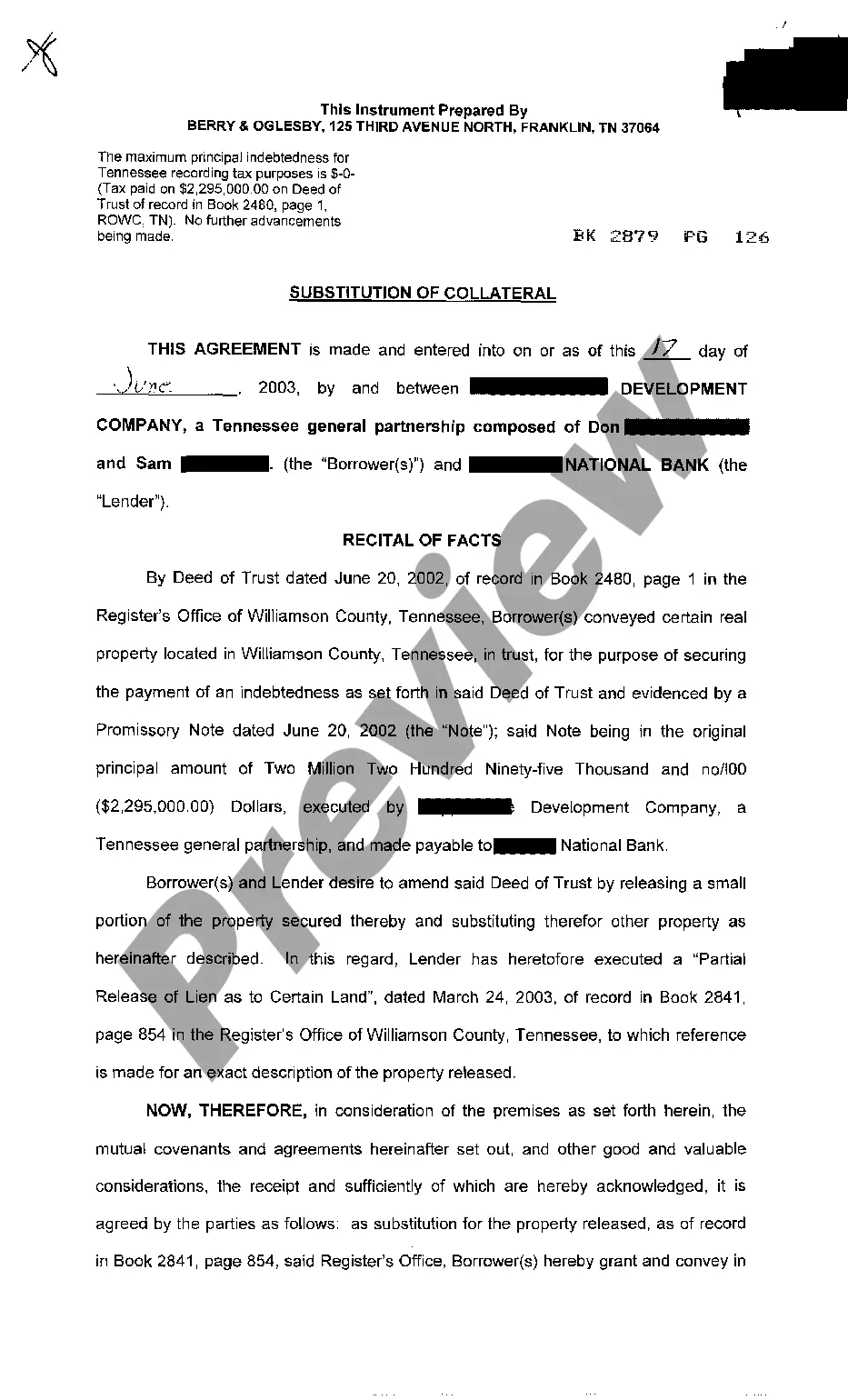

Tennessee Substitution of Collateral

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

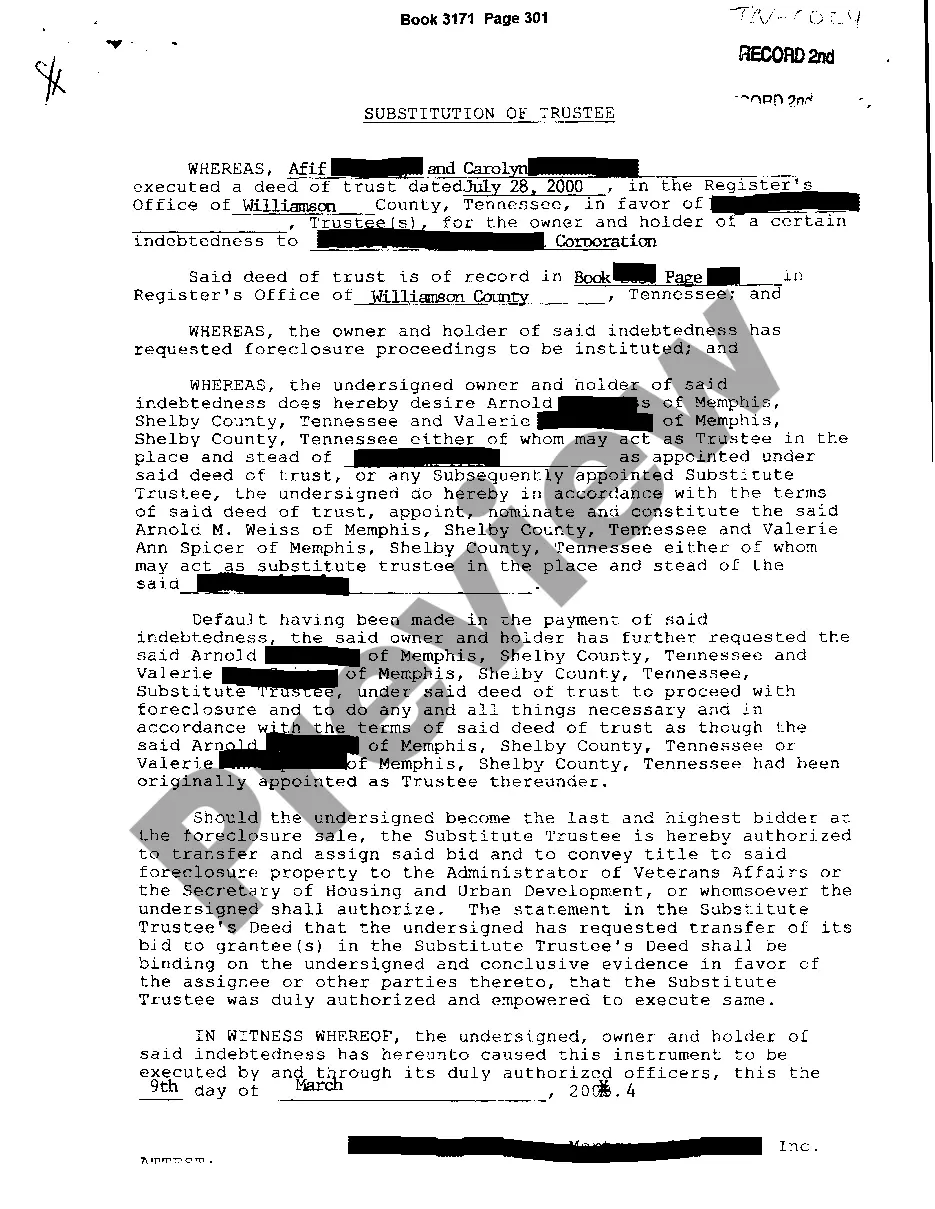

How to fill out Tennessee Substitution Of Collateral?

Get access to top quality Tennessee Substitution of Collateral samples online with US Legal Forms. Prevent hours of lost time searching the internet and dropped money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Find over 85,000 state-specific authorized and tax templates that you could download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click on Download button. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Check if the Tennessee Substitution of Collateral you’re looking at is appropriate for your state.

- View the form using the Preview function and read its description.

- Check out the subscription page by clicking on Buy Now button.

- Choose the subscription plan to keep on to register.

- Pay out by credit card or PayPal to finish making an account.

- Select a favored file format to download the document (.pdf or .docx).

You can now open the Tennessee Substitution of Collateral example and fill it out online or print it out and do it yourself. Take into account mailing the document to your legal counsel to make certain things are completed correctly. If you make a mistake, print and complete sample again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get a lot more forms.

Form popularity

FAQ

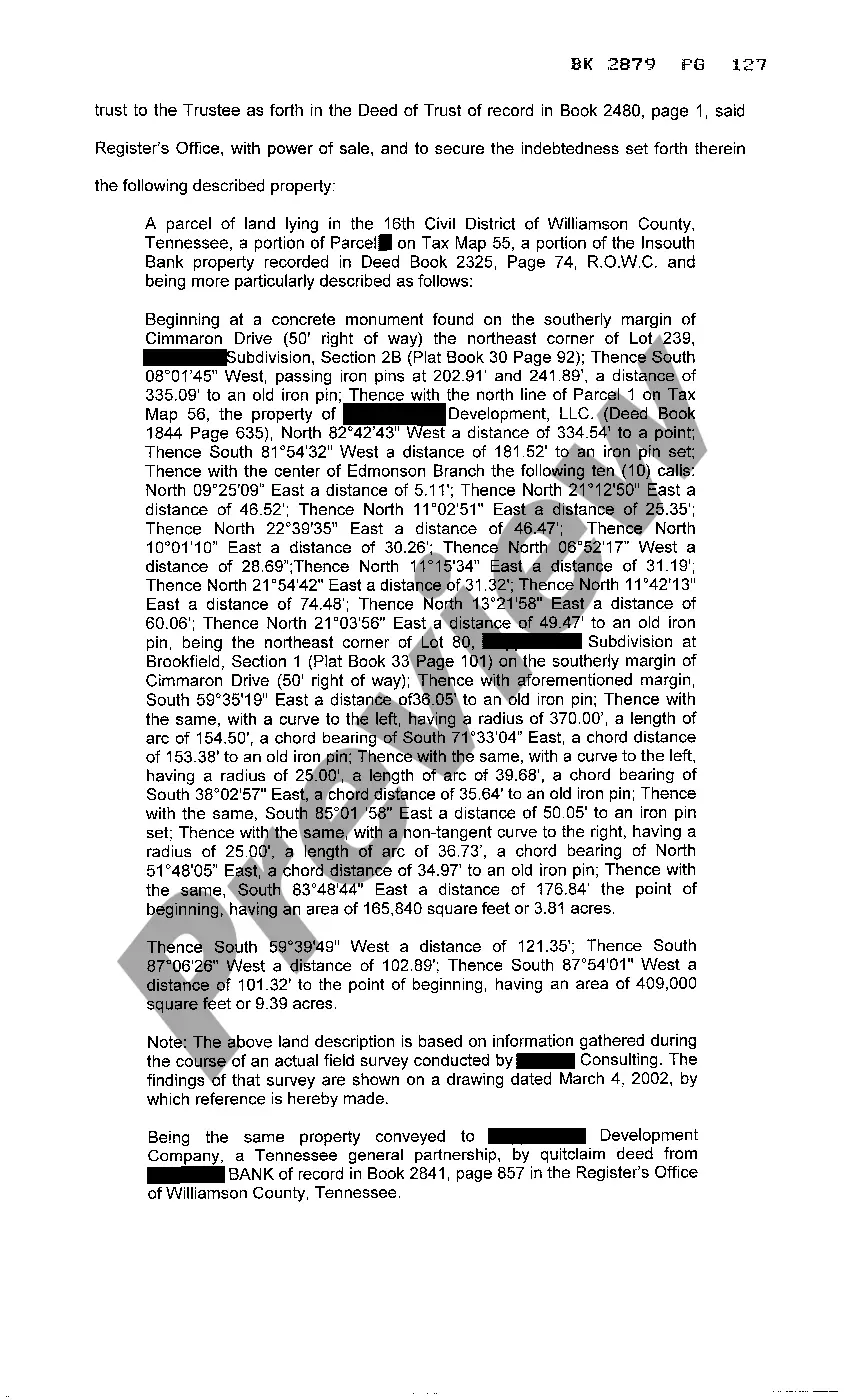

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

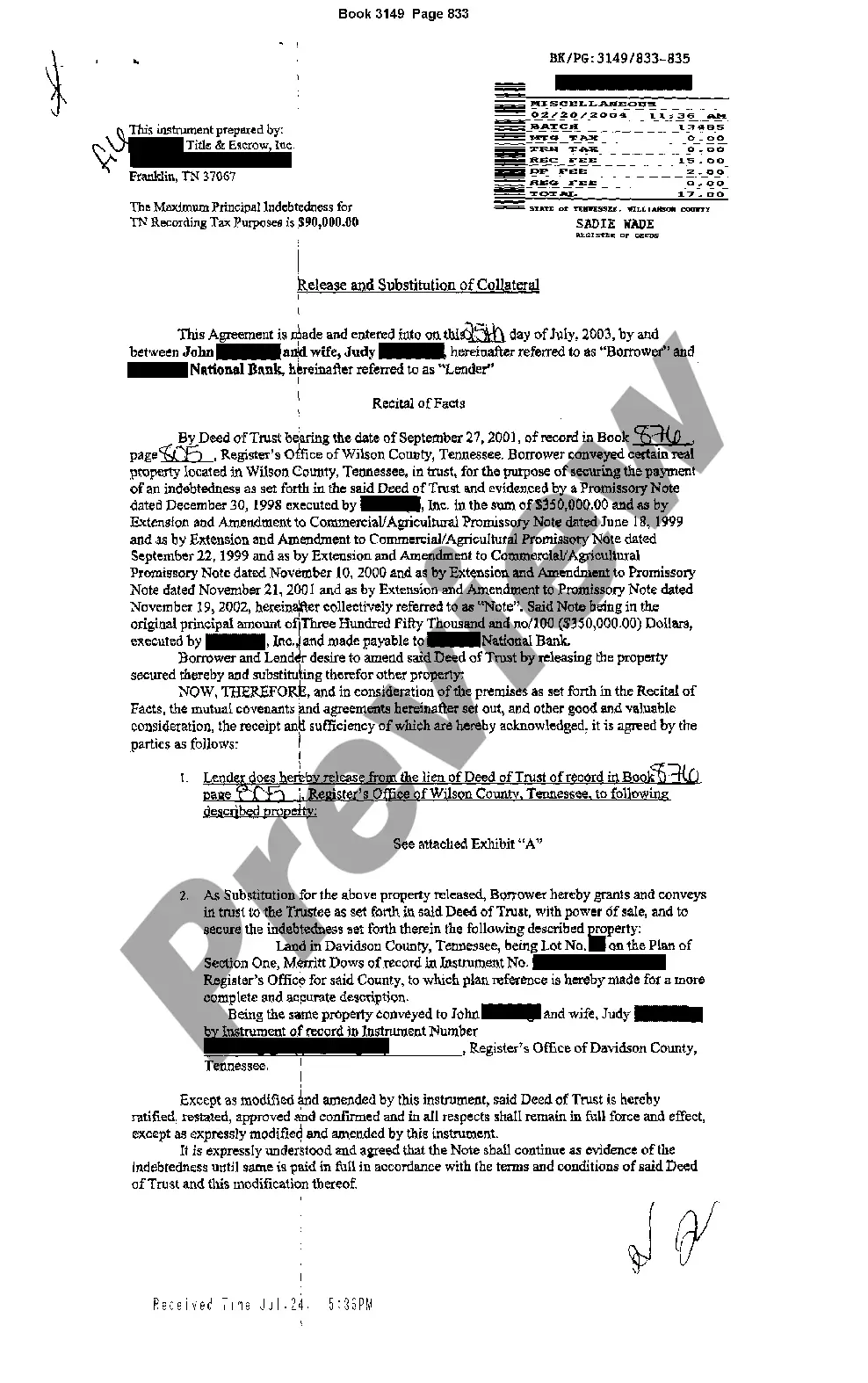

Consider a "Substitution of Collateral." Essentially, a Substitution of Collateral is where your car lender will agree to move the lien that they have on the old (wrecked) car to a new (substitute) car. Basically, the new car becomes the security for the old loan.

Substitution of collateral is when a lender allows the borrower to transfer the mortgage that the borrower signed to another property that the borrower has that is of equal or greater value.A clause must be in purchase agreement stating the seller allows you to substitute collateral at any time during your agreement.

Real estate. The most common type of collateral used by borrowers is real estate. Cash secured loan. Cash is another common type of collateral because it works very simply. Inventory financing. Invoice collateral. Blanket liens.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.

Subordinate or Substitute. Subordination occurs when a lender who holds a mortgage (or deed of trust) on a piece of property agrees to make their lien subordinate to another lien. A mortgage or deed of trust is a lien placed on a property as collateral for a loan.

According to Experian, in the most basic terms, collateral is an asset.In the event the borrower becomes incapable of making payments, the lender can seize the collateral to make up for their financial loss. A mortgage, on the other hand, is a loan specific to housing where the real estate is the collateral.