South Carolina FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

If you need to compile, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and convenient search to find the documents you require. Various templates for business and personal purposes are sorted by types and claims, or keywords.

Use US Legal Forms to procure the South Carolina FCRA Disclosure and Authorization Statement with just a few clicks.

Every legal document template you download is yours permanently. You have access to every form you have acquired within your account. Click on the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the South Carolina FCRA Disclosure and Authorization Statement with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the South Carolina FCRA Disclosure and Authorization Statement.

- You can also retrieve forms you have previously acquired under the My documents section of your account.

- If you are new to US Legal Forms, follow the steps outlined below.

- Step 1. Ensure you have chosen the form appropriate for your region/country.

- Step 2. Utilize the Review option to scrutinize the contents of the form. Remember to read the overview.

- Step 3. If you are dissatisfied with the form, take advantage of the Search field at the top of the screen to discover alternative legal form templates.

- Step 4. Once you locate the form you need, select the Purchase now option. Choose your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Process the transaction. You may use your Visa, MasterCard, or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the South Carolina FCRA Disclosure and Authorization Statement.

Form popularity

FAQ

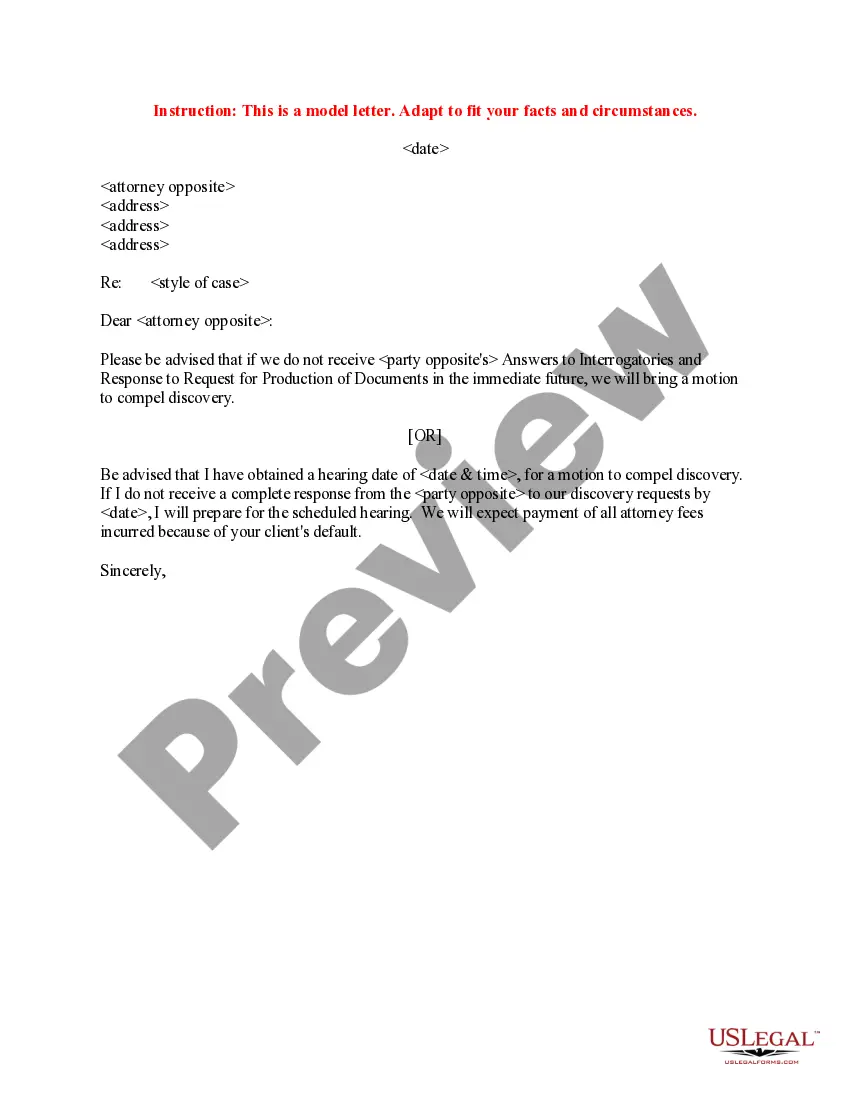

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

While the Fair Credit Reporting Act (FCRA) requires that a disclosure of rights be provided in a separate document, it may include lines for signature and date, and be part of an application packet, the 9th U.S. Circuit Court of Appeals ruled.

What is FCRA Compliance? FCRA compliance is designed to protect consumers. The FCRA regulates employers that use background reports and the Consumer Reporting Agencies (CRAs) (aka background screening companies) that provide the information.