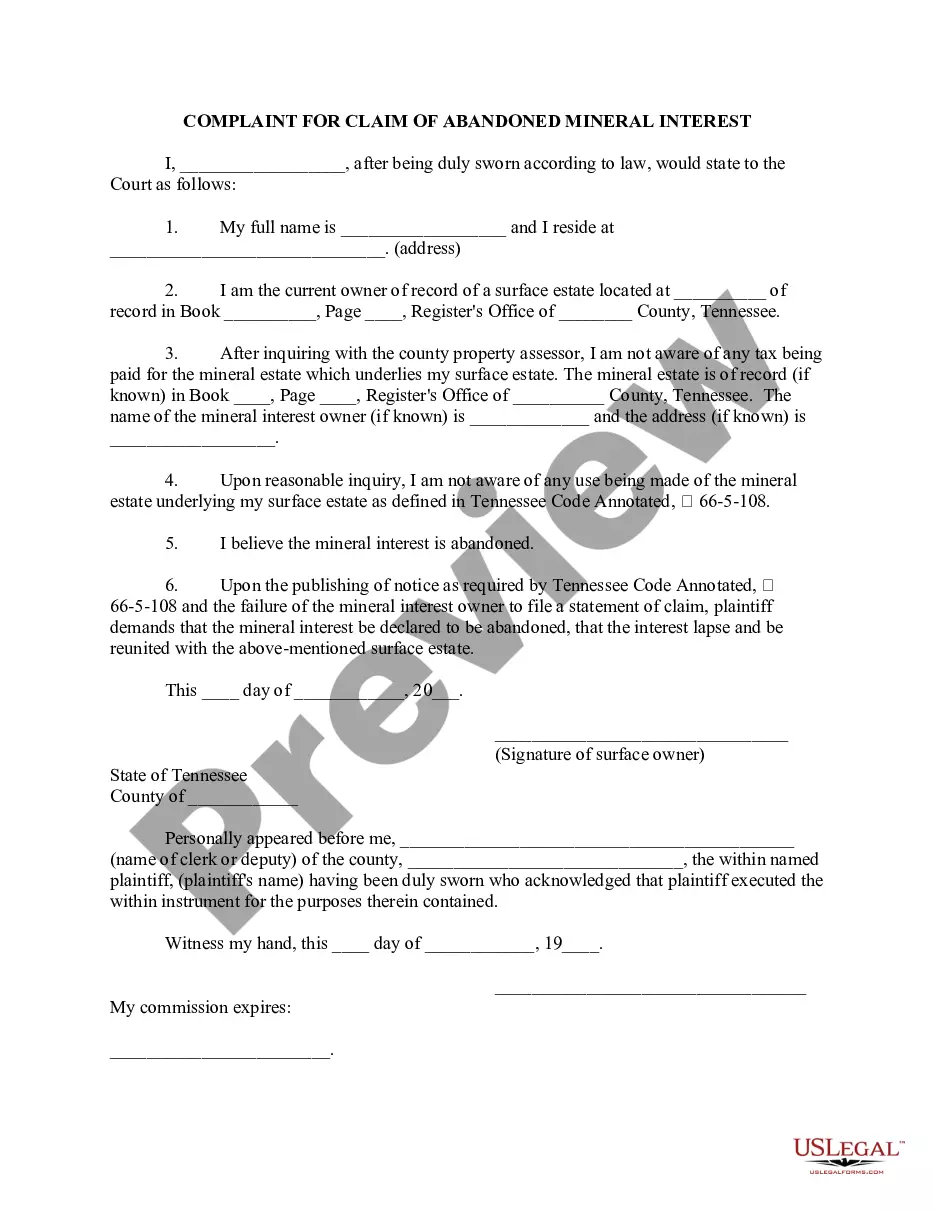

This is a sample form for use in Tennessee, a Order on Complaint for Abandoned Mineral Interest. Adapt to fit your circumstances. Available in standard formats.

Tennessee Order on Complaint for Abandoned Mineral Interest

Description

How to fill out Tennessee Order On Complaint For Abandoned Mineral Interest?

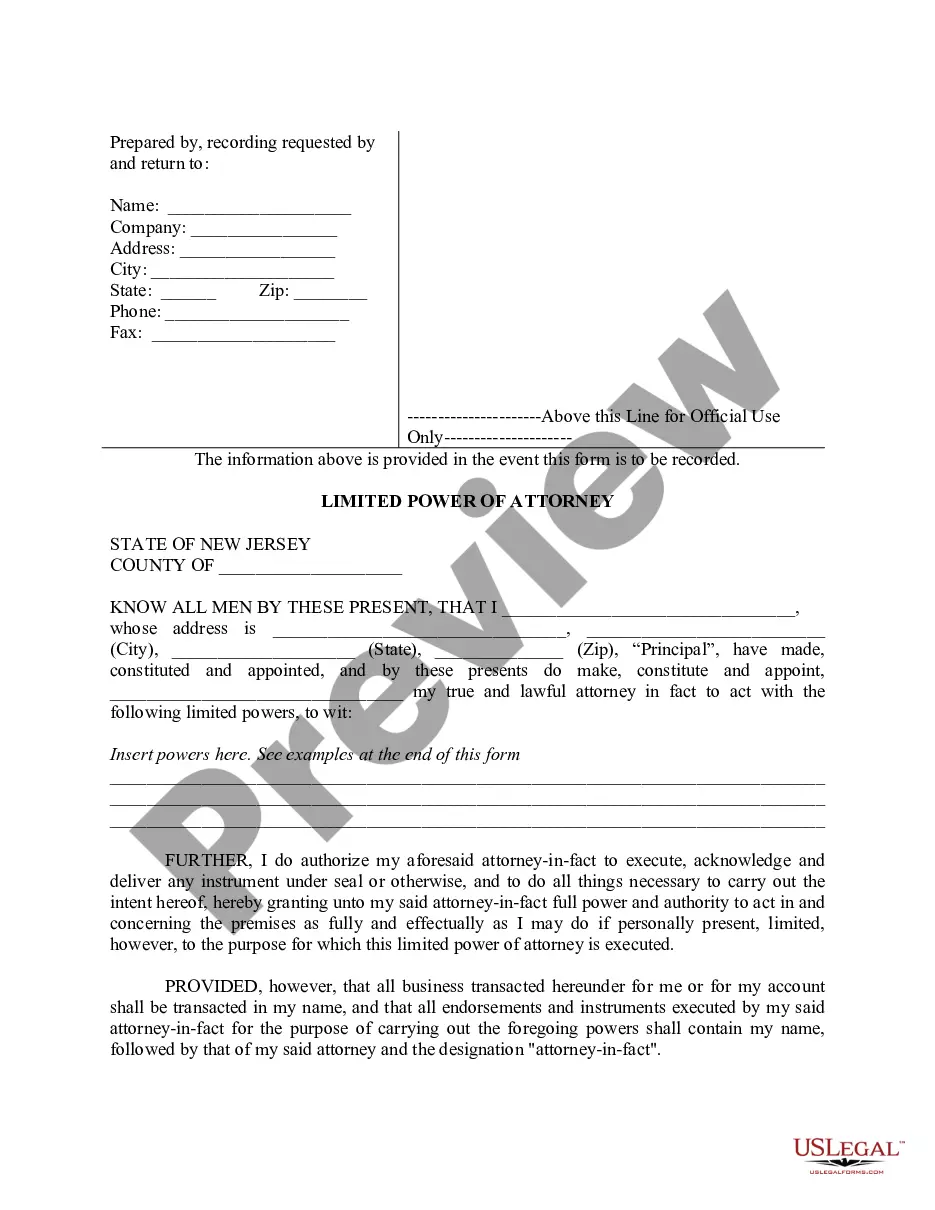

Get access to high quality Tennessee Order on Complaint for Abandoned Mineral Interest samples online with US Legal Forms. Steer clear of hours of misused time seeking the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to just that. Find above 85,000 state-specific authorized and tax forms that you could download and fill out in clicks in the Forms library.

To receive the sample, log in to your account and click Download. The file is going to be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- See if the Tennessee Order on Complaint for Abandoned Mineral Interest you’re looking at is appropriate for your state.

- Look at the form using the Preview function and read its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by credit card or PayPal to complete making an account.

- Choose a favored file format to save the document (.pdf or .docx).

You can now open the Tennessee Order on Complaint for Abandoned Mineral Interest example and fill it out online or print it and do it yourself. Consider sending the file to your legal counsel to ensure things are filled in appropriately. If you make a error, print and complete sample once again (once you’ve made an account every document you save is reusable). Make your US Legal Forms account now and get access to more forms.

Form popularity

FAQ

You have no idea how troublesome it is to probate wills decades after the person died so that the oil company will pay royalties to the heirs. But if you push they will pay per the state statutes. So, if you had no siblings, your state statute probably says that you inherit from your mother.

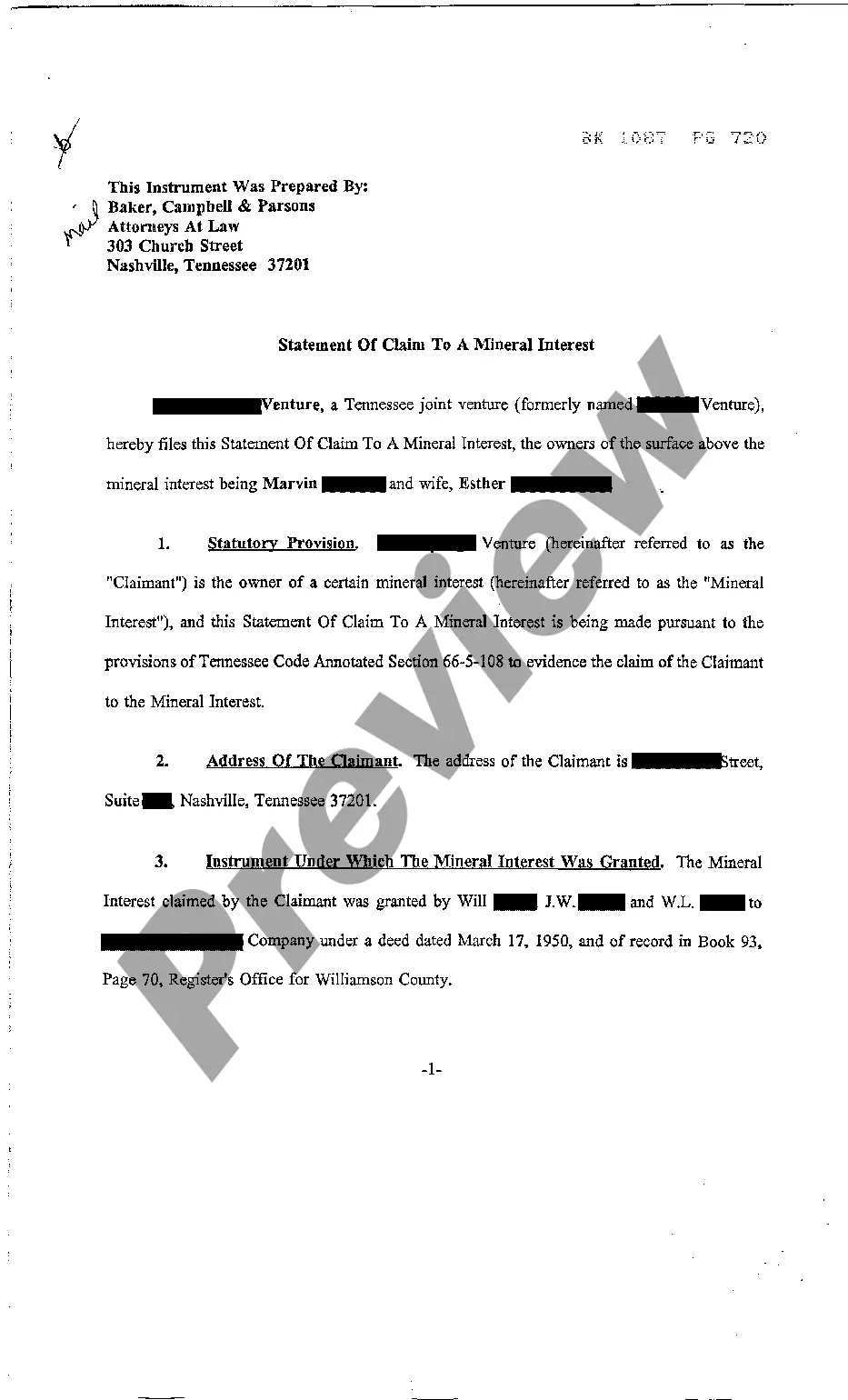

Mineral rights must be transferred to heirs before any transactions related to them can take place. Unlike a home, which can be sold by an estate, mineral rights must be transferred before any sale. Mineral rights can be transferred to rightful heir(s) or to a trust through a mineral deed.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Severance can occur in a number of ways, including an express transfer or lease of the mineral estate separate from the surface estate, or a reservation of the mineral estate to the Seller in a deed for the conveyance of a property.

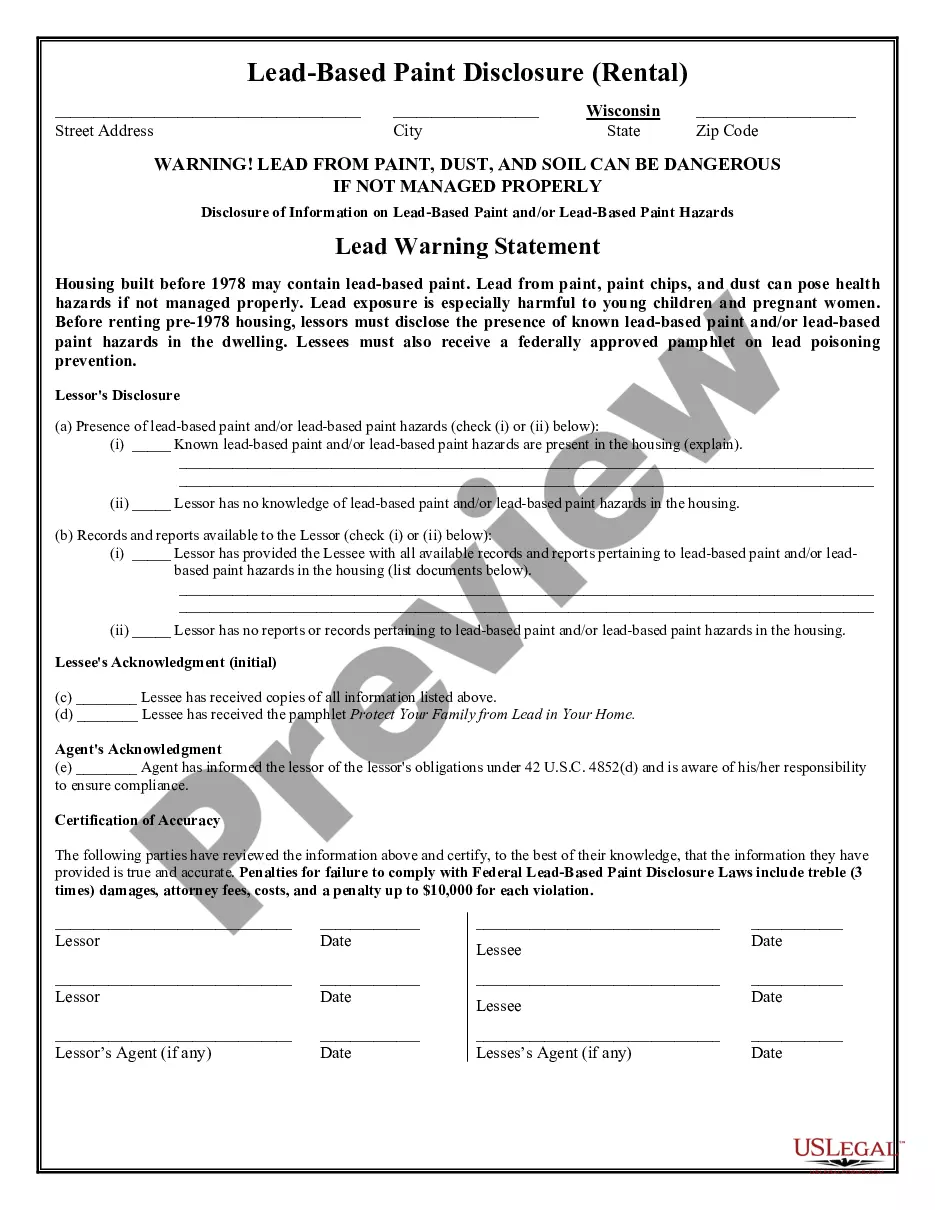

Not owning the mineral rights to a parcel of land doesn't mean your property is worthless. If someone else owns the mineral rights and they sell those rights to an individual or corporation, you can still make a profit as the surface rights owner.

Even if mineral rights have been previously sold on your property, they could be expired. There is no one answer to how long mineral rights may last. Each mineral rights agreement will have different terms.