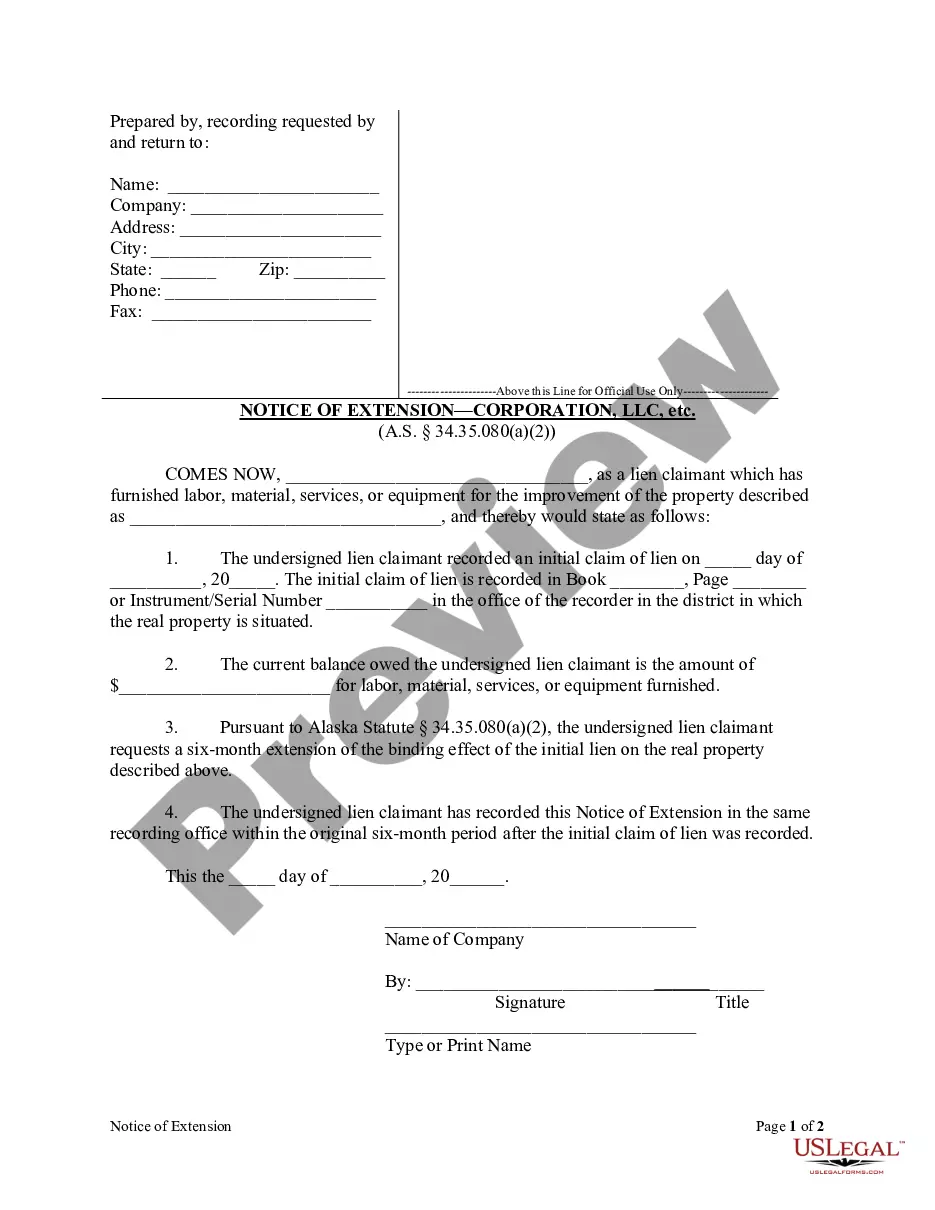

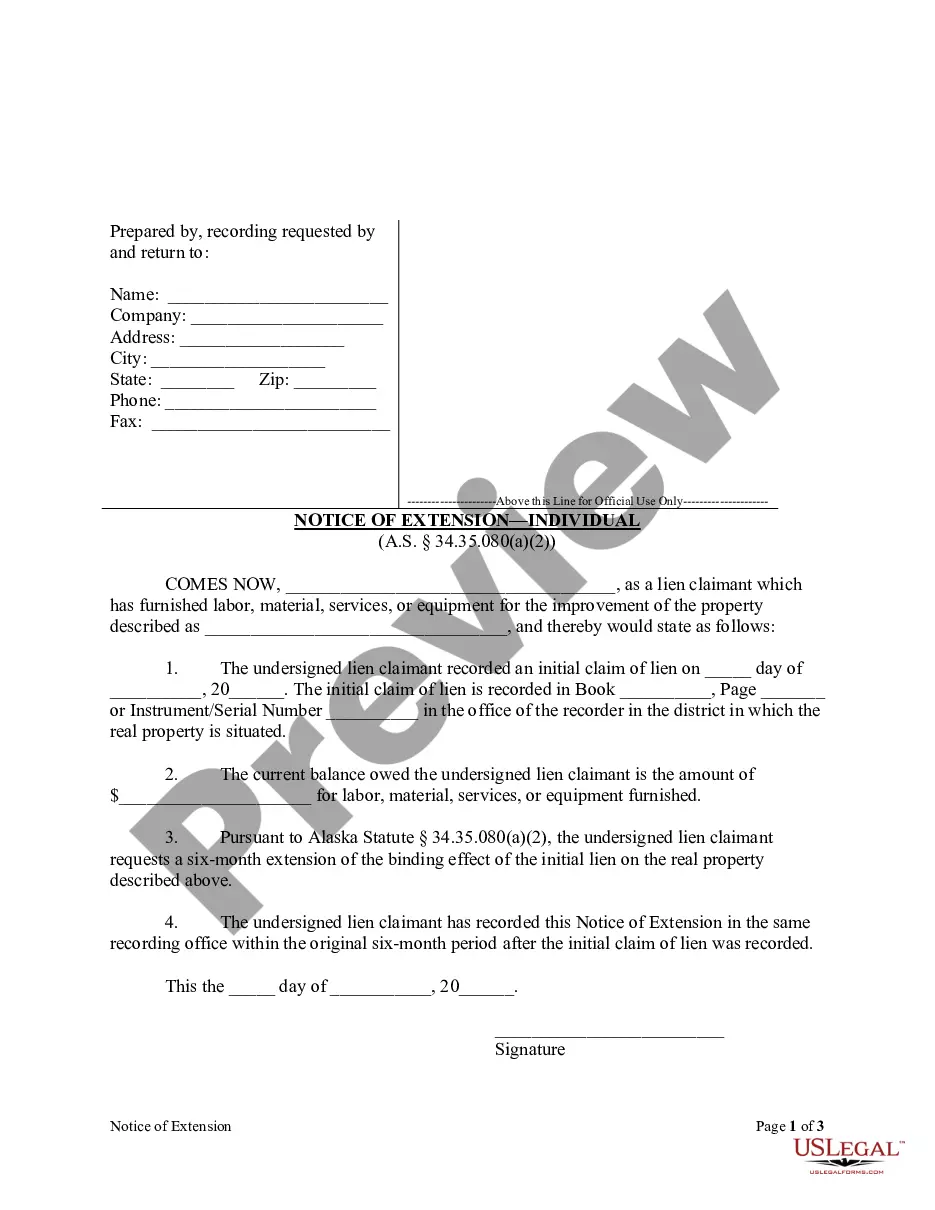

Notice of Extension - Corporation

Note: This summary is not intended to be an all inclusive discussion of Alaska’s construction or mechanic’s lien laws, but does include basic provisions.

What is a construction or mechanic’s lien?

Every State permits a person who supplies labor or materials for a construction project to claim a lien against the improved property. While some states differ in their definition of improvements and some states limit lien claims to buildings or structures, most permit the filing of a document with the local court that puts parties interested in the property on notice that the party asserting the lien has a claim. States differ widely in the method and time within which a party may act on their lien. Also varying widely are the requirements of written notices between property owners, contractors, subcontractors and laborers, and in some cases lending institutions. As a general rule, these statutes serve to prevent unpleasant surprises by compelling parties who wish to assert their legal rights to put all parties who might be interested in the property on notice of a claim or the possibility of a claim. This by no means constitutes a complete discussion of construction lien law and should not be interpreted as such. Parties seeking to know more about construction laws in their State should always consult their State statutes directly.

Who can claim a lien in this State?

Alaska statute permits any person who furnishes labor, materials, equipment, or services for the improvement of real property at the request of the owner or the agent of the owner. In addition, the trustee of an employee benefit trust for the benefit of individuals performing labor on the building or improvement and has a direct contract with the owner or the agent of the owner for direct payments into the trust may also have a lien. A.S. § 34.35.050.

How long does a party have to claim a lien?

As a general proposition, the time within which a party may file a lien depends on whether the owner filed a Notice of Completion. If the owner has NOT filed a Notice of Completion, the lien claimant has one hundred and twenty (120) days after the completion of the construction contract or one hundred and twenty (120) days after the lien claimant ceases to furnish labor or materials to file a lien claim.

If the owner HAS filed a Notice of Completion, generally a lien claimant has fifteen (15) days after the recording of the Notice to record a Claim of Lien or a Notice of Right to a Lien. However, the fifteen (15) day limitation only applies to parties who received advance notification of the recording of the Notice of Completion, or a lien claimant who has not provided a Notice of Right to a lien.

In addition, a claimant who records a Notice of Right to a Lien within fifteen (15) days as required above, has an additional one hundred and twenty (120) days to file a Claim of Lien. Lien Claimants who provided a Notice of Right to a Lien but were not given advance notification of the recording of a Notice of Completion also have one hundred and twenty (120) to record a Lien Notice. A.S. § 34.35.068.

What kind of notice is required prior to claiming a lien?

As explained above, Alaska law provides for a series of notices prior to the actual filing of a lien. Potential lien claimants should submit a Notice of Right to Lien prior to commencing work on the contract. This Notice may be recorded any time after the lien claimant enters into a contract or before he first furnishes labor or materials. Alaska law requires that this Notice contain a form warning placing the property owner on notice that the property may be subject to a lien . A.S. § 34.35.064

By what method is a lien filed in this State?

A Claim of Lien is recorded at any time after entering into a contract for a construction project, subject to the time restrictions outlined above. The Claim of Lien must be verified by the oath of the claimant and contains a description of the property, name of the owner, name and address of the claimant, name and address of the person with whom the claimant contracted, a general description of the labor, materials, services, or equipment furnished, an amount due for each category of labor or materials furnished, and the date of last services rendered. A.S. § 34.35.070.

How long is a lien good for?

Alaska law does not permit property to be bound by a lien for more than six months after the recording of a Claim of Lien, unless a legal action to enforce said lien is commenced within that period or file an extension within the original 6 months that refers to the prior recorded lien notice by date, book, page or instrument on the original lien and the balance owing. A.S. § 34.35.080.

Are liens assignable?

Alaska statute does not have a provision which specifically states that liens may be assigned to other parties.

Does this State permit a person with an interest in property to deny responsibility for improvements?

Yes. Alaska statute permits a party with an ownership interest in property being improved to provide a Notice of Non-Responsibility that the party providing the Notice will not be responsible for the cost of the improvements. This Notice must be posted in an obvious place upon the property being improved within three (3) days of the owner obtaining knowledge of the improvements. Also, three days after posting, the Notice must be recorded with the county recorder. A.S. § 34.35.065.

By what method does the law of this State permit the release of a lien?

Alaska statutes have no specific provision for the release of a lien other than by expiration of the statute of limitations after six (6) months.

Does this State permit the use of a bond to release a lien?

Yes. Alaska statute allows a contracting owner who disputes the validity of a lien to record, before the filing of a suit to enforce the lien, to record a bond in the amount of one and one half times the amount of the claim of lien. Upon the acceptance of the bond by the county clerk, the lien against the real property shall be discharged and released. A.S. § 34.35.072.

Alaska Statutes

Title 34 Property

Chapter 34.35 Liens

Article 01. FORECLOSURE

Sec. 34.35.005. Action for foreclosure.

(a) When an action is required to enforce a lien provided for in this chapter and the action falls within the monetary jurisdiction of the district court, the action shall be started in the district court in the judicial district in which venue lies. An action that exceeds the monetary jurisdiction of the district court shall be started in the superior court in the judicial district in which venue lies. The procedure, except as otherwise provided in this chapter, is the same as in the trial of an action to secure property to hold it for the satisfaction of a lien against it.

(b) In an action to enforce a lien, the court shall allow as part of the costs all money paid for drawing the lien and for filing and recording the lien claim, and a reasonable attorney fee for the foreclosure of the lien.

(c) An action to enforce a lien created by AS 34.35.005 – 34.35.425 has preference upon the calendar of civil actions before the court and shall be tried without unnecessary delay.

Sec. 34.35.010. Joinder of claimants in lien statement.

Any number of persons who claim liens under AS 34.35.005 – 34.35.425 against the same property may join in one statement of lien. The consolidated statement of lien shall be verified by the oath of one or more of the claimants having knowledge of the facts.

Sec. 34.35.015. Joinder in foreclosure suit.

Any number of persons who claim liens against the same property may join in the same action, and when separate actions are commenced the court may consolidate them.

Sec. 34.35.020. Sufficiency in lien notice or pleadings.

(a) A mistake in formality or lack of statement in the lien notice or the pleadings is not ground for dismissal or unnecessary delay in an action to foreclose a lien.

(b) Substantial compliance with the law relating to the contents of the lien notice is considered sufficient, if the notice satisfactorily shows the name of the claimant, the amount of the demand, the time of the employment, the property sought to be charged with the lien sufficient for identification, and the name of the owner or reputed owner of the property.

(c) The inclusion of nonlienable items in the amount of the claimant’s demand or error in the terms and conditions of the contract of employment, if there is a contract of employment, or other error in the lien notice, made in good faith, is not considered material, unless the error affects the substantial rights of the adverse party, acquired in good faith without notice.

(d) The lien notice and pleadings may be amended at any time before judgment. If a material statement or averment is omitted or misstated, this is ground for a reasonable delay or continuance to enable opposing parties to meet the amendment, and a nonsuit or dismissal may not be entertained in the action except upon the merits of the cause.

Sec. 34.35.025. Parties to foreclosure.

In an action to foreclose a lien created by AS 34.35.005 – 34.35.425, all persons personally liable and all lien holders whose claims have been recorded, and all other persons interested in the matter in controversy or the property sought to be charged with the lien may be made parties. Persons who are not parties are not bound by the proceedings.

Sec. 34.35.030. Lien claim against different properties.

If a lien claim is filed for the same labor against two separate kinds of property owned or claimed by different persons, the court shall determine the liability of each kind of property and designate which shall be sold first to discharge the amount of the lien claim.

Sec. 34.35.035. Several judgment for each claimant.

In an action to enforce a lien judgment shall be given in favor of each person having a lien for the amount due the person, and the court shall order property subject to the lien to be sold by the peace officer in the same manner that property is sold on execution, or in any manner that the court considers proper. The proceeds of the sale shall be apportioned to the payment of each judgment pro rata, if the amount is insufficient to pay them in full.

Sec. 34.35.040. Order of priority and payment. [Repealed, Sec. 19 ch 175 SLA 1978. For current law see AS 34.35.112 ].

Repealed or Renumbered

Sec. 34.35.045. Lienor’s action on contract.

Except as otherwise expressly provided, nothing in AS 34.35.005 – 34.35.425 may be construed to prevent a lienor under a contract from maintaining an action as if the lienor has no lien for the security of the debt and the bringing of this action does not prejudice rights under AS 34.35.005 – 34.35.425.

Article 02 Mechanics and Materialmen

Sec. 34.35.050. Lien for labor or materials furnished.

A person has a lien, only to the extent provided under this chapter, to secure the payment of the contract price if the person

(1) performs labor upon real property at the request of the owner or the agent of the owner for the construction, alteration, or repair of a building or improvement;

(2) is a trustee of an employee benefit trust for the benefit of individuals performing labor on the building or improvement and has a direct contract with the owner or the agent of the owner for direct payments into the trust;

(3) furnishes materials that are delivered to real property under a contract with the owner or the agent of the owner that are incorporated in the construction, alteration, or repair of a building or improvement;

(4) furnishes equipment that is delivered to and used upon real property under a contract with the owner or the agent of the owner for the construction, alteration, or repair of a building or improvement;

(5) performs services under a contract with the owner or the agent of the owner in connection with the preparation of plans, surveys, or architectural or engineering plans or drawings for the construction, alteration, or repair of a building or improvement, whether or not actually implemented on that property; or

(6) is a general contractor.

Sec. 34.35.055. Land subject to lien.

(a) The land upon which a building or other improvement described in AS 34.35.050 is constructed, together with a convenient space about the building or other improvement or so much as is required for the convenient use and occupation of it (to be determined by the judgment of the court at the time of the foreclosure of the lien), and the mine on which the work is performed or for which the material is furnished is also subject to the lien created by AS 34.35.050 – 34.35.120 if, at the time the work is started or the materials for the building or other improvements are first furnished, the land belongs to the person who causes the building or other improvement to be constructed, altered, or repaired.

(b) If the person owns less than a fee simple estate in the land, then only the interest of the person in it is subject to the lien.

(c) If the interest is a leasehold interest, and the holder forfeits the rights of the holder to it, the purchaser of the building or improvement and leasehold term, or so much of it as remains unexpired at a sale under AS 34.35.050 – 34.35.120 is considered to be the assignee of the leasehold term, and may pay the lessor all arrears of rent or other money and costs due under the lease.

(d) If the lessor regains possession of the land and property, or obtains judgment for the possession of it before the commencement of the construction, alteration, or repair of the building or other improvement, the purchaser may only remove the building or other improvement within 30 days after the purchase, and the owner of the land shall receive the rent due payable out of the proceeds of the sale, according to the terms of the lease, down to the time of the removal.

Sec. 34.35.060. Priorities.

(a) Except as provided in (c) of this section, an encumbrance which is properly recorded shall be preferred to a lien created under AS 34.35.050 – 34.35.120 unless the claim of lien under AS 34.35.070 or notice of right to lien under AS 34.35.064 has been recorded before the encumbrance. The preference granted for a prior mortgage or deed of trust under this section applies without regard to when the sums are disbursed or whether the disbursements are required under the terms of a loan agreement.

(b) [Repealed, Sec. 19 ch 175 SLA 1978].

(c) A lien created by AS 34.35.050 – 34.35.120 in favor of an individual actually performing labor upon a building or other improvement in its original construction or of a trustee of an employee benefit trust for those individuals is preferred to a prior encumbrance upon the land on which the building or other improvement is constructed.

(d) In enforcing the lien, the building or other improvement may be sold separately from the land. When sold separately, the purchaser may remove the building or other improvement within a reasonable time after the sale, not to exceed 30 days, upon the payment to the owner of the land of a reasonable rent for its use from the date of its purchase to the time of removal. If removal is prevented by legal proceedings, the 30 days does not begin to run until the final determination of the proceedings in the court of first resort, or in the appellate court if appeal is taken.

Sec. 34.35.062. Construction financing.

(a) A claimant to whom payment for the labor, material, service, or equipment furnished for a project is past due may give the lender a stop-lending notice. The claimant shall at the same time give a copy of the notice to the owner and to each prime contractor with whom or through whom the claimant or the claimant’s debtor has contracted. A stop-lending notice must

(1) instruct the lender to stop disbursing, advancing, or otherwise providing construction financing for the project;

(2) be verified by the claimant;

(3) state the claimant’s name, address, and telephone number;

(4) describe the labor, material, service, or equipment furnished by the claimant and state the name of the person to whom furnished;

(5) describe the real property improved by the labor, material, service, or equipment and state the name of the person the claimant believes to be the owner of the real property;

(6) state the amount due and unpaid to the claimant for the labor, material, service, or equipment.

(b) A stop-lending notice is binding upon a lender from the time the lender has received it and had a reasonable opportunity to act upon it until it expires or is revoked. A notice expires on the 91st day after it is received by the lender unless the claimant has commenced an action on the claim that is the subject of the notice before that day and the lender has received written notification of the action. A stop-lending notice may be revoked at any time in writing signed by the claimant. Expiration or revocation of a notice extinguishes the liability of the lender to the claimant under (c) of this section.

(c) A lender who disburses, advances, or otherwise provides construction financing for a project after it is the subject of a stop-lending notice is liable to the claimant in an amount equal to the lowest of the following amounts:

(1) the amount of construction financing disbursed, advanced, or otherwise provided by the lender after receipt of the claimant’s stop-lending notice; if there are two or more stop-lending notices when the disbursement occurs, the lender’s liability to each claimant is based on the claimant’s ranking under AS 34.35.112 ;

(2) the amount owed to the claimant, including interest, costs, and attorney’s fees, for labor, material, service, or equipment furnished for the project by the claimant as established by a written agreement signed on or after the date of the stop-lending notice by the claimant, the owner and the prime contractor with whom or through whom the claimant or the claimant’s debtor has contracted or by a final judgment in an action in which the owner, the claimant, and the claimant’s debtor are named and, if necessary, served parties;

(3) 150 percent of the amount stated in the stop-lending notice.

(d) Within 10 days after receiving the written agreement or a certified copy of the judgment under (c)(2) of this section establishing the amount owed to a claimant from whom it has a binding stop-lending notice, a lender shall send to the claimant a verified statement showing, by date and amount, all construction financing provided by the lender for the project. Except as provided in (e) of this section, the lender shall include with the statement payment in the amount of the lender’s liability to the claimant under (c) of this section.

(e) If there are two or more claimants to whom a lender is or may be liable under (c) of this section and the lender is uncertain as to the amount of its liability or possible liability to each, the lender may bring an action to require the claimants to interplead their claims.

(f) A draw against construction financing may be made only after certification of job progress is delivered to the lender by the owner. The form of the certification may be prescribed by the lender and must include

(1) a statement of the progress of the project, including the percentage of completion of the project;

(2) the name, address, and telephone number of each prime contractor who has furnished labor, material, service, or equipment for the project;

(3) the amount owed by the owner to each listed prime contractor; and

(4) the portion of the draw that the owner will pay to each listed prime contractor.

(g) The owner shall use each draw as indicated in the certificates given by the owner to the lender under (f) of this section. The lender may not be required to verify the information in a certificate and is not liable for an error in a certificate.

(h) An owner who intentionally fails to apply construction financing proceeds as indicated by the certificate required under (f) of this section is guilty of a class A misdemeanor. The penalty provided under this subsection does not replace any other penalty that may be provided for by law for the same conduct.

(i) Within 10 days after being requested, a lender shall provide a person who has given the lender a stop-lending notice with a copy of

(1) each certificate received by the lender under (f) of this section; and

(2) a verified certificate stating the amount of construction financing proceeds committed by the lender for the project that have not been disbursed by the lender.

(j) The lender may not provide construction financing proceeds for payment of indebtedness of the owner that is not incurred for the project.

Sec. 34.35.064. Notice of right to lien.

(a) Before furnishing labor, material, service, or equipment for a project, a person may give a notice of right to lien to the owner or owner’s agent. If the notice is given in accordance with this section, the owner has the burden of proof to show that the owner did not know of or consent to the furnishing of the labor, material, service, or equipment by the claimant in an action to foreclose the claimant’s lien on the property under AS 34.35.050 – 34.35.120. Otherwise the claimant has the burden of proof to show that the owner knew of and consented to the furnishing of the labor, material, service, or equipment. The notice of right to lien must be in writing, state that it is a notice of a right to assert a lien against real property for labor, materials, services, or equipment furnished in connection with a project, and contain

(1) a legal description sufficient for identification of the real property;

(2) the name of the owner;

(3) the name and address of the claimant;

(4) the name and address of the person with whom the claimant contracted;

(5) a general description of the labor, materials, services, or equipment provided or to be provided;

(6) a statement that the claimant may be entitled to record a claim of lien; and

(7) the following statement in type no smaller than that used in providing the information required by (1) – (6) of this subsection:

WARNING: Unless provision is made for payment of sums that may be due to the undersigned, your above property may be subject to foreclosure to satisfy those sums even though you may pay a prime contractor or other person for the labor, material, service, or equipment furnished by the undersigned.

(b) Upon request from an owner, lender, or prime contractor, a claimant who has given a notice of right to lien under this section shall disclose to the requester within five days the most recent accounting of the amount due and unpaid to that claimant under the terms of the contract and a description of labor, materials, services, or equipment that the claimant reasonably anticipates furnishing.

Sec. 34.35.065. Notice of nonresponsibility.

(a) A building or improvement mentioned in AS 34.35.050 constructed with the knowledge of the owner of the land or the person having or claiming an interest in the land is considered to be constructed at the instance of the owner or person having or claiming the interest.

(b) The interest owned or claimed is subject to a lien recorded under AS 34.35.050 – 34.35.120, unless

(1) the owner or person having or claiming an interest in the land gives notice within three days after the owner or other person obtains knowledge of the construction, alteration, or repair that the owner or other person will not be responsible for it, by posting a notice to that effect in writing in some conspicuous place upon the land or upon the building or other improvement located on the land;

(2) the notice is signed by the owner or person having or claiming an interest in the land in the presence of two attesting witnesses or acknowledged by the owner or other person before a notary public;

(3) the posting of notice is attested to by a witness; and

(4) an attested or notarized copy of the notice is recorded with the recorder of the recording district in which the land, building, or other improvement is located within three days after the posting of the notice.

Sec. 34.35.067. Recording notice of right to lien.

A notice of right to lien may be recorded by a claimant at any time after the claimant enters into a contract for or first furnishes labor, material, service, or equipment in connection with a project. The notice shall be recorded in the same manner as specified for the recording of a claim of lien under AS 34.35.070 .

Sec. 34.35.068. Time periods for claiming liens.

(a) If a notice of completion is not recorded by the owner as provided in AS 34.35.071 , a claim of lien shall be recorded not later than 120 days after the claimant

(1) completes the construction contract; or

(2) ceases to furnish labor, material, services, or equipment for the construction, alteration, or repair of the owner’s property.

(b) If a notice of completion is recorded by the owner as provided in AS 34.35.071 ,

(1) the following shall record a claim of lien or a notice of right to lien not later than 15 days after the notice of completion is recorded:

(A) a claimant who has received advance notification of the date that the notice of completion is recorded as provided in AS 34.35.071(a)(2);

(B) a claimant who has not given a notice of right to lien as permitted in AS 34.35.064 ;

(2) the following shall record a claim of lien not later than the time specified in (a) of this section:

(A) a claimant who records a notice of right to lien before or within the period specified in (1) of this subsection;

(B) a claimant who has given a notice of right to lien but who has not received advance notice of the date that the notice of completion is recorded by the owner as provided in AS 34.35.071 (a)(2).

(c) A claim of lien is enforceable only if recorded by a claimant within the time specified in (a) or (b) of this section.

Sec. 34.35.069. Acknowledgment of right to lien. [Repealed, Sec. 18 ch 102 SLA 1986].

Repealed or Renumbered

Sec. 34.35.070. Claim of lien.

(a) A claimant may record a claim of lien after entering into a contract for a project. A claim of lien may not be recorded later than the time specified under AS 34.35.068 .

(b) [Repealed, Sec. 9 ch 61 SLA 1979].

(c) The lien shall be verified by the oath of the claimant or another person having knowledge of the facts and state

(1) the real property subject to the lien, with a legal description sufficient for identification;

(2) the name of the owner;

(3) the name and address of the claimant;

(4) the name and address of the person with whom the claimant contracted;

(5) a general description of the labor, materials, services, or equipment furnished for the construction, alteration, or repair, and the contract price of the labor, materials, services, or equipment;

(6) the amount due to the claimant for the labor, materials, services, or equipment; and

(7) the date the last labor, materials, services, or equipment were furnished.

(d) [Repealed, Sec. 19 ch 175 SLA 1978].

(e) [Repealed, Sec. 19 ch 175 SLA 1978].

(f) A violation of the provisions of this section places the violator in the position of guarantor regarding another person who suffers damages that are proximately caused by the violation.

Sec. 34.35.071. Notice of completion.

(a) The owner of real property that may be subject to a lien under AS 34.35.050 – 34.35.120 may announce the date of completion of the project by

(1) recording a notice of completion after completion of the project in the office of the recorder of the district in which the real property is situated; and

(2) giving notice at least five days before the recording of the notice of completion to all claimants who have given a notice of right to lien or a stop-lending notice to the owner and the lender prior to 10 days before recording a notice of completion; the notice must include a copy of the notice of completion and a statement advising claimants that a notice of completion will be recorded not earlier than five days after the date of the notice.

(b) The notice of completion shall be signed and verified by the owner, and must state

(1) the date of completion of the building or other improvement;

(2) the name and address of the owner;

(3) the nature of the interest or estate of the owner;

(4) the legal description of the property sufficient for identification; and

(5) the name of the general contractor.

(c) [Repealed, Sec. 9 ch 61 SLA 1979].

(d) A notice of completion is not effective if recorded before completion.

(e) Labor, materials, services, or equipment furnished after a notice of completion is recorded to satisfy warranty obligations or to remedy defective or unsatisfactory construction, alterations, or repairs for which no additional consideration is owed to the person furnishing the additional labor, materials, services, or equipment does not result in lien liability under AS 34.35.050 – 34.35.120.

(f) After recording a common interest community declaration under AS 34.08, an owner may record a notice of completion under this section as to each unit after completion of the original construction of each unit of the common interest community.

Sec. 34.35.072. Bond.

If the owner of the property sought to be charged with a claim of lien under AS 34.35.050 – 34.35.120, or a prime contractor or subcontractor disputes the correctness or validity of the claim of lien brought under AS 34.35.050 – 34.35.120, the owner or contractor may record either before or after the commencement of an action to enforce the claim of lien, in the office of the recorder in which district the claim of lien was recorded, a bond executed by a person authorized to issue surety bonds in this state under AS 21, a financial institution licensed under AS 06, or a national bank authorized under the federal banking laws, in the penal sum equal to one and one-half times the amount of the claim of lien, which bond shall guarantee the payment of the sum that the lien claimant has claimed, together with the lien claimant’s reasonable cost of suit in the action, if the claimant recovers on the claim of lien. If the owner records a bond under this section, the property described in the bond is freed from the effect of a claim of lien under AS 34.35.050 – 34.35.120 and an action brought to foreclose the claim of lien. The principal on the bond may be the owner of the property, the prime contractor, or a subcontractor who is affected by the claim of lien.

Sec. 34.35.074. Civil suits.

(a) A person injured by a violation of AS 34.35.050 – 34.35.120 may bring a civil action

(1) except as provided in AS 34.35.062 (c), for actual and consequential damages that are proximately caused by the violation plus costs, including reasonable attorney fees;

(2) to enjoin the violation, and if the person prevails, the person shall be awarded costs, including reasonable attorney fees.

(b) A claimant who gives a stop-lending notice or has a claim of lien recorded under AS 34.35.075 and who fails to promptly revoke the stop-lending notice or remove the claim of lien from the record upon receiving payment in full on the claim or discovering that the stop-lending notice or claim of lien is in error, unjust, premature, or excessive is liable for actual and consequential damages caused by giving the stop-lending notice or improperly recorded claim of lien plus costs, including reasonable attorney fees.

Sec. 34.35.075. Record and index of claim.

The recorder shall record the claim in a book kept for that purpose. The records shall be indexed as deeds and other conveyances are required by law to be indexed. The recorder is entitled to the same fees allowed by law for recording deeds and other instruments.

Sec. 34.35.080. Duration of lien.

(a) A lien provided for in AS 34.35.050 – 34.35.120 does not bind real property for more than six months after the claim of lien is recorded, unless an action is commenced in the proper court to enforce the lien within

(1) that time; or

(2) six months after recording of an extension notice in the same recording office within the original six-month period showing the recording date and the book and page or instrument number or serial number of the initial claim of lien, and the balance owing.

(b) [Repealed, Sec. 18 ch 102 SLA 1986].

(c) A lien whose duration is extended by commencement of an action under (a) of this section is void as against a person who, after the commencement of the action and without knowledge or actual notice of its pendency, acquires an interest in the subject property in good faith for valuable consideration, unless a notice of the pendency of the action has been duly filed for record before the time the person’s conveyance is duly filed for record. Notice of the pendency of the action must conform to the requirements of AS 09.45.940.

Sec. 34.35.085. Lien for improving lot or street.

A person who, at the request of the owner of a lot in the state, grades, fills in, or improves the lot or the street in front of or adjoining the lot has a lien upon the lot for work done and materials furnished. The provisions of AS 34.35.050 – 34.35.120 for securing and enforcing the mechanic’s lien apply to the lien provided by this section.

Sec. 34.35.090. Payment to contractor.

A payment by the owner of a building or structure to a prime contractor or subcontractor, made before 120 days from the completion of the building, is not valid to defeat or discharge a lien created by AS 34.35.050 – 34.35.120 in favor of other claimants, unless the payment is distributed among the other claimants. If a payment is distributed in part only, then the payment is valid only to the extent it is distributed.

Sec. 34.35.095. Amount of lien.

(a) Except as provided in (c) of this section, a claimant may recover upon a lien recorded by the claimant only the amount due to the claimant according to the terms of the contract, after deducting all claims of other persons claiming through the claimant for work done and materials furnished.

(b) [Repealed, Sec. 9 ch 61 SLA 1979].

(c) An individual may recover upon a lien recorded by the individual only the amount due according to the terms of the employment.

Sec. 34.35.100. Action against contractor on lien.

(a) Where a lien is recorded under AS 34.35.050 – 34.35.120 for work done or materials furnished to a prime contractor, the prime contractor shall defend an action at the expense of the prime contractor, and during the pendency of the action the owner may withhold from the prime contractor the amount of money for which the lien is recorded.

(b) If judgment is given against the owner or the property of the owner upon the liens, the owner may deduct from the amount due or to become due by the owner to the prime contractor the amount of the judgment and costs.

(c) If the amount of the judgment and costs exceeds the amount due by the owner to the prime contractor, or if the owner settles with that contractor in full, the owner may recover back from the prime contractor an amount paid by the owner in excess of the contract price, and for which the prime contractor was originally liable.

Sec. 34.35.105. Materials not subject to process.

When a mechanic, artisan, machinist, builder, lumber merchant, contractor, laborer, or other person furnishes or procures materials for use in the construction, alteration, or repair of a building or other improvement, the materials are not subject to attachment, execution, or other legal process to enforce a debt due by the purchaser of the materials except a debt due for the purchase money thereof, so long as the materials have been or are about to be applied in good faith to the construction, alteration, or repair of the building or other improvement.

Sec. 34.35.110. Actions to enforce liens.

(a) An action to enforce a lien created by AS 34.35.050 – 34.35.120 shall be brought in the superior court. The pleadings, process, practice, and procedure are the same as in other cases. Each claimant is entitled to execution for the balance due after distribution. The clerk of the superior court, upon demand, shall issue the execution after the return of the officer making the execution showing the balance due.

(b) In an action under AS 34.35.050 – 34.35.120 the court shall, upon entering judgment for the plaintiff, allow as a part of the costs all money paid for the filing and recording of the lien and a reasonable amount as attorney fees. An action to enforce a lien created by AS 34.35.050 – 34.35.120 has preference upon the calendar of civil actions of the court and shall be tried without unnecessary delay.

(c) In an action to enforce a lien created by AS 34.35.050 – 34.35.120 all persons personally liable and all lienholders whose claims have been filed for record under AS 34.35.070 shall be made parties; all other persons interested in the matter in controversy or in the property sought to be charged with the lien may be made parties. However, those persons who are not made parties are not bound by the proceedings. The proceedings upon the foreclosure of a lien created by AS 34.35.050 – 34.35.120 shall, as nearly as possible, conform to the proceedings of a foreclosure of a mortgage lien upon real property.

Sec. 34.35.112. Payment of claimant’s liens.

(a) If more than one lien created under AS 34.35.050 – 34.35.120 is claimed against property, the court in its judgment shall declare the rank of each lien or class of liens in the following order:

(1) all persons other than prime contractors or subcontractors with lien rights under AS 34.35.050 (1);

(2) the trustees of employment benefit trusts for persons described in (1) of this subsection;

(3) all materialmen and subcontractors;

(4) persons described in AS 34.35.050 (5) and prime contractors, other than the general contractor;

(5) the general contractor.

(b) For purposes of AS 34.35.050 – 34.35.120, if the proceeds of the foreclosure sale of the property are insufficient to pay the lien claims of all persons who have recorded claims of lien, the

(1) liens of all individuals with lien rights under AS 34.35.050 (1) shall first be paid in full, or pro rata if the proceeds are insufficient to pay them in full;

(2) liens of trustees of employment benefit trusts for persons described in (1) of this subsection shall be paid in full or pro rata if the proceeds are insufficient to pay them in full;

(3) liens of materialmen and subcontractors shall be paid in full or pro rata if the proceeds are insufficient to pay them in full;

(4) liens of persons described in AS 34.35.050 (5) and prime contractors other than the general contractor, shall be paid in full or pro rata if the remainder is insufficient to pay them in full; and

(5) lien of the general contractor shall be paid out of the balance.

(c) For purposes of AS 34.35.050 – 34.35.120, if the proceeds of the foreclosure sale of the property are sufficient to pay the lien claims of all persons who have recorded claims of lien, the balance shall be paid to the person who owned the property before the foreclosure sale.

Sec. 34.35.114. Obligation of claimant and lender to provide information.

(a) A prime contractor, on request, shall provide the following information within five days to any person entitled to claim a lien through the prime contractor:

(1) a description of the real property being improved sufficient to identify the property;

(2) the name and address of the owner with whom the prime contractor contracted;

(3) the name and address of the lender providing construction financing; and

(4) whether there is a payment bond and, if so, the name of the surety.

(b) At the request of any person who may claim a lien through a claimant other than a prime contractor, the claimant shall provide, within five days, the name of the person who contracted for the furnishing by the claimant of the labor, materials, services, or equipment from which a lien claim may arise.

(c) A person who receives a stop-lending notice or notice of right to lien identifying a project for which the person is not the lender shall notify the claimant in writing within 10 days after receipt of the notice that the person is not the lender.

(d) A claimant shall, within 10 days after receipt of a request, provide an owner or lender to whom the claimant has given a stop-lending notice or notice of right to lien a written statement of the amount due to the claimant and unpaid.

(e) [Repealed, Sec. 18 ch 102 SLA 1986].

Sec. 34.35.115. Persons considered agent of owner.

Every contractor, subcontractor, architect, builder, or other person having charge of the construction, alteration, or repair, in whole or in part, of a building or other improvement as provided in AS 34.35.050 and 34.35.085, is considered to be the agent of the owner for the purposes of AS 34.35.050 – 34.35.120.

Sec. 34.35.117. Waiver of lien rights.

(a) Except as provided under (b) of this section, a written waiver of lien or stop-lending notice of rights created under AS 34.35.050 – 34.35.120 signed by a claimant requires no consideration and is valid and binding. A waiver permitted under this section may not relate to labor, materials, services, or equipment furnished after the date the waiver is signed by the claimant.

(b) An individual described in AS 34.35.120 (10) may not waive right to claim a lien under AS 34.35.050 – 34.35.120. A waiver that purports to waive the lien rights of that individual or class of individuals is void.

Sec. 34.35.118. Claimant liability. [Repealed, Sec. 18 ch 102 SLA 1986].

Repealed or Renumbered

Sec. 34.35.119. Waiver of liens on unsold common interest community units.

(a) A lien created under AS 34.35.050 – 34.35.120 arising out of original construction that becomes subject to AS 34.07 or AS 34.08 before the first sale of a unit within a common interest community after commencement of construction shall be subject to the provisions of this section.

(b) Subject to (c) of this section, a claimant who claims a lien against an entire common interest community shall release that portion of the lien claim that relates to a particular unit within a common interest community selected by the owner of the unsold common interest community units after the claimant receives a partial payment of the lien claim that is equal to 115 percent of the amount determined

(1) if the common interest community has been established under AS 34.07 by

(A) dividing the surface area of the common areas and facilities attendant to the common interest community unit by the surface area of all common areas and facilities of the common interest community building; and

(B) multiplying the result obtained in (A) of this paragraph by the total amount of the claimant’s lien claim;

(2) by the allocated interest in the common expenses if the common interest community has been established under AS 34.08.

(c) A lien claimant is not required to waive a portion of the lien claim under this section unless the amount of indebtedness secured by a prior encumbrance against the common interest community building held by a construction lender is also reduced by an amount calculated in the same manner as provided in (b) of this section.

Sec. 34.35.120. Definitions.

In AS 34.35.050 – 34.35.120,

(1) “building or other improvement,” includes a wharf, bridge, ditch, flume, tunnel, fence, well, land clearing, machinery, aqueduct to create hydraulic power, or for mining or other purposes, and all other structures and superstructures;

(2) “completion” means the cessation of the performance of labor or services or the furnishing of material or equipment on the building or other improvement to be constructed, altered, or repaired and includes, but is not limited to, the following:

(A) the occupation or use by the owner or an agent of the owner of the building or other improvement constructed, altered, or repaired accompanied by cessation of the furnishing of labor, services, material, or equipment on the building or improvement;

(B) the acceptance by the owner or an agent of the owner of the construction, alteration, or repair after labor, service, material, or equipment is furnished; or

(C) the issuance of a certificate of occupancy for a building by a municipality empowered to issue that certificate accompanied by cessation of the furnishing of labor, services, material, or equipment on the building or improvement;

(3) “construction, alteration, or repair”, includes partial construction, and all repairs done in and upon a building or other improvement;

(4) “construction financing” means money loaned or other credit extended to an owner secured by an encumbrance on real property to finance a project on that real property;

(5) “contract price” means the amount agreed upon by the contracting parties for furnishing services, labor, materials, or equipment covered by the contract, increased or diminished by the price of change orders, extras, or amounts attributable to altered specifications; if no price is agreed upon by the contracting parties, “contract price” means the reasonable value of all services, labor, materials, or equipment covered by the contract;

(6) “draws” means periodic disbursements of construction financing by a lender;

(7) “encumbrance” means a mortgage, deed of trust, or lien arising other than under AS 34.35.050 – 34.35.120;

(8) “general contractor” means a person who is a prime contractor and who has the responsibility for supervising all other contractors furnishing labor, materials, services, or equipment in connection with the construction, alteration, or repair of a building or other improvement;

(9) “give notice” means to mail a notice required under AS 34.35.050 – 34.35.120 by first-class mail and by using a form of mail requiring a signed receipt, or to deliver the notice and obtain a receipt signed by the person to whom it is directed or an agent of that person; a notice is effective when given or delivered to

(A) a lender at the address designated in the encumbrance securing that lender;

(B) an owner at the last known address of the owner;

(C) a prime contractor at the last known address of the prime contractor;

(D) a potential lien claimant at the address specified in a stop-lending notice or notice of right to lien or claim of lien;

(10) “individual” means a natural person who actually performs labor upon a building or other improvement as an employee of the owner or any contractor furnishing labor, materials, services, or equipment for the construction, alteration, or repair of a building or other improvement;

(11) “lender” means any person providing construction financing;

(12) “materialman” means a person who furnishes materials used in the construction, alteration, or repair of the owner’s real property;

(13) “owner” means a person who owns real property or a possessory interest in real property and who enters into a contract, express or implied, for a project on that property;

(14) “potential lien claimant” or “claimant” means any person entitled to assert lien rights under AS 34.35.050 – 34.35.120;

(15) “prime contractor” means a person who enters into a contract directly with an owner to furnish labor, materials, services, or equipment for the construction, alteration, or repair of a building or other improvement on the owner’s real property;

(16) “project” means construction, alteration, or repair of an improvement on real property or work done to enhance the real property itself;

(17) “subcontractor” means a person who enters into a contract with a prime contractor to furnish labor, services, or equipment for the construction, alteration, or repair of a building or other improvement on the owner’s real property and does not include a materialman.