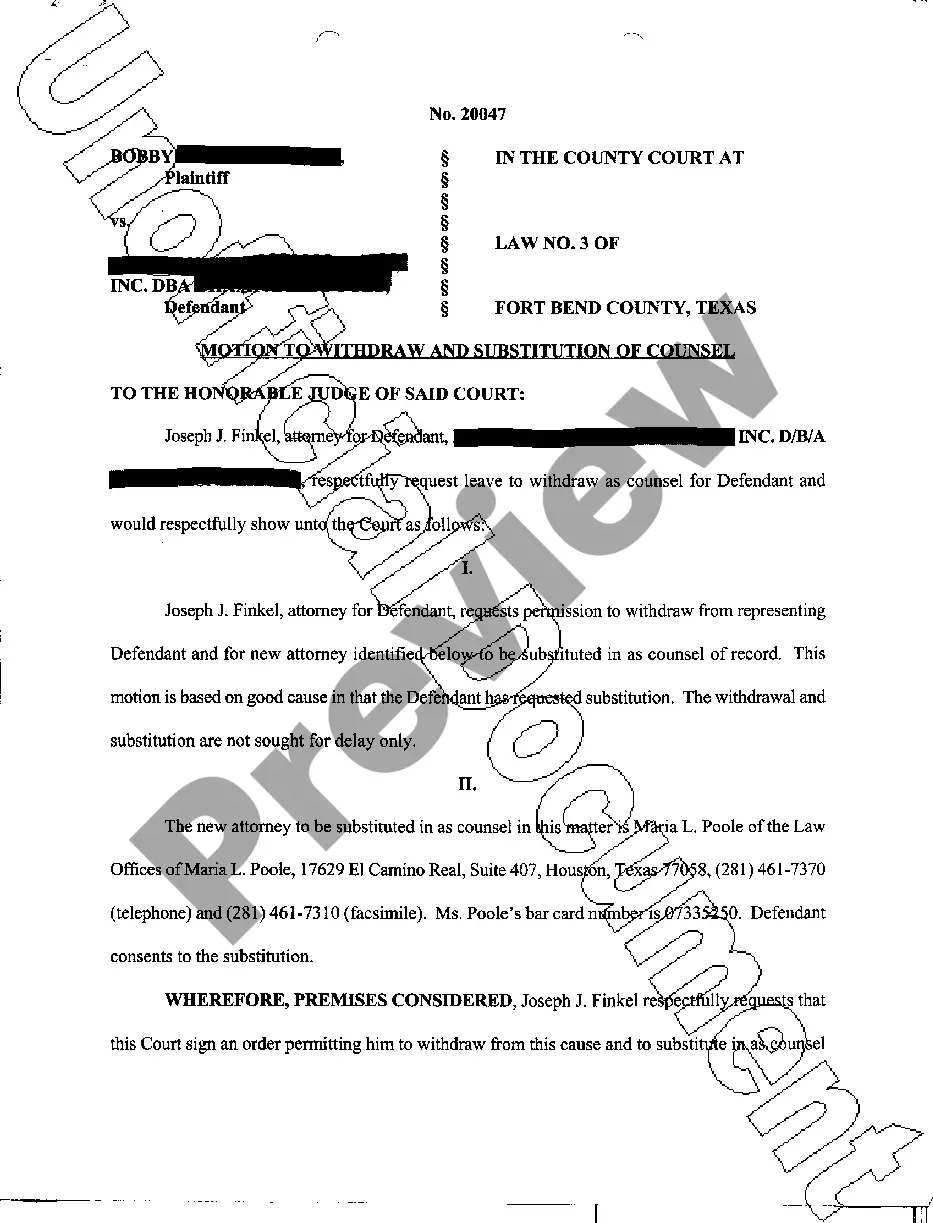

Alabama Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.

Description

How to fill out Stock Option Plan To Approve Incentive Stock Option Plan Of Pacific Animated Imaging Corp.?

Discovering the right lawful record design can be a struggle. Needless to say, there are a lot of web templates accessible on the Internet, but how will you find the lawful develop you want? Use the US Legal Forms web site. The support provides 1000s of web templates, such as the Alabama Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp., that can be used for company and personal requires. All of the varieties are examined by experts and meet state and federal demands.

When you are previously signed up, log in to your accounts and click the Obtain option to have the Alabama Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.. Make use of your accounts to check throughout the lawful varieties you may have ordered in the past. Proceed to the My Forms tab of the accounts and get an additional copy from the record you want.

When you are a fresh user of US Legal Forms, allow me to share basic guidelines that you should comply with:

- Very first, make sure you have selected the correct develop for your area/state. It is possible to look over the shape making use of the Review option and look at the shape description to guarantee this is basically the right one for you.

- In the event the develop is not going to meet your needs, utilize the Seach area to obtain the right develop.

- When you are certain the shape is suitable, click the Buy now option to have the develop.

- Select the rates program you would like and enter the necessary details. Design your accounts and pay for the transaction using your PayPal accounts or credit card.

- Opt for the document format and download the lawful record design to your product.

- Total, modify and printing and indicator the received Alabama Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp..

US Legal Forms is the biggest library of lawful varieties that you can find various record web templates. Use the service to download appropriately-created papers that comply with state demands.

Form popularity

FAQ

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Your ESPP will have set offering and purchase periods, while a stock option grant has a set term in which you can exercise the options after they vest. The purchase price of stock under a tax-qualified Section 423 ESPP is typically discounted in some way from the market price at purchase.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

Stock options grant employees the right to purchase shares, but it's not an obligation for them to do so. ISOs have the potential for favorable tax treatment. If a stock option isn't an ISO, it's typically referred to as a nonqualified stock option. NQOs don't qualify for special tax treatment.

Summary of ISO vs. NSO Differences Incentive Stock Options (ISOs)Non-Qualified Stock Options (NSOs)Eligible RecipientsEmployees onlyAny service provider (e.g. employees, advisors, consultants, directors)Tax at GrantNo tax eventNo tax event10 more rows

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value. Stock options can result in high levels of compensation of executives for mediocre business results.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.

Key Takeaways. An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.