Tennessee Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages

Description

How to fill out Agreement Waiving Right Of Inheritance Between Husband And Wife In Favor Of Children By Prior Marriages?

Have you been within a position where you will need files for sometimes enterprise or individual purposes just about every day time? There are a variety of legal file templates accessible on the Internet, but discovering ones you can rely isn`t effortless. US Legal Forms delivers 1000s of form templates, like the Tennessee Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages, that are written to satisfy state and federal requirements.

In case you are previously acquainted with US Legal Forms internet site and also have a free account, simply log in. Afterward, you can down load the Tennessee Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages web template.

Should you not provide an bank account and wish to start using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for the right town/area.

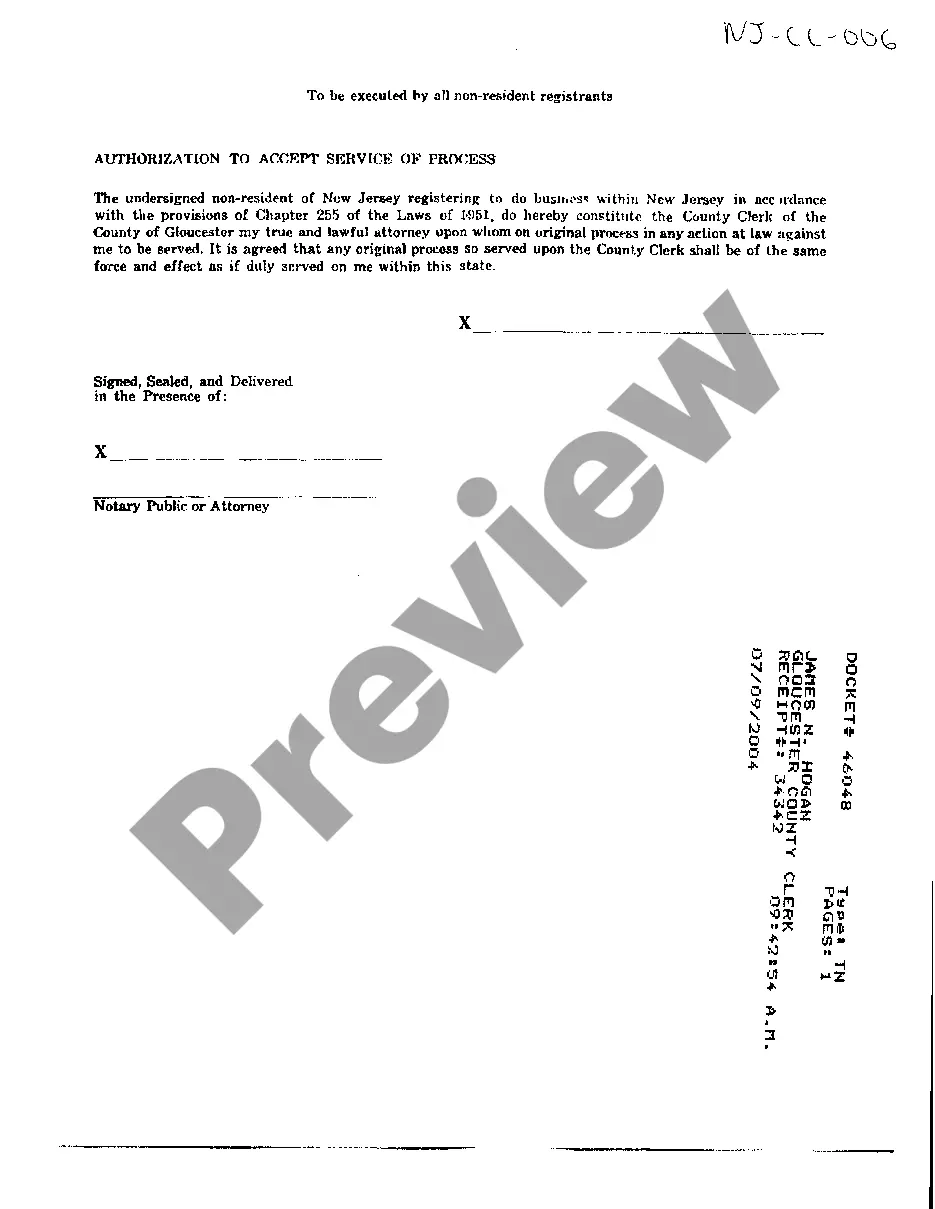

- Use the Preview switch to examine the shape.

- Browse the outline to actually have chosen the proper form.

- When the form isn`t what you are searching for, make use of the Search discipline to get the form that meets your needs and requirements.

- Once you find the right form, click on Purchase now.

- Select the costs strategy you want, fill in the specified details to produce your account, and purchase an order utilizing your PayPal or Visa or Mastercard.

- Choose a hassle-free document format and down load your duplicate.

Locate all of the file templates you may have bought in the My Forms food selection. You can get a more duplicate of Tennessee Agreement Waiving Right of Inheritance between Husband and Wife in Favor of Children by Prior Marriages anytime, if needed. Just click on the essential form to down load or printing the file web template.

Use US Legal Forms, the most comprehensive selection of legal forms, to save lots of time and avoid mistakes. The assistance delivers skillfully created legal file templates which can be used for a variety of purposes. Produce a free account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

Perhaps the best way to keep your child's inheritance separate from their spouse's money is to put it in an irrevocable trust. To do this, you would: Transfer the inheritance (money, real property, other assets) into the trust. Name your child as beneficiary.

Spouses in Tennessee Inheritance Laws For childless marriages, every piece of property that a decedent owned will be left to his or her spouse. But if the decedent had children with his or her spouse, with another person or both, the intestate estate is divided evenly among all parties.

Divvying up your estate in an equal way between your children often makes sense, especially when their histories and circumstances are similar. Equal distribution can also avoid family conflict over fairness or favoritism.

Assets Owned by a Trust Using a trust is probably the strongest way to pass assets to people other than the spouse, without requiring the spouse's permission. Many clients in second marriages use trusts to protect the assets and control the distribution to the children, rather than to the spouse.

?Trusts are the most common vehicle to protect and impact assets with some control. Parents can activate a trust while they are still living or have a trust created at the time of their passing," he said. "Trusts can also limit distributions made to current or future spouses.

While often money that is inherited during a marriage is considered marital property, with proper estate planning you can ensure that your legacy is left to your children and their children, and not to their spouse due to a potential future divorce or death.

A spendthrift Trust Will Typically Contain Provisions That Restrict trust spending to essential expenses, such as payments for medical care, groceries, and education. Stipulate that a beneficiary will only receive gifts if they meet certain conditions, such as graduating college or maintaining a high GPA.

This leads many people to wonder whether there's a way to leave money to their children without passing any rights on to their children's spouses. Typically, this can be done through trusts, and pre- and postnuptial agreements.