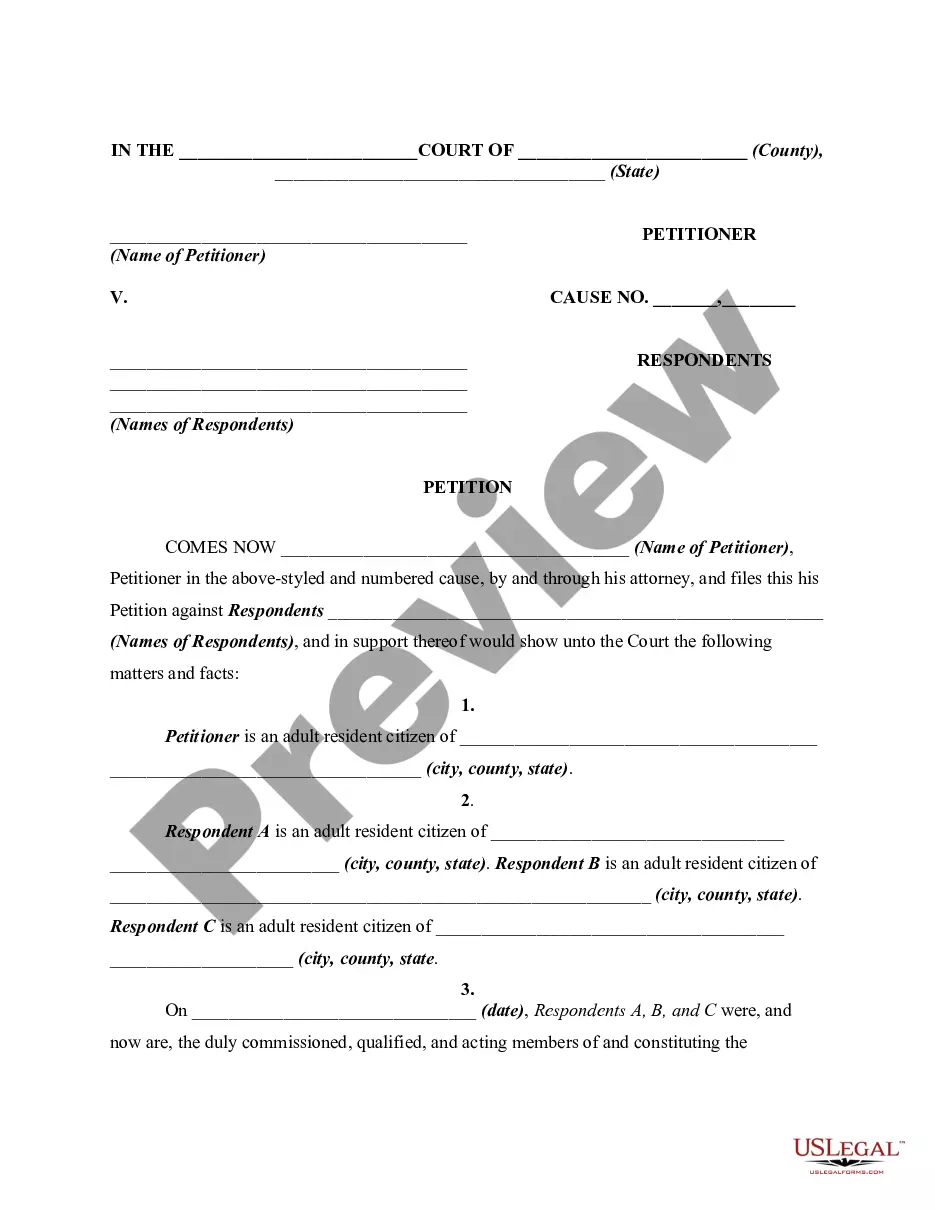

Agreements among family members for the settlement of an intestate's estate will be upheld in the absence of fraud and when the rights of creditors are met. Intestate means that the decedent died without a valid will. The termination of any family controversy or the release of a reasonable, bona fide claim in an intestate estate have been held to be sufficient consideration for a family settlement.

Tennessee Agreement Between Heirs as to Division of Estate

Description

How to fill out Agreement Between Heirs As To Division Of Estate?

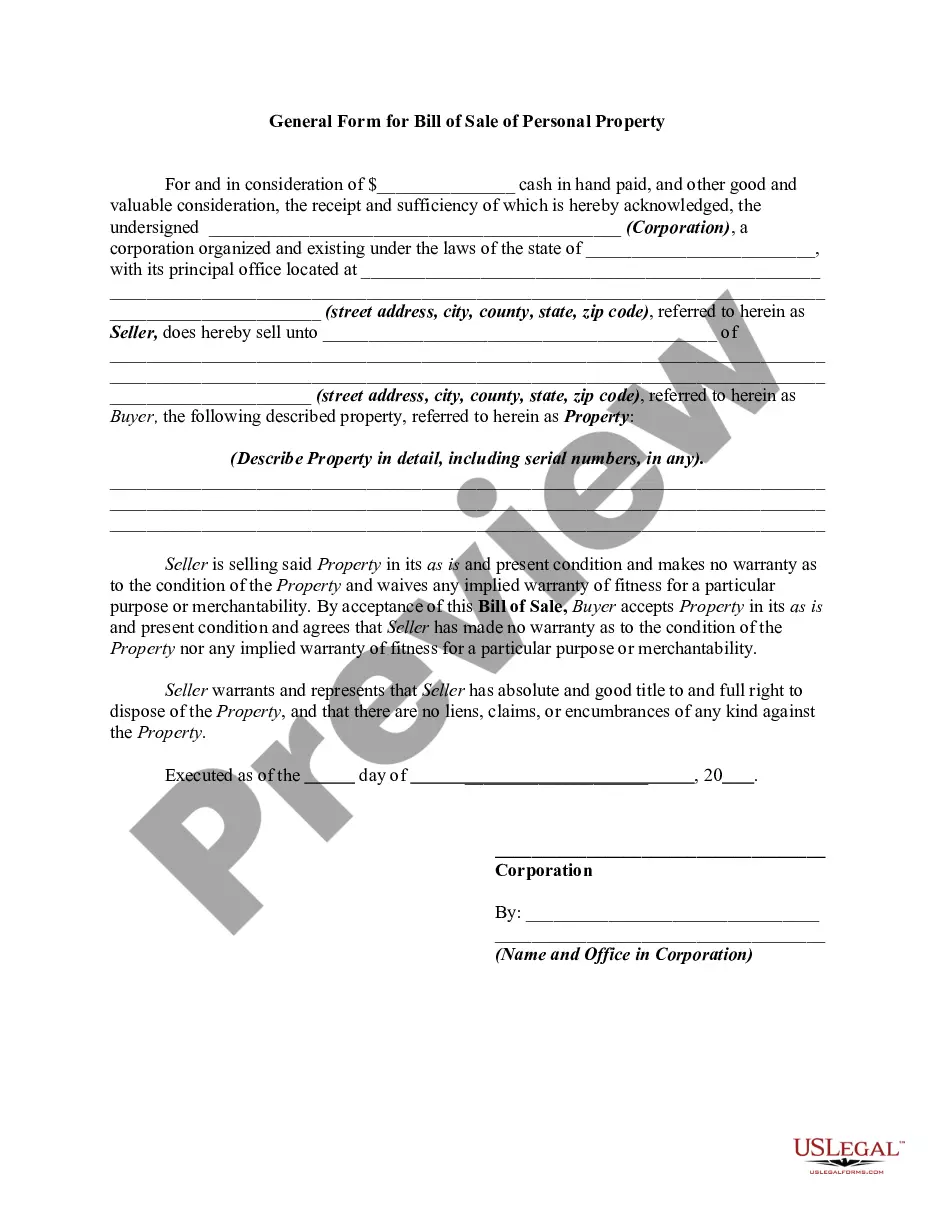

Have you been within a situation where you need to have paperwork for sometimes company or specific reasons virtually every working day? There are tons of lawful record web templates available on the net, but discovering versions you can rely isn`t simple. US Legal Forms provides a huge number of kind web templates, like the Tennessee Agreement Between Heirs as to Division of Estate, that are written to meet state and federal demands.

Should you be currently informed about US Legal Forms internet site and have a merchant account, simply log in. Next, you are able to down load the Tennessee Agreement Between Heirs as to Division of Estate format.

Should you not provide an profile and wish to begin using US Legal Forms, follow these steps:

- Find the kind you want and make sure it is for the correct area/area.

- Make use of the Preview option to analyze the form.

- Read the outline to actually have selected the correct kind.

- In the event the kind isn`t what you are seeking, take advantage of the Look for area to discover the kind that fits your needs and demands.

- Once you find the correct kind, simply click Get now.

- Pick the prices prepare you need, submit the desired information and facts to make your bank account, and pay for the transaction with your PayPal or Visa or Mastercard.

- Choose a convenient paper structure and down load your duplicate.

Locate all of the record web templates you may have bought in the My Forms food list. You can aquire a additional duplicate of Tennessee Agreement Between Heirs as to Division of Estate anytime, if required. Just click the essential kind to down load or print out the record format.

Use US Legal Forms, probably the most comprehensive assortment of lawful kinds, to save time and prevent mistakes. The assistance provides professionally produced lawful record web templates which you can use for a selection of reasons. Produce a merchant account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

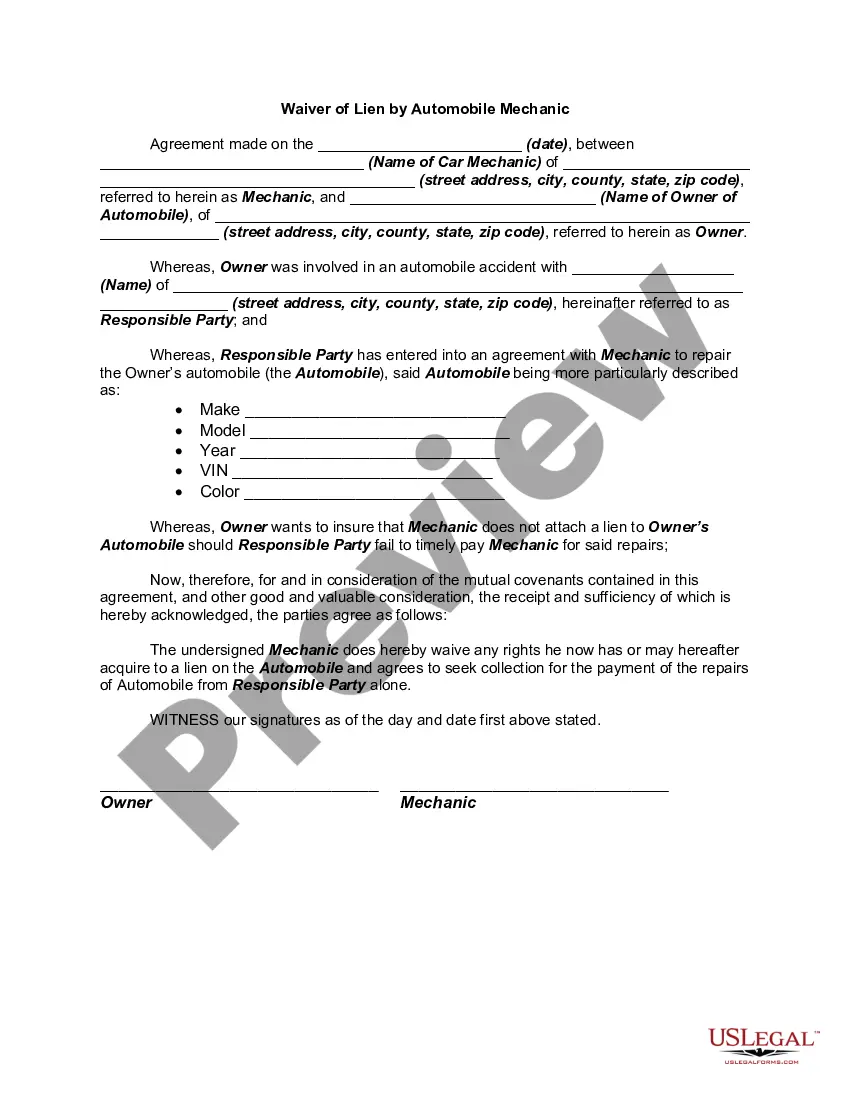

Commonly called a contract, a contractual agreement between two or more parties allows or restricts them from engaging in certain acts by creating mutual obligations enforceable by law.

The purchase and sale of inheritance rights is an agreement between two parties in which one person sells his or her right to inherit the property and assets of a deceased person in exchange for financial compensation.. In other words, it is the sale of a person's interest in the estate of a deceased relative.

A Tennessee Affidavit of Heirship provides conclusive evidence of the deceased person's family history and their heirs, allowing legal measures to be taken to establish the rightful inheritance of the property. Title companies accept a Tennessee Affidavit of Heirship during the process of transferring real estate.

A contract is an agreement between parties, creating mutual obligations that are enforceable by law. The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

This is a written document that must be signed by everyone involved. It acknowledges that they have a right to inherit, and sets out how the new agree inheritance will be carried out, which will be different to that written within the will.

Surviving spouses and children are first to qualify as direct heirs-at-law in California's Intestate Succession which orders the priority of heirs on how closely they are related to the decedent. Grand children would qualify as direct heirs only if their parents are deceased.

If there is nevertheless a desire to provide one's partner with financial security, a contract of inheritance might make sense in these instances, as it allows the partners to appoint each other as heirs with binding effect.

If ownership changes hands without probate, a beneficiary can ask that the property not be sold. But if just one co-heir wants to sell, that person can force the sale through a legal process called a partition action, no matter what the other beneficiaries want.