South Carolina Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

Finding the correct legal document template can be a challenge. Certainly, there are multiple formats available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The service offers numerous templates, including the South Carolina Letter to Debt Collector - Only Contact Me In Writing, which can be utilized for both business and personal purposes.

All forms are reviewed by professionals and comply with state and federal regulations.

If the form does not fulfil your needs, use the Search field to find the correct form. Once you are certain that the form is correct, click the Purchase now button to acquire the form. Choose the pricing plan you desire and enter the required information. Create your account and complete your purchase with your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired South Carolina Letter to Debt Collector - Only Contact Me In Writing. US Legal Forms is the premier repository of legal forms where you can access various document formats. Use the service to obtain properly formatted documents that adhere to state guidelines.

- If you are already registered, Log In to your account and click the Download button to obtain the South Carolina Letter to Debt Collector - Only Contact Me In Writing.

- Use your account to browse through the legal forms you have previously acquired.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state.

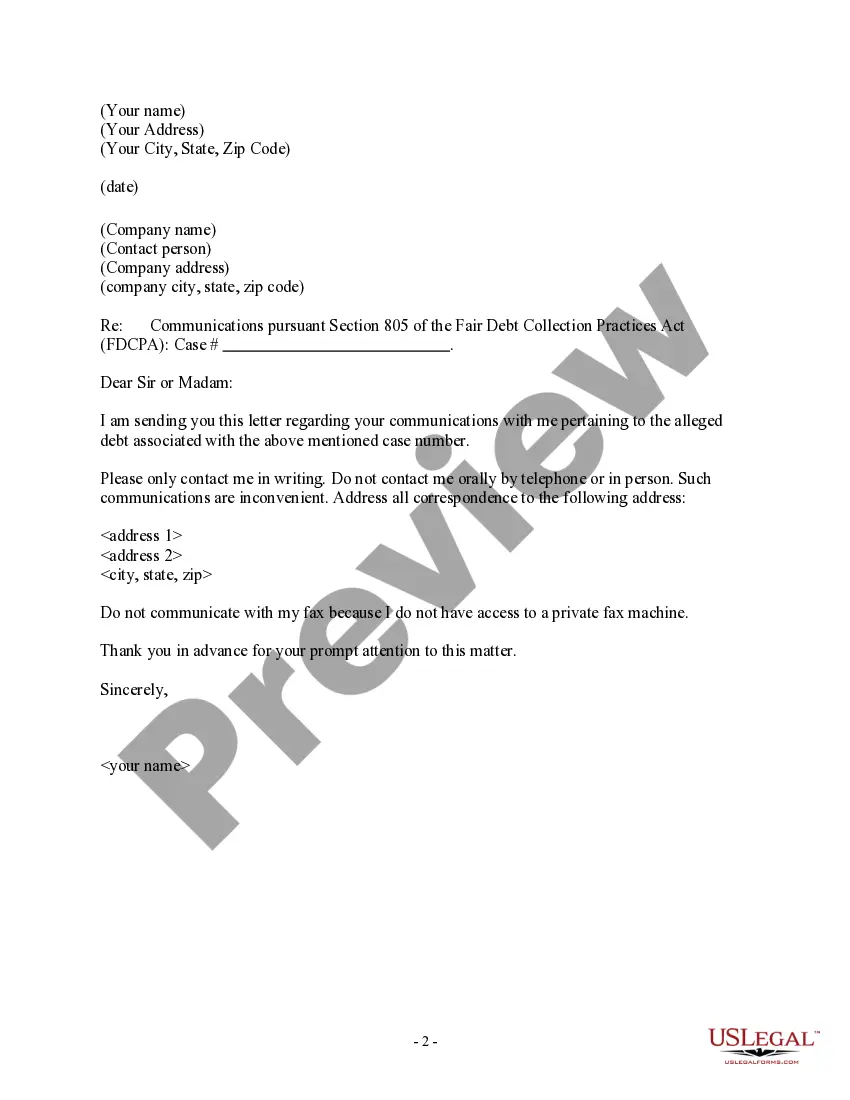

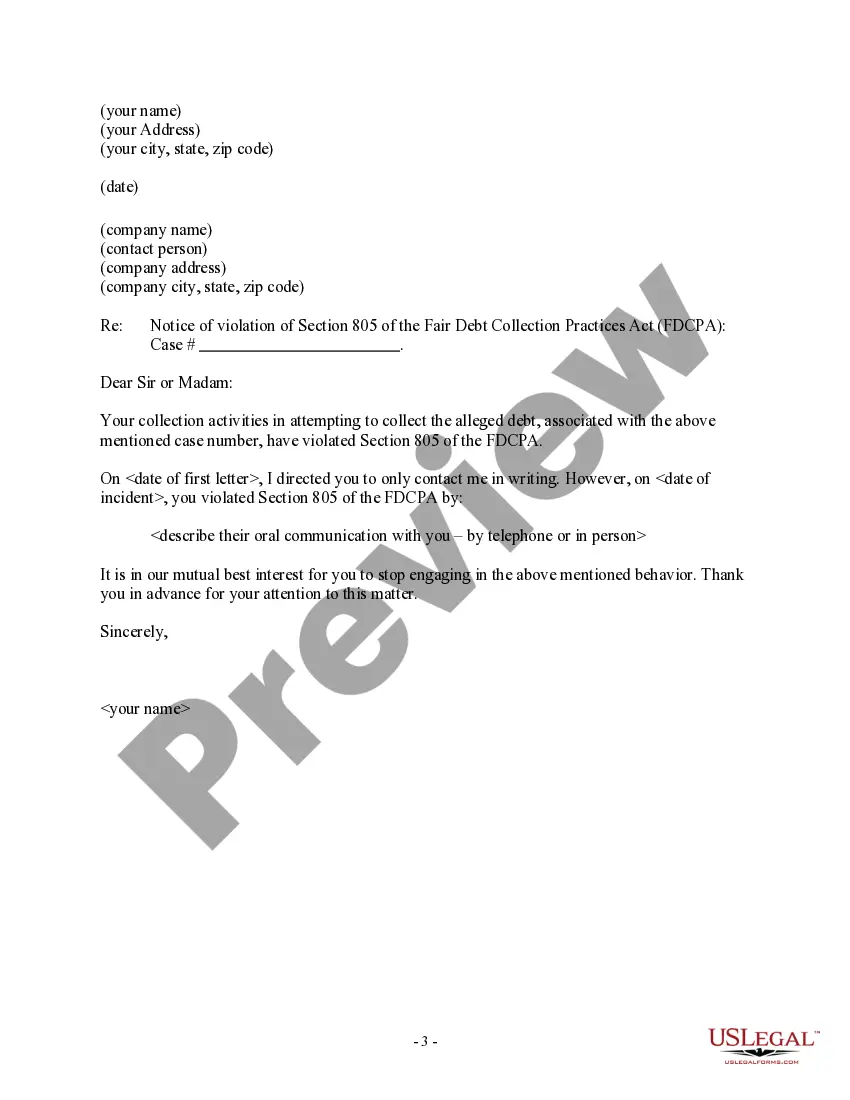

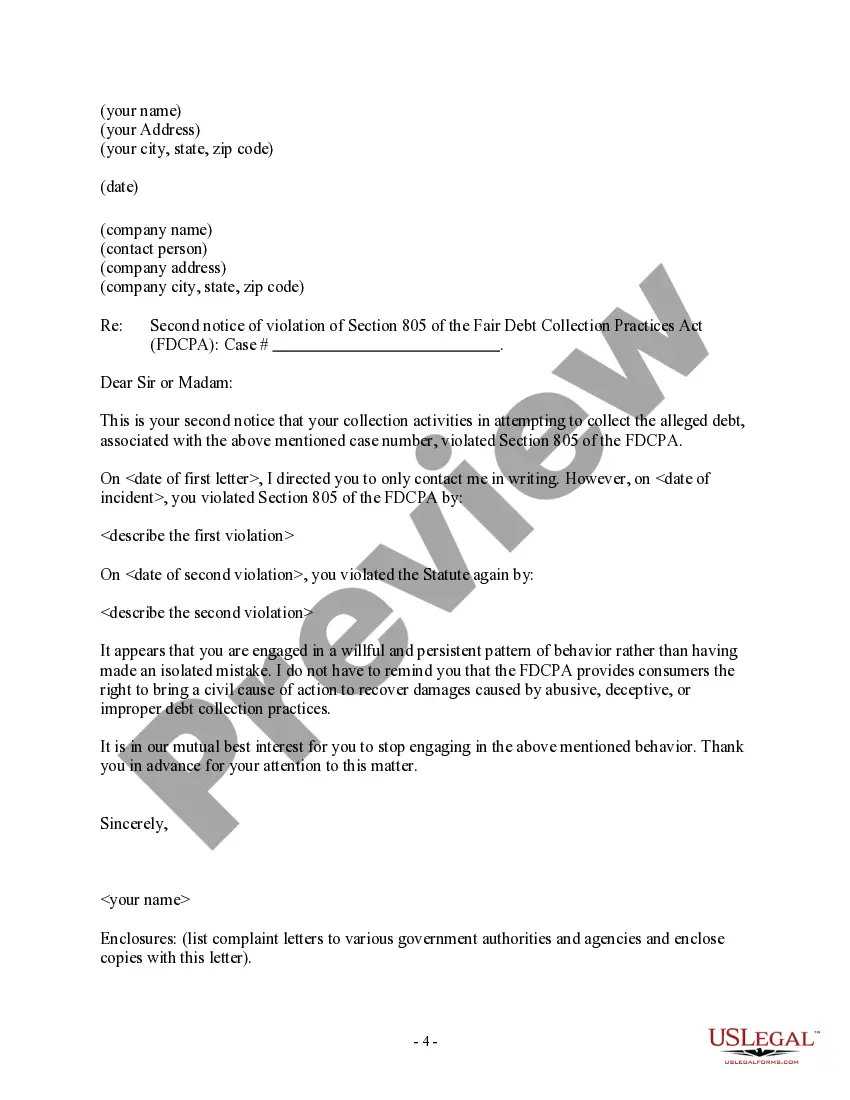

- You can review the form using the Preview button and examine the form outline to confirm it is suitable for you.

Form popularity

FAQ

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA).

There appears to be no legal reason why debt collectors cannot electronically communicate with consumers rather than using U.S. Mail because the FDCPA does not specify the form of communication by which a debt collector may communicate with its debtor.

Legally Speaking, Emails are Considered WritingsIf sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

This first collection letter should include important points, such as:Days past due.Amount due.Note previous attempts to collect.Summary of account.Instructions- what would you like them to do next?Due date for payment- it is important to use an actually date, not in the next 7 business days as this can be vauge.More items...

Debt Collectors Can Send the Validation Notice By Email Without Violating FDCPA.

It should be short, concise, to the point and very clear as to what you want. It's imperative that you say as much as you can with as little text as possible. Remember to include the exact amount owed, the invoice number and the due date.

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

Legally Speaking, Emails are Considered Writings If sent to a consumer by a third-party debt collector, emails must comply with the Fair Debt Collection Practices Act (or FDCPA). If the email communication pertains to healthcare debt, the Health Insurance Portability and Accountability Act (HIPAA) applies.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.