South Carolina Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan

Description

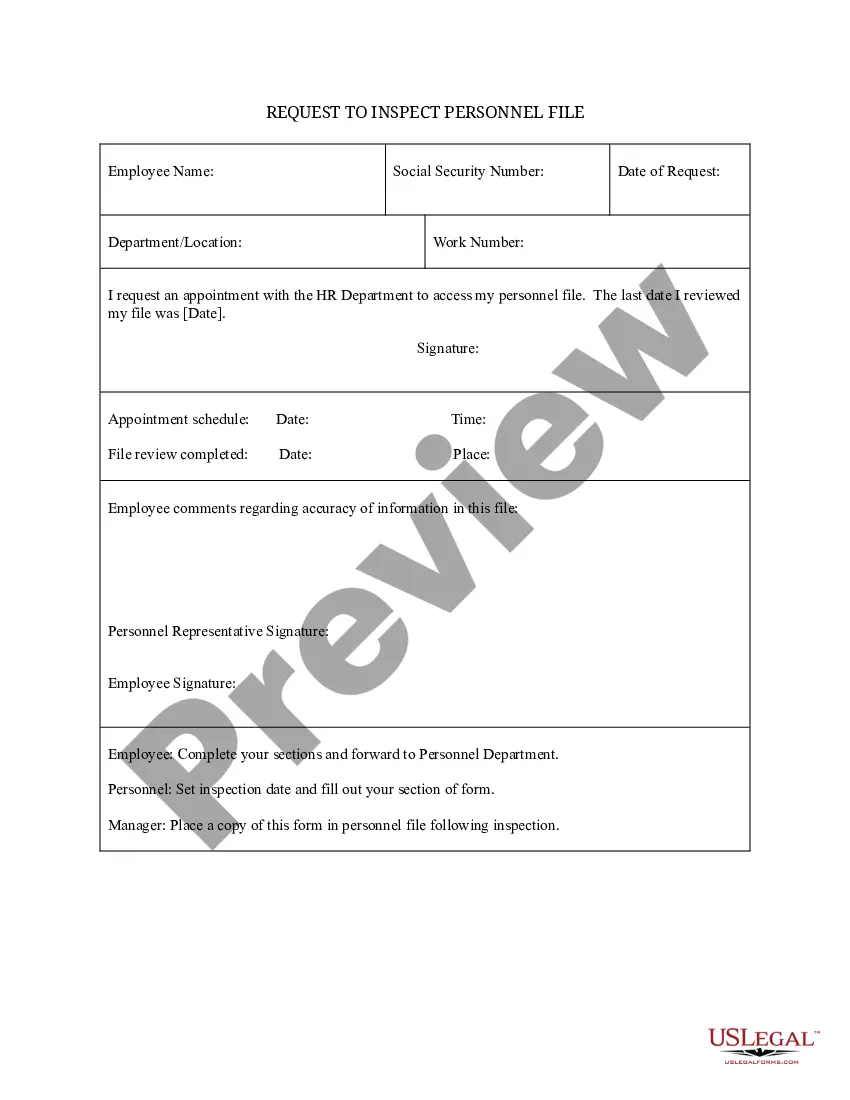

How to fill out Adoption Of Nonemployee Directors Deferred Compensation Plan With Copy Of Plan?

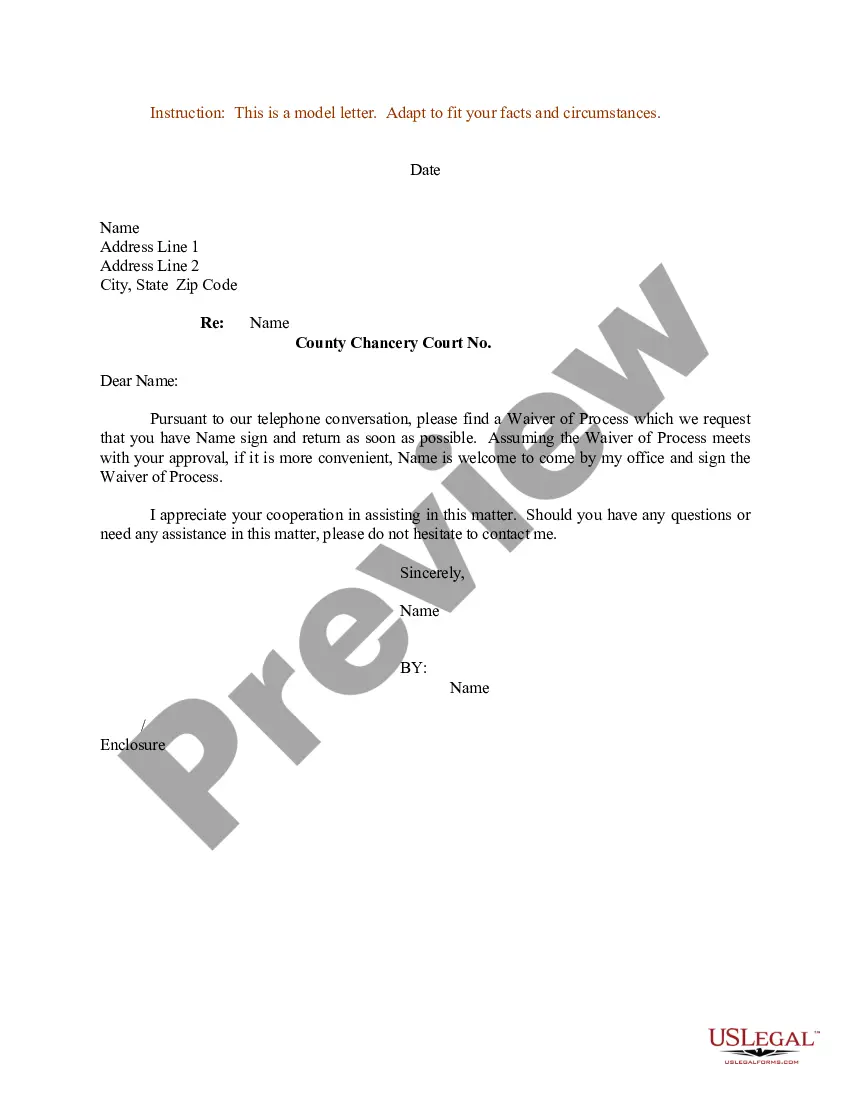

US Legal Forms - one of the most significant libraries of legitimate kinds in the USA - delivers a variety of legitimate document themes it is possible to acquire or printing. Utilizing the web site, you can get thousands of kinds for business and specific uses, categorized by types, claims, or key phrases.You will find the latest models of kinds such as the South Carolina Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan in seconds.

If you have a monthly subscription, log in and acquire South Carolina Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan in the US Legal Forms library. The Down load option can look on every type you view. You gain access to all in the past delivered electronically kinds from the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, here are simple directions to help you get began:

- Ensure you have picked the best type for your town/county. Click the Preview option to examine the form`s articles. Read the type outline to ensure that you have chosen the correct type.

- In the event the type doesn`t satisfy your requirements, take advantage of the Look for industry near the top of the display screen to discover the the one that does.

- If you are satisfied with the form, confirm your option by visiting the Buy now option. Then, opt for the costs program you prefer and supply your credentials to register for an accounts.

- Process the purchase. Utilize your charge card or PayPal accounts to perform the purchase.

- Find the structure and acquire the form on your product.

- Make adjustments. Fill up, change and printing and indicator the delivered electronically South Carolina Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan.

Each and every design you added to your bank account lacks an expiration particular date which is the one you have permanently. So, in order to acquire or printing an additional backup, just go to the My Forms portion and click around the type you want.

Get access to the South Carolina Adoption of Nonemployee Directors Deferred Compensation Plan with Copy of Plan with US Legal Forms, probably the most comprehensive library of legitimate document themes. Use thousands of skilled and condition-distinct themes that meet your organization or specific requires and requirements.

Form popularity

FAQ

A deferred compensation plan allows a portion of an employee's compensation to be paid at a later date, usually to reduce income taxes. Because taxes on this income are deferred until it is paid out, these plans can be attractive to high earners.

However, S corporations and unincorporated businesses can adopt NQDC plans for regular employees who have no ownership in the business. NQDC plans are most suitable for employers that are financially sound and have a reasonable expectation of continuing profitable business operations in the future.

Each 457(b) account must designate a beneficiary, or beneficiaries, to receive any remaining assets upon your death. Designating beneficiaries can help ensure your assets are paid per your wishes, avoid the potential costs and delays of probate, and allow non-spouse beneficiaries to receive additional tax benefits.

Primary Beneficiary: A person or trust you name to receive your DCP account in the event of your death. If you name multiple primary beneficiaries and any of them die before you, the percentage such beneficiary would have received will be divided equally among your surviving primary beneficiaries.

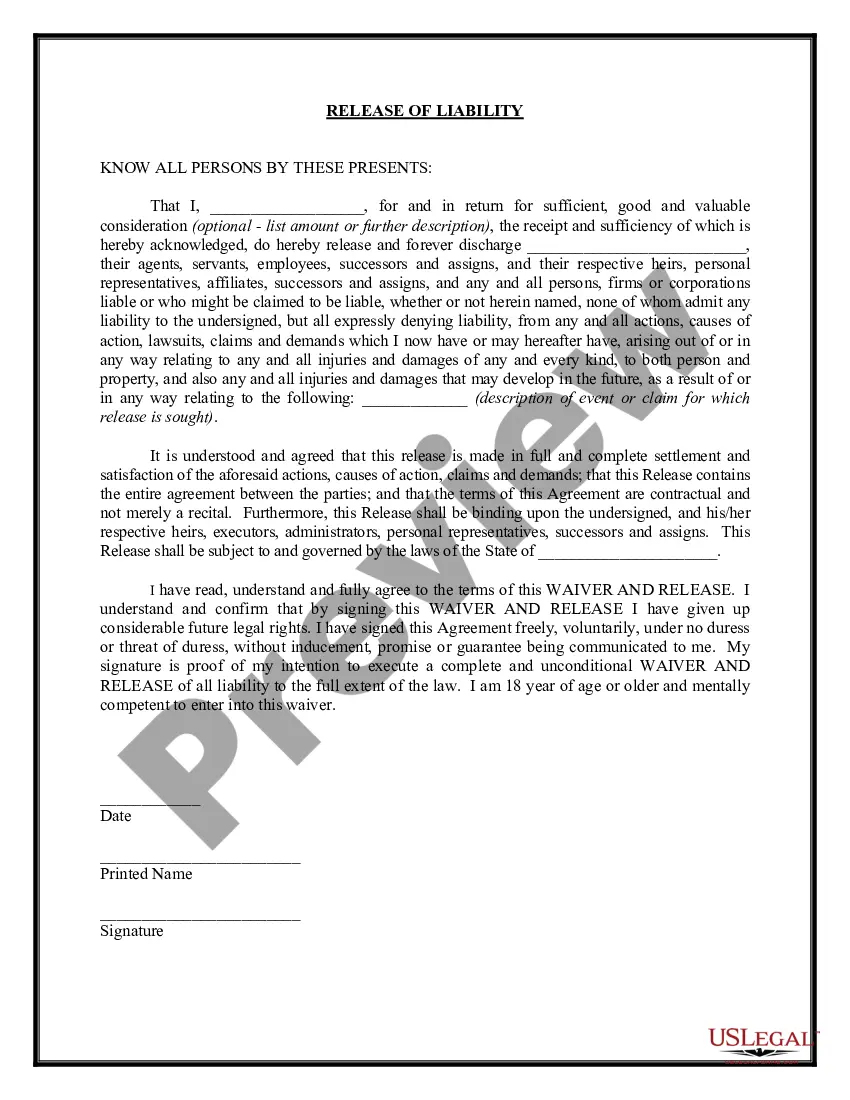

A deferred compensation plan can be qualifying or non-qualifying. Qualifying plans are protected under the ERISA and must be drafted based on ERISA rules. While such rules do not apply to NQDC plans, tax laws require NQDC plans to meet the following conditions: The plan must be in writing.

To enroll, your employer must participate in the Plan (employers can visit our Employer Resource Center or call us at (800) 696-3907 to learn more). For more information, visit CalPERS 457 Plan website, call the Plan Information Line at (800) 260-0659, or view the additional resources below.

For deferred compensation plan, in the event that you pass away, your beneficiaries essentially step into your shoes and have all the same rights that you did in the plan, including the right to start receiving payments or continue to defer them just like you had the right to do.

Primary Beneficiary: A person or trust you name to receive your DCP account in the event of your death. If you name multiple primary beneficiaries and any of them die before you, the percentage such beneficiary would have received will be divided equally among your surviving primary beneficiaries.