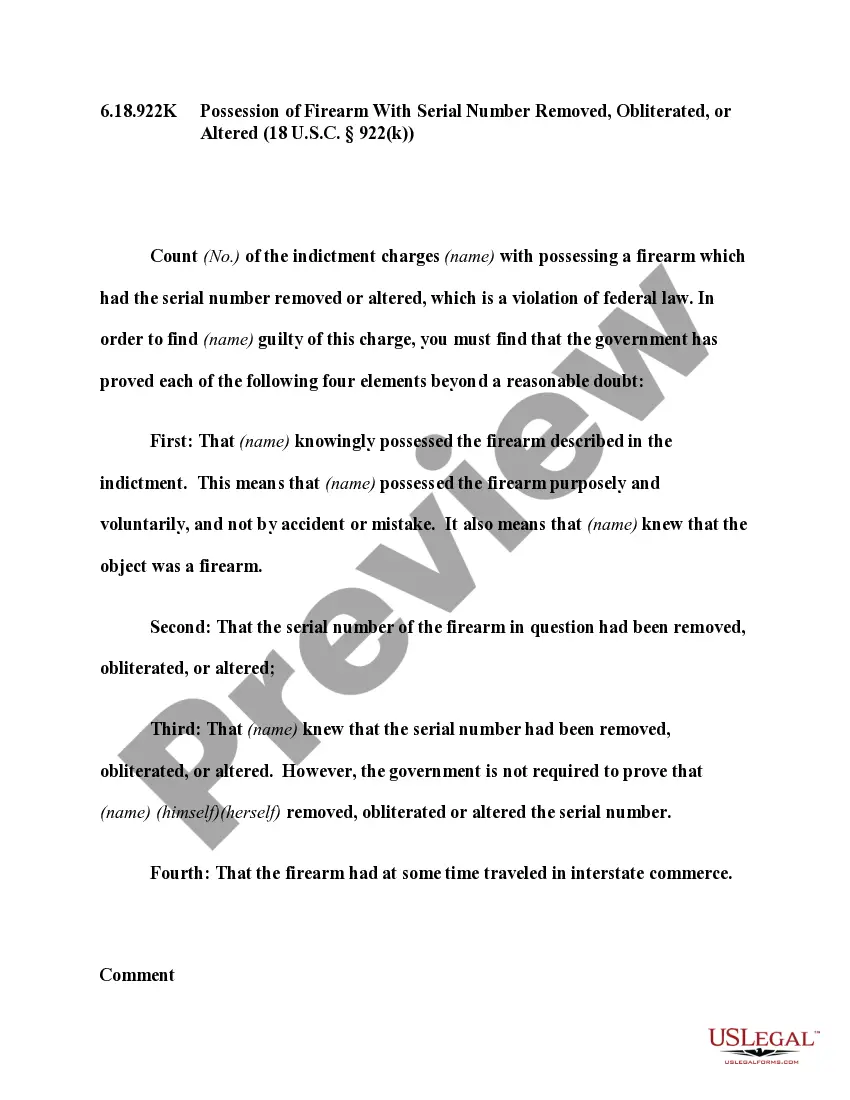

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

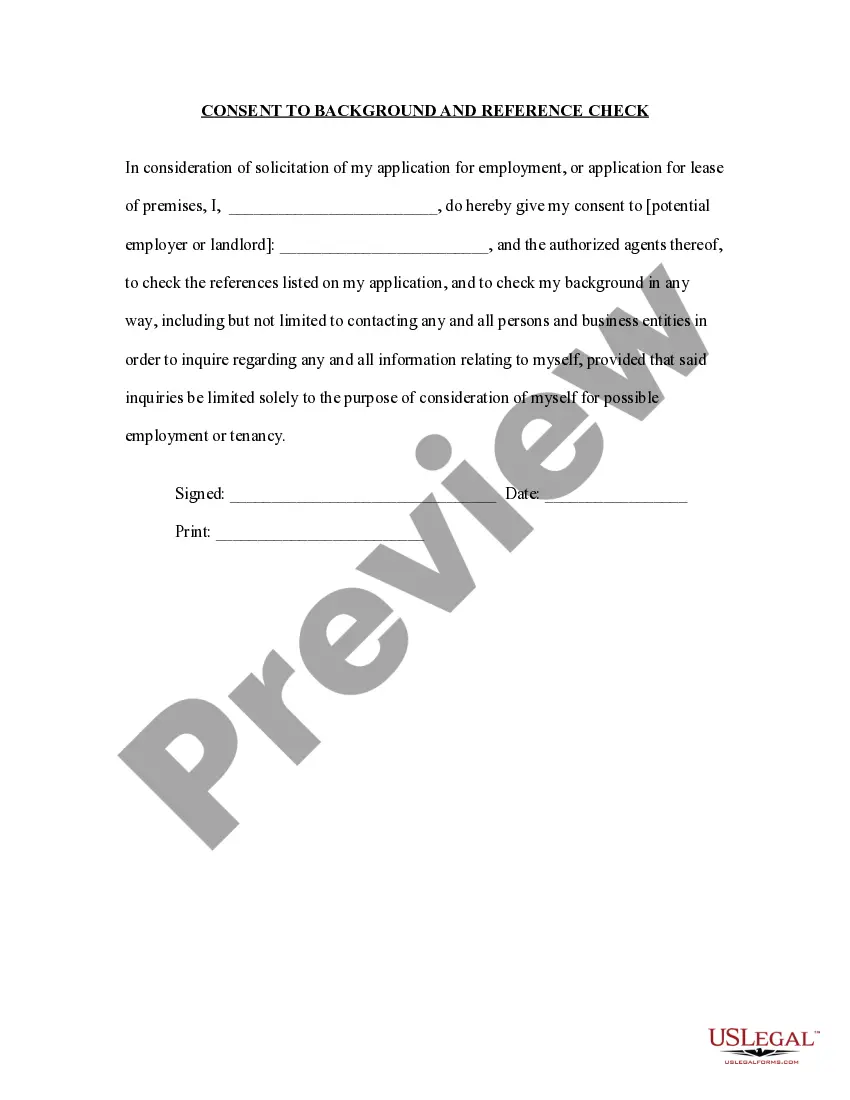

Private Placements are non-public sales of shares or other securities without a prospectus to a closed group of investors. The companies which are selling shares in a form of a private placement may listed or unlisted companies.

Hear this out loud PauseThese fundraising rounds allow investors to invest money into a growing company in exchange for equity/ownership. The initial investment?also known as seed funding?is followed by various rounds, known as Series A, B, and C. A new valuation is done at the time of each funding round. Series Funding: A, B, and C - Investopedia Investopedia ? personal-finance ? ser... Investopedia ? personal-finance ? ser...

Hear this out loud PauseThe first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company. Series A Preferred Stock - ILPA ilpa.org ? glossary ? series-a-preferred-stock ilpa.org ? glossary ? series-a-preferred-stock