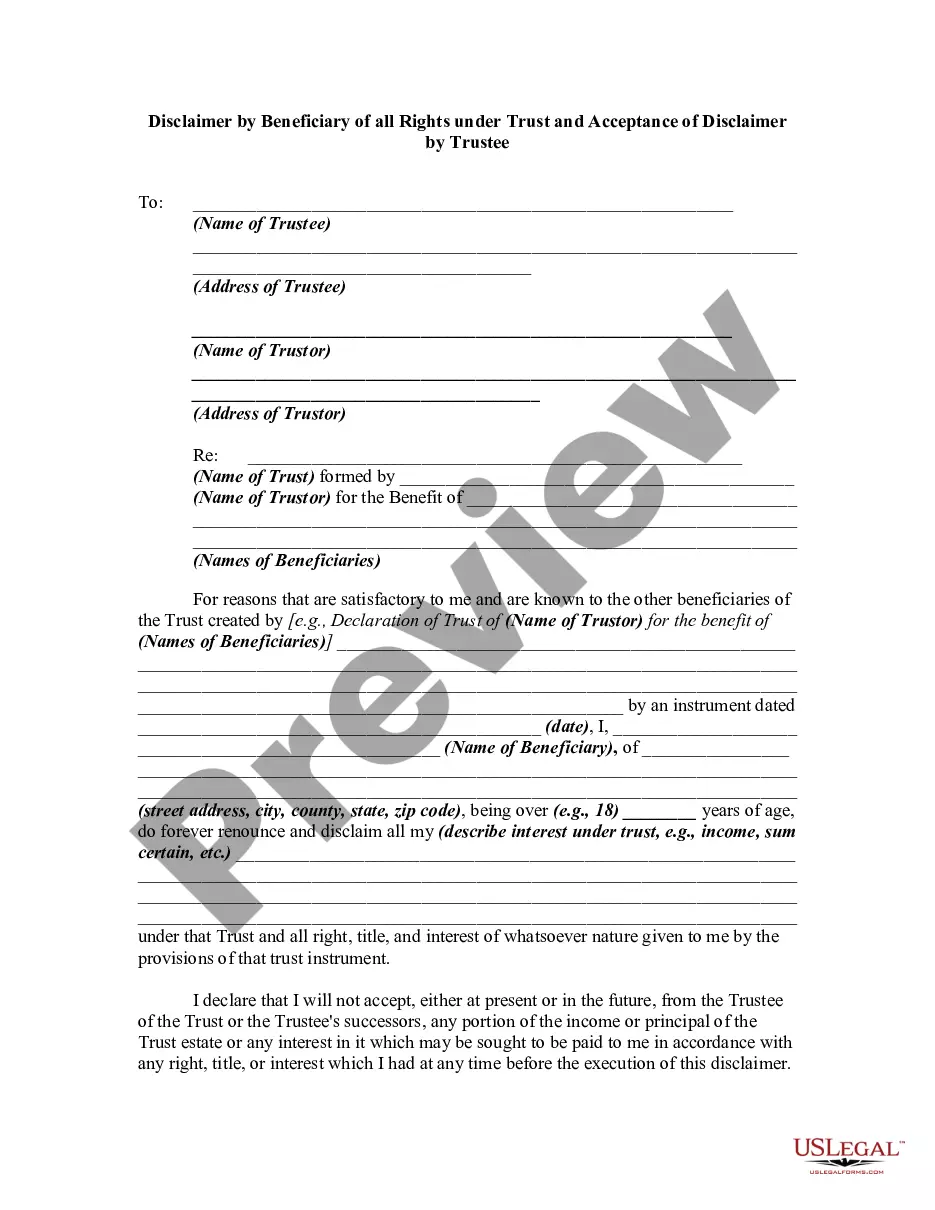

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Disclaimer by Beneficiary of all Rights in Trust

Description

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

Finding the correct valid document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you secure the valid form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Tennessee Disclaimer by Beneficiary of all Rights in Trust, which can be utilized for business and personal purposes.

If the form does not fit your needs, use the Search field to find the correct form. Once you are certain that the form is suitable, click the Buy Now button to acquire the form. Choose the pricing plan you wish and fill in the required information. Create your account and pay for your purchase using your PayPal account or credit card. Select the file format and download the valid document template to your device. Complete, modify, print, and sign the received Tennessee Disclaimer by Beneficiary of all Rights in Trust. US Legal Forms is the largest repository of legal forms from which you can find numerous document templates. Take advantage of the service to download professionally crafted documents that comply with state requirements.

- All of the documents are verified by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Tennessee Disclaimer by Beneficiary of all Rights in Trust.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your area. You can review the form using the Preview option and read the form details to confirm it is the right one for you.

Form popularity

FAQ

A beneficiary in Tennessee holds certain rights, including the right to receive information about the trust and its assets. They can also request an accounting and may have the ability to exercise a disclaimer of their interest. However, with the complexities involved in trust law, understanding the full scope of these powers can be challenging. Utilizing the resources available on the US Legal Forms platform can help clarify the role of a beneficiary and the Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Tennessee follows a specific order of inheritance according to its probate laws. Generally, the first beneficiaries are the children of the deceased, followed by parents, siblings, and then more distant relatives. If no relatives exist, the estate could escheat to the state. Understanding the implications of a Tennessee Disclaimer by Beneficiary of all Rights in Trust can help you navigate these complexities and ensure your wishes are honored.

In Tennessee, a disclaimer by a beneficiary can override their rights to inherit assets from a trust. When a beneficiary formally disclaims their interest, it ensures that the assets pass to the next eligible heir as defined in the trust or by state law. This process can provide clarity and prevent any potential disputes among beneficiaries. Considering a Tennessee Disclaimer by Beneficiary of all Rights in Trust might be a wise step for those looking to manage inheritance issues efficiently.

Writing a beneficiary Disclaimer letter requires clear and concise communication of your intent to renounce the trust interest. The letter should include details about the trust, your relationship to it, and a statement of disclaimer. For assistance, consider using templates from USLegalForms, which can help guide you through creating a Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Yes, a transfer on death (TOD) beneficiary has the right to disclaim their inheritance. This disclaimer allows the assets to pass to alternate beneficiaries as outlined in the trust. In Tennessee, accurate procedures must be followed to ensure a valid Tennessee Disclaimer by Beneficiary of all Rights in Trust if a TOD beneficiary decides to renounce their share.

Disclaimer trusts can present challenges, including potential confusion about asset distribution. If not executed correctly, a disclaimer might not transfer the intended benefits to the next beneficiary. Addressing these potential pitfalls is crucial, and utilizing resources like USLegalForms can help ensure compliance with the Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Yes, a beneficiary can disclaim their interest in a trust. This action allows them to pass their benefits to another party, usually the next beneficiary in line. To do this in Tennessee, beneficiaries should always ensure they follow legal protocols to execute a valid Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Beneficiaries in Tennessee possess specific rights granted under trust law. These rights typically include receiving information about the trust, accessing trust assets, and enforcing the trust's terms. It’s important to know and understand your rights to navigate trust agreements effectively, especially if you are considering a Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Yes, a trust beneficiary can disclaim their interest. Disclaiming allows beneficiaries to forfeit their rights, which can be beneficial if the inheritance is burdensome. In Tennessee, the process is straightforward, and following the proper procedures leads to a clear Tennessee Disclaimer by Beneficiary of all Rights in Trust.

Certainly, a beneficiary can renounce an interest in a trust. This action is often pursued to avoid tax implications or other responsibilities linked to the trust assets. In Tennessee, beneficiaries can use a legally defined Tennessee Disclaimer by Beneficiary of all Rights in Trust to formalize their renunciation effectively.