South Dakota Accounting Procedures

Description

How to fill out Accounting Procedures?

Are you currently within a position the place you require paperwork for either company or individual functions almost every time? There are plenty of lawful record themes available on the Internet, but finding kinds you can rely is not effortless. US Legal Forms provides a huge number of type themes, just like the South Dakota Accounting Procedures, that happen to be created to meet federal and state demands.

When you are presently acquainted with US Legal Forms internet site and possess your account, merely log in. After that, it is possible to obtain the South Dakota Accounting Procedures template.

Should you not offer an account and want to begin using US Legal Forms, adopt these measures:

- Get the type you require and make sure it is to the correct city/county.

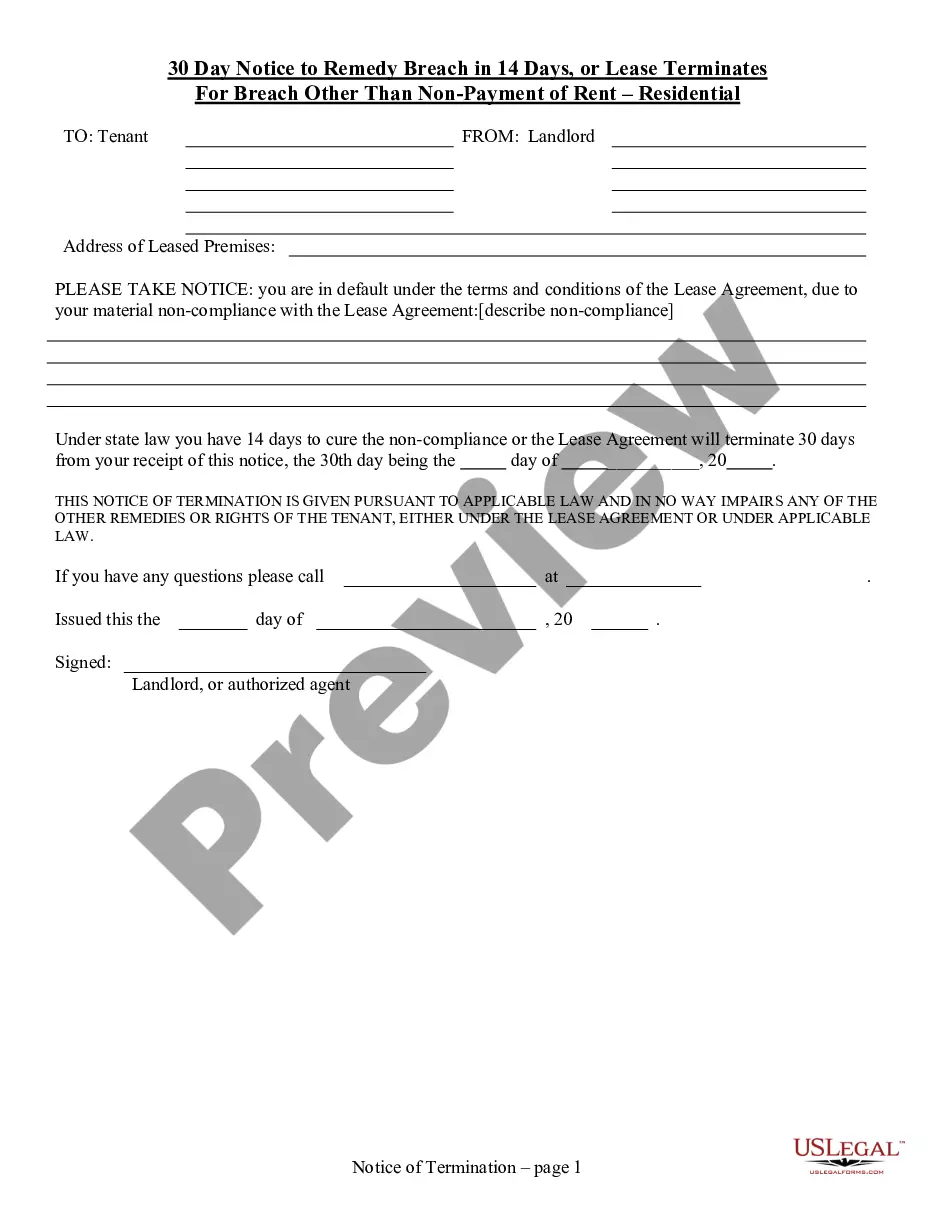

- Utilize the Review switch to review the shape.

- See the description to actually have selected the appropriate type.

- In case the type is not what you are seeking, make use of the Lookup field to get the type that fits your needs and demands.

- If you find the correct type, click Get now.

- Pick the pricing plan you need, submit the required information and facts to generate your money, and pay money for the order making use of your PayPal or bank card.

- Select a hassle-free data file formatting and obtain your duplicate.

Find all the record themes you possess purchased in the My Forms menu. You can obtain a more duplicate of South Dakota Accounting Procedures whenever, if possible. Just go through the needed type to obtain or produce the record template.

Use US Legal Forms, one of the most extensive assortment of lawful kinds, to save lots of time and avoid blunders. The support provides expertly manufactured lawful record themes that can be used for an array of functions. Generate your account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

There are ten steps in an accounting cycle, which include analyzing transactions, journalizing transactions, post transactions, preparing an unadjusted trial balance, preparing adjusting entries, preparing the adjusted trial balance, preparing financial statements, preparing closing entries, posting a closing trial ...

A manual accounting system is a bookkeeping system for recording business activity transactions, where financial records are kept without using a computer system with specialized accounting software.

The steps in the accounting cycle are identifying transactions, recording transactions in a journal, posting the transactions, preparing the unadjusted trial balance, analyzing the worksheet, adjusting journal entry discrepancies, preparing a financial statement, and closing the books.

The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. Accrual accounting records revenues and expenses when they occur. Generally accepted accounting principles (GAAP) requires accrual accounting.

The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance. We begin by introducing the steps and their related documentation.

Defining the accounting cycle with steps: (1) Financial transactions, (2) Journal entries, (3) Posting to the Ledger, (4) Trial Balance Period, and (5) Reporting Period with Financial Reporting and Auditing.

Definition of accounting system An accounting system is how you keep your business's records. You would put into your accounting system transactions such as invoices, money spent from the business's bank account, bills from suppliers, and money you've spent yourself on business costs.

? Accounting systems are comprised of manual or computerized. records of financial transactions for the purpose of recording, categorizing, analyzing and reporting timely financial. management information.