Tennessee Demand for Indemnity from a Limited Liability Company LLC by Member

Description

How to fill out Demand For Indemnity From A Limited Liability Company LLC By Member?

Are you presently in a placement in which you will need paperwork for either organization or individual purposes almost every working day? There are tons of lawful papers themes available on the net, but discovering ones you can depend on is not straightforward. US Legal Forms delivers 1000s of kind themes, like the Tennessee Demand for Indemnity from a Limited Liability Company LLC by Member, which are published in order to meet federal and state needs.

In case you are currently familiar with US Legal Forms web site and get a merchant account, simply log in. Following that, you can download the Tennessee Demand for Indemnity from a Limited Liability Company LLC by Member design.

Should you not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is to the correct town/state.

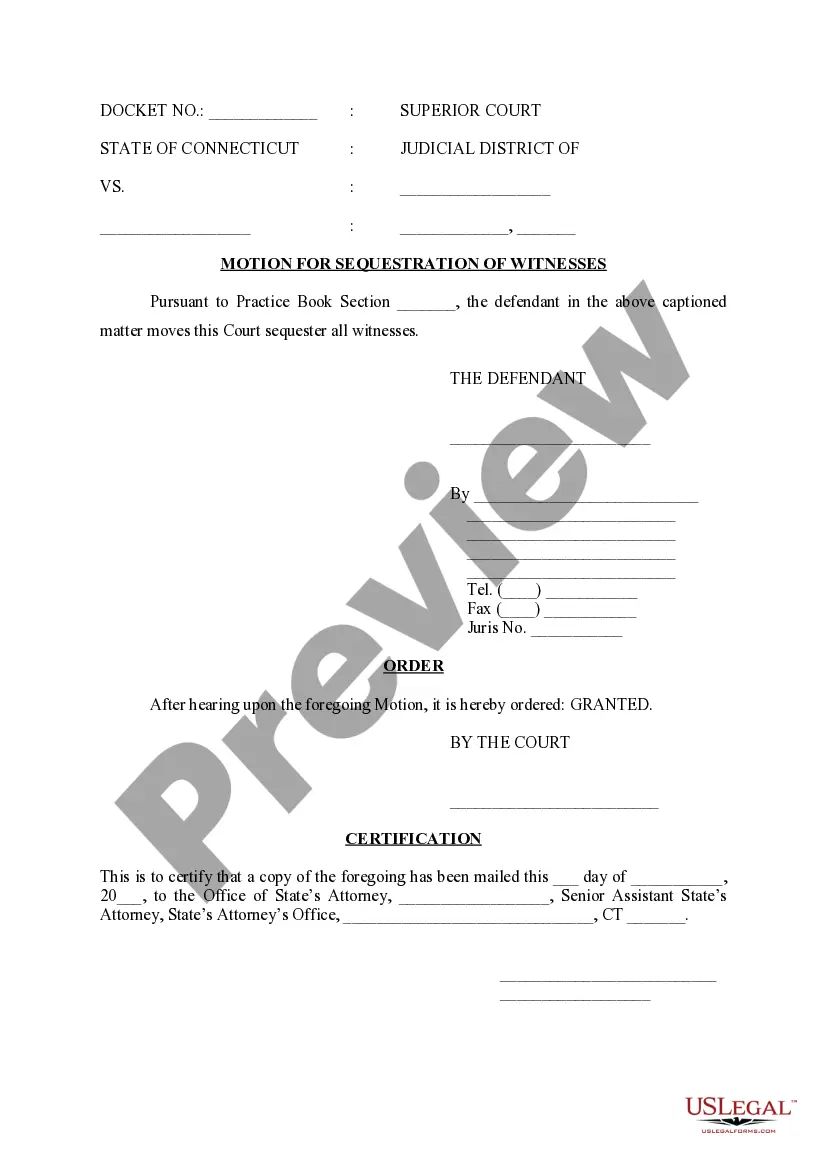

- Use the Review option to examine the form.

- Look at the outline to actually have selected the proper kind.

- In the event the kind is not what you are seeking, utilize the Lookup area to get the kind that fits your needs and needs.

- Whenever you get the correct kind, just click Get now.

- Opt for the pricing strategy you want, fill out the necessary information to create your account, and buy an order using your PayPal or charge card.

- Choose a hassle-free file structure and download your duplicate.

Locate each of the papers themes you possess purchased in the My Forms food list. You can aquire a extra duplicate of Tennessee Demand for Indemnity from a Limited Liability Company LLC by Member at any time, if needed. Just click the required kind to download or printing the papers design.

Use US Legal Forms, probably the most comprehensive collection of lawful kinds, to conserve some time and steer clear of errors. The service delivers skillfully made lawful papers themes which you can use for a selection of purposes. Generate a merchant account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

For example, it is easier to think of indemnities being useful for the customer or client in a contract: their prime purpose being protection. On the other hand, limited liability clauses are more useful for the supplier in a contract in order to limit their exposure.

Generally, indemnification (or indemnity) is an undertaking by one party to compensate the other party for certain costs and expenses. Indemnity is imposed either by law or contract in Tennessee.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

If there is no indemnification clause you are at a higher risk of liability when a dispute arises. Remember, your service contract is there to protect YOU. While all contracts should be somewhat two-sided and have clauses protecting the rights of your client, YOUR CONTRACT is mainly there to safeguard you.

The indemnification clause is a crucial element in commercial contracts as it helps mitigate the risks and consequences associated with potential breaches of contracts. This clause also ensures that the parties are fairly compensated for their losses and helps maintain a stable and predictable business relationship.

Both corporations and LLCs authorize, and sometimes mandate, indemnification of agents but allow the entity to craft the indemnification terms. Indemnification encourages people to take on the responsibilities and risks of serving as decision makers for an entity.

The indemnity clause provided that the LLC's manager ?shall not be liable for and shall be indemnified and held harmless ? from any loss or damage incurred ? in connection with the business of the Company, including costs and attorneys' fees ?

In most contracts, an indemnification clause serves to compensate a party for harm or loss arising in connection with the other party's actions or failure to act. The intent is to shift liability away from one party, and on to the indemnifying party.