Tennessee Series Seed Preferred Stock Purchase Agreement

Description

Preferred stock pays fixed dividends and has also the potential to appreciate in price. That is to say, it combines features of debt and equity.

Preferred stock usually yields more than common stock, and it can be paid every month or every quarter. The dividends are fixed or set according to a benchmark interest rate. The dividend yield is influenced by adjustable-rate shares, and participating shares are able to pay more dividends that calculated by common stock dividends or business profits.

This is a template for agreeing on preferred stock purchases for your company to use when working with investors."

How to fill out Series Seed Preferred Stock Purchase Agreement?

US Legal Forms - one of many biggest libraries of legal kinds in the United States - provides a wide array of legal papers layouts you are able to down load or print. Using the internet site, you can get thousands of kinds for enterprise and personal purposes, categorized by types, says, or keywords and phrases.You can get the most recent versions of kinds such as the Tennessee Series Seed Preferred Stock Purchase Agreement in seconds.

If you have a monthly subscription, log in and down load Tennessee Series Seed Preferred Stock Purchase Agreement from your US Legal Forms local library. The Obtain switch will show up on each type you see. You get access to all in the past acquired kinds inside the My Forms tab of your respective account.

If you wish to use US Legal Forms initially, here are easy guidelines to get you began:

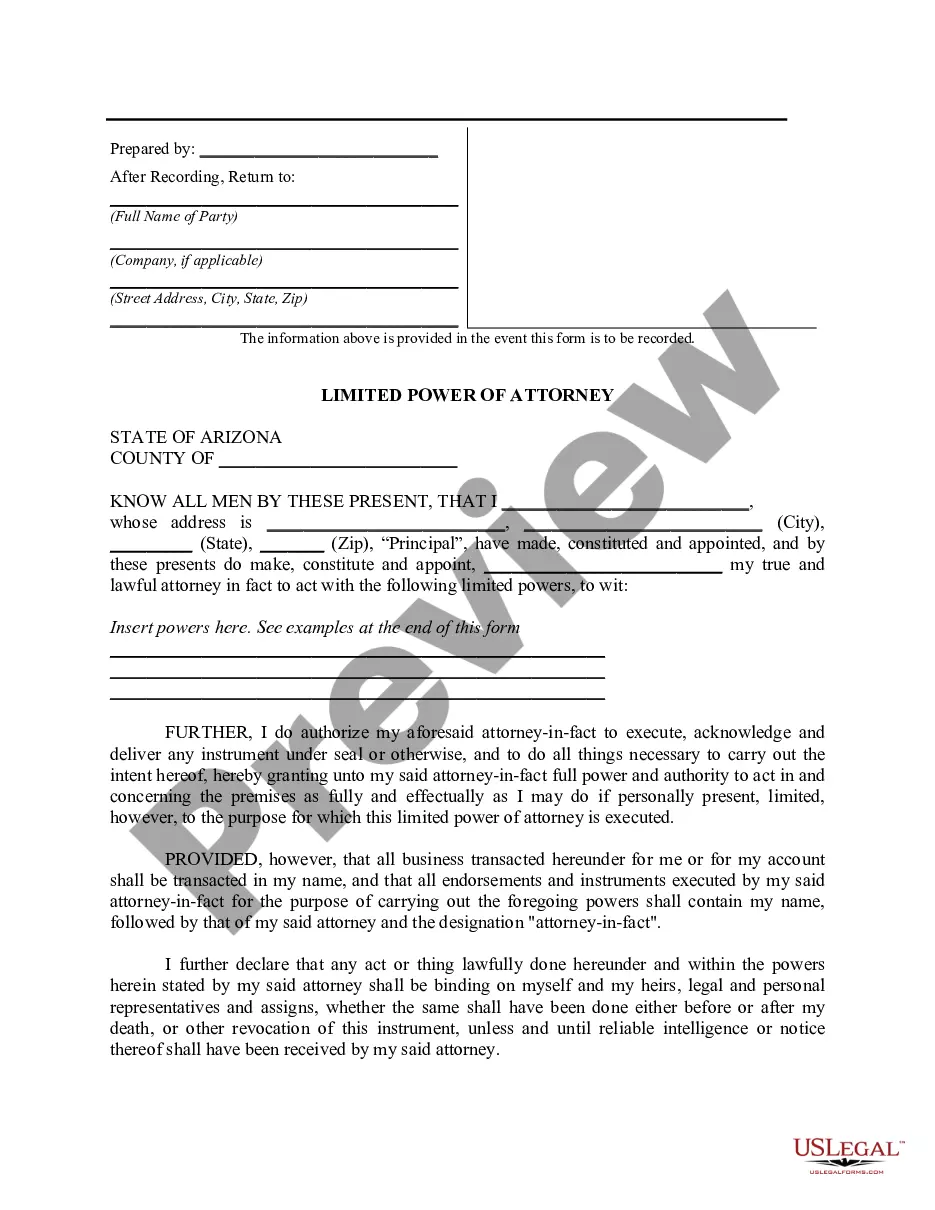

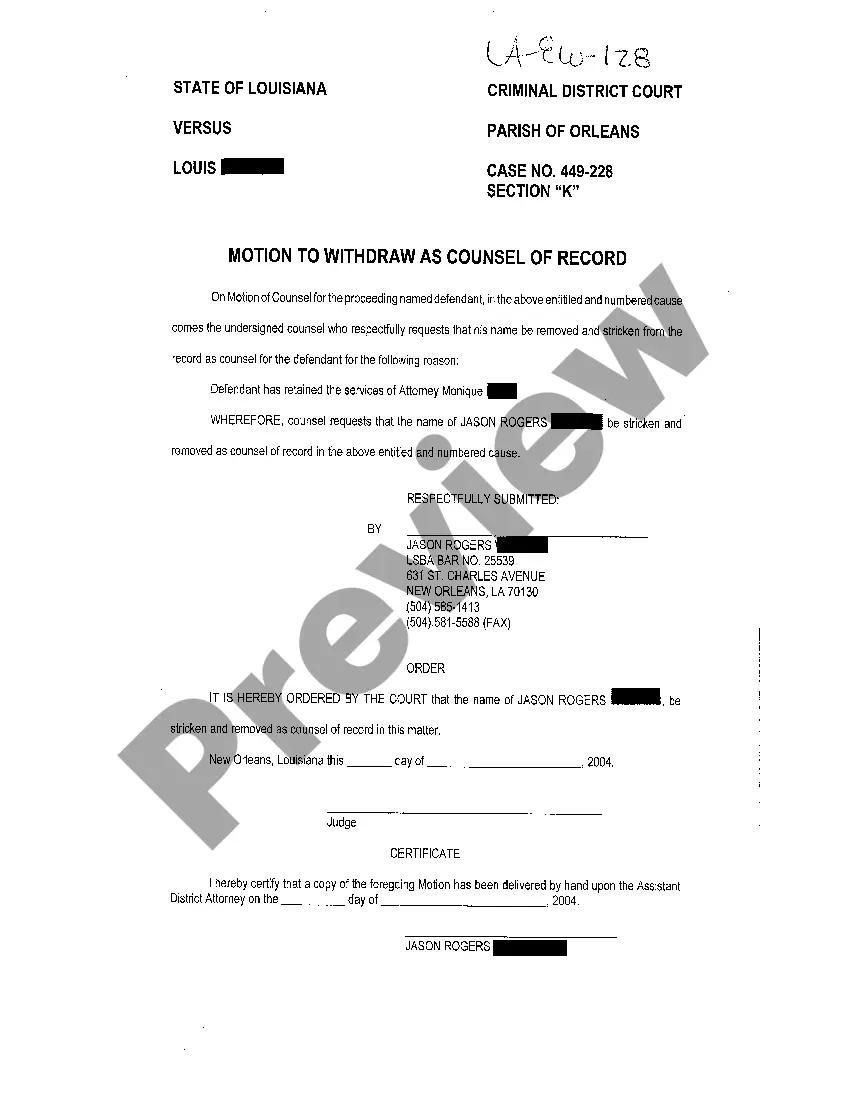

- Ensure you have chosen the correct type for the area/state. Click on the Review switch to review the form`s information. See the type information to actually have chosen the appropriate type.

- When the type doesn`t suit your demands, take advantage of the Look for discipline on top of the display to find the one that does.

- In case you are satisfied with the form, confirm your choice by simply clicking the Acquire now switch. Then, pick the costs strategy you want and give your qualifications to sign up to have an account.

- Procedure the financial transaction. Make use of bank card or PayPal account to finish the financial transaction.

- Choose the structure and down load the form on the product.

- Make adjustments. Complete, edit and print and sign the acquired Tennessee Series Seed Preferred Stock Purchase Agreement.

Every single web template you put into your money does not have an expiry day and is also yours for a long time. So, in order to down load or print another duplicate, just proceed to the My Forms segment and click on on the type you require.

Get access to the Tennessee Series Seed Preferred Stock Purchase Agreement with US Legal Forms, by far the most comprehensive local library of legal papers layouts. Use thousands of skilled and condition-certain layouts that meet your small business or personal needs and demands.

Form popularity

FAQ

Series Seed Preferred Stock is a type of preferred stock issued by startups during their early stage of development. Preferred stock is a hybrid security that combines elements of both debt and equity.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A SPA should specify the sale price for the shares, specify the currency and timescale for the sale, and list any other conditions like staged payments. Usually, payment is made in cash, although sometimes the buyer may offer the seller some of its shares, or issue loan notes to the seller.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

Series Seed Preferred Shares means the Series Seed Preferred Shares of the Company, par value US$0.001 per share, with the rights, preferences, and privileges as set forth in the Memorandum and Articles. Series Seed Preferred Shares means the Company's Series Seed Preferred Shares, par value US$0.000005 per share.