Tennessee Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Are you within a situation where you will need documents for sometimes organization or individual purposes virtually every day? There are a variety of legal record layouts available on the net, but finding types you can rely on isn`t easy. US Legal Forms provides thousands of type layouts, like the Tennessee Summary of Terms of Proposed Private Placement Offering, which are created to fulfill state and federal requirements.

When you are presently familiar with US Legal Forms internet site and possess a merchant account, basically log in. Afterward, you may download the Tennessee Summary of Terms of Proposed Private Placement Offering design.

Should you not have an account and want to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is for your proper city/region.

- Take advantage of the Review key to examine the shape.

- Look at the information to ensure that you have chosen the appropriate type.

- In the event the type isn`t what you`re searching for, use the Search area to obtain the type that meets your requirements and requirements.

- When you find the proper type, click on Acquire now.

- Opt for the costs prepare you want, fill out the desired info to produce your account, and buy an order with your PayPal or Visa or Mastercard.

- Select a practical file format and download your duplicate.

Get every one of the record layouts you possess bought in the My Forms menus. You may get a more duplicate of Tennessee Summary of Terms of Proposed Private Placement Offering anytime, if possible. Just go through the needed type to download or print the record design.

Use US Legal Forms, one of the most extensive collection of legal kinds, in order to save time as well as stay away from mistakes. The support provides skillfully made legal record layouts which you can use for a variety of purposes. Produce a merchant account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

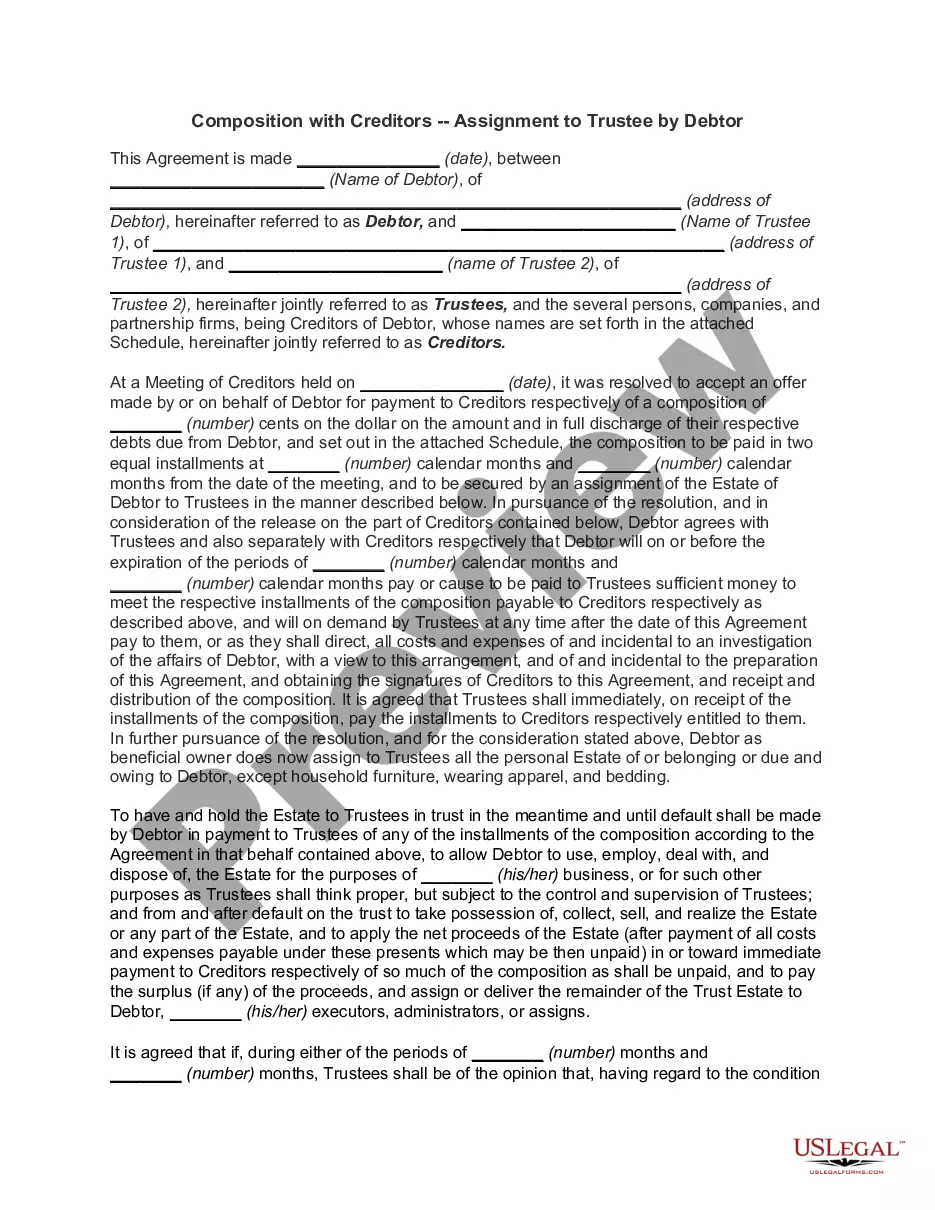

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

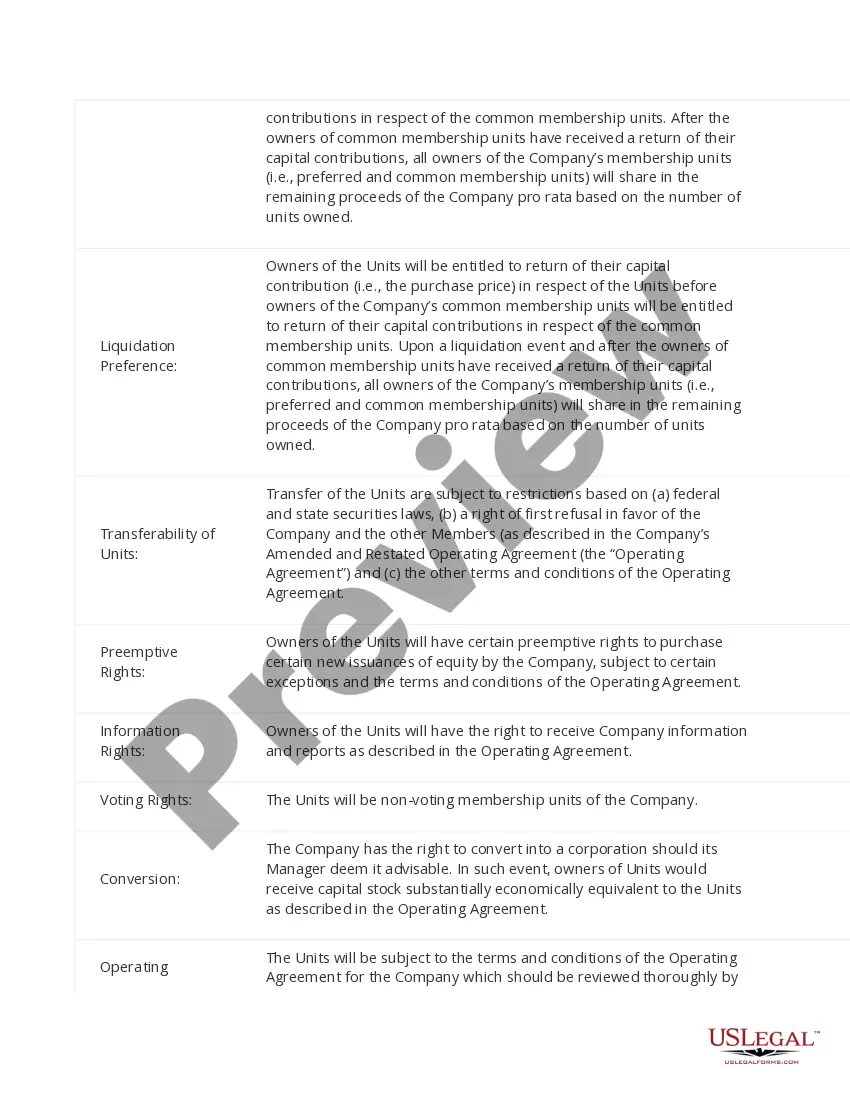

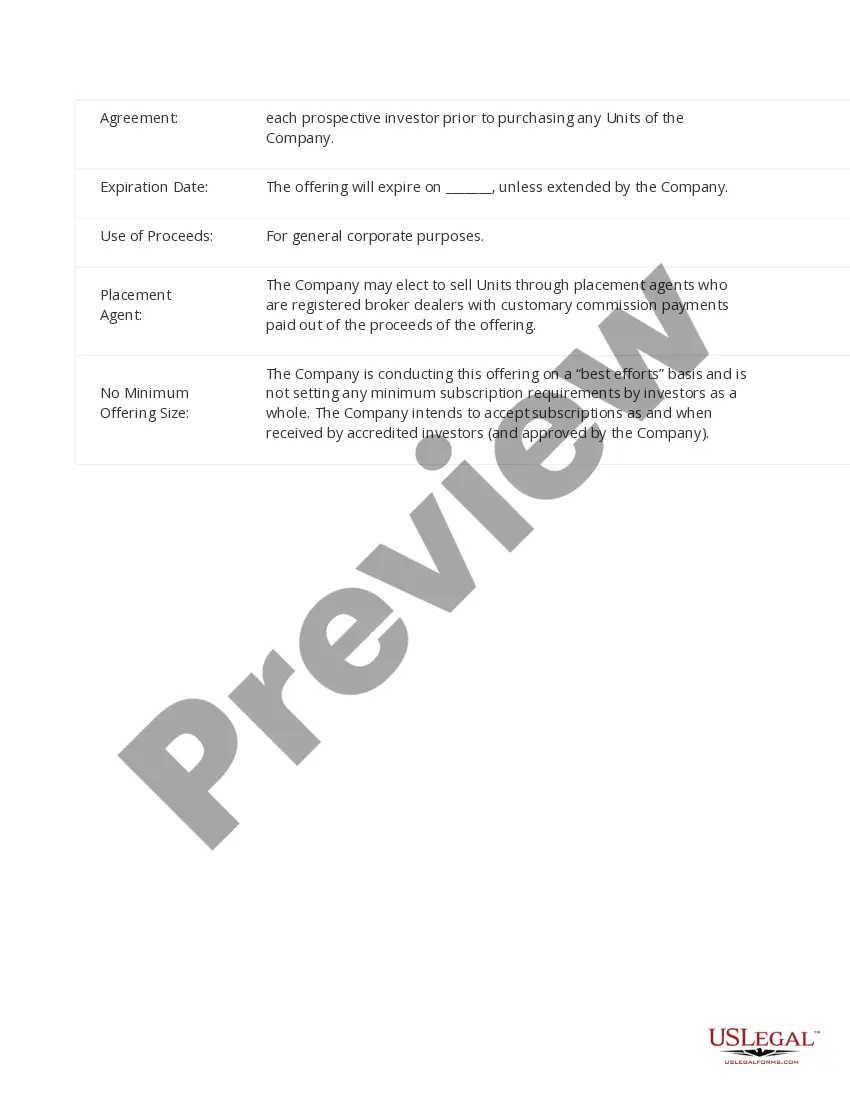

An offering memorandum is a document issued to potential investors in a private placement deal. The offering memorandum spells out the private placement's objectives, risks, financials, and deal terms.

PPM (Parts per million) is a measurement used today by many customers to measure quality performance. To calculate: For example, let's say you had 25 pieces defective in a shipment of 1,000 pieces. 25/1000= . 025 or 2.5% defective. .

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.