US Legal Forms - one of the biggest libraries of legitimate kinds in the United States - offers a variety of legitimate record layouts it is possible to download or print out. Making use of the website, you can get thousands of kinds for enterprise and personal functions, sorted by types, states, or keywords and phrases.You will find the newest variations of kinds much like the South Dakota Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act in seconds.

If you have a registration, log in and download South Dakota Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act from your US Legal Forms collection. The Obtain option can look on every single develop you look at. You gain access to all formerly saved kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms for the first time, allow me to share easy guidelines to help you started out:

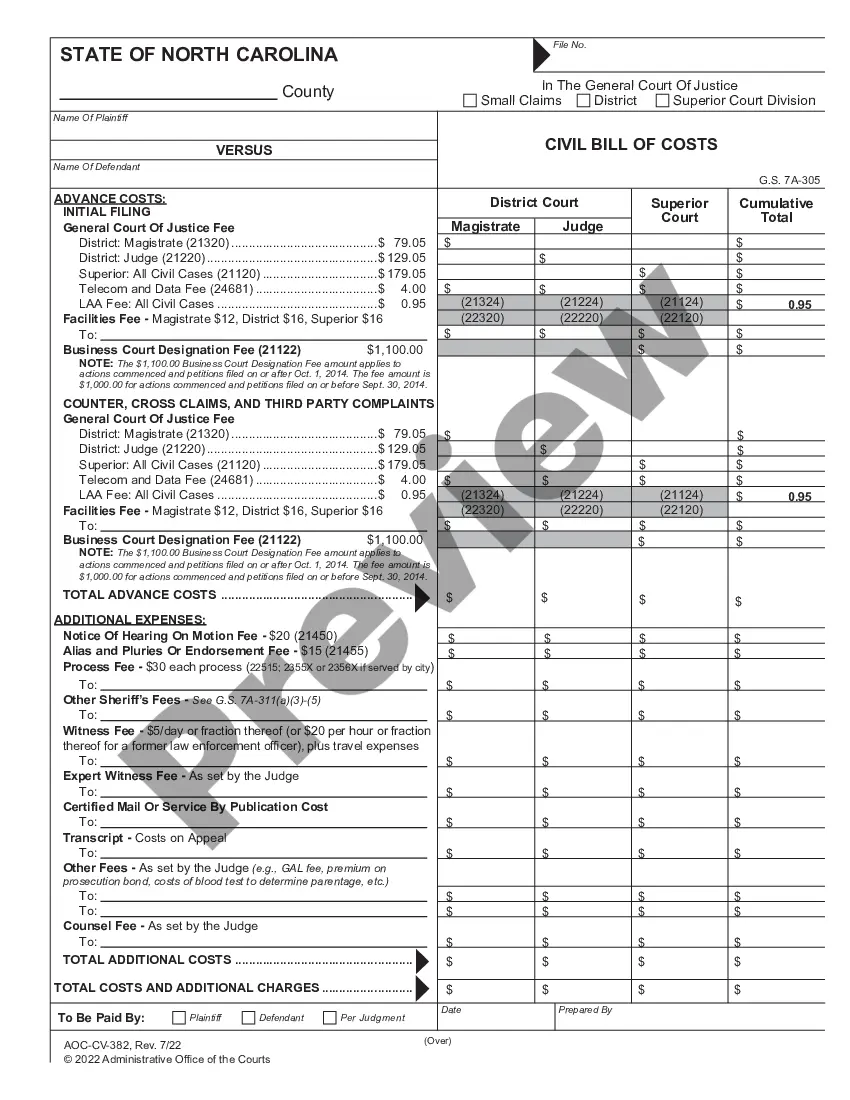

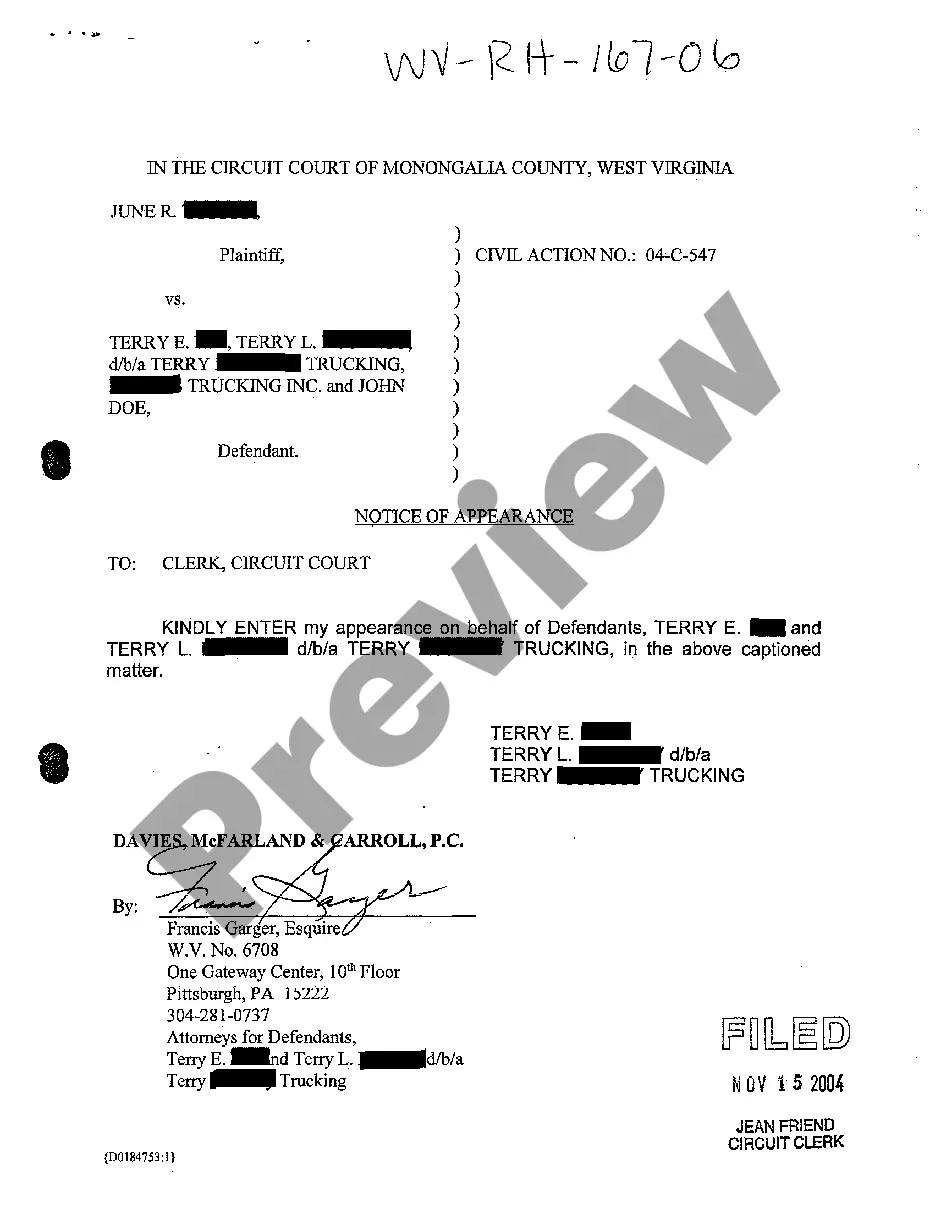

- Be sure to have selected the best develop for your town/area. Select the Review option to review the form`s articles. Look at the develop outline to ensure that you have selected the correct develop.

- In case the develop doesn`t match your needs, make use of the Research discipline towards the top of the monitor to obtain the the one that does.

- Should you be satisfied with the form, validate your option by simply clicking the Purchase now option. Then, opt for the costs strategy you prefer and give your accreditations to register on an bank account.

- Procedure the purchase. Make use of your credit card or PayPal bank account to finish the purchase.

- Pick the structure and download the form on the system.

- Make alterations. Fill up, modify and print out and signal the saved South Dakota Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act.

Each and every web template you added to your money does not have an expiration particular date and is also your own property for a long time. So, if you wish to download or print out an additional version, just go to the My Forms area and then click on the develop you want.

Gain access to the South Dakota Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act with US Legal Forms, one of the most substantial collection of legitimate record layouts. Use thousands of professional and condition-certain layouts that satisfy your company or personal demands and needs.