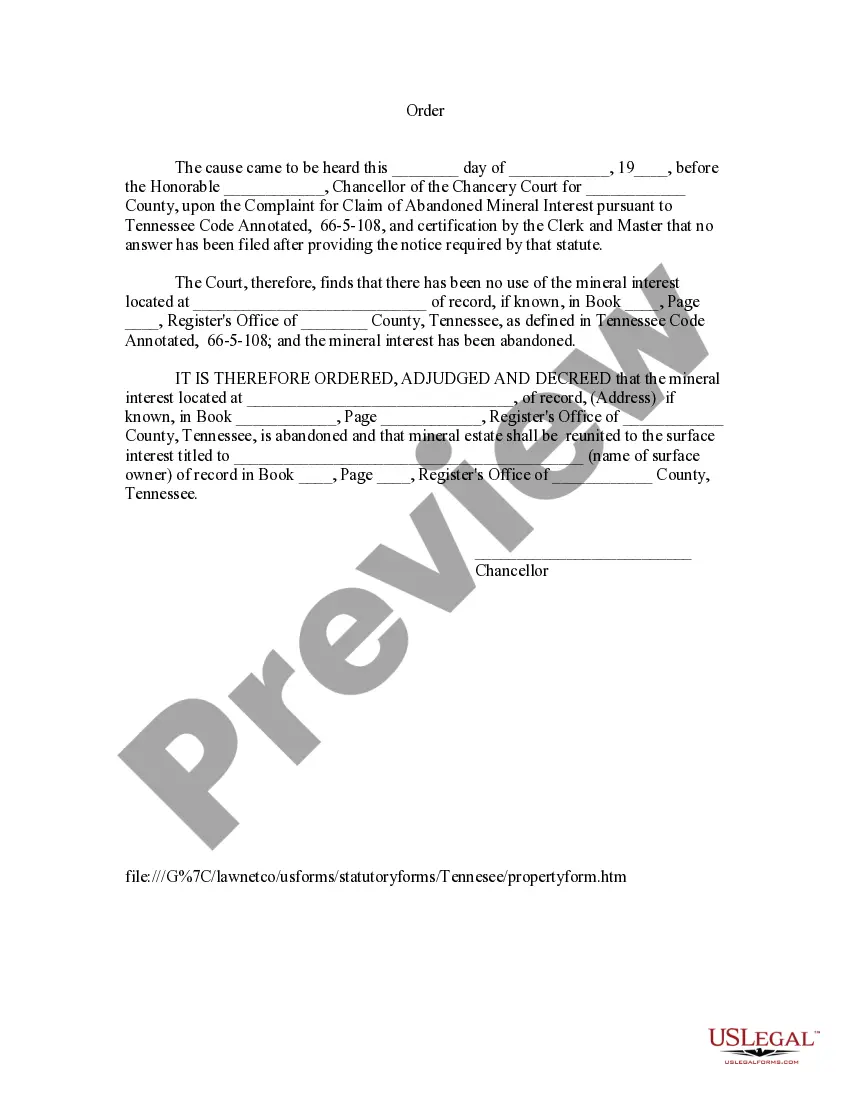

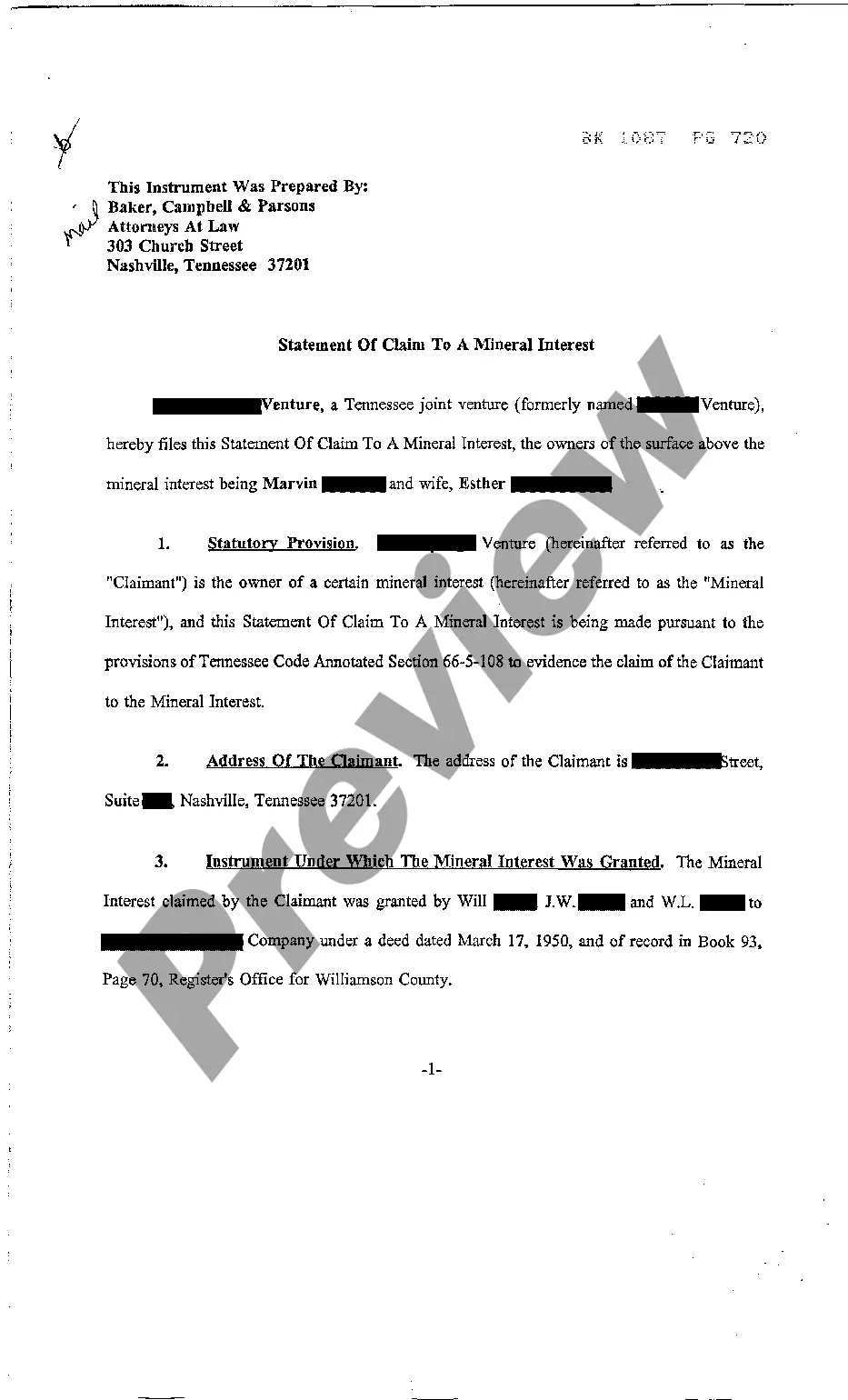

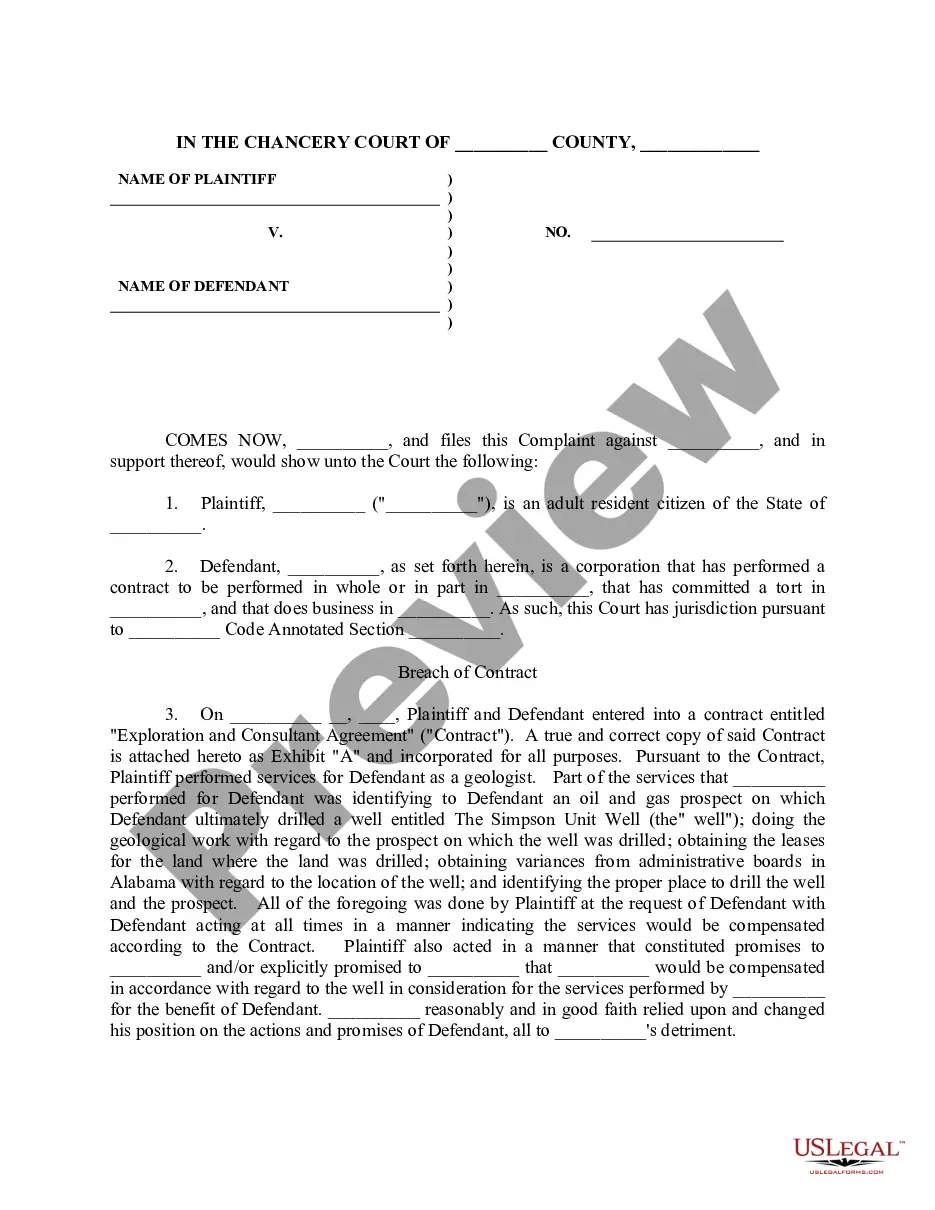

This is a sample form for use in Tennessee, a Complaint for Claim of Abandoned Mineral Interest. Adapt to fit your circumstances. Available in standard formats.

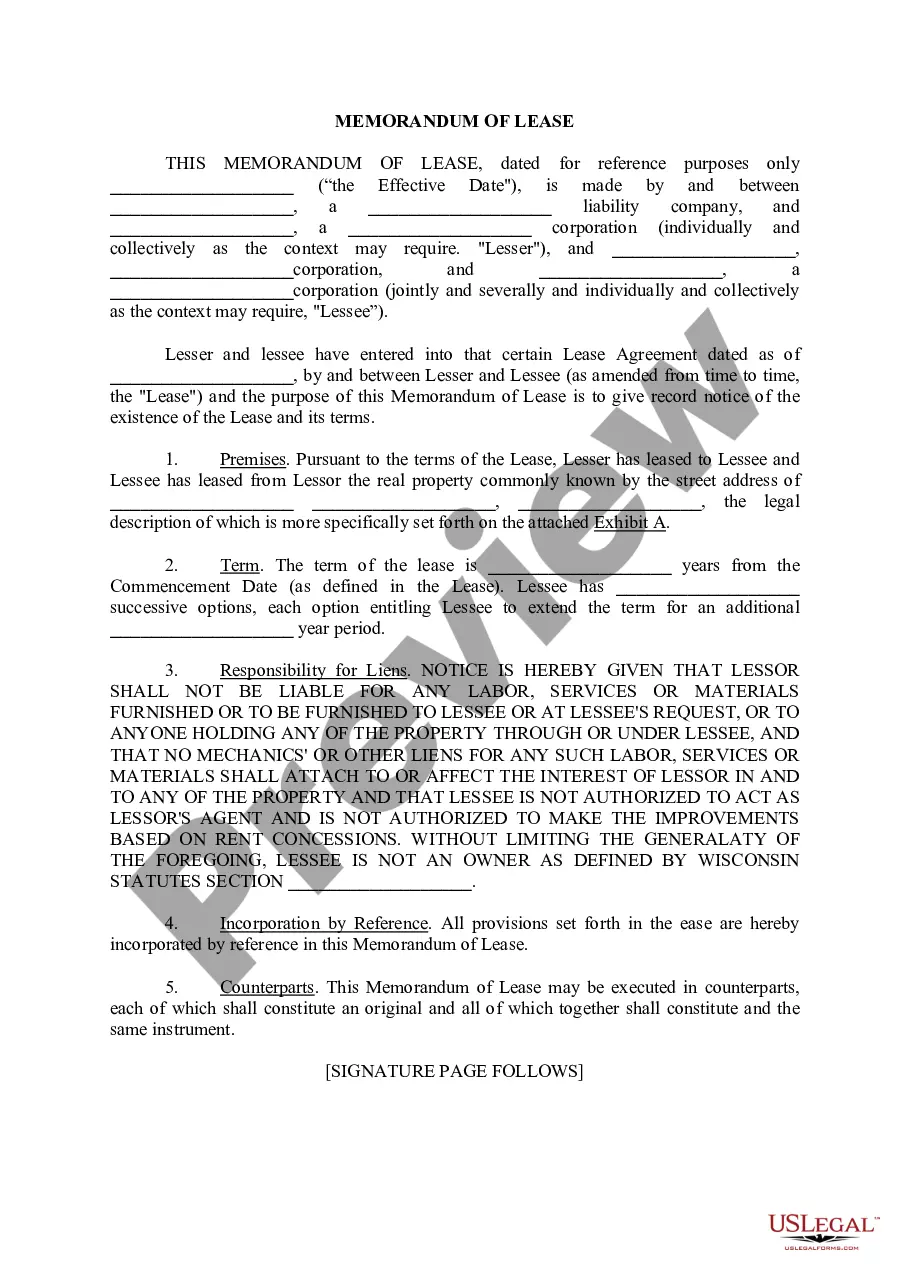

Tennessee Complaint for Claim of Abandoned Mineral Interest

Description

How to fill out Tennessee Complaint For Claim Of Abandoned Mineral Interest?

Access to top quality Tennessee Complaint for Claim of Abandoned Mineral Interest forms online with US Legal Forms. Avoid hours of misused time seeking the internet and dropped money on forms that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Find around 85,000 state-specific legal and tax templates that you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click Download. The document will be stored in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Verify that the Tennessee Complaint for Claim of Abandoned Mineral Interest you’re considering is suitable for your state.

- See the form making use of the Preview option and browse its description.

- Go to the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to register.

- Pay out by card or PayPal to complete making an account.

- Choose a favored file format to save the file (.pdf or .docx).

You can now open up the Tennessee Complaint for Claim of Abandoned Mineral Interest template and fill it out online or print it out and do it by hand. Consider giving the document to your legal counsel to make sure everything is completed properly. If you make a mistake, print out and fill application again (once you’ve registered an account every document you save is reusable). Make your US Legal Forms account now and get access to a lot more samples.

Form popularity

FAQ

When it comes to mineral rights, the standard admonition has long been consistent and emphatic: Avoid selling them. After all, simply owning mineral rights costs you nothing. There are no liability risks, and in most cases, taxes are assessed only on properties that are actively producing oil or gas.

You can retain your mineral rights simply by putting an exception in your sales contract, provided that the buyer agrees to it, of course. If you sell your house with no such legal clarification, then those mineral rights automatically transfer to the buyer.

Online Mineral Rights Exchange. By listing on a mineral listing service with lots of active buyers and sellers, you can discover what price the market assigns your mineral rights. Auction. Mineral properties that are auctioned often go for a higher price due to the higher volume of bidders. Broker.

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller.Conveying (selling or otherwise transferring) the land but retaining the mineral rights.

A mineral rights agreement may range from a few to 20 years. Oil and gas leases often have two terms: a primary and a secondary term. If no drilling or production activity has taken place at the end of a primary term, the lease will expire.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

In Louisiana for example, if you sell land, you may retain ownership of the minerals beneath it for a period of 10 years and one day at which time you must transfer such mineral rights to the current owner of that tract of land, but only if that owner has retained the land for the same period of time.