South Carolina Notice of Violation of Fair Debt Act - False Information Disclosed

Description

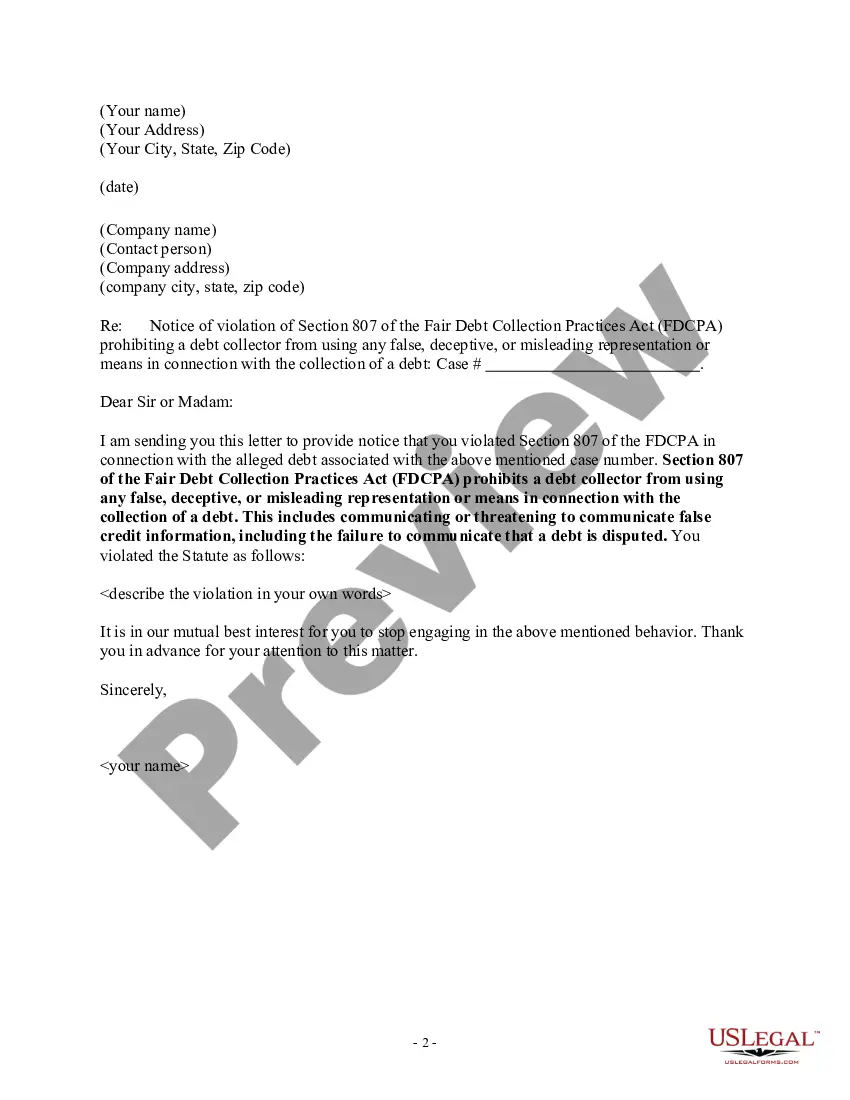

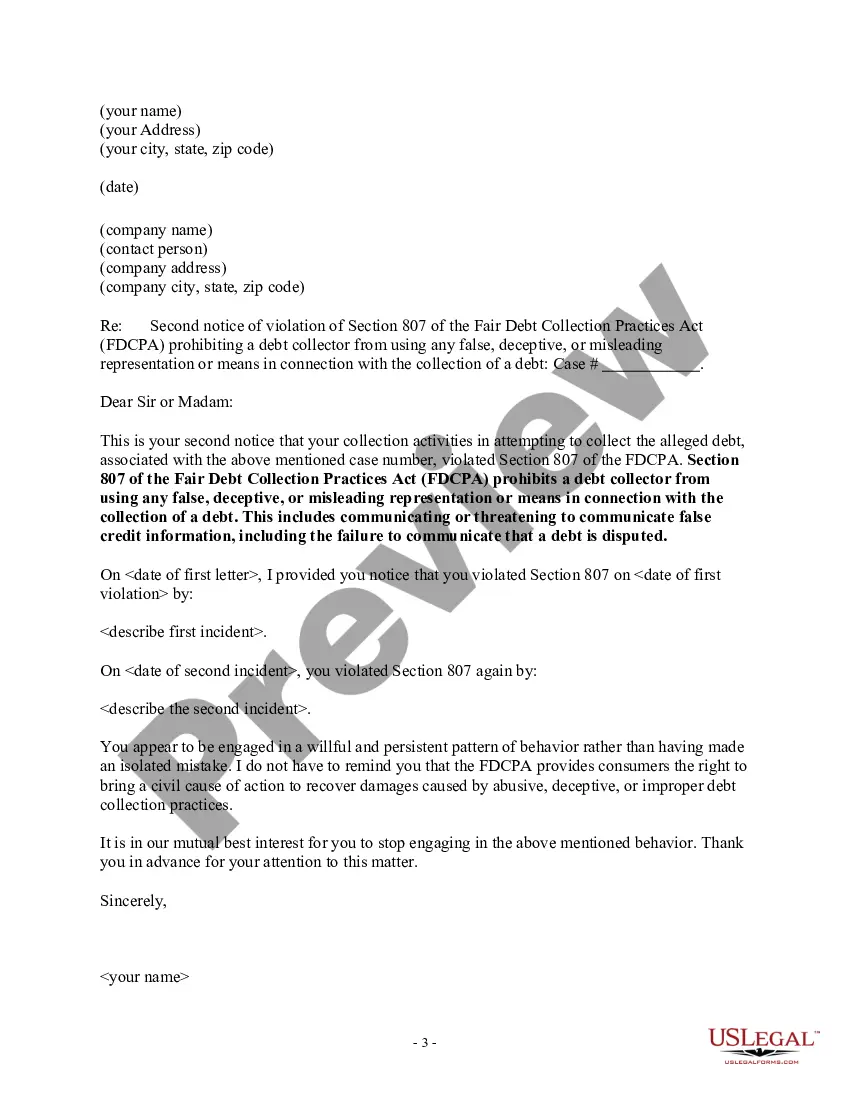

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a range of legal form templates you can obtain or print.

By utilizing the site, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords.

You can download the latest forms such as the South Carolina Notice of Violation of Fair Debt Act - False Information Disclosed within moments.

Read the form description to confirm you have picked the correct form.

If the form doesn’t meet your requirements, use the Search field at the top of the page to find one that does.

- If you have a subscription, Log In and obtain the South Carolina Notice of Violation of Fair Debt Act - False Information Disclosed from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms within the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your area/region.

- Press the Preview button to review the contents of the form.

Form popularity

FAQ

A frequent violation of the Fair Debt Collection Practices Act is the use of false or misleading representations by collectors. Collectors may inflate the amount owed, impersonate government officials, or fail to provide required disclosures. If you encounter any of these practices, it may warrant a South Carolina Notice of Violation of Fair Debt Act - False Information Disclosed. Protect yourself by understanding your rights under the FDCPA.

South Carolina has several laws designed to safeguard its consumers and homeowners. Specifically, the South Carolina Consumer Protection Code, which is enforced by the South Carolina Department of Consumer Affairs, establishes a license requirement for mortgage lending in the state.

That is why Congress enacted the federal Fair Debt Collection Practices Act, a 1977 law that prohibits third-party collection agencies from harassing, threatening and inappropriately contacting someone who owes money. U.S. debt collection agencies employ just under 130,000 people through about 4,900 agencies.

(1) This title prescribes maximum charges for all creditors, except lessors and those excluded (Section 37-1-202), extending consumer credit including consumer credit sales (Section 37-2-104), and consumer loans (Section 37-3-104), and displaces existing limitations on the powers of those creditors based on maximum

In South Carolina, creditors and debt collectors can only come after you for medical and credit card debt for three years. They can pursue you for mortgage debt for twenty years and state tax debt for ten years.

Unlike many states, South Carolina has no statute of limitations on criminal cases, meaning prosecutors can file criminal charges at any time after a crime has been committed.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Debt collectors must be truthful The Fair Debt Collection Practices Act states that debt collectors cannot use any false, deceptive or misleading representation to collect the debt. Along with other restrictions, debt collectors cannot misrepresent: The amount of the debt. Whether it's past the statute of limitations.