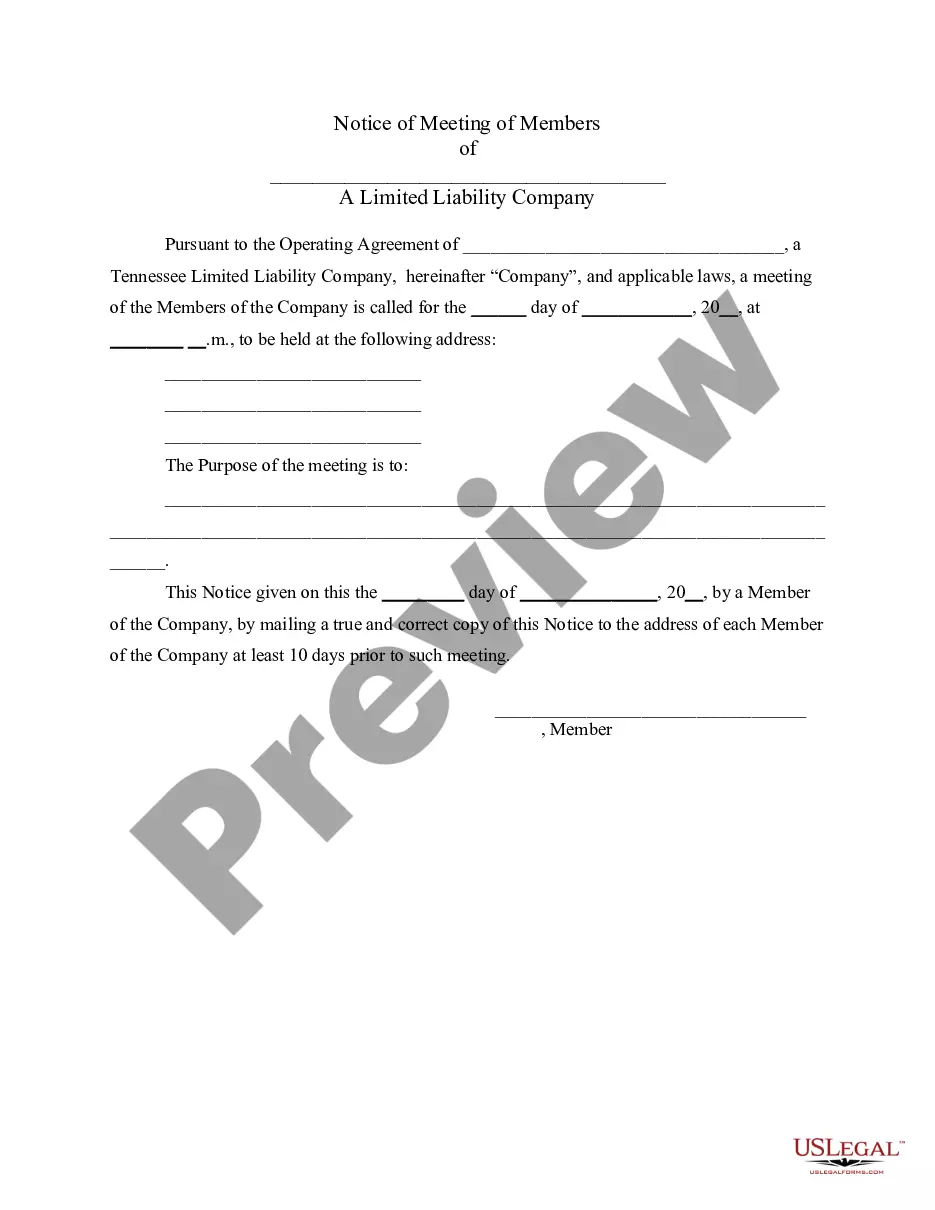

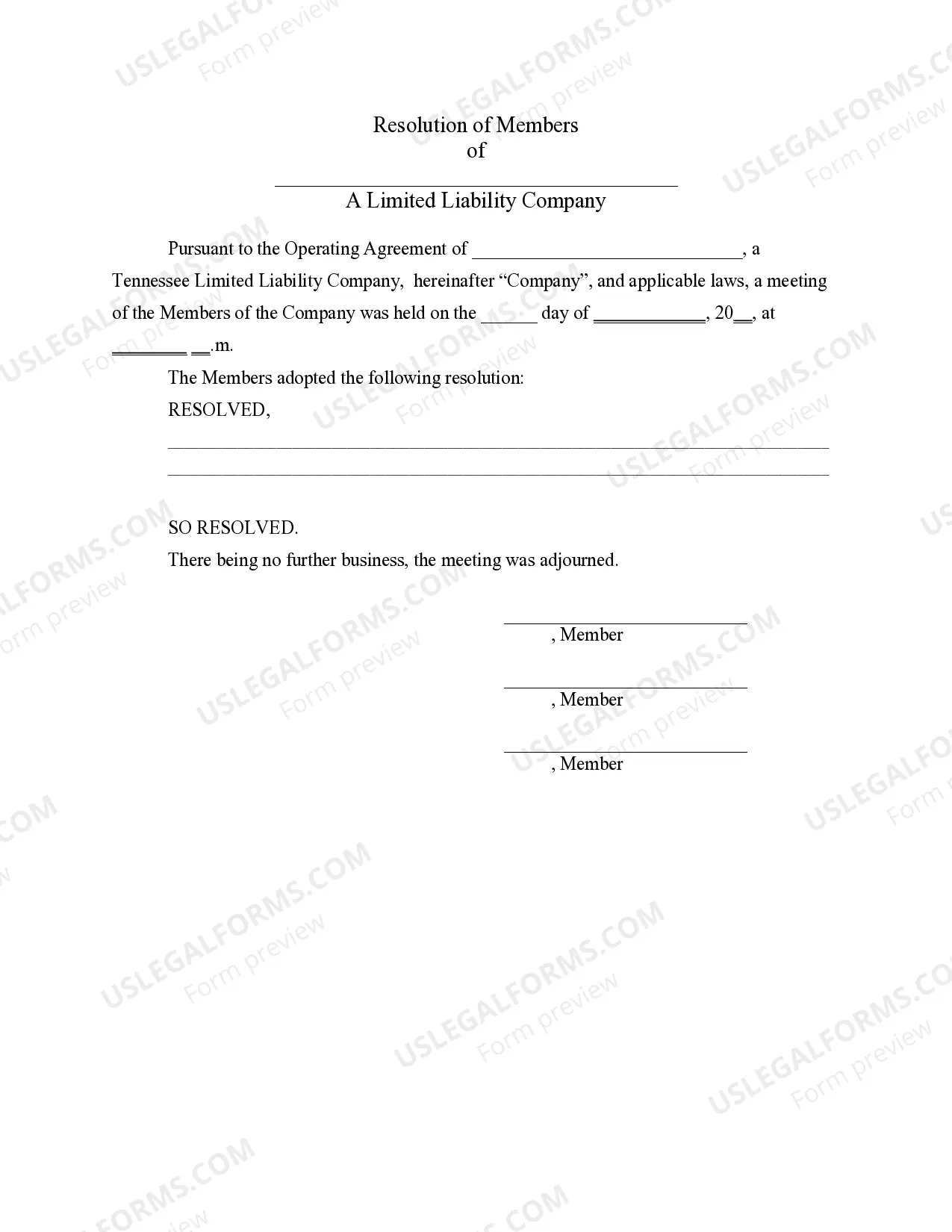

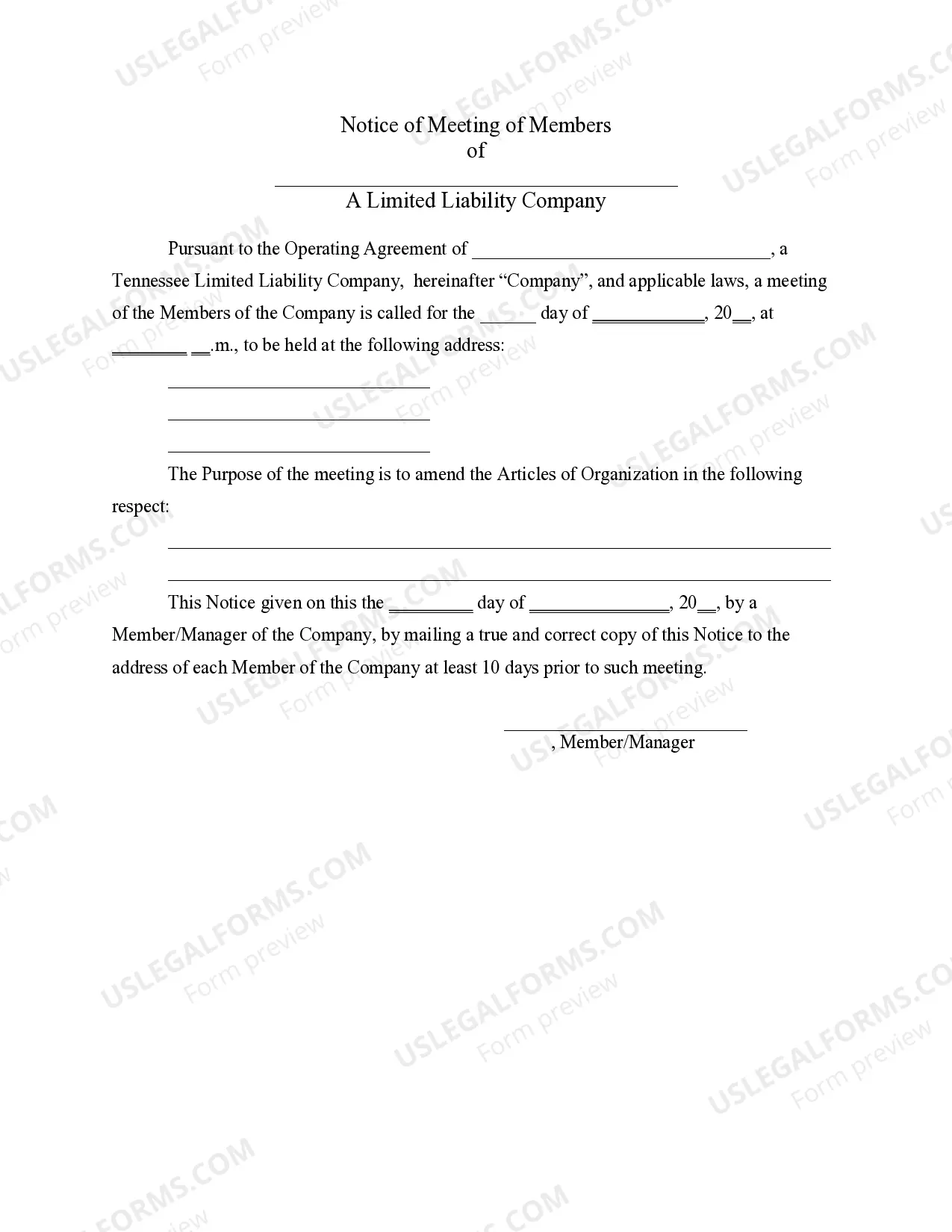

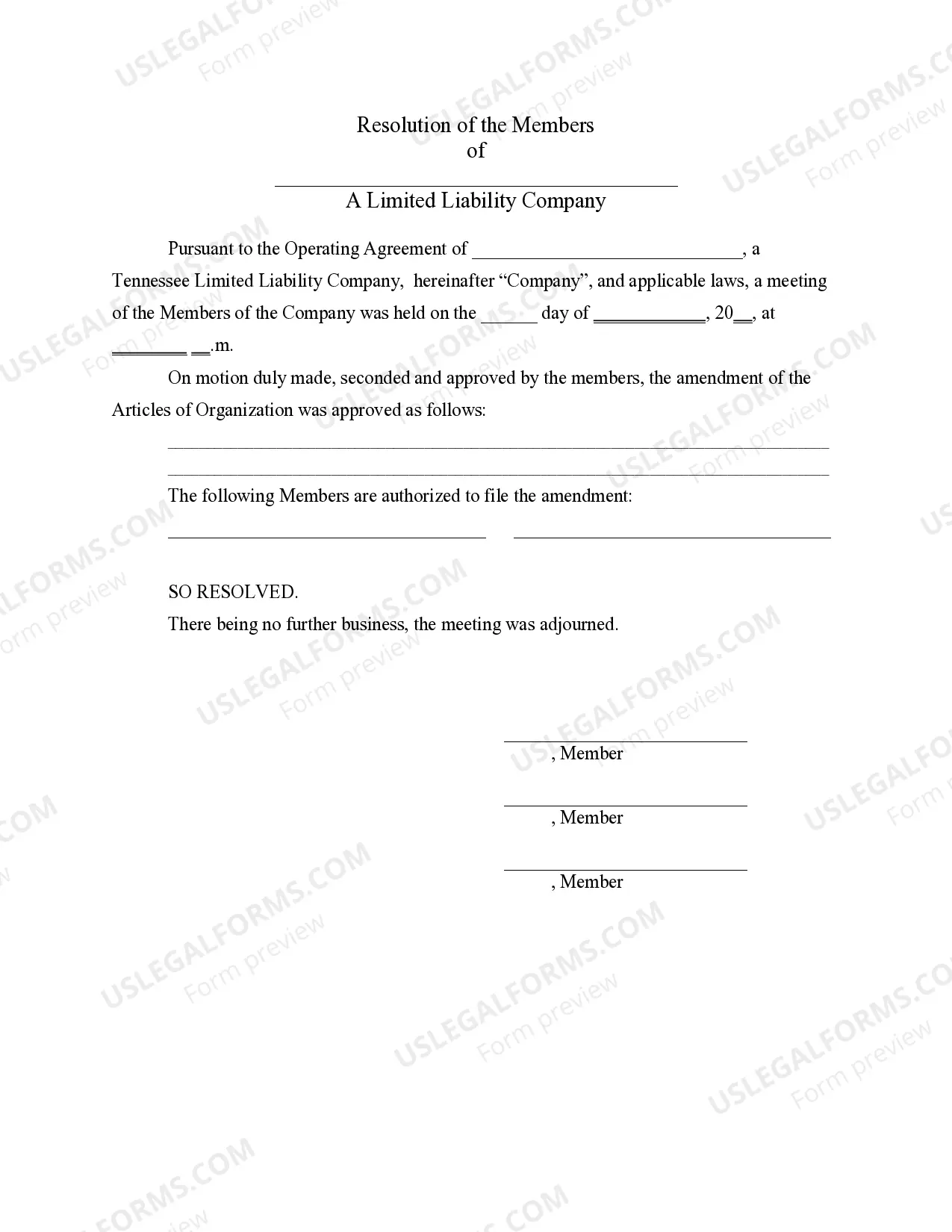

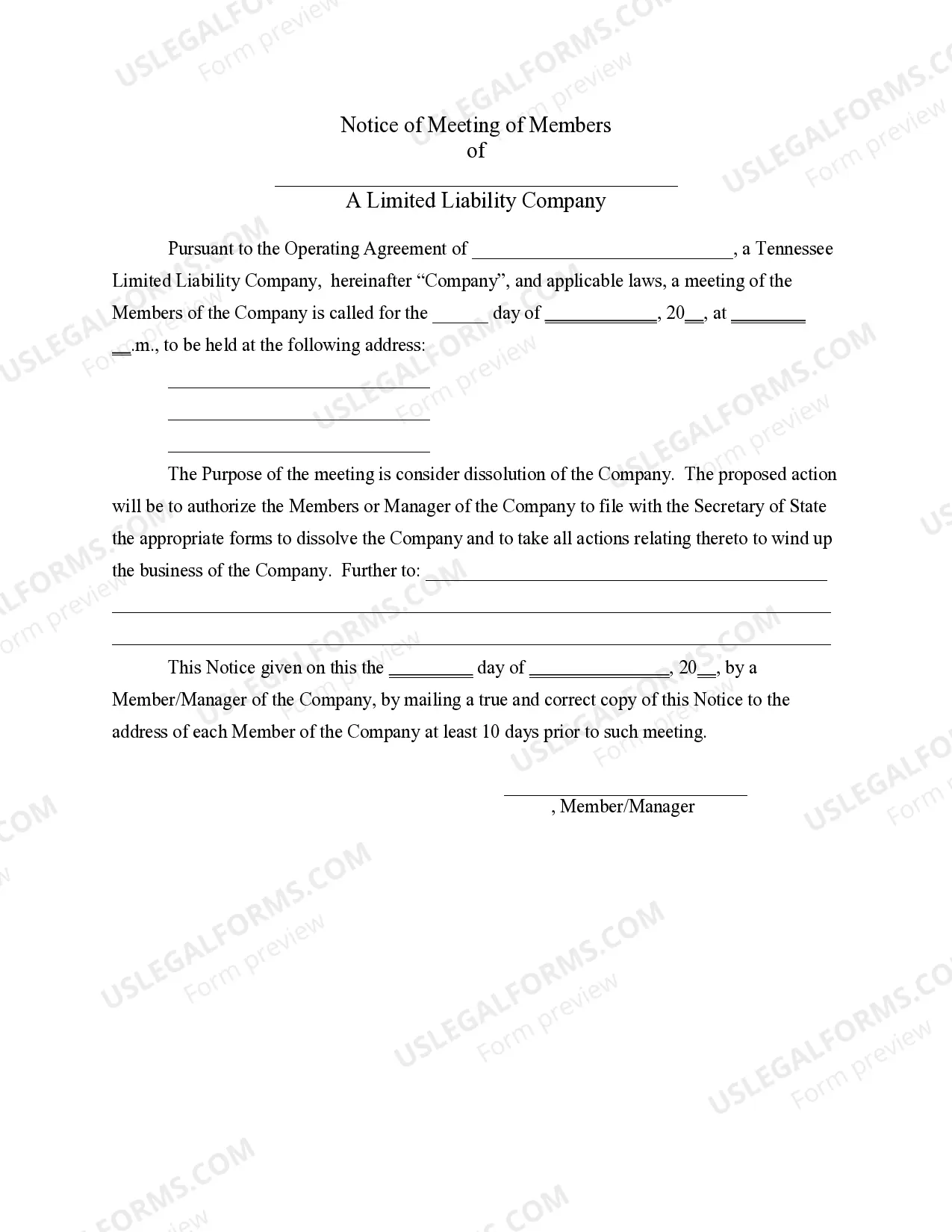

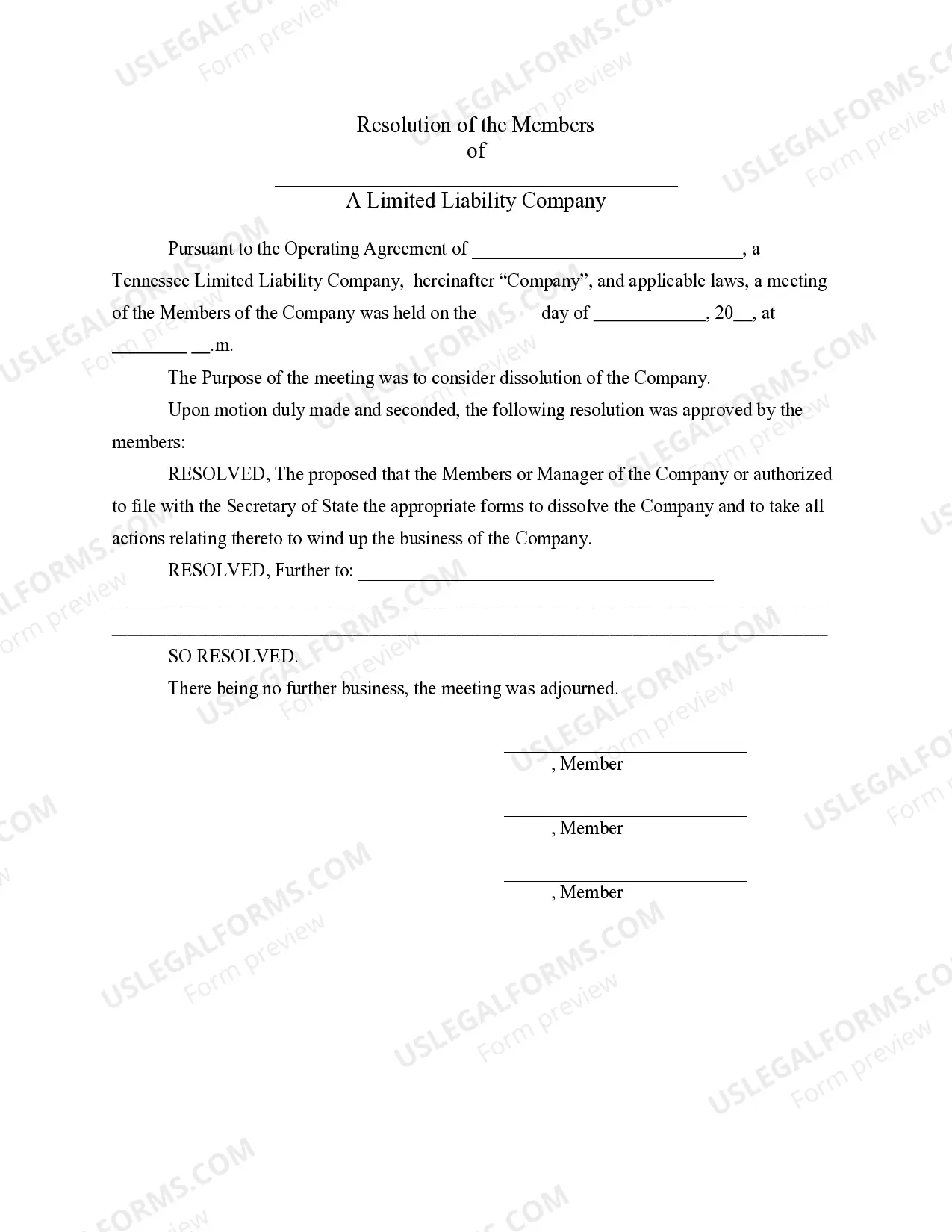

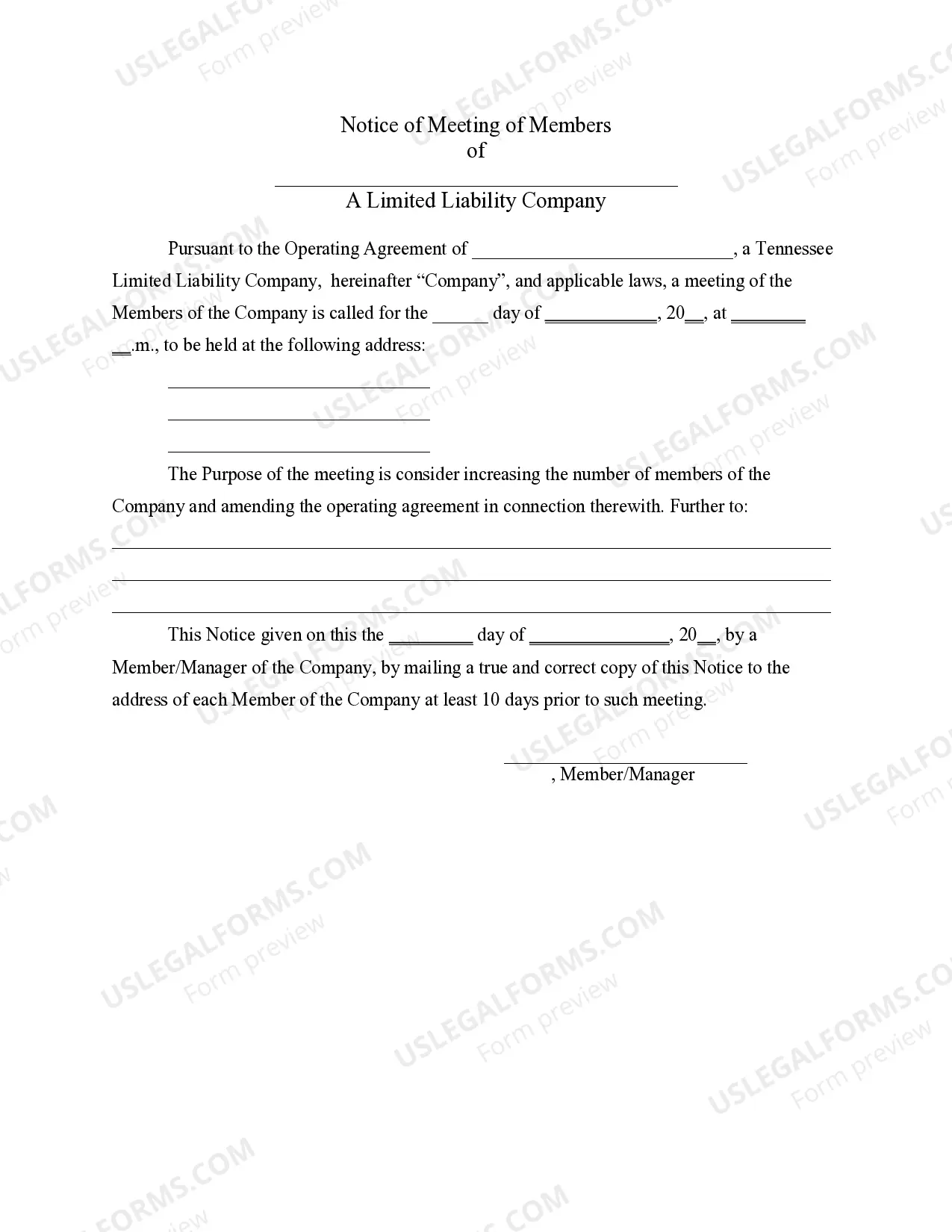

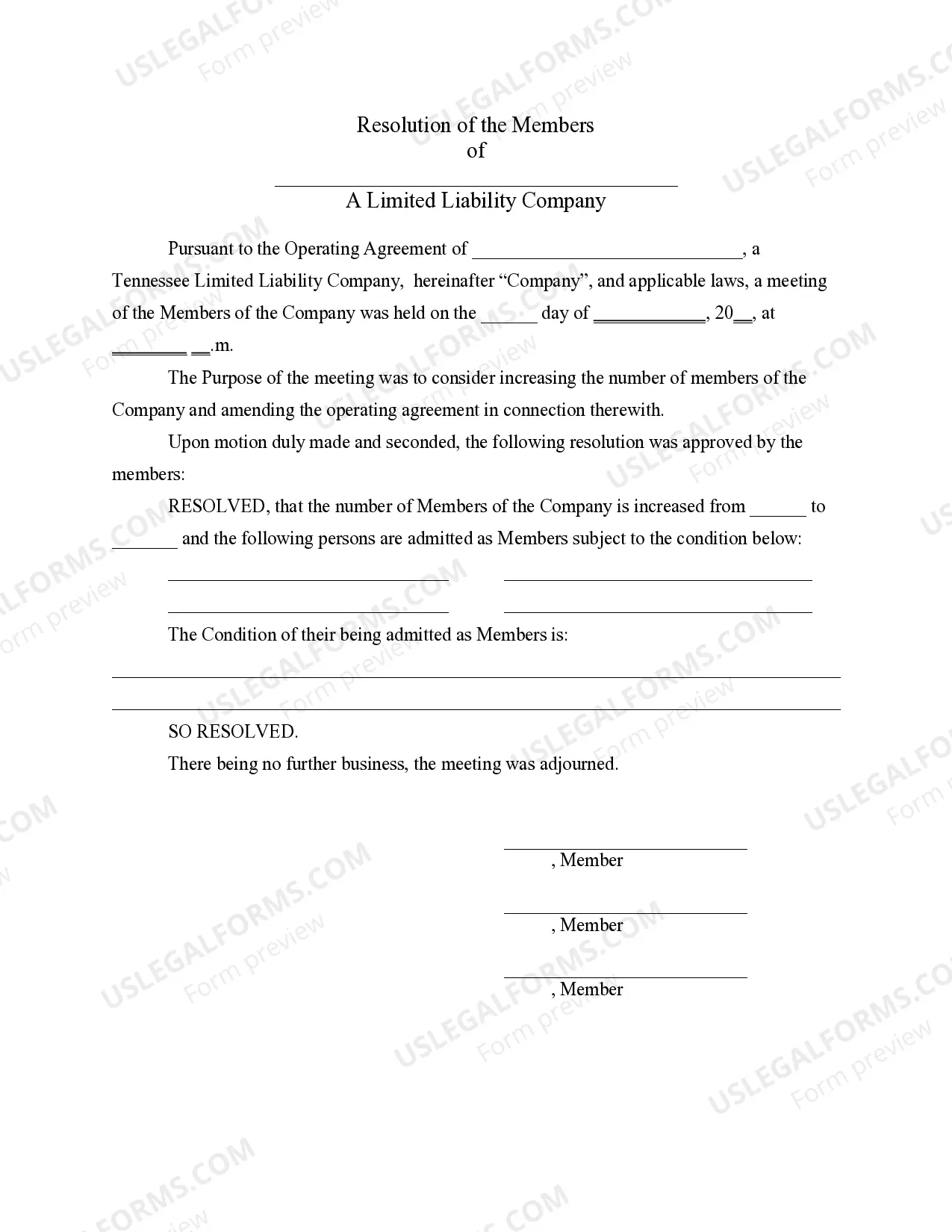

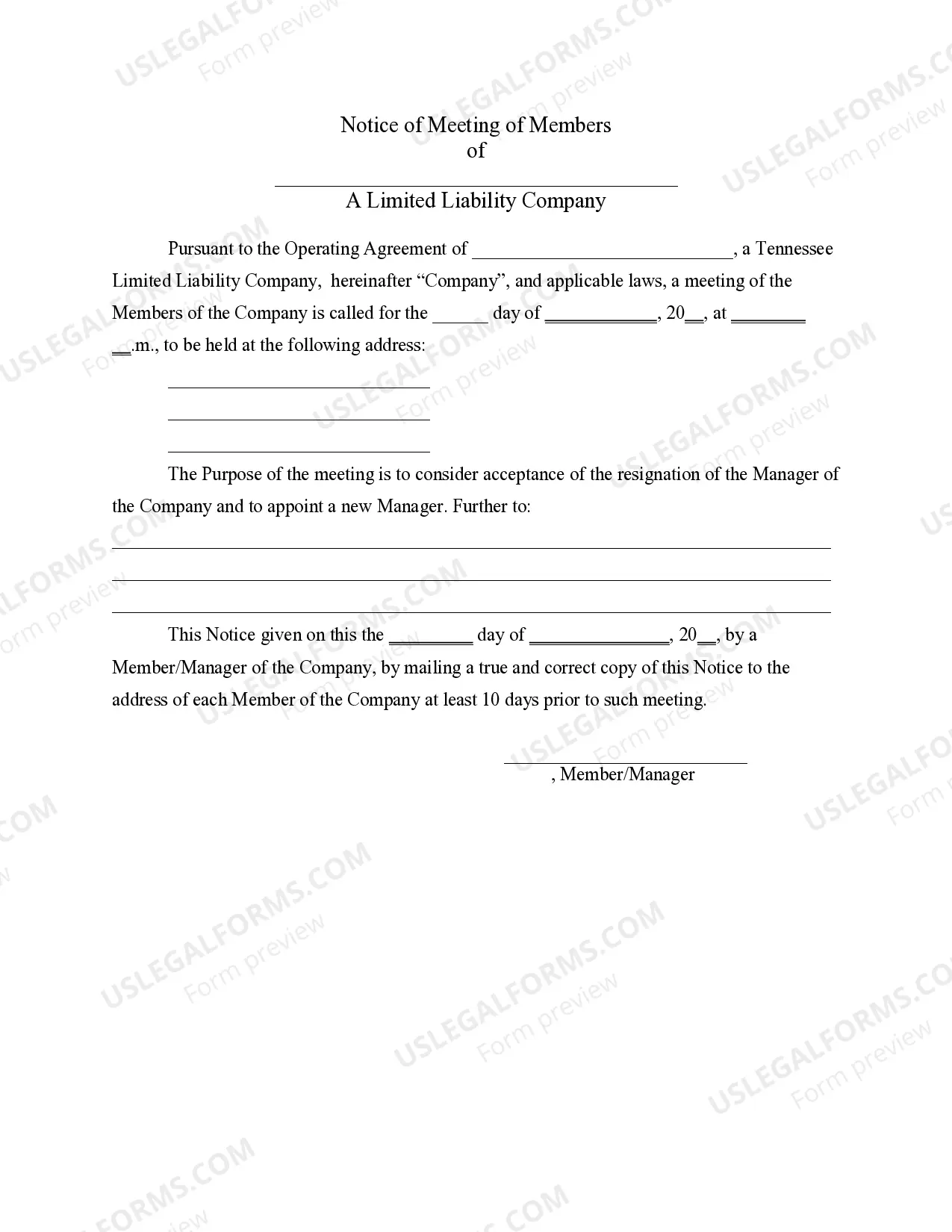

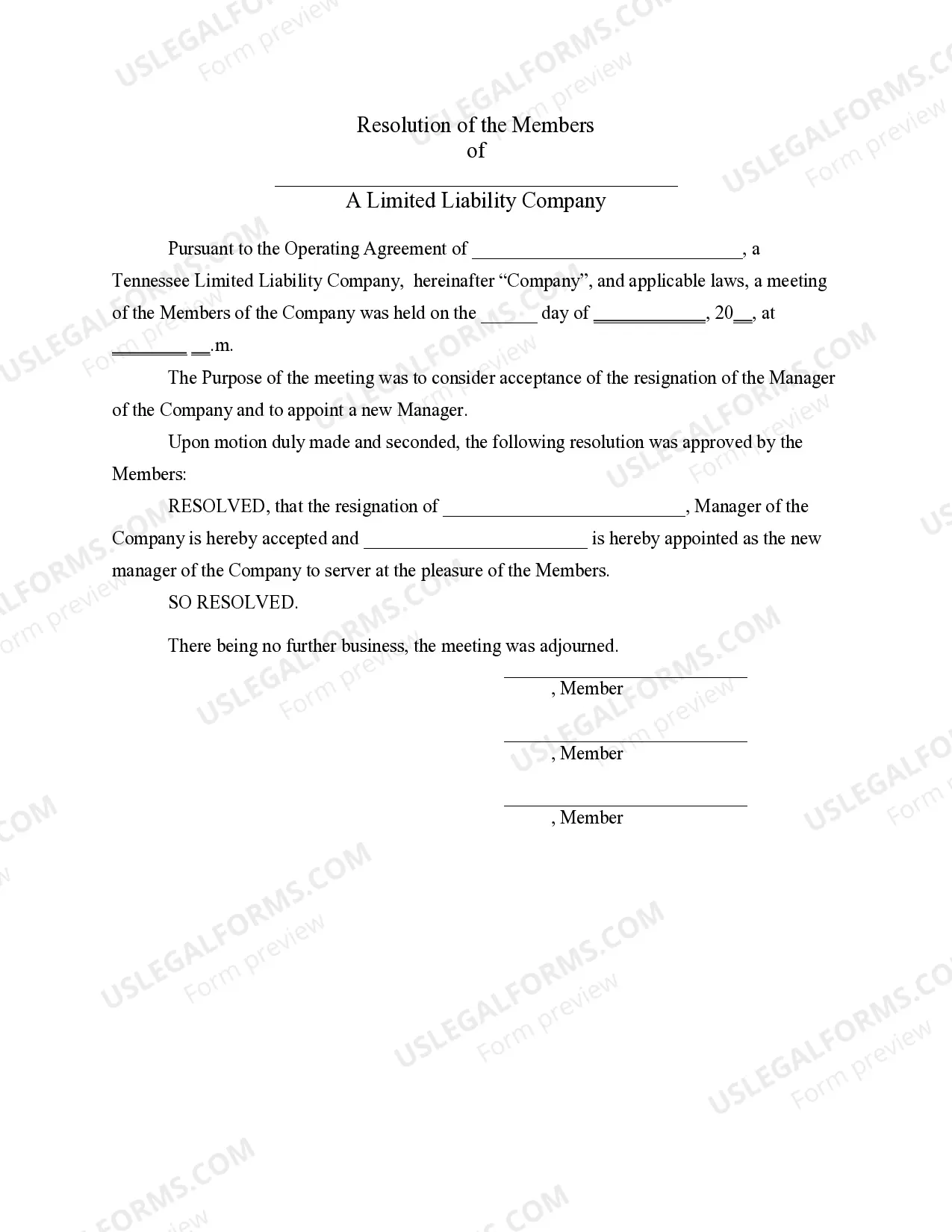

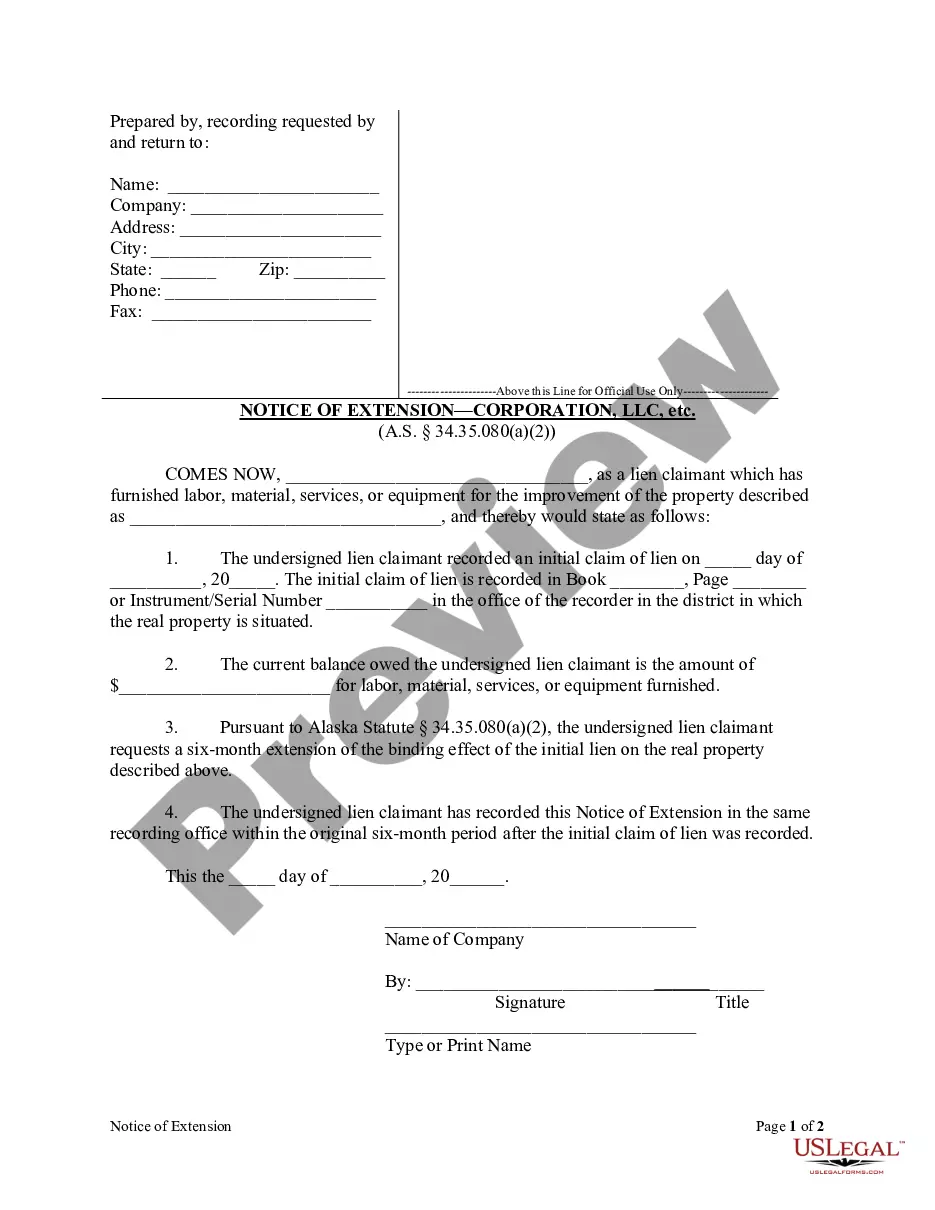

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Tennessee LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out Tennessee LLC Notices, Resolutions And Other Operations Forms Package?

Access to top quality Tennessee LLC Notices, Resolutions and other Operations Forms Package samples online with US Legal Forms. Prevent days of wasted time searching the internet and dropped money on forms that aren’t up-to-date. US Legal Forms offers you a solution to exactly that. Find around 85,000 state-specific authorized and tax forms you can save and complete in clicks within the Forms library.

To find the sample, log in to your account and click Download. The file is going to be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide listed below to make getting started easier:

- Check if the Tennessee LLC Notices, Resolutions and other Operations Forms Package you’re considering is suitable for your state.

- View the sample using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to sign up.

- Pay by card or PayPal to complete making an account.

- Choose a favored format to download the document (.pdf or .docx).

Now you can open up the Tennessee LLC Notices, Resolutions and other Operations Forms Package template and fill it out online or print it and get it done by hand. Think about sending the papers to your legal counsel to make sure things are filled in properly. If you make a mistake, print out and complete application once again (once you’ve made an account every document you download is reusable). Make your US Legal Forms account now and access far more forms.

Form popularity

FAQ

By default, LLCs themselves do not pay federal income taxes, only their members do. Tennessee, however, imposes a franchise tax and an excise tax on most LLCs. You must register for this tax through the Department of Revenue (DOR).Tennessee's franchise and excise taxes also apply to LLCs taxed as corporations.

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

STEP 1: Name your Tennessee LLC. STEP 2: Choose a Tennessee Registered Agent. STEP 3: File the Tennessee LLC Articles of Organization. STEP 4: Create Your Tennessee LLC Operating Agreement. STEP 5: Get a Tennessee LLC EIN.

How long does it take to form an LLC in Tennessee? Filing the Articles of Organization takes 24 hours online, 3 to 5 business days by mail.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

If you have business partners or employees, an LLC protects you from personal liability for your co-owners' or employees' actions. An LLC gives you a structure for operating your business, including making decisions, dividing profits and losses, and dealing with new or departing owners. An LLC offers taxation options.

State Business Tax By default, LLCs themselves do not pay federal income taxes, only their members do. Tennessee, however, imposes a franchise tax and an excise tax on most LLCs. You must register for this tax through the Department of Revenue (DOR).

How much does it cost to form an LLC in Tennessee? The Tennessee Secretary of State charges $50 per LLC member included in the filing, with a minimum total fee of $300. The filing fee cannot exceed $3,000 for the Articles of Organization. A convenience fee will also be charged when paying online by credit card.