South Dakota Jury Instruction - Failure To File Tax Return

Description

How to fill out Jury Instruction - Failure To File Tax Return?

Finding the right lawful file template can be a struggle. Obviously, there are plenty of templates available on the net, but how would you get the lawful kind you will need? Take advantage of the US Legal Forms website. The assistance offers thousands of templates, such as the South Dakota Jury Instruction - Failure To File Tax Return, that can be used for organization and personal needs. All of the types are checked out by professionals and satisfy federal and state specifications.

When you are presently signed up, log in to your accounts and then click the Download switch to get the South Dakota Jury Instruction - Failure To File Tax Return. Utilize your accounts to appear through the lawful types you might have purchased earlier. Check out the My Forms tab of the accounts and obtain one more backup of your file you will need.

When you are a fresh user of US Legal Forms, listed below are easy recommendations that you should adhere to:

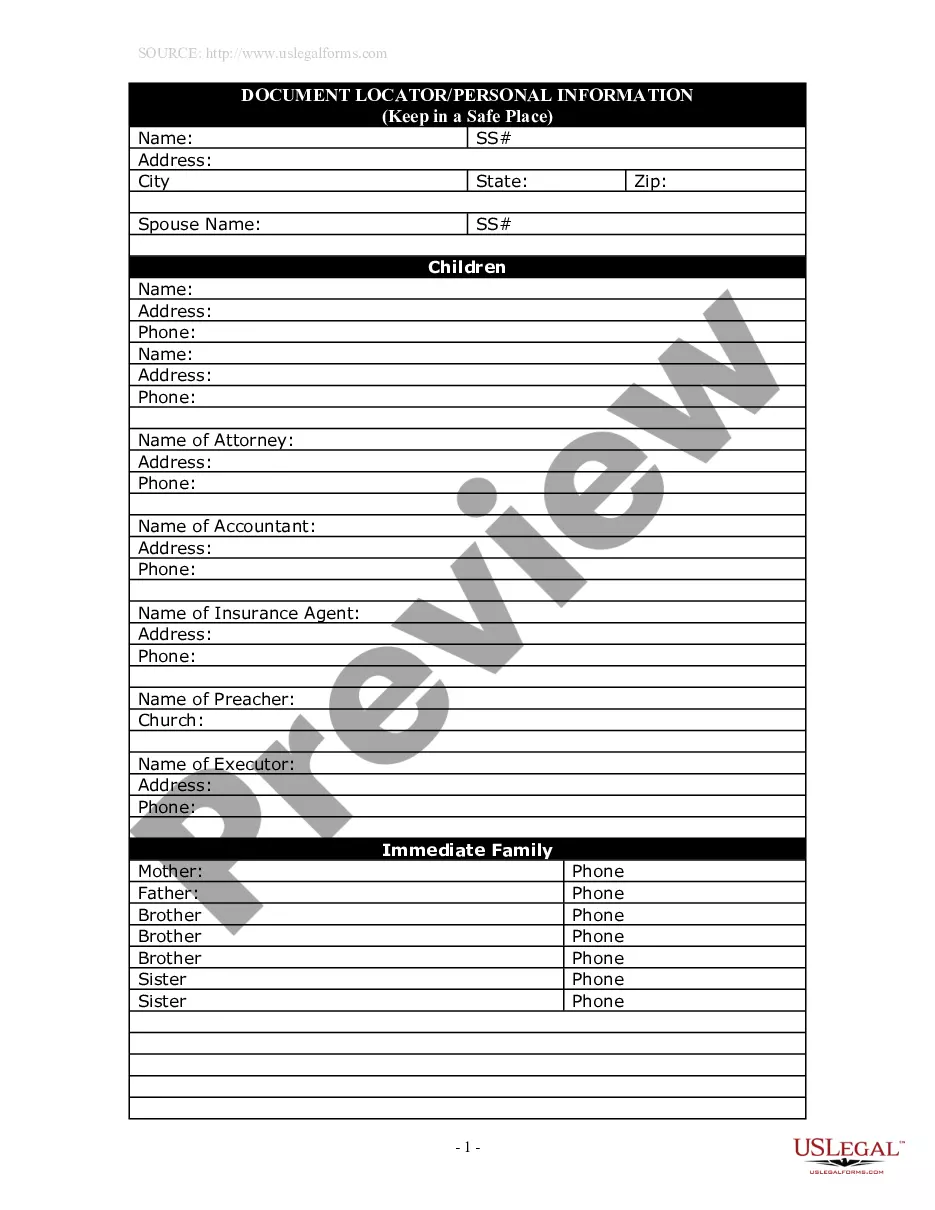

- Initially, make certain you have selected the correct kind to your metropolis/county. You can examine the shape while using Review switch and study the shape outline to ensure it is the right one for you.

- In the event the kind does not satisfy your expectations, make use of the Seach discipline to get the correct kind.

- Once you are certain the shape is acceptable, click on the Buy now switch to get the kind.

- Pick the pricing prepare you would like and enter the necessary information. Create your accounts and pay for the order with your PayPal accounts or Visa or Mastercard.

- Pick the submit format and obtain the lawful file template to your product.

- Full, revise and produce and signal the acquired South Dakota Jury Instruction - Failure To File Tax Return.

US Legal Forms may be the most significant local library of lawful types for which you can see numerous file templates. Take advantage of the company to obtain expertly-produced paperwork that adhere to status specifications.

Form popularity

FAQ

Juror Pay Information: Jurors receive $50.00 per day attendance for each day reporting whether selected for service or not.

Any member of a church or religious organization is exempt from jury duty if jury service conflicts with the religious belief of that church or religious organization. Any person who has been convicted of a felony unless restored to civil rights is not eligible to serve as a juror.

Do I get paid? Yes. Jurors receive $50 for the first half day and $100 for serving the whole day.

The highest daily juror rate is $50 per day. Six states offer this payment: Arkansas, Colorado, Connecticut, Georgia, Massachusetts, and South Dakota.

If you are age 70 or over and have either a physical or mental disability or impairment you may be excused from jury service.