South Dakota Secured Promissory Note

Description

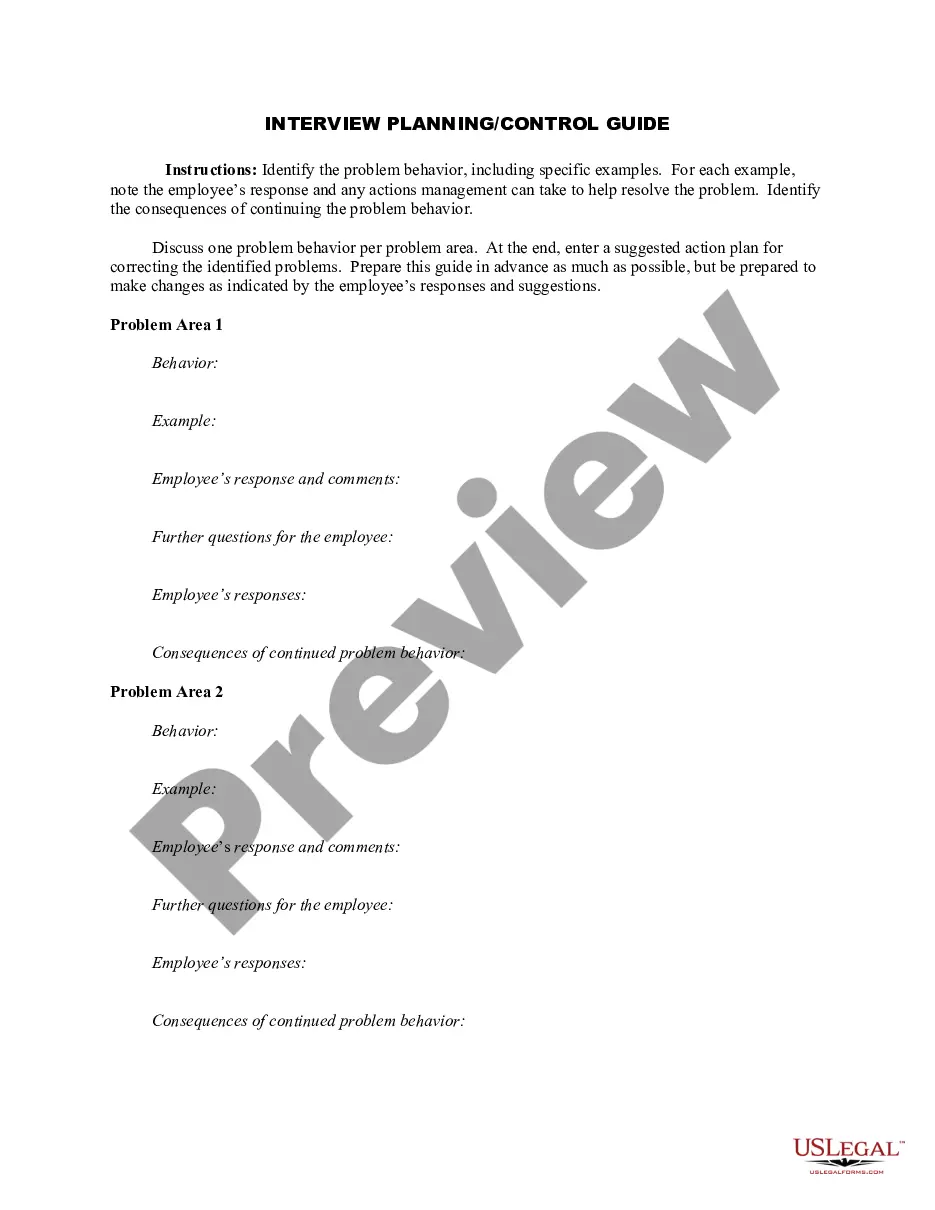

How to fill out Secured Promissory Note?

Finding the appropriate legal document template can be a real challenge.

Of course, there are numerous templates available online, but how do you find the legal form that you need.

Make use of the US Legal Forms website.

If you are already registered, Log In to your account and click on the Download button to get the South Dakota Secured Promissory Note. Use your account to inquire about the legal templates you may have acquired earlier. Visit the My documents tab in your account and download another copy of the document you need.

- The service provides a vast array of templates, such as the South Dakota Secured Promissory Note, which can be utilized for business and personal purposes.

- All of the forms are reviewed by experts and comply with federal and state regulations.

Form popularity

FAQ

You can get your promissory note by retrieving it from where you stored important documents, such as filing cabinets or digital storage. If you can't find your South Dakota Secured Promissory Note, contact the lender who issued it. They may be able to provide you a copy or direct you on how to recreate it.

If your South Dakota Secured Promissory Note is lost, you should first search for any copies you might have. In many cases, a lost promissory note can create complications, as it serves as a legal document confirming your agreement. Consider consulting a legal professional or using services like US Legal Forms to re-establish the terms of your note if necessary.

The format of a South Dakota Secured Promissory Note generally follows a straightforward layout. It starts with the title, followed by the date, the identities of the borrower and lender, the principal amount, terms of repayment, and the borrower's signature. Using an established template can save time and ensure you include all necessary elements in your note.

Filling out a promissory demand note, such as the South Dakota Secured Promissory Note, requires clear, precise information. You should include the names of the parties, the amount borrowed, the interest rate, and a statement indicating that the lender can demand repayment at any time. A template can help simplify this process, ensuring you don't miss any vital details.

An example of a South Dakota Secured Promissory Note may involve a borrower receiving $10,000 from a lender. The note would specify the repayment period of two years, a fixed interest rate of 5%, and a schedule of payments. Including specific details like these helps both parties understand their commitments and responsibilities.

To report promissory note income, you should include the interest payments received from the note on your tax return as income. For individuals, this typically goes on Schedule B of Form 1040. It’s important to keep thorough records of all payments, as accurately reporting this income related to your South Dakota Secured Promissory Note is necessary for compliance.

Yes, a promissory note can absolutely be secured. A secured promissory note involves collateral, which provides the lender with a claim on specific assets if the borrower defaults. This arrangement not only mitigates risk for the lender but can also lead to better terms for the borrower. Therefore, understanding the benefits of a South Dakota Secured Promissory Note is essential for both parties.

To file a lien in South Dakota, you need to complete the necessary lien documents and submit them to the Register of Deeds in the county where the property is located. Ensure that all required information, including details of the South Dakota Secured Promissory Note, is included. Filing the lien creates a public record that notifies others of your interest in the property, giving you legal grounds for enforcement if needed.

In QuickBooks, you can record a promissory note payment to a shareholder by selecting the 'Write Checks' option or using the 'Banking' menu. Enter the appropriate account for the shareholder and include a description mentioning the South Dakota Secured Promissory Note. This will ensure accurate bookkeeping and help you track any outstanding amounts related to the note.

To file a promissory note in South Dakota, you typically do not need to file it with a government office unless you're securing it with a lien against property. It is advisable to keep the note in a safe place and provide a copy to all parties involved. If the note is secured, you may want to consider recording the security interest with the appropriate county office. This process helps protect your rights under a South Dakota Secured Promissory Note.