Statutory Guidelines [Appendix A(5) Tres. Regs 1.46B and 1.46B-1 to B-5] regarding designated settlement funds and qualified settlement funds.

South Dakota Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5

Description

How to fill out Designated Settlement Funds Treasury Regulations 1.468 And 1.468B.1 Through 1.468B.5?

It is possible to devote hrs online attempting to find the legal file web template which fits the federal and state specifications you need. US Legal Forms provides a large number of legal varieties which are analyzed by pros. You can easily obtain or print out the South Dakota Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5 from the assistance.

If you currently have a US Legal Forms profile, you are able to log in and then click the Download switch. Next, you are able to complete, revise, print out, or indication the South Dakota Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5. Every legal file web template you get is your own permanently. To have yet another copy of any bought type, visit the My Forms tab and then click the related switch.

If you are using the US Legal Forms site the first time, follow the straightforward directions listed below:

- Initial, make sure that you have selected the best file web template for that state/area that you pick. Read the type description to make sure you have picked out the proper type. If readily available, utilize the Preview switch to search through the file web template too.

- If you wish to find yet another version of the type, utilize the Lookup industry to obtain the web template that suits you and specifications.

- After you have discovered the web template you need, just click Get now to proceed.

- Find the costs program you need, key in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can use your credit card or PayPal profile to cover the legal type.

- Find the format of the file and obtain it for your device.

- Make modifications for your file if required. It is possible to complete, revise and indication and print out South Dakota Designated Settlement Funds Treasury Regulations 1.468 and 1.468B.1 through 1.468B.5.

Download and print out a large number of file web templates making use of the US Legal Forms web site, that provides the biggest collection of legal varieties. Use skilled and state-distinct web templates to tackle your small business or specific requirements.

Form popularity

FAQ

A QSF is assigned its own Employer Identification Number from the IRS. A QSF is taxed on its modified gross income[v] (which does not include the initial deposit of money), at a maximum rate of 35%.

There are only three requirements for establishing a QSF. It must be created by a court order with continuing jurisdiction over the QSF. [i] The trust is set up to resolve tort or other legal claims prescribed by the Treasury regulations. [ii] Finally, it must be a trust under applicable state law.

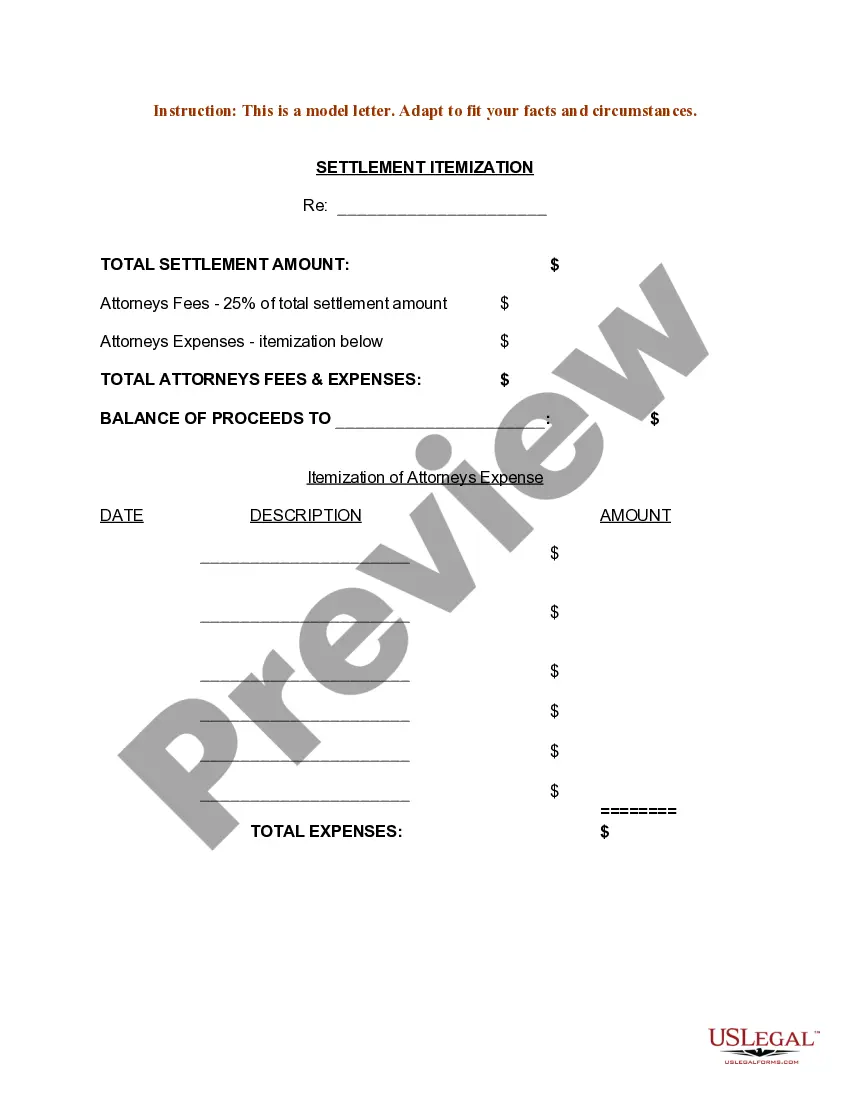

Qualified Settlement Fund Services Generating client closing statements and providing accounting for the fund. Disbursement of all claimant payments, including directing funding of Special Needs Trusts and/or structured settlements.

§ 1.468B. Modified gross income of the FUND consists of income from intangible property, including obligations of the United States exempted from state tax by section 3124, Title 31, United States Code.

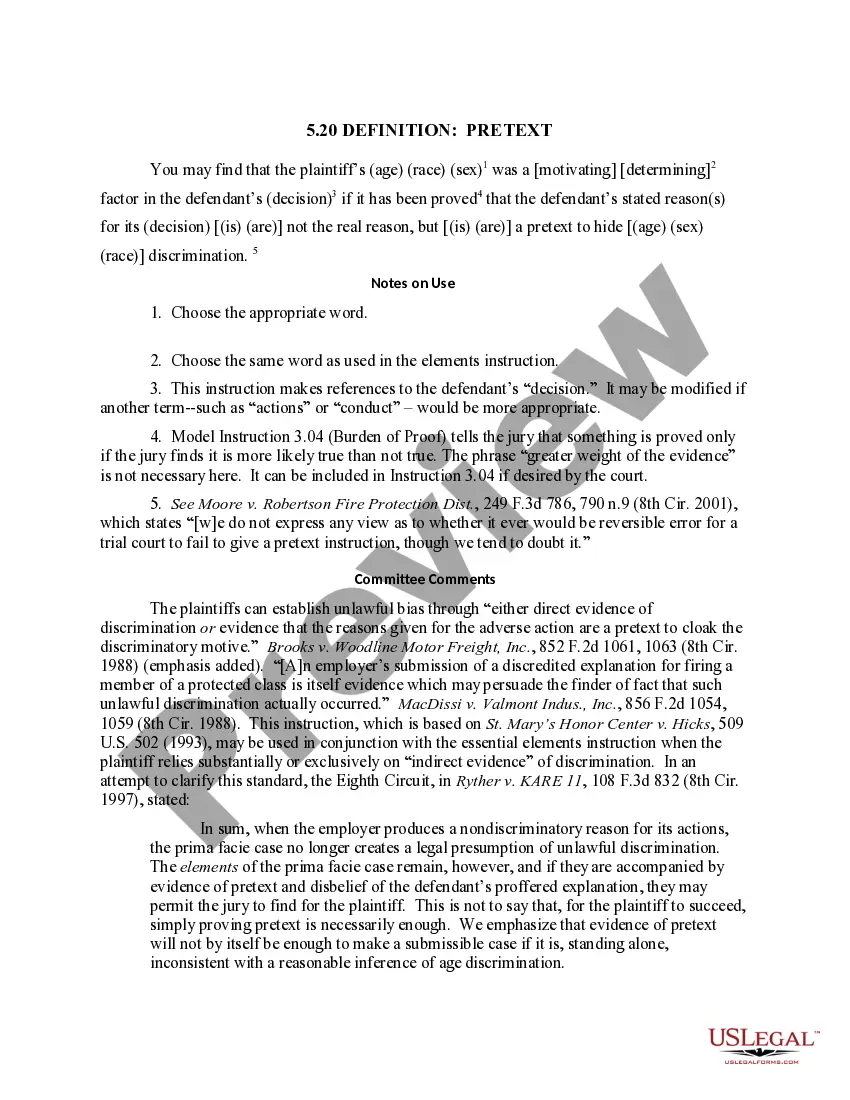

§ 1.468B-1 Qualified settlement funds. (a) In general. A qualified settlement fund is a fund, account, or trust that satisfies the requirements of paragraph (c) of this section. (b) Coordination with other entity classifications.

A Qualified Settlement Fund (QSF) allows tax payers involved in litigation to receive settlement funds and potentially avoid tax ramifications until the funds are otherwise paid to the taxpayer.

A Qualified Settlement Fund (QSF) allows tax payers involved in litigation to receive settlement funds and potentially avoid tax ramifications until the funds are otherwise paid to the taxpayer.

Tax deduction A QSF enables the defendant (or insurer) to accelerate its tax deduction to the date that the settlement amount paid is to the Qualified Settlement Fund in exchange for a general release, rather than when each plaintiff, signs and is paid.