Montana Minutes for Partnership

Description

How to fill out Minutes For Partnership?

If you intend to finalize, acquire, or print lawful document templates, utilize US Legal Forms, the predominant selection of legal forms that are accessible online.

Employ the site's straightforward and user-friendly search function to find the documents you need.

Various templates for corporate and personal use are categorized by type and state, or by keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you have saved in your account. Click the My documents section and select a form to print or download again.

Compete and obtain, and print the Montana Minutes for Partnership with US Legal Forms. There are millions of specialized and state-specific forms available for your business or personal needs.

- Use US Legal Forms to access the Montana Minutes for Partnership with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Montana Minutes for Partnership.

- You can also view forms you saved earlier from the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure that you have chosen the appropriate form for your area/state.

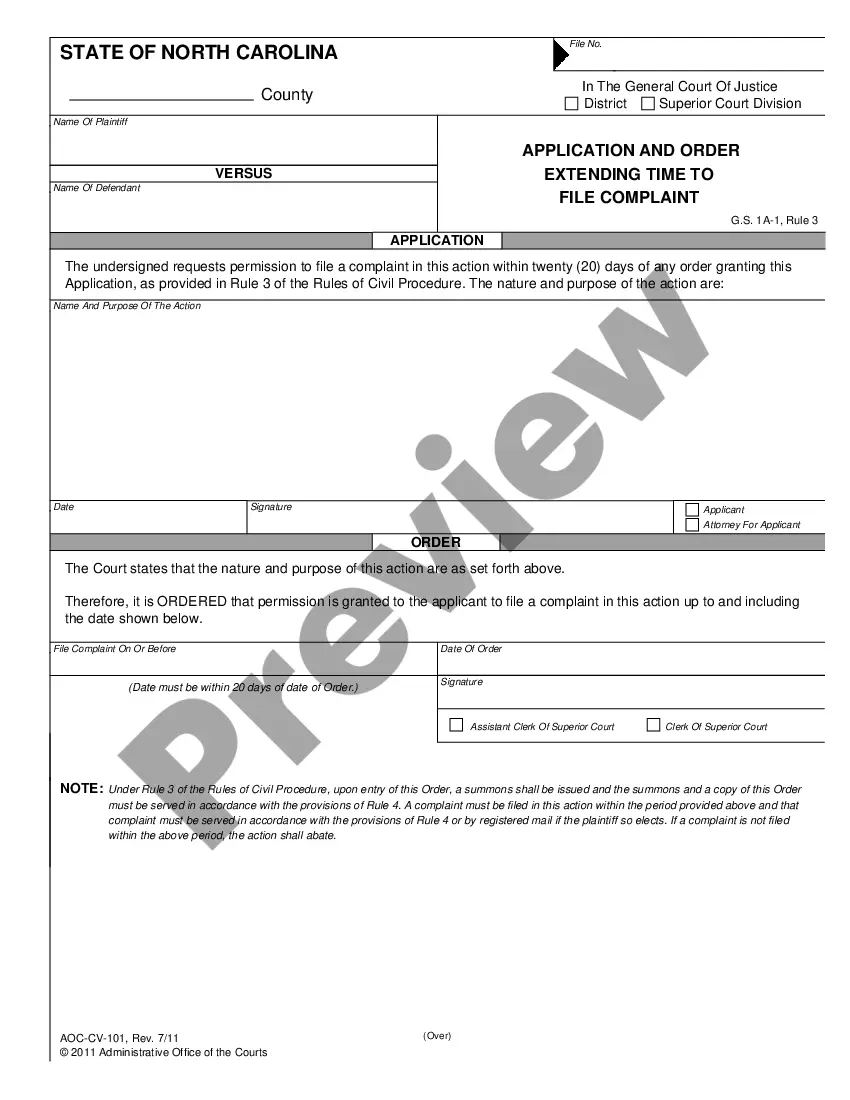

- Step 2. Use the Review option to examine the contents of the form. Be sure to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search section at the top of the screen to find other versions of the legal template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Montana Minutes for Partnership.

Form popularity

FAQ

The duration of a partnership can vary significantly based on the agreement made by the partners. Some partnerships are established for a specific project or time frame, while others may continue indefinitely. It is essential to clarify the terms in your partnership agreement, including conditions for dissolution or continuation. Montana Minutes for Partnership can help maintain clear records as the partnership evolves, ensuring all partners agree on the timeline.

Running a partnership meeting effectively requires preparation and structure. Start by setting a clear agenda and distribute it to all partners prior to the meeting. During the meeting, ensure everyone has the opportunity to speak and discuss relevant topics, while keeping engagement focused on the agenda. Utilize Montana Minutes for Partnership to document key discussions and decisions, ensuring that all partners have access to those records after the meeting.

Typically, partnerships do not have units like corporations do. Instead, partnerships operate on shared ownership, where each partner contributes capital or services. This structure allows flexibility and can accommodate varying levels of investment from partners. However, it’s vital to outline the ownership and profit-sharing arrangements clearly in your Montana Minutes for Partnership to prevent misunderstandings.

Yes, partnerships should maintain minutes to document important decisions and discussions. These records serve as an official account of meetings, helping resolve future disputes or questions. Using Montana Minutes for Partnership, partners can easily ensure that all agreements and actions are accurately recorded. This practice enhances transparency and accountability within the partnership.

Partnerships often come with significant drawbacks. First, partners share profits, which might limit individual income. Second, each partner bears personal liability for business debts, adding financial risk. Third, decision-making can be complex, as all partners may need to agree, leading to potential conflicts. Lastly, partnerships may lack continuity, as changes in ownership can affect the business's stability, necessitating careful Montana Minutes for Partnership documentation.

In 2024, the pass-through entity tax rate in Montana is set at a specific percentage that may change annually. It’s essential to stay updated on the current rate to effectively calculate your partnership’s tax liabilities. US Legal Forms keeps you informed about these changes, ensuring you manage your partnership taxes diligently.

Yes, Montana does have a pass-through entity tax, which applies to certain partnerships and similar entities. This tax allows profits to pass through to individual partners, who then report them on their personal tax returns. Understanding how this tax affects your partnership is vital, and US Legal Forms provides handy tools for compliance and clarity.

While Montana does not mandate an extension for partnerships, it is beneficial if you need more time to file. An extension allows you to collect all necessary documentation without rush. Using the US Legal Forms platform can simplify the extension process, ensuring you meet all requirements seamlessly.

The 183-day rule in Montana pertains to determining a partnership's residency status for tax purposes. Essentially, if a partner spends more than 183 days in the state, they may be considered a resident for tax obligations. Awareness of this rule is essential in managing your partnership’s tax responsibilities effectively, and US Legal Forms can assist in ensuring you remain compliant.

Montana does not require a partnership extension if you file on time. However, if you cannot meet the tax deadline, applying for an extension can provide additional time to prepare your filings. Make sure to file your extension correctly to maintain compliance; US Legal Forms offers resources to help you avoid common pitfalls.