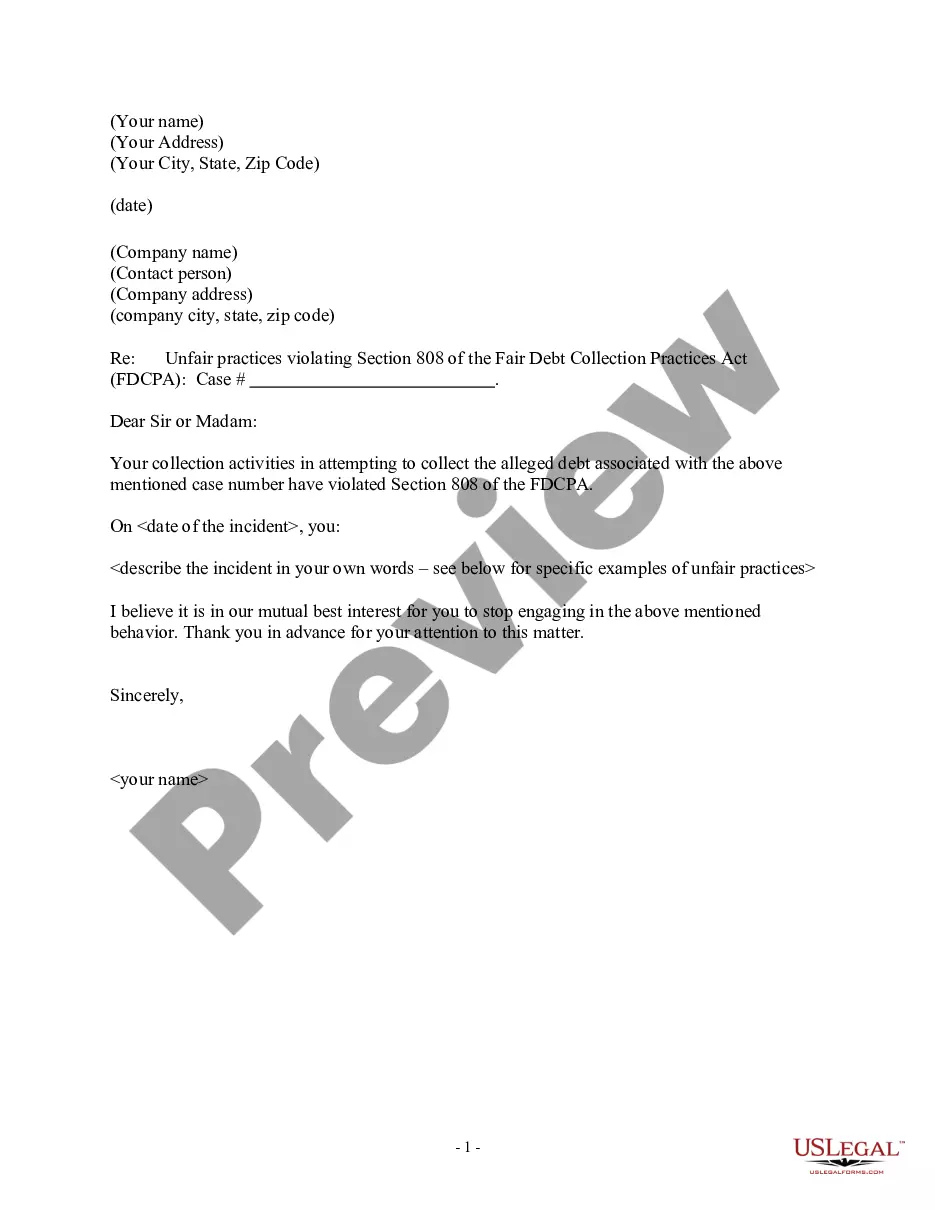

South Carolina Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission

Description

How to fill out Notice Of Violation Of Fair Debt Act - Letter To The Federal Trade Commission?

Selecting the appropriate legal document template can be quite challenging.

Clearly, there are numerous designs accessible online, but how can you obtain the legal document you desire.

Utilize the US Legal Forms site. The service offers a vast array of templates, including the South Carolina Notice of Violation of Fair Debt Act - Correspondence To The Federal Trade Commission, which can be utilized for both business and personal purposes.

First, ensure you have selected the correct form for your city/region. You can view the document using the Preview button and read the form details to confirm this is suitable for you.

- All of the templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to retrieve the South Carolina Notice of Violation of Fair Debt Act - Letter To The Federal Trade Commission.

- Use your account to browse the legal forms you have previously obtained.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

Report fraud, scams, and bad business practices at ReportFraud.ftc.gov.

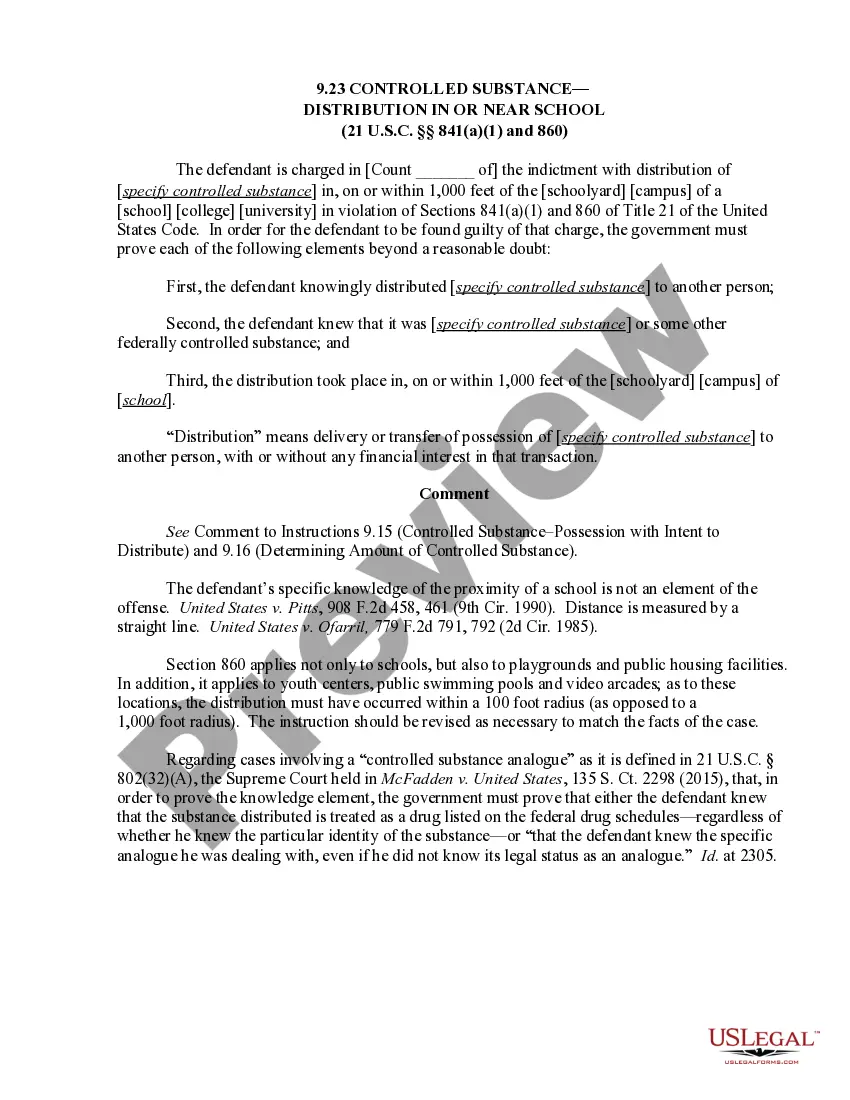

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

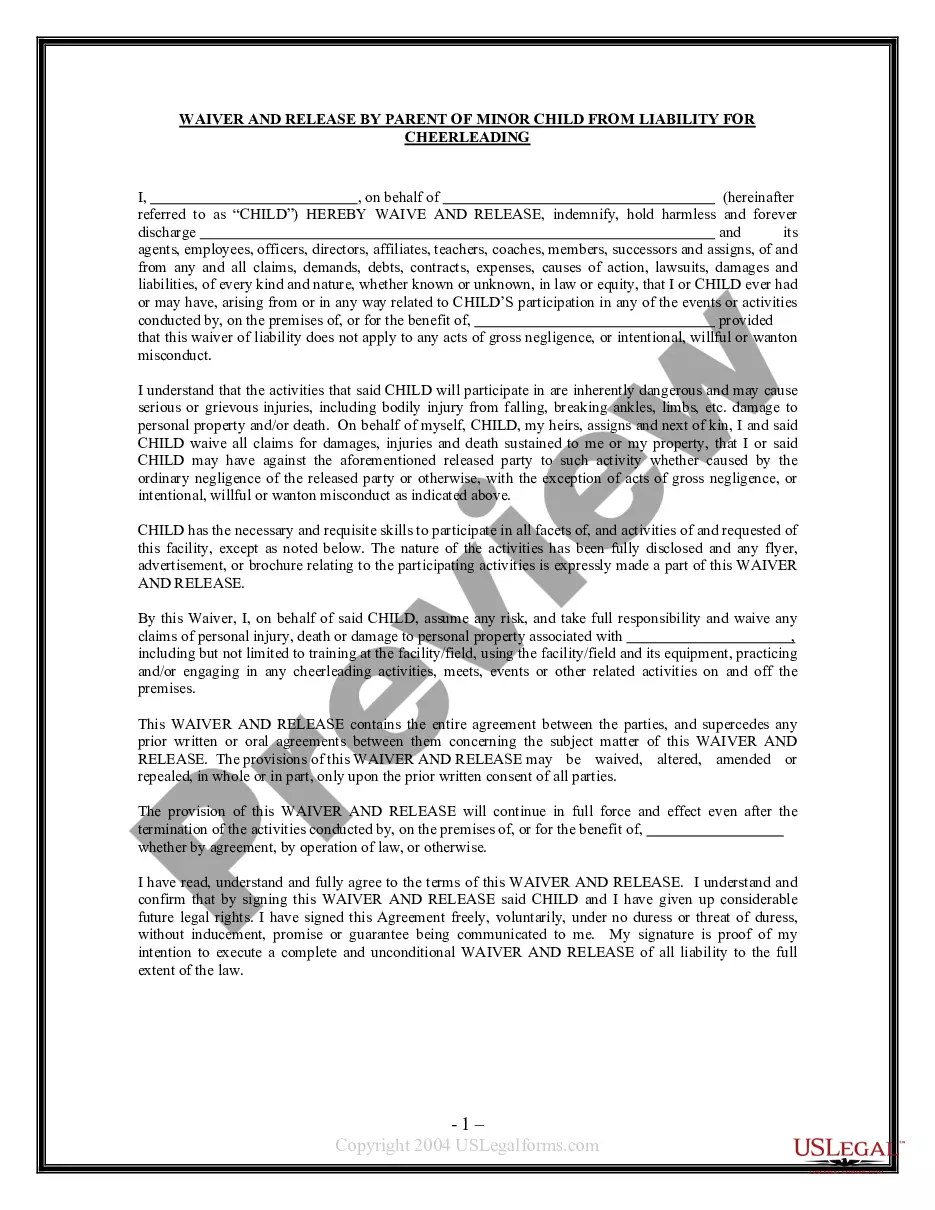

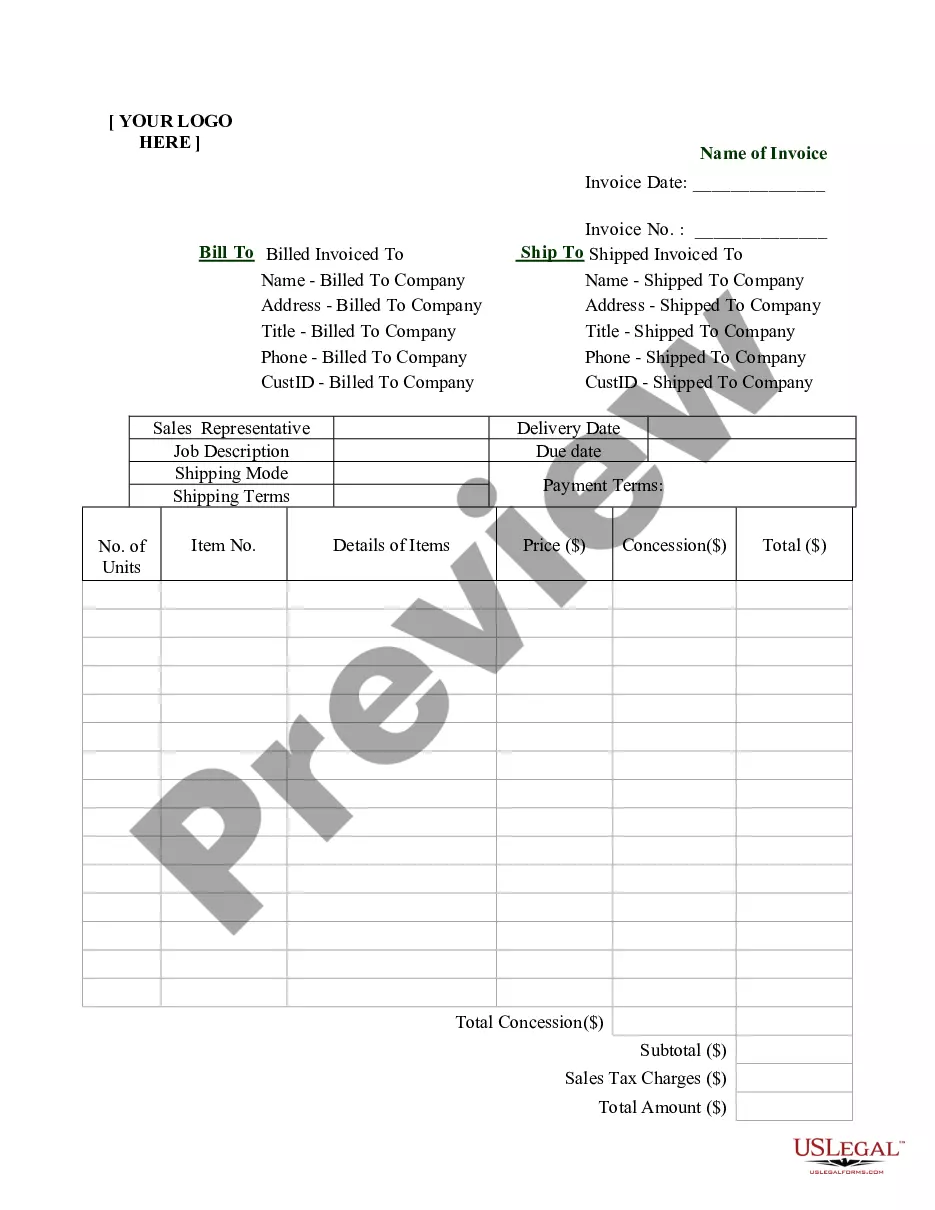

A debt collection letter should include the following information:The amount the debtor owes you.The initial due date of the payment.A new due date for the payment, whether ASAP or longer.Instructions on how to pay the debt.More items...?

A collection letter is a written notification to inform a consumer of his due payments. It is an official message to a borrower. A collection letter may include reminders, inquiries, warnings or notification of possible legal actions.

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which prohibits deceptive, unfair, and abusive debt collection practices.

I do not have any responsibility for the debt you're trying to collect. If you have good reason to believe that I am responsible for this debt, mail me the documents that make you believe that. Stop all other communication with me and with this address, and record that I dispute having any obligation for this debt.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Collection letters should do two things: 1) retain customer goodwill, and 2) help you get paid....Your collection letter should:Tell the reason for your letter in the first sentence.Explain more about the first sentence in your second sentence.Suggest a solution.Thank the recipient.

The third collection letter should include the following information:Mention of all previous attempts to collect.Invoice number and amount.Original invoice due date.Current days past due.Instructions on what they should do next.A warning of the impending consequences.More items...