South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

If you desire to complete, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online. Make use of the site's straightforward and user-friendly search feature to discover the documents you require.

Various templates for business and personal purposes are organized by categories and claims, or keywords. Use US Legal Forms to find the South Carolina Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the South Carolina Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation. You can also access forms you previously obtained in the My documents tab of your account.

Every legal document template you obtain is yours indefinitely. You have access to all forms you acquired within your account. Click the My documents section and select a form to print or download again.

Stay competitive and obtain, and print the South Carolina Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1. Make sure you have selected the form for the correct state/region.

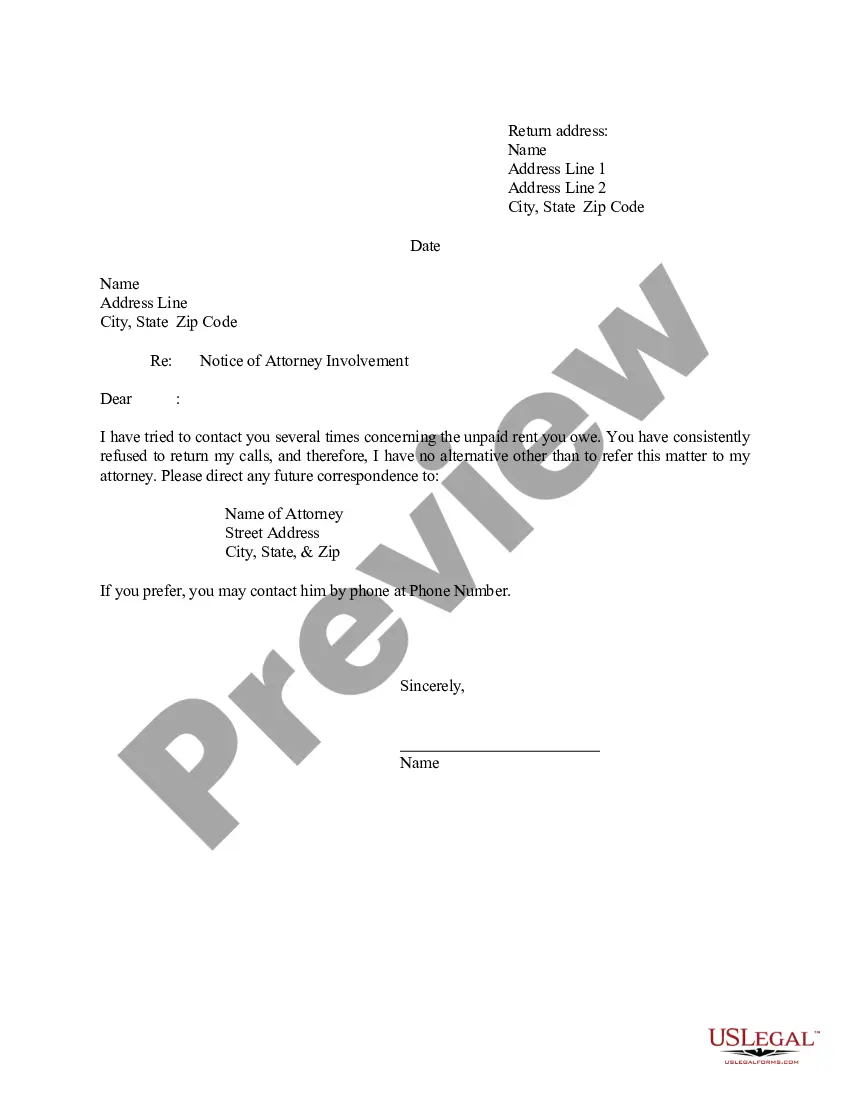

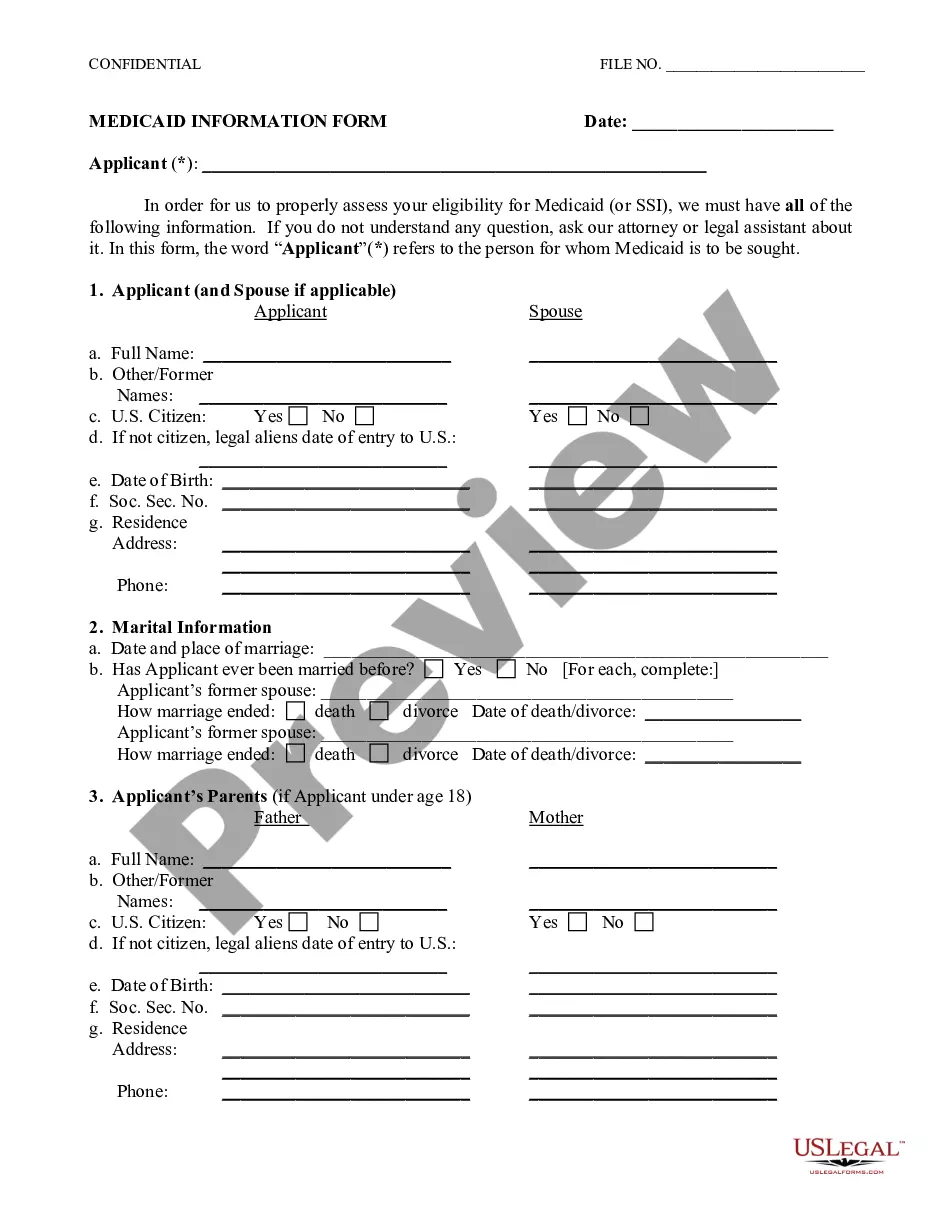

- Step 2. Use the Review option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, utilize the Search area at the top of the screen to find alternative versions of your legal document template.

- Step 4. Once you have found the form you need, select the Acquire now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the South Carolina Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation.

Form popularity

FAQ

To set up a buy-sell agreement, first define the triggering events that would necessitate a transfer of shares, such as retirement or death. Next, establish a clear valuation method for shares and detail how transactions will be conducted. For a structured approach, consider utilizing USLegalForms to ensure your South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is thorough and effective.

Typically, a shareholders agreement is drawn up by an attorney who specializes in corporate law to ensure compliance and effectiveness. However, business owners can also draft their own agreements using online resources or templates. Using USLegalForms can help you create a legally sound South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation without needing extensive legal training.

To write up a shareholder agreement, begin by outlining the purpose of the agreement and the key terms that define the relationship between shareholders. Include sections on ownership structure, management responsibilities, and procedures for transferring shares. Leverage tools from USLegalForms to draft a comprehensive South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation that meets your specific needs.

Yes, you can write your own shareholders agreement, but it's essential to ensure that it meets legal requirements and covers all necessary aspects. This agreement should specify how shares are transferred, how disputes will be resolved, and the roles of each shareholder. If you're unfamiliar with legal terminology or requirements, using a platform like USLegalForms might be beneficial for creating a tailored South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

To set up a shareholders agreement, first identify the key terms regarding ownership, decision-making, and business operations. You should include clauses that outline what happens in various situations, such as if a shareholder wants to sell shares or if the company faces financial difficulties. For a thorough understanding, consider consulting resources like USLegalForms to create a South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

Yes, you can generally refuse to sell your shares if a company goes private, depending on the terms set in your shareholder agreement. In the South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, the specific rights around selling shares are defined. It’s important to understand your ownership rights and to refer to this agreement for clarification.

Yes, shareholders can refuse to sell their shares unless a buy-sell agreement states otherwise. The South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation may include specific clauses that address this situation. This helps protect shareholders' rights and provides guidance on how to respond in various scenarios.

While it may not be required for all shareholders to agree, having a mutual understanding is key for smooth operations. The South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can help outline the level of agreement necessary for various actions. Ensuring that all parties understand the agreement can help prevent disputes down the road.

This agreement allows one shareholder to sell their shares to another shareholder, ensuring that ownership stays within the company. In the context of the South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, this arrangement can lead to smoother ownership transitions. It also keeps control in familiar hands, which can enhance business stability.

When shareholders don't agree, the lack of a clear resolution can lead to disputes and complications. The South Carolina Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can provide mechanisms for resolving such conflicts, including mediation or arbitration. Having predefined terms helps mitigate potential issues and ensures orderly procedures.