Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

South Dakota Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description

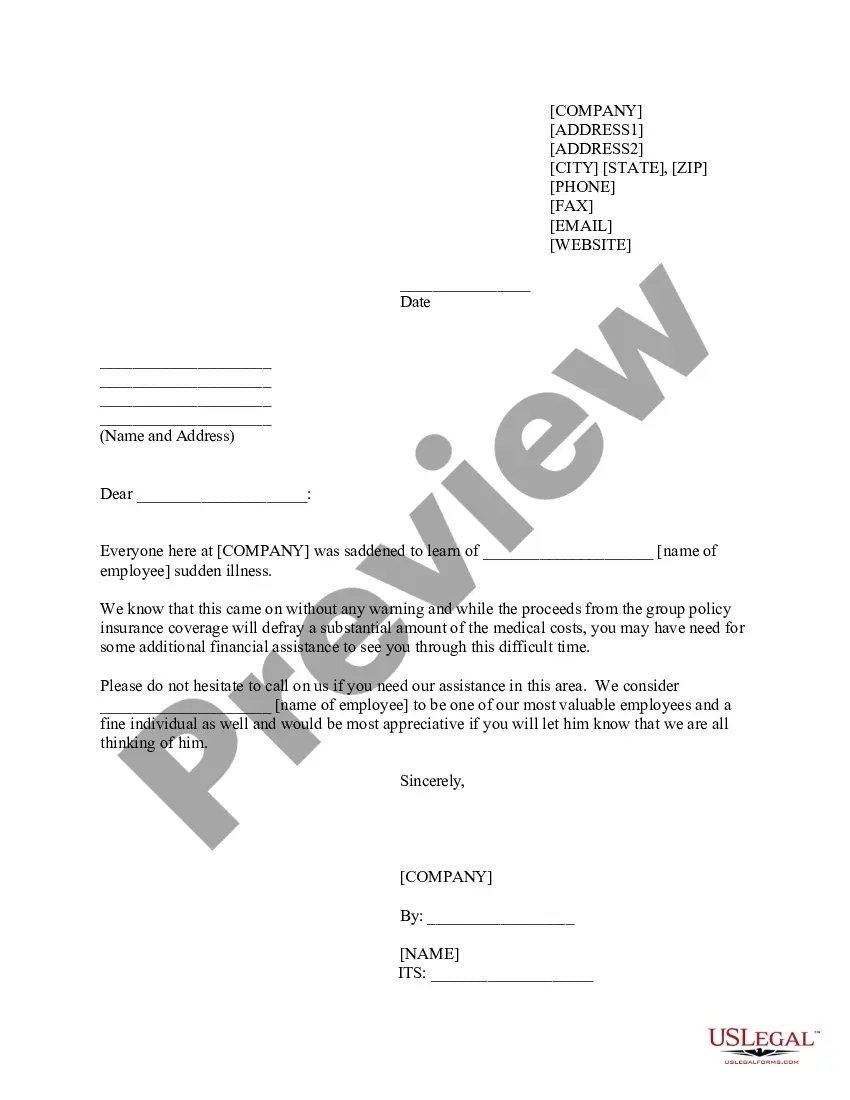

How to fill out Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency?

If you wish to total, obtain, or produce legitimate file themes, use US Legal Forms, the biggest selection of legitimate kinds, that can be found online. Utilize the site`s easy and handy lookup to get the papers you require. Different themes for company and specific functions are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to get the South Dakota Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency with a handful of click throughs.

In case you are currently a US Legal Forms customer, log in for your accounts and then click the Down load key to have the South Dakota Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency. Also you can gain access to kinds you formerly delivered electronically in the My Forms tab of your accounts.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for your appropriate town/land.

- Step 2. Use the Preview choice to look through the form`s information. Don`t neglect to read the explanation.

- Step 3. In case you are unhappy with all the form, take advantage of the Search industry on top of the display screen to get other types in the legitimate form template.

- Step 4. When you have discovered the form you require, go through the Purchase now key. Opt for the costs strategy you favor and add your accreditations to register for an accounts.

- Step 5. Method the deal. You can use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Choose the formatting in the legitimate form and obtain it on the product.

- Step 7. Total, modify and produce or indicator the South Dakota Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency.

Every single legitimate file template you acquire is your own permanently. You have acces to each form you delivered electronically within your acccount. Click the My Forms section and choose a form to produce or obtain once more.

Be competitive and obtain, and produce the South Dakota Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency with US Legal Forms. There are thousands of specialist and condition-certain kinds you can utilize for the company or specific requires.

Form popularity

FAQ

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

It bars practices associated with predatory lending such as frequently refinancing a loan in order to charge fees. It also requires certain fair practices. For example, lenders must take into account your ability to repay the loan with interest. They cannot offer a loan which they know you cannot repay.

Section 623(a) of the FCRA also requires a person who regularly furnishes information to CRAs to promptly notify a CRA if the person determines the previously furnished information is not complete or accurate.

A credit report or another type of consumer report to deny your application for credit, insurance, or employment ? or to take another adverse action against you ? must tell you, and must give you the name, address, and phone number of the agency that provided the information.

Section 603(d) defines a consumer report to include information about a consumer such as that which bears on a consumer's creditworthiness, character, and capacity among other factors. Communication of this information may cause a person, including a financial institution, to become a consumer reporting agency.

A consumer report is any written, oral or other communication of any information by a Consumer Reporting Agency bearing on a consumer's credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living.

A debt collector may not contact you at inconvenient times or places, such as before 8 in the morning or after 9 at night, unless you agree to it. And collectors may not contact you at work if they;re told (orally or in writing) that you're not allowed to get calls there.

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated. Federal Register to implement this section (72 FR 62910).