An Order granting relief from stay regarding collateral is a court order issued by a judge in a bankruptcy case that allows a secured creditor to enforce its security interest in the debtor's property. The order is granted after the creditor has requested relief from the automatic stay, which is put in place when a bankruptcy petition is filed and prohibits creditors from taking action against the debtor or its property. Types of Order granting relief from stay regarding collateral include: * Absolute Order of Relief — this order grants the creditor full relief from the stay, allowing it to take legal action against the debtor without any further court approval. * Conditional Order of Relief — this order grants the creditor limited relief from the stay, allowing it to take legal action against the debtor only if certain conditions are met. * Partial Order of Relief — this order grants the creditor partial relief from the stay, allowing it to take legal action against only a specific piece of property.

Order granting relief from stay regarding collateral

Description

Key Concepts & Definitions

Order granting relief from stay regarding: A legal document issued by a bankruptcy court that permits a creditor to continue with collection actions, which the automatic stay in bankruptcy would normally prohibit. This order is specific to certain collateral or circumstances outlined in the motion relief filed by the creditor. Automatic stay: An automatic injunction that halts actions by creditors, with certain exceptions, to collect debts from a debtor who has declared bankruptcy. This stay is automatically in place upon filing bankruptcy under chapters like stay chapter 7 or 13.

Step-by-Step Guide

- Filing the Motion: The creditor must file a motion relief to the pertinent bankruptcy court outlining why the stay should be lifted, which can include arguments regarding the collateral or detriment to the creditor if the stay continues.

- Notice to Other Parties: After filing, the creditor must provide notice of the motion to the debtor and any other relevant parties.

- Objection Period: Interested parties are given a window during which they can object to the motion. This period is crucial for the presentation of any counterarguments.

- Court Hearing: If objections are received, a court hearing will be scheduled, otherwise, the court might rule on the filing based on the information provided in the documents.

- Issuance of the Order: If the court finds merit in the creditor's request, it will issue an order granting relief from the automatic stay, allowing the creditor to proceed with actions regarding the stated collateral.

Risk Analysis

- Legal Risks: Inaccurate or incomplete filings can lead to a denial of the motion relief, potentially incurring additional legal costs.

- Financial Risks: If the motion is denied, the creditor may continue to face delays in recovery of debts, impacting financial health.

- Reputational Risks: Filing a motion can sometimes be viewed negatively by customers or the public, affecting a creditor's reputation.

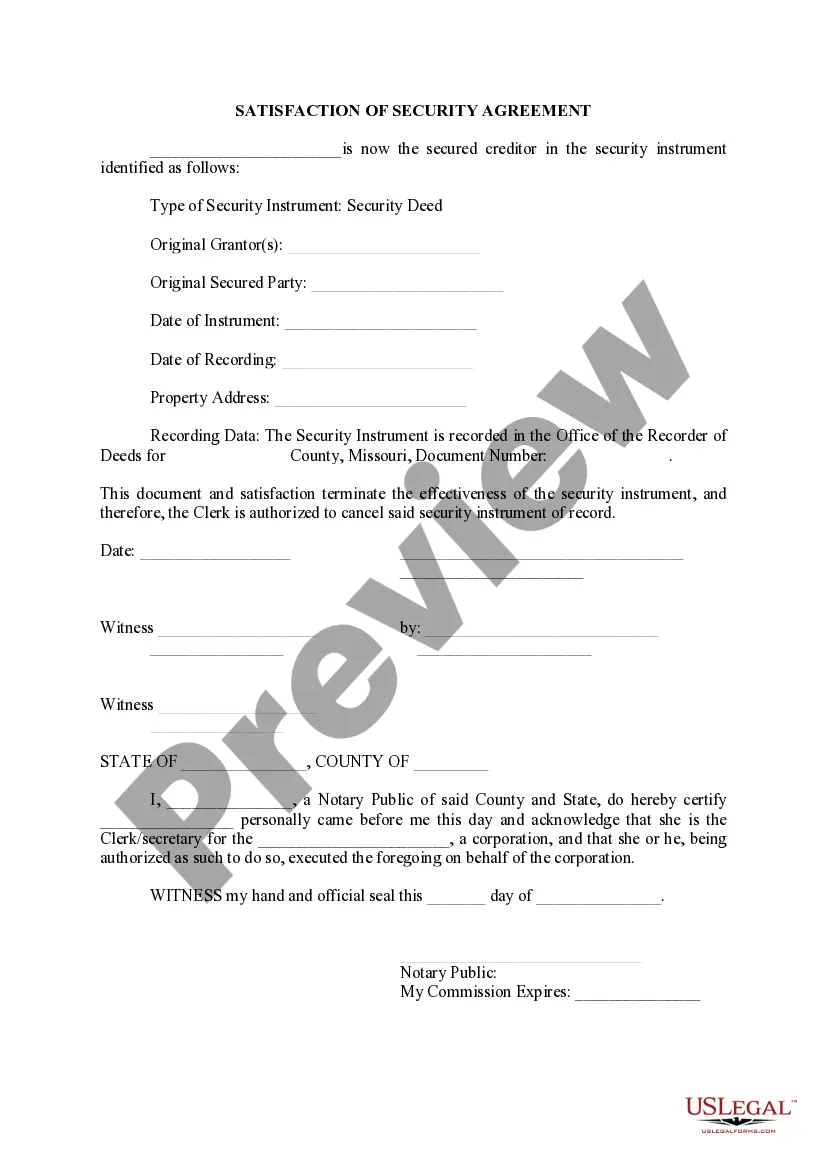

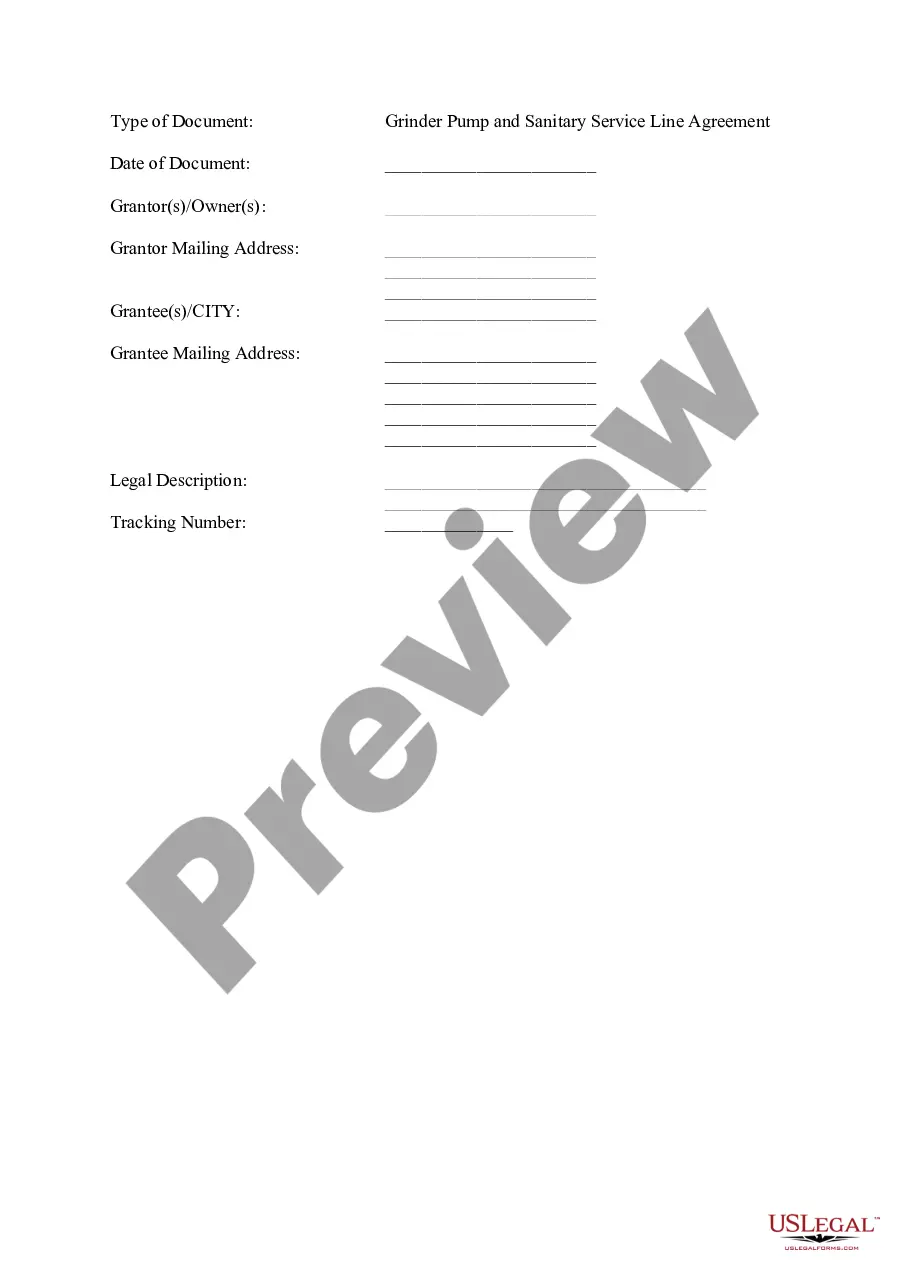

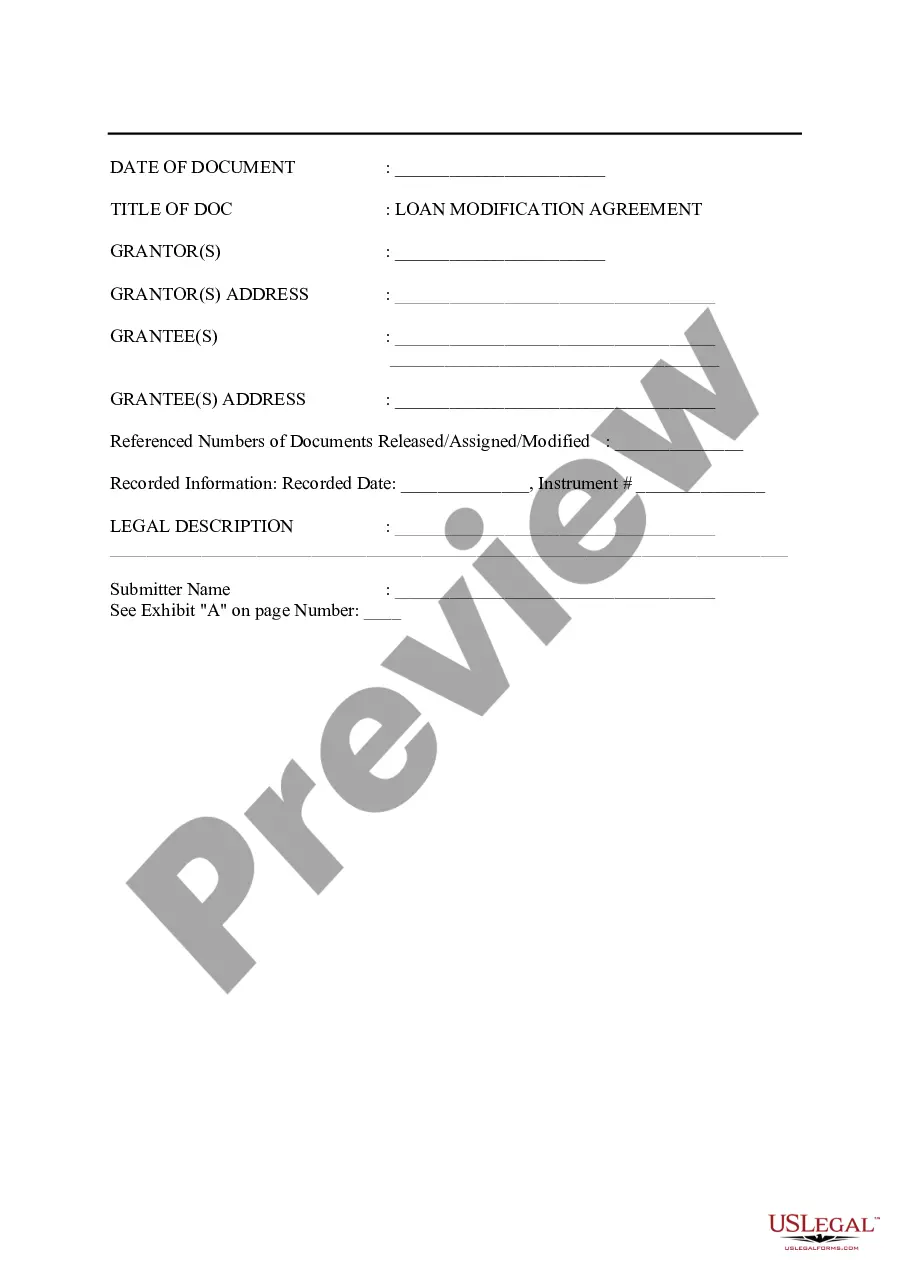

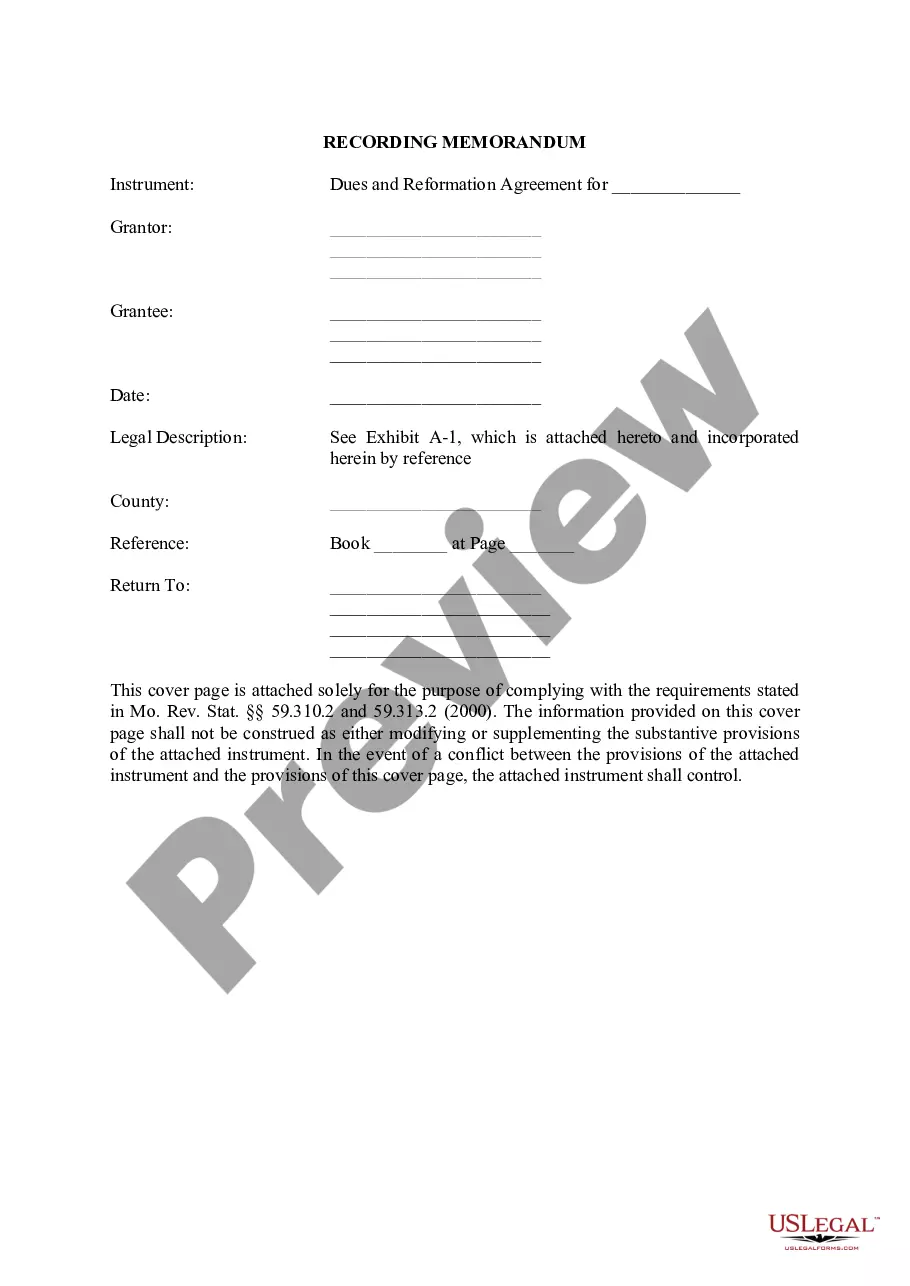

How to fill out Order Granting Relief From Stay Regarding Collateral?

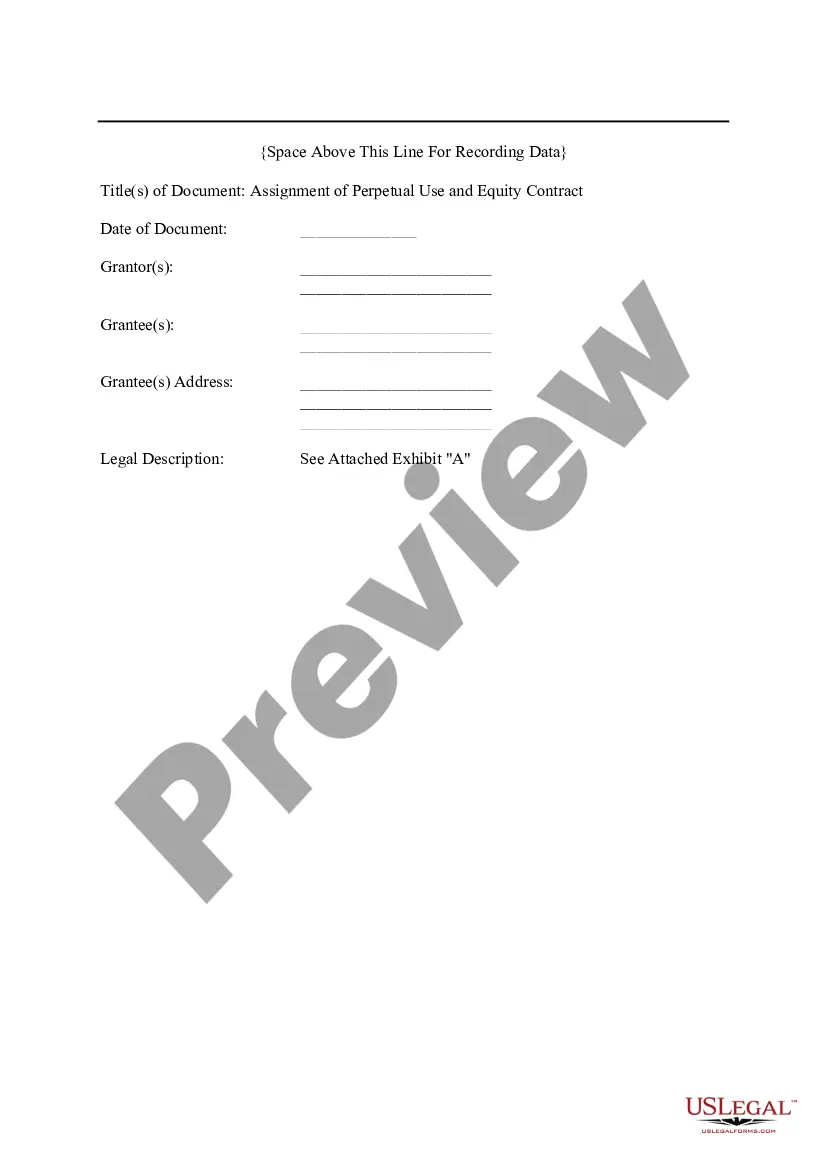

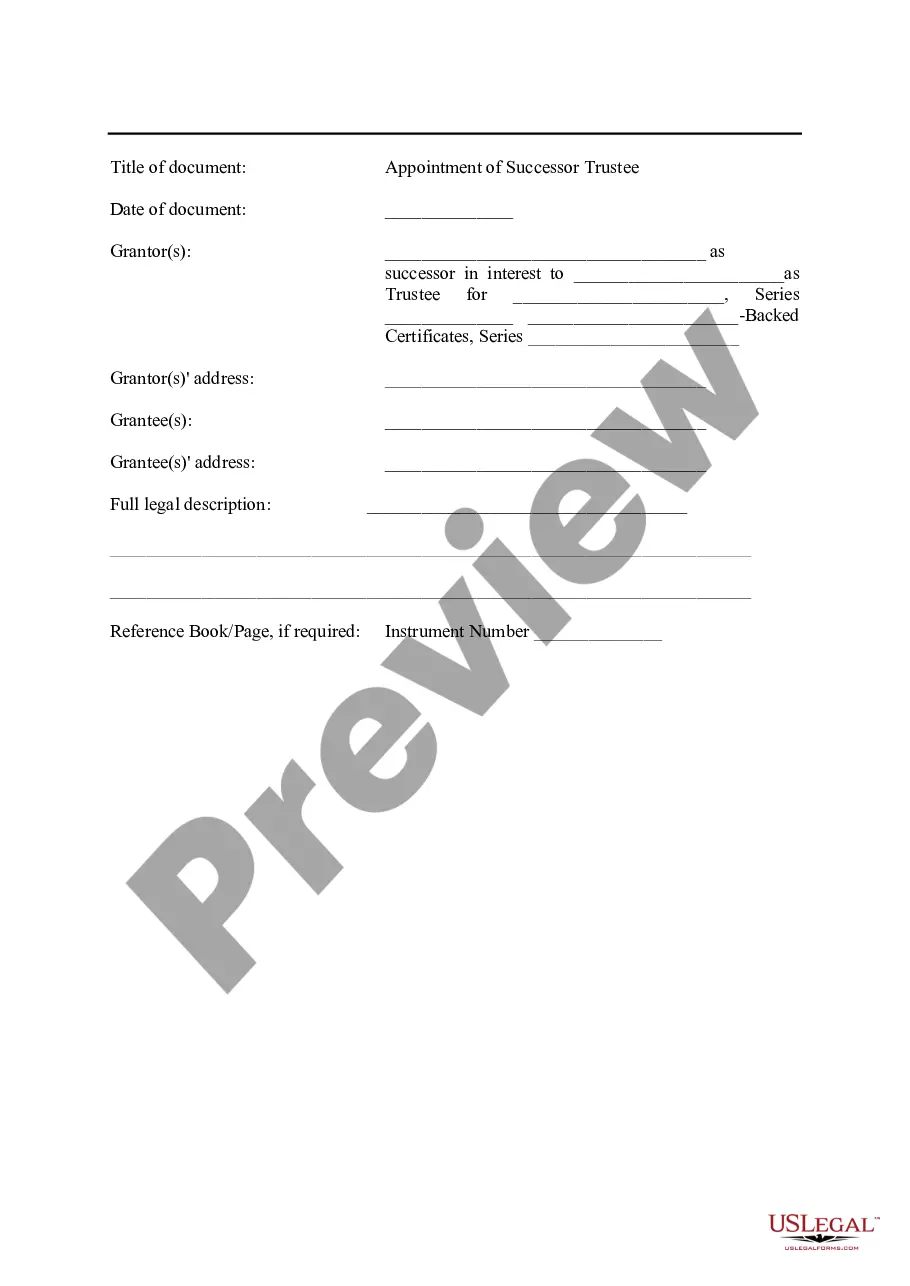

Working with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Order granting relief from stay regarding collateral template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is straightforward and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Order granting relief from stay regarding collateral within minutes:

- Remember to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Order granting relief from stay regarding collateral in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Order granting relief from stay regarding collateral you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

A Chapter 11 bankruptcy allows a company to stay in business and restructure its obligations. If a company filing for Chapter 11 opts to propose a reorganization plan, it must be in the best interest of the creditors. If the debtor does not put forth a plan, the creditors may propose one instead.

The most commonly sought exceptions are actions by parties to securities contracts to close out open positions; eviction of a debtor by a landlord where the lease has been fully terminated prior to the bankruptcy filing; actions by taxing authorities to conduct tax audits, issue deficiency notices, demand tax returns

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

The automatic stay provides a period of time in which all judgments, collection activities, foreclosures, and repossessions of property are suspended and may not be pursued by the creditors on any debt or claim that arose before the filing of the bankruptcy petition.

The automatic stay remains in effect until the case is closed or dismissed or, in an individual case, until the granting or denial of the debtor's discharge, whichever happens first. Creditors may file a Motion for Relief from the Automatic Stay requesting the stay be lifted to allow them to pursue their legal rights.

An order for relief invokes the automatic stay and brings down an iron curtain, separating the pre-bankruptcy from the post-bankruptcy debtor, creating a bankruptcy estate and prohibiting unauthorized transfers of the debtor's property.

The Stay Has Been Lifted ? Now What? Once a creditor gets a court order lifting the automatic stay, they are allowed to move forward with foreclosure or repossession of the property that secures the debt. That said, the creditor still needs to follow state law for their collection or eviction proceedings.