Tennessee Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

Are you presently inside a position in which you require papers for possibly business or person reasons almost every working day? There are a variety of legal record layouts accessible on the Internet, but discovering versions you can depend on is not straightforward. US Legal Forms provides a large number of develop layouts, just like the Tennessee Disclaimer of Inheritance Rights for Stepchildren, that happen to be created to meet state and federal needs.

Should you be presently acquainted with US Legal Forms website and get an account, simply log in. After that, it is possible to download the Tennessee Disclaimer of Inheritance Rights for Stepchildren format.

Should you not come with an account and would like to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is to the appropriate area/area.

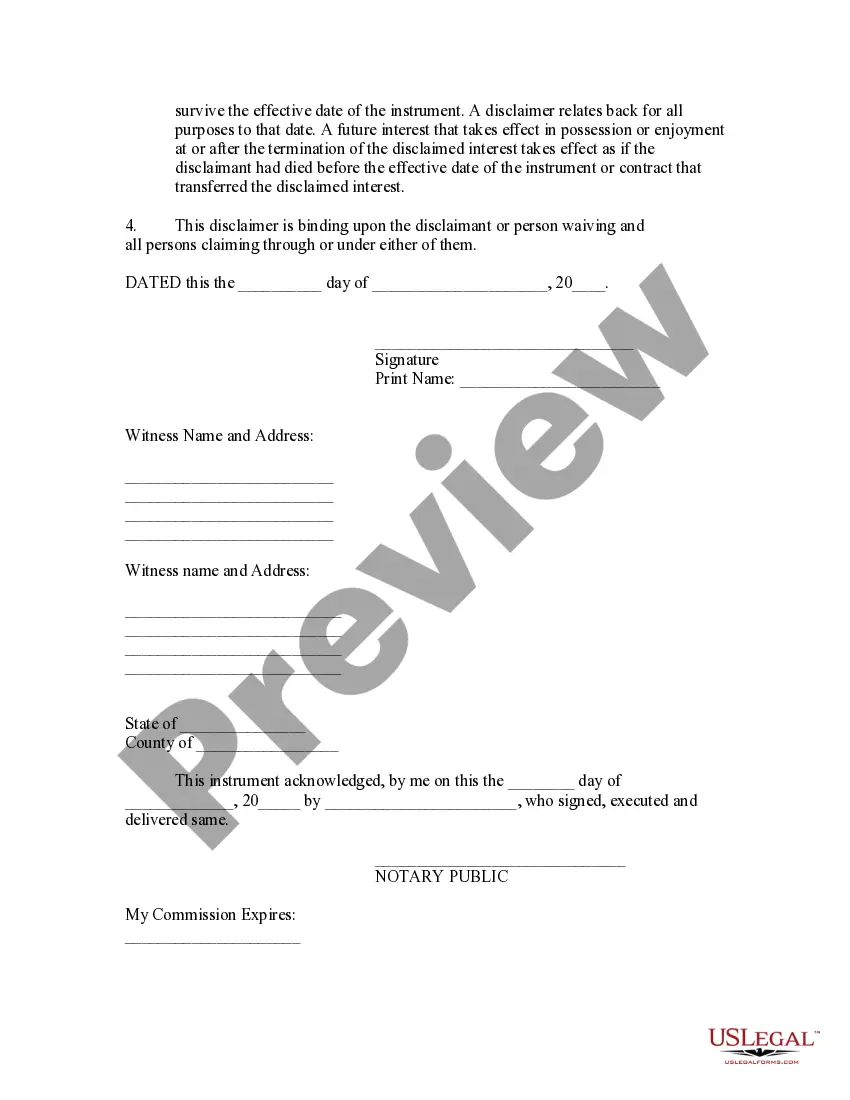

- Utilize the Preview button to check the form.

- See the outline to actually have selected the right develop.

- In case the develop is not what you are trying to find, take advantage of the Search industry to get the develop that meets your requirements and needs.

- Whenever you discover the appropriate develop, just click Get now.

- Select the prices strategy you would like, complete the required details to create your money, and buy your order utilizing your PayPal or Visa or Mastercard.

- Decide on a practical data file structure and download your version.

Locate each of the record layouts you possess bought in the My Forms food list. You may get a more version of Tennessee Disclaimer of Inheritance Rights for Stepchildren any time, if needed. Just go through the required develop to download or print the record format.

Use US Legal Forms, probably the most comprehensive assortment of legal kinds, to save lots of efforts and stay away from blunders. The service provides expertly produced legal record layouts that can be used for a selection of reasons. Create an account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

Trusts. A trust offers a more reliable method that works in nearly any circumstance. To keep assets from going directly to stepchildren on your death, you can set up a trust and name your spouse as the trustee. If you do this, however, your spouse will decide where assets go, so they may still go to stepchildren.

A last will and testament: Name your stepchildren as beneficiaries of your will. You can designate a set amount for them or instruct that they receive a percentage of whatever your estate is worth at the time of your death. A trust: Create a trust and make your stepchildren beneficiaries.

You can create a trust during your lifetime or through your will and name your child as the beneficiary. You can also appoint a trustee who will be responsible for distributing the trust income and principal ing to your instructions. A Trust can offer several advantages over leaving money directly to your child.

The non-custodial parent, despite their standing in any child support or custody issues, has primary authority over them, unless they are barred by legal action from asserting that parental right. even before your spouse dies you have no legal rights over your step children.

A last will and testament: Name your stepchildren as beneficiaries of your will. You can designate a set amount for them or instruct that they receive a percentage of whatever your estate is worth at the time of your death. A trust: Create a trust and make your stepchildren beneficiaries.

Stepchildren are not in line for a share of any part of the estate, the house included. The deceased must have legally adopted them for any inheritance rights to exist.

Lastly, a step-child can also be named as a beneficiary of a life insurance policy or a Pay-On-Death financial account. While there is no legal obligation to leave step-children an inheritance, it may be the best choice when there's a close relationship or the step-parent played a significant role in raising the child.

How Can I Exclude My Stepchild? You don't have to do anything to ensure that your stepchildren get nothing from your estate. Unless you designate them in your will, your stepchildren have no rights to the property.