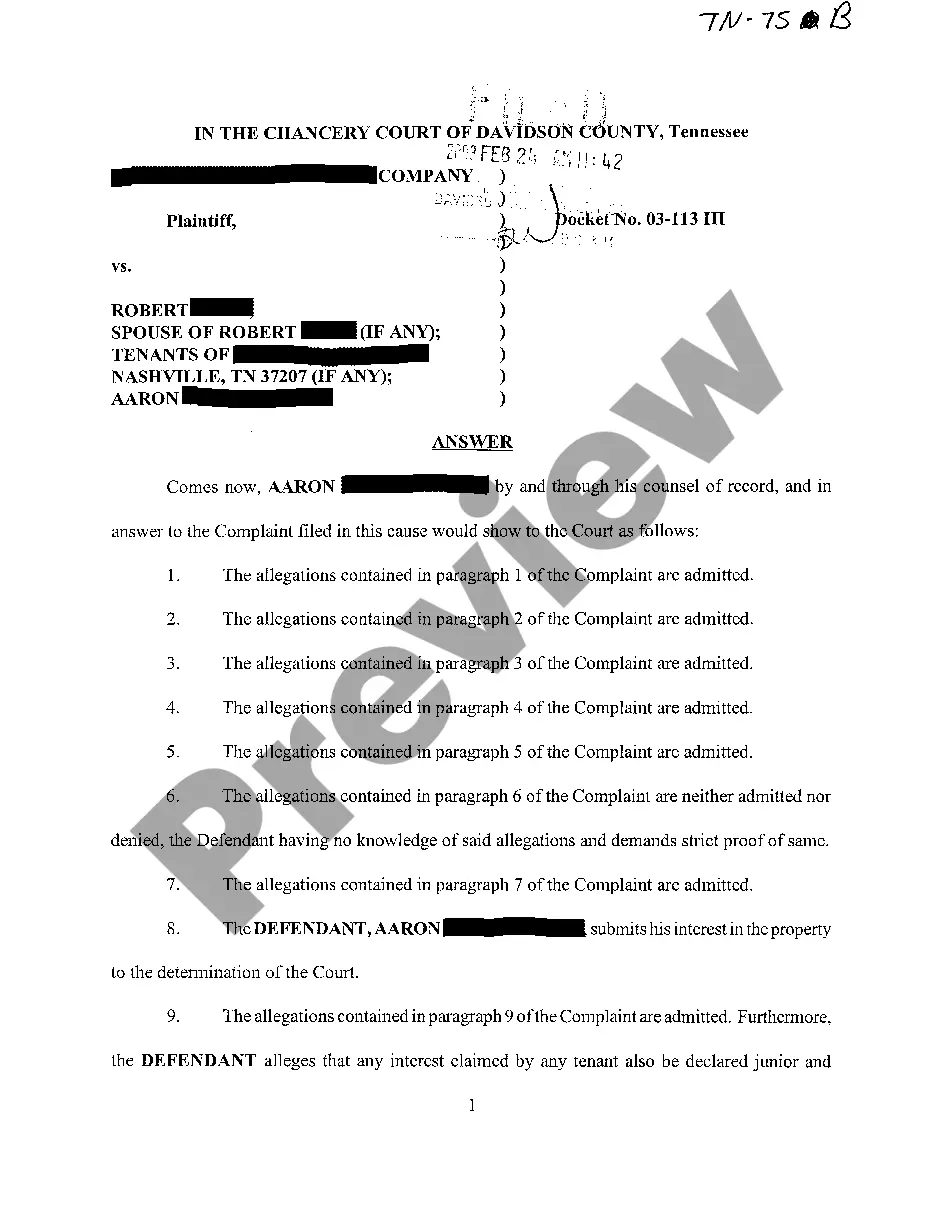

Tennessee Answer to Complaint in Equity for Real Property of Deed of Trust

Description

How to fill out Tennessee Answer To Complaint In Equity For Real Property Of Deed Of Trust?

Get access to high quality Tennessee Answer to Complaint in Equity for Real Property of Deed of Trust forms online with US Legal Forms. Avoid hours of misused time seeking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get more than 85,000 state-specific authorized and tax samples that you could save and submit in clicks in the Forms library.

To receive the sample, log in to your account and then click Download. The file is going to be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide listed below to make getting started simpler:

- Find out if the Tennessee Answer to Complaint in Equity for Real Property of Deed of Trust you’re considering is appropriate for your state.

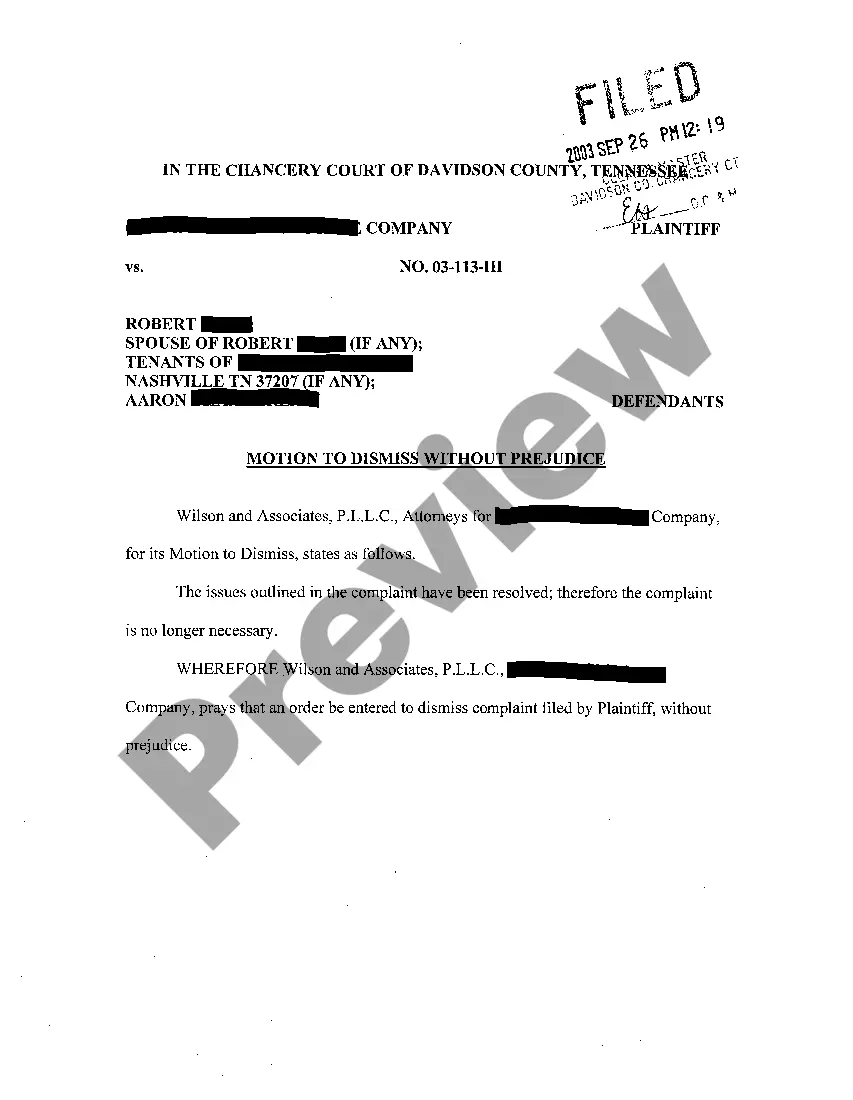

- Look at the form utilizing the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to continue on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Pick a favored file format to save the file (.pdf or .docx).

You can now open up the Tennessee Answer to Complaint in Equity for Real Property of Deed of Trust sample and fill it out online or print it and get it done yourself. Take into account mailing the document to your legal counsel to ensure all things are completed appropriately. If you make a error, print out and complete sample again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get access to far more samples.

Form popularity

FAQ

Code Ann. § 28-2-101). A person can also establish this type of presumptive ownership under color of title after having paid the taxes on a piece of property for 20 years or more without the original owner, or the government, objecting. (See Tenn.

Tennessee, however, has no statutory time limit for when an executor must submit the will for probate. There is no penalty for not probating a will. That means if the will is never submitted to probate, the assets remain in the decedent's name so long as the estate continues to pay the required taxes.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

5% on the first $20K. 4% on the next $80K. 3% on the next $150K. 2% on the next $500K.

Under Tennessee law, there are simplified rules for handling a small estate. A small estate is one in which the total value of the personal property of the estate is $50,000 or less. Many county probate courts have forms online to help you handle a small estate.

Real Estate: Muniment of Title is a legal action used to legally transfer clear title of one type of property (for assets such as real estate, a bank account, or a stock account) to a beneficiary. This procedure is appropriate only if the decedent executed a valid Will.

At the very least, one can expect six to nine months of time before the Estate can close and if there is litigation outstanding, the Estate can stay open for years. At times, when sizable assets need to be sold over time, Estates can stay open for decades.

It depends, under certain circumstances a party's payment of property taxes can create a rebuttable presumption that the party has title, or ownership, to the property in question. These requirements are addressed in Tennessee Code Annotated ? 28-2-109 & 110. T.C.A.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.