Tennessee Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.

Description

How to fill out Demand For Information From Limited Liability Company LLC By Member Regarding Financial Records, Etc.?

Discovering the right legal document format can be a have a problem. Of course, there are a variety of web templates available online, but how would you find the legal kind you require? Take advantage of the US Legal Forms site. The service provides thousands of web templates, like the Tennessee Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc., which can be used for organization and personal requires. Every one of the forms are inspected by pros and fulfill state and federal demands.

When you are already listed, log in to the profile and click on the Obtain key to find the Tennessee Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc.. Make use of profile to look through the legal forms you possess purchased earlier. Check out the My Forms tab of the profile and obtain another duplicate from the document you require.

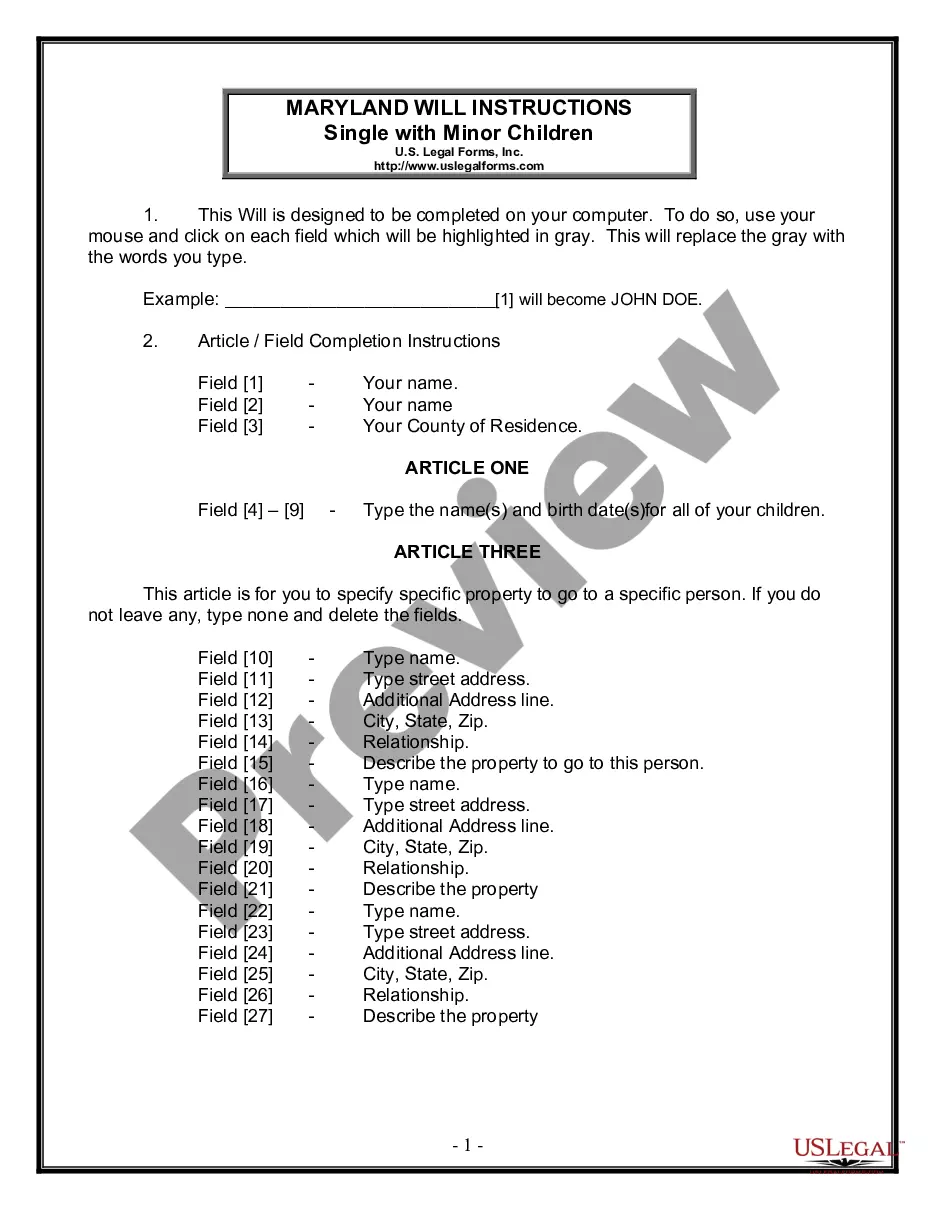

When you are a new consumer of US Legal Forms, allow me to share straightforward recommendations that you can adhere to:

- First, be sure you have selected the proper kind for your personal city/state. You can look through the form using the Preview key and browse the form outline to make sure this is basically the right one for you.

- In the event the kind will not fulfill your needs, take advantage of the Seach industry to obtain the right kind.

- When you are certain the form is proper, go through the Acquire now key to find the kind.

- Choose the prices strategy you would like and enter in the necessary info. Create your profile and pay for the order with your PayPal profile or bank card.

- Pick the submit structure and down load the legal document format to the device.

- Complete, revise and printing and sign the acquired Tennessee Demand for Information from Limited Liability Company LLC by Member regarding Financial Records, etc..

US Legal Forms is the most significant collection of legal forms in which you can see a variety of document web templates. Take advantage of the company to down load appropriately-made papers that adhere to state demands.

Form popularity

FAQ

To prepare your articles, you'll usually need the following information: Your LLC name. An additional designation for the LLC's name?if it is a professional LLC, series LLC, or banks. A name consent if the LLC's name is similar to an existing name in Tennessee.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

To officially start your LLC in Tennessee, you must file Articles of Organization with the Tennessee Secretary of State, Business Services Division. It costs a minimum of $300 (for LLCs with six members or fewer). After that, it costs $50 for each additional member.

Starting an LLC in Tennessee will include the following steps: #1: Choose a Name for Your Tennessee LLC. #2: Name a Registered Agent for Your Tennessee LLC. #3: File Articles of Organization for Your Tennessee LLC. #4: Secure an IRS Employer Identification Number. #5: Prepare Your Business for Operations.

How to start a business in Tennessee in 8 steps 1) Think about the type of business you want to start. ... 2) Set up your legal structure. ... 3) Name and register your business. ... 4) Apply for business licenses and permits. ... 5) Choose a location. ... 6) Open a bank account and prepare for future taxes. ... 7) Purchase business insurance.

By default, LLCs themselves don't pay income taxes, only their members do. Tennessee, unlike most other states, doesn't treat LLCs as pass-through entities. Instead, LLCs are subject to the same taxes as corporations. Must pay a franchise and excise taxes.

member LLC is a disregarded entity for federal tax purposes. Therefore, if the singlemember is an individual, the business income is reported on the member's personal tax return on Schedule C of Form 1040. member LLC is subject to Tennessee franchise and excise taxes.

Here are the steps to start an LLC in Tennessee: Name your LLC. Select a registered agent. Submit your LLC articles of organization. Create an operating agreement. Obtain an EIN. Apply for required business license(s). File an annual report.