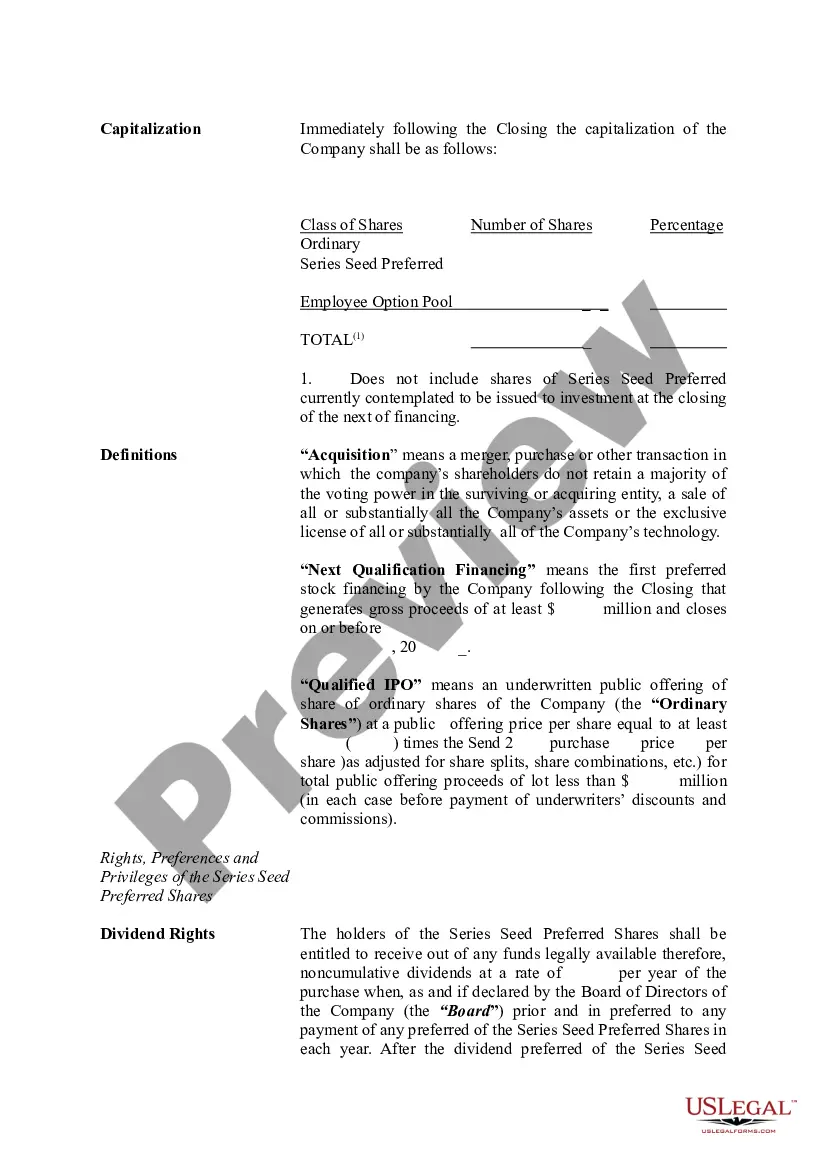

Tennessee Term Sheet - Series Seed Preferred Share for Company

Description

How to fill out Term Sheet - Series Seed Preferred Share For Company?

You are able to devote several hours on-line looking for the legitimate papers web template that suits the federal and state needs you need. US Legal Forms provides 1000s of legitimate varieties that happen to be evaluated by professionals. It is possible to down load or produce the Tennessee Term Sheet - Series Seed Preferred Share for Company from our services.

If you already have a US Legal Forms profile, it is possible to log in and click on the Obtain button. Following that, it is possible to comprehensive, modify, produce, or indication the Tennessee Term Sheet - Series Seed Preferred Share for Company. Each and every legitimate papers web template you purchase is yours for a long time. To have another duplicate for any bought develop, visit the My Forms tab and click on the related button.

If you are using the US Legal Forms website the very first time, stick to the basic directions listed below:

- Initially, make sure that you have chosen the right papers web template for the state/town that you pick. See the develop information to ensure you have picked out the proper develop. If accessible, use the Preview button to appear through the papers web template as well.

- If you wish to get another variation of your develop, use the Look for field to get the web template that meets your needs and needs.

- Once you have discovered the web template you would like, simply click Purchase now to proceed.

- Pick the pricing plan you would like, type your credentials, and register for your account on US Legal Forms.

- Full the purchase. You may use your credit card or PayPal profile to purchase the legitimate develop.

- Pick the format of your papers and down load it to your gadget.

- Make adjustments to your papers if possible. You are able to comprehensive, modify and indication and produce Tennessee Term Sheet - Series Seed Preferred Share for Company.

Obtain and produce 1000s of papers layouts using the US Legal Forms website, that provides the greatest variety of legitimate varieties. Use professional and condition-specific layouts to deal with your small business or specific requirements.

Form popularity

FAQ

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

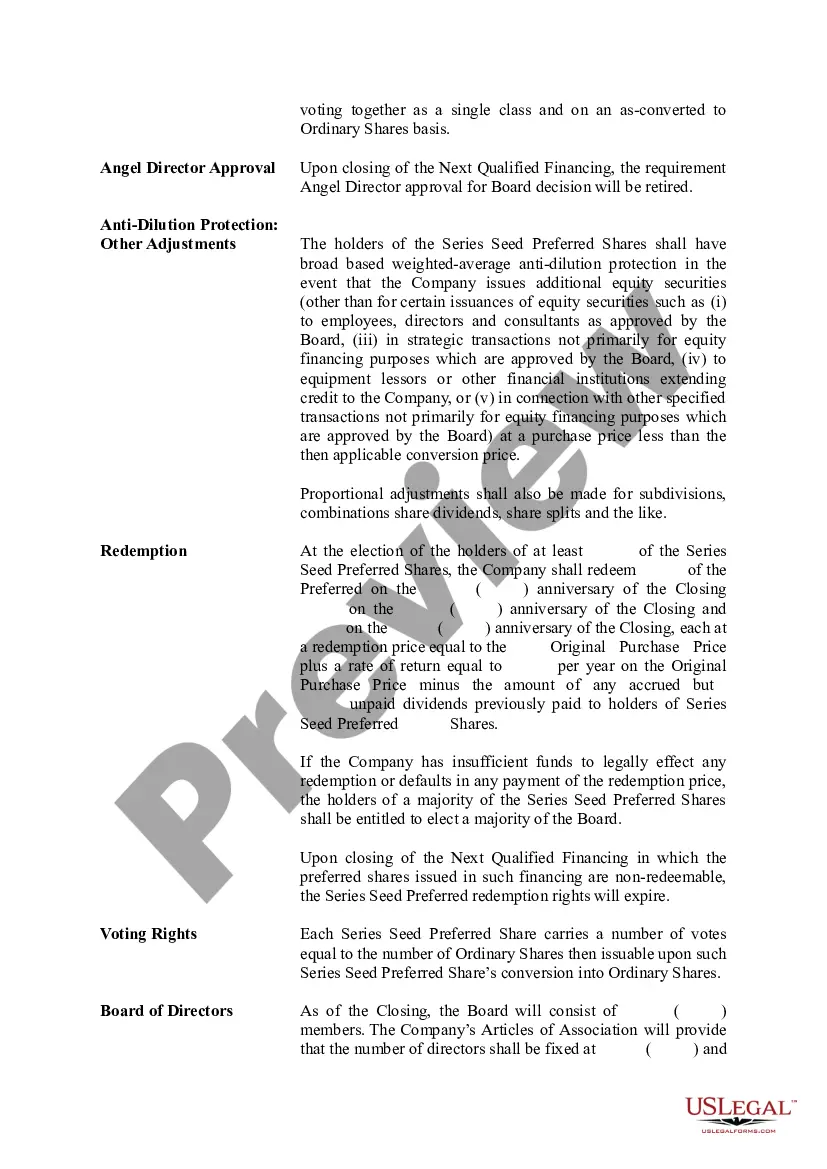

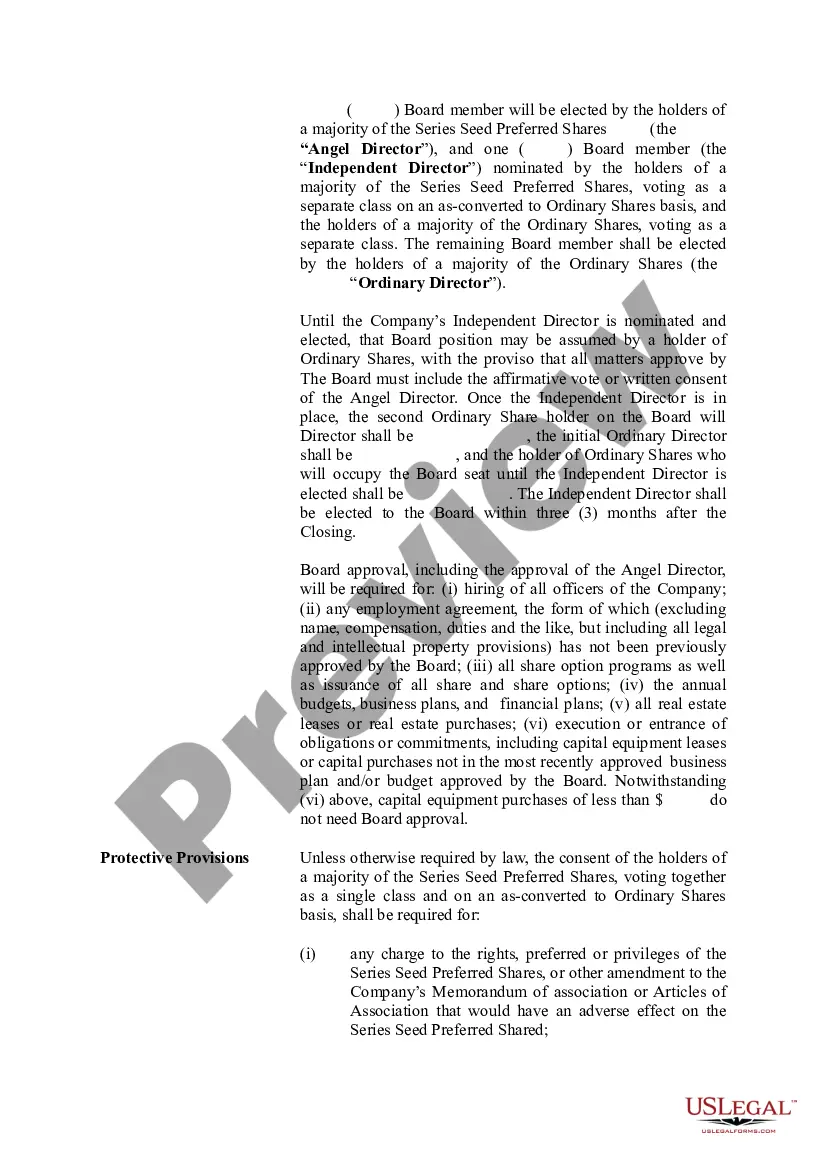

Series A Preferred Stock is the class of stock that is issued to investors in a Series A round. The stock is preferred because it contains certain rights superior to the company's common stock, commonly liquidation preference, anti-dilution protection, and control rights.

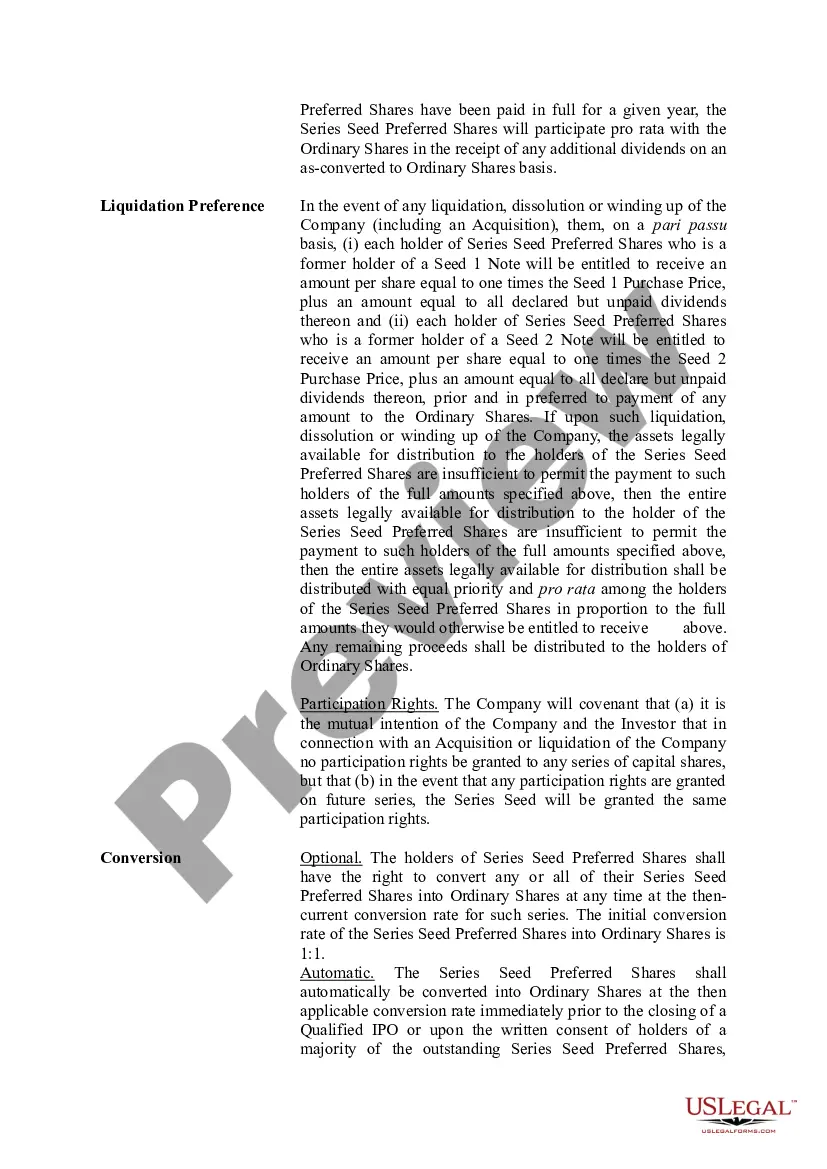

Series Seed will generally be issued as preferred stock. This is the order of payments made to various classes of stockholders in the event that the business is liquidated and there is cash available for distribution to the stockholders.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Common Series Seed terms include: Preferred Stock. Preferred stock is a class of stock with certain preferences and rights that are superior to the rights of the common stock that is issued to the founders. Series Seed will generally be issued as preferred stock. Liquidation Preference.

Series A funding is different from seed funding in a few key ways. First, seed funding is typically used to finance a startups initial costs, such as product development and market research. Series A funding, on the other hand, is used to finance a company's early-stage growth.

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).