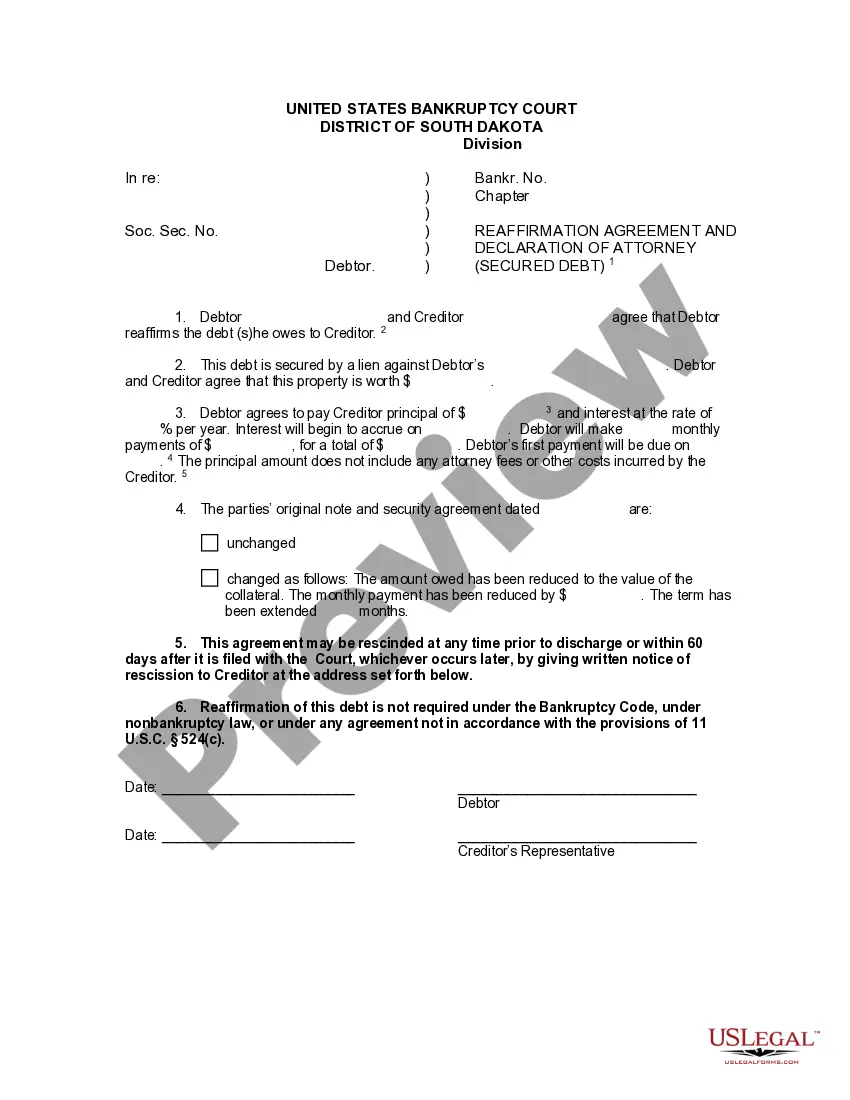

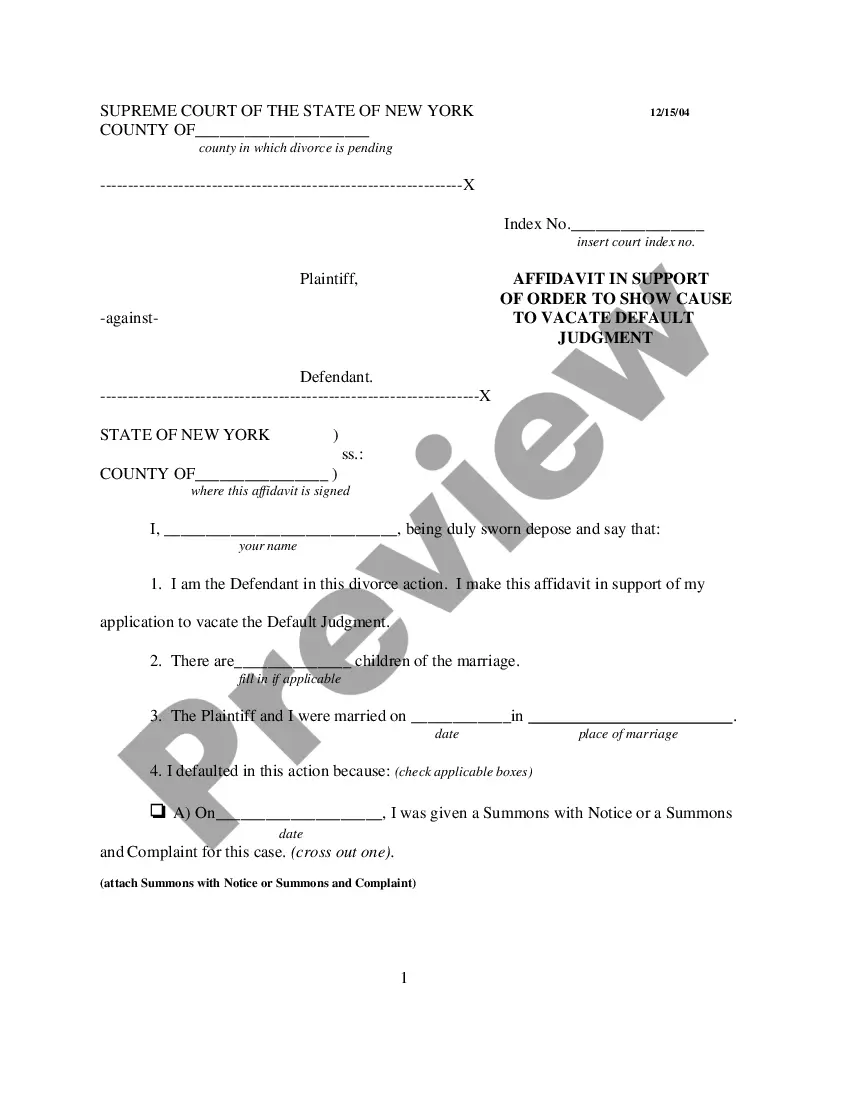

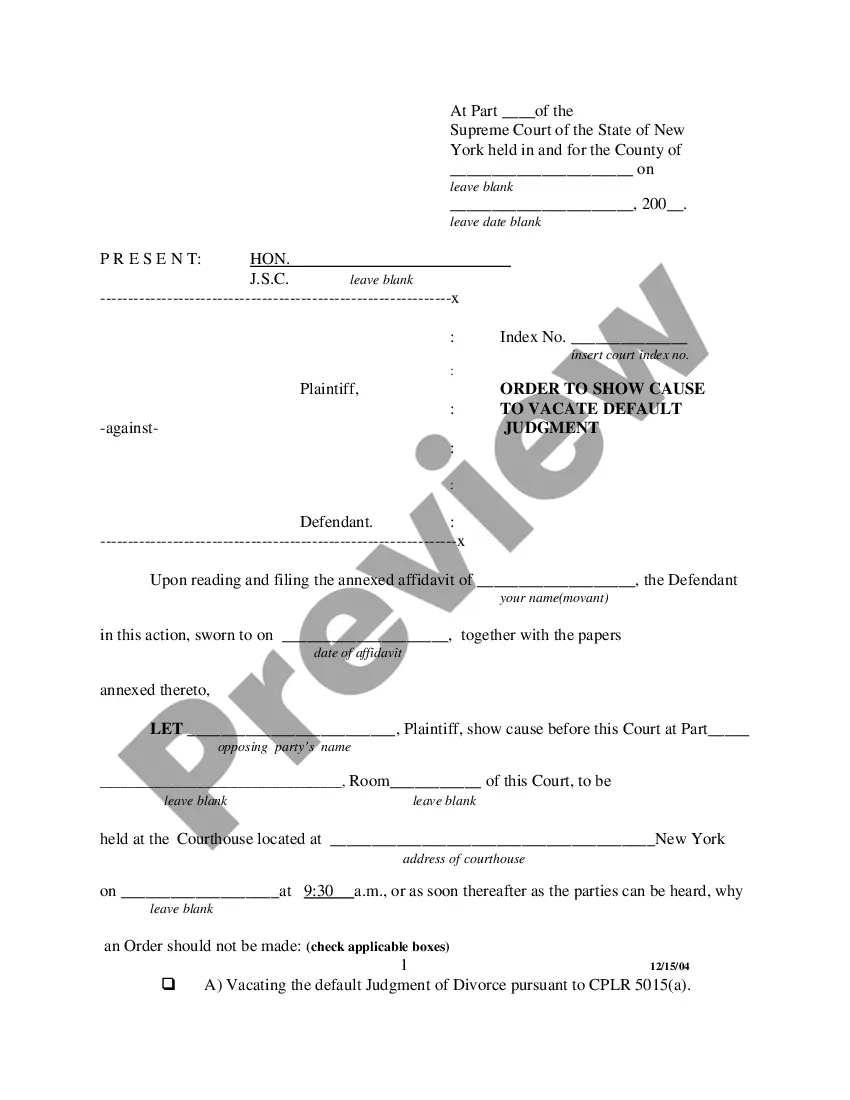

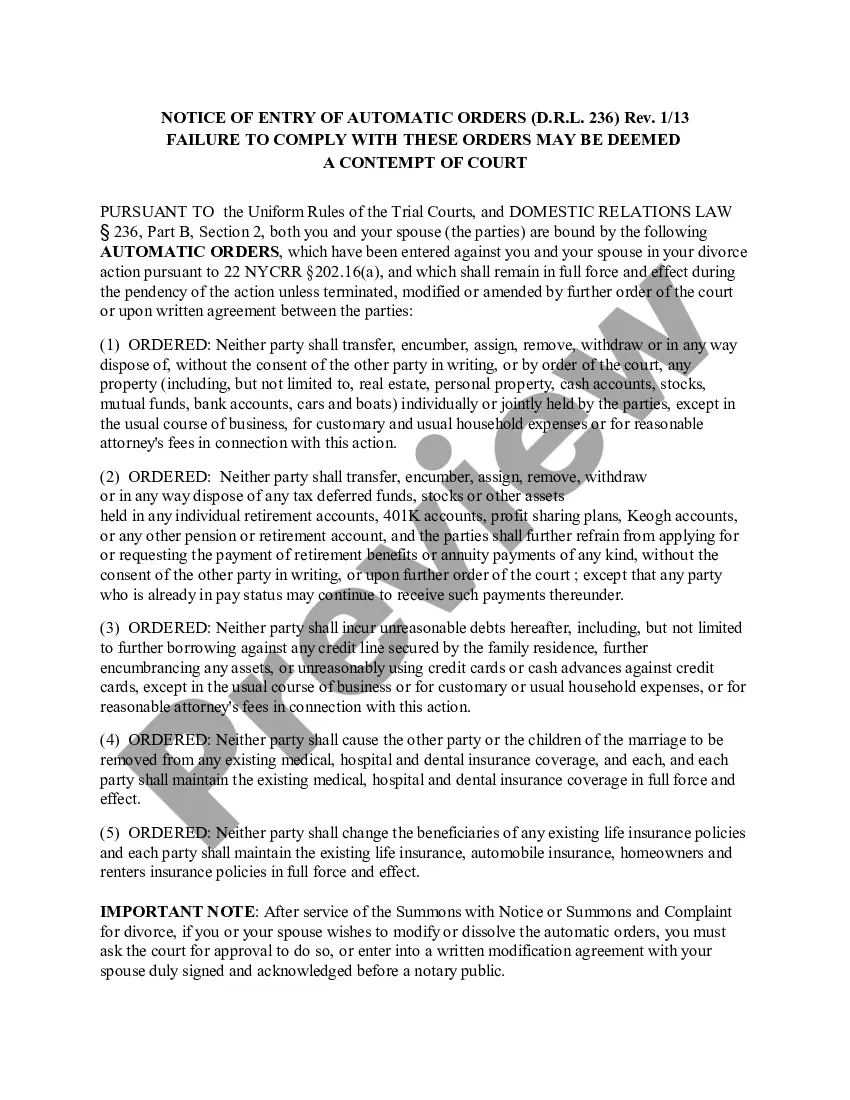

The reaffirmation agreement is used to reaffirm a particular debt. Once the debtor signs the agreement, the debtor gives up any protection of the bankruptcy discharge against the particular debt. The debtor is not required to enter into this agreement by any law. This document also contains a declaration of attorney.

South Dakota Reaffirmation Agreement - Unsecured Debt

Description

How to fill out South Dakota Reaffirmation Agreement - Unsecured Debt?

Access to top quality South Dakota Reaffirmation Agreement - Unsecured Debt samples online with US Legal Forms. Prevent days of wasted time looking the internet and lost money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get over 85,000 state-specific authorized and tax samples that you can download and complete in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, take a look at our how-guide below to make getting started easier:

- Verify that the South Dakota Reaffirmation Agreement - Unsecured Debt you’re looking at is suitable for your state.

- See the sample making use of the Preview function and browse its description.

- Check out the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay by credit card or PayPal to complete creating an account.

- Pick a favored format to download the document (.pdf or .docx).

Now you can open up the South Dakota Reaffirmation Agreement - Unsecured Debt template and fill it out online or print it out and do it by hand. Consider giving the file to your legal counsel to make sure things are completed properly. If you make a mistake, print and fill application once again (once you’ve made an account all documents you save is reusable). Create your US Legal Forms account now and get more templates.

Form popularity

FAQ

You cannot reaffirm any debt after your bankruptcy has been discharged. Bankruptcy law requires any reaffirmation to occur before the discharge is entered. In addition, the only reason to reaffirm is to persuade the mortgage company to report your ongoing payments to the credit bureaus.

Alimony and child support. Certain unpaid taxes, such as tax liens. Debts for willful and malicious injury to another person or property. Debts for death or personal injury caused by the debtor's operation of a motor vehicle while intoxicated from alcohol or other substances.

Reaffirmation agreements are strictly voluntary. A debtor is not required to reaffirm any of his or her debts. If a debtor signs a reaffirmation agreement, the debtor agrees to pay a debt that otherwise might be discharged in his or her bankruptcy case.

Another type of debt you should never reaffirm is unsecured debts. An unsecured debt has no collateral that backs up the debt. A signature loan, a medical debt and credit card debt are examples of unsecured debts.

What Are the Requirements for a Valid Reaffirmation Agreement? You must be current on the loan you wish to reaffirm. Either your consumer bankruptcy lawyer or bankruptcy judge will have to approve of and sign-off on the reaffirmation terms. The terms must be construed as reasonable, relative to your case.

Either way - if the reaffirmation agreement is not approved, your personal liability is discharged. And - just like when the court denies approval of the reaffirmation - most lenders will simply keep everything the same, as long as you make timely payments and keep the vehicle insured.

Yes. You can cancel (or rescind) your reaffirmation agreement, even if a judge has already approved it. NOTE: WE STRONGLY RECOMMEND THAT YOU SPEAK WITH AN ATTORNEY TO ADVISE YOU ABOUT THE CONSEQUENCES OF CANCELLING A REAFFIRMATION AGREEMENT IN YOUR CASE.

It is not possible to reaffirm the mortgage loan after the bankruptcy case has discharged and closed.Even if it was possible to reopen the bankruptcy case, vacate the discharge and reaffirm the debt, a bankruptcy judge in California is highly unlikely to sign the order reaffirming the debt.