South Carolina Fair Credit Act Disclosure Notice

Description

How to fill out Fair Credit Act Disclosure Notice?

Are you in an environment where you require documents for both business and personal activities almost every workday.

There is a wide array of legal document templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms provides a vast selection of template types, including the South Carolina Fair Credit Act Disclosure Notice, which can be tailored to satisfy both federal and state regulations.

Once you locate the appropriate form, click Get now.

Select the pricing plan you prefer, provide the necessary details to establish your account, and complete your purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Carolina Fair Credit Act Disclosure Notice template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to your specific city/state.

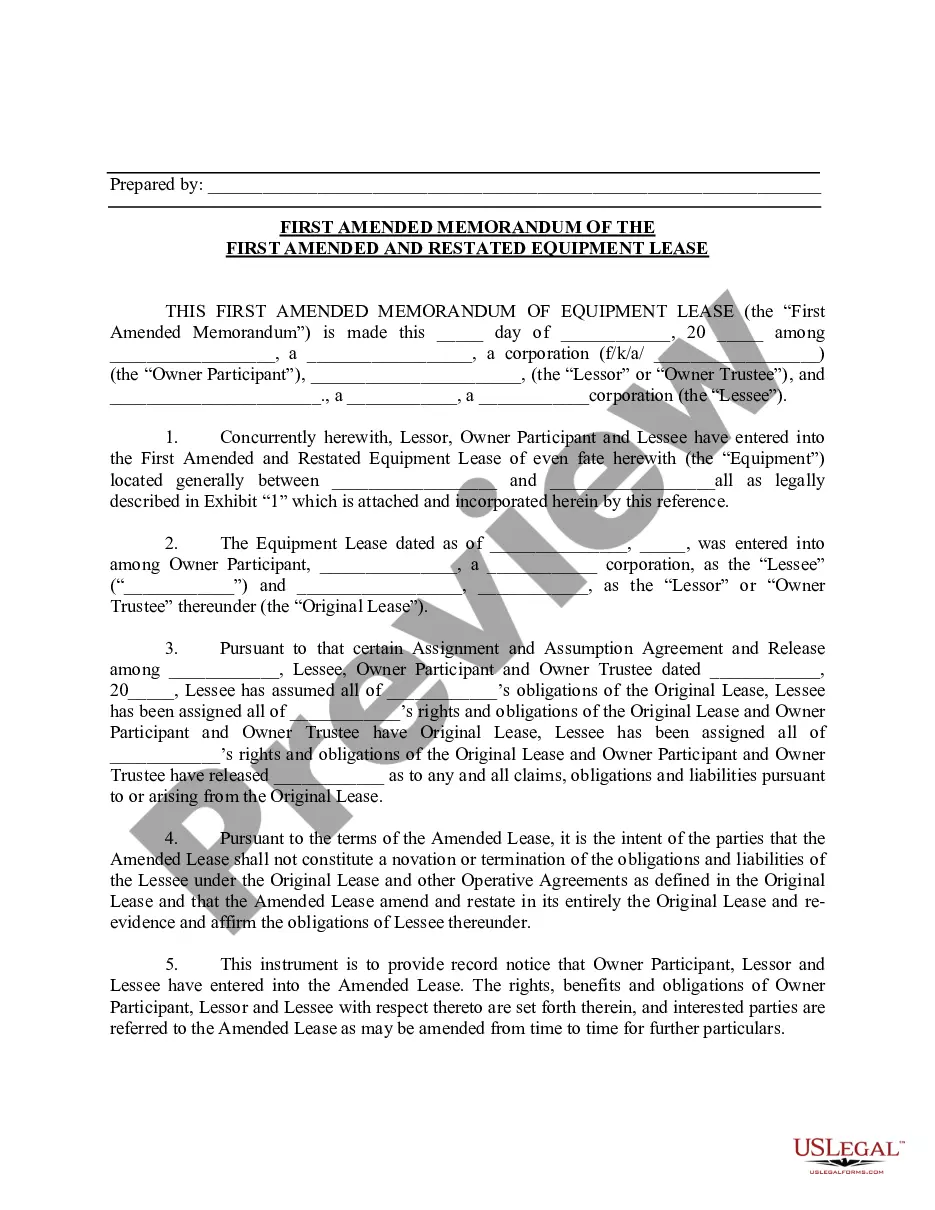

- Utilize the Preview button to examine the form.

- Review the outline to confirm you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

Form popularity

FAQ

Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

Regulation V generally applies to: Persons that obtain and use information about consumers to determine the consumer's eligibility for products, services, or employment, Persons that share such information among affiliates, and. Furnishers of information to consumer reporting agencies.

2022 You have the right to know what is in your file. report; 2022 you are the victim of identity theft and place a fraud alert in your file; 2022 your file contains inaccurate information as a result of fraud; 2022 you are on public assistance; 2022 you are unemployed but expect to apply for employment within 60 days.

What Is the Fair Credit Reporting Act?The right to know what's in your credit file.The right to request a credit score (more on this in a minute)The right to an adverse action notice if a creditor denies you financing because of something on your credit file.The right to seek damages for violations.More items...?

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.

Reg. 57252 (Sept. 20, 2010). This title may be cited as the Fair Credit Reporting Act.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

FCRA is intended to ensure consumer reports are accurate and used for permissible purposes. It creates consumer protections and rights and imposes responsibilities on banks as users of consumer reports and entities furnishing information to the consumer reporting agencies.