South Carolina Option to Purchase Stock - Short Form

Description

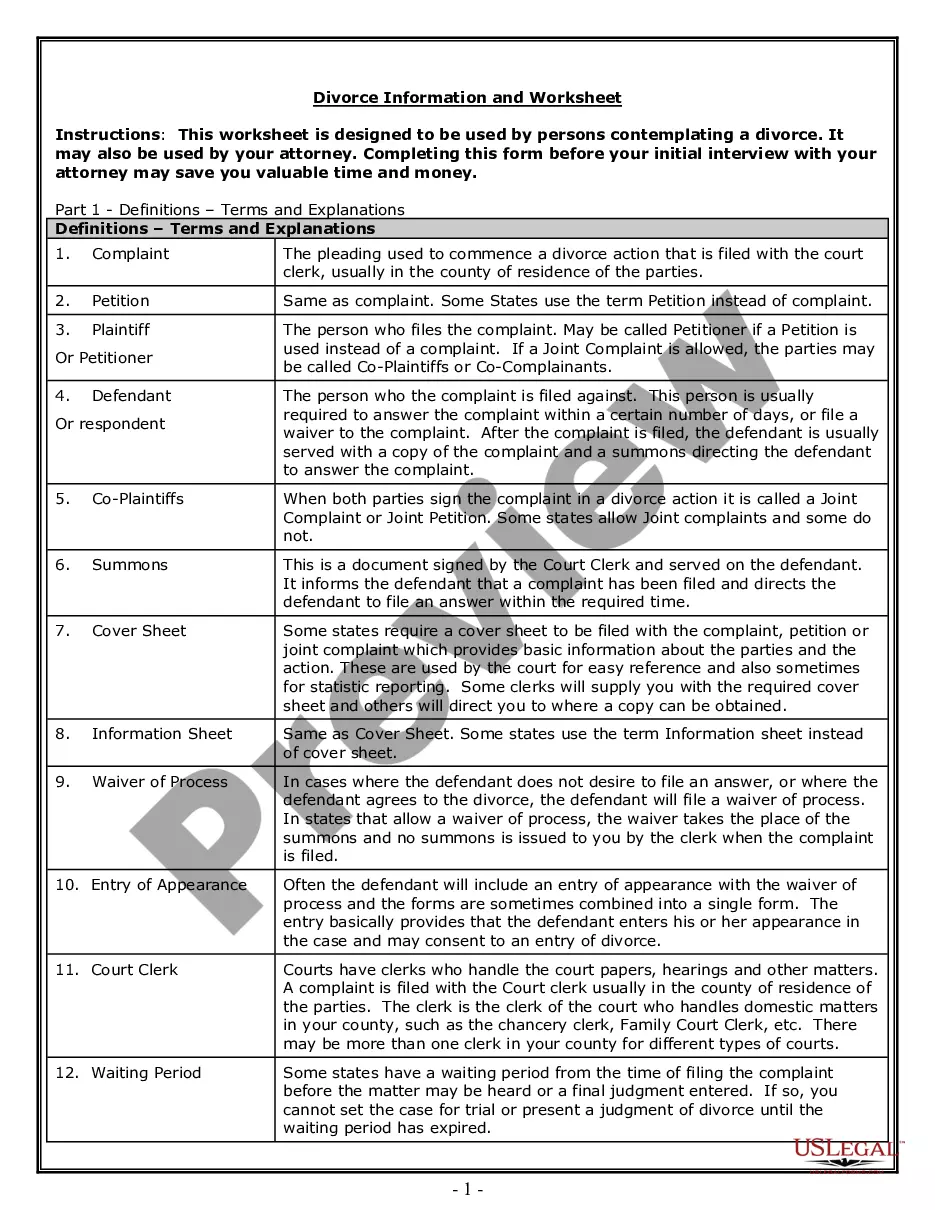

How to fill out Option To Purchase Stock - Short Form?

If you wish to finalize, acquire, or produce legal documents themes, utilize US Legal Forms, the most extensive selection of legal forms available on the web.

Take advantage of the website's straightforward and seamless search to obtain the documents you require.

Various themes for business and personal use are classified by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and provide your details to create an account.

Step 5. Process the purchase. You can utilize your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the South Carolina Option to Acquire Stock - Brief Form with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the South Carolina Option to Acquire Stock - Brief Form.

- You can also find previously obtained forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the appropriate municipality/property.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, take advantage of the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To register for withholding in South Carolina, you must complete the appropriate forms with the South Carolina Department of Revenue. This process ensures that taxes are withheld accurately from your paycheck or option exercises. Be sure to provide information about your earnings, particularly income from stock options. Resources like uslegalforms can assist you in this registration process.

It is possible to hedge a short stock position by buying a call option. Hedging a short position with options limits losses. This strategy has some drawbacks, including losses due to time decay.

When you sell an option short, you incur the obligation to either buy or sell the underlying security at any time up until the option expires. When considering options trading, it's important to understand the impact of dividends on option prices.

The most common examples of index options include (but are not restricted to): S&P 500 and SPX. DJX Dow Jones Index. IWB iShares Russell 1000® Index Fund.

A short call strategy is one of two simple ways options traders can take bearish positions. It involves selling call options, or calls. Calls give the holder of the option the right to buy an underlying security at a specified price. If the price of the underlying security falls, a short call strategy profits.

Rather than borrowing shares, selling them, and buying them back as you would with the standard short-selling process, you can short a stock with options. Specifically, you can use call and put options to create what is known as a synthetic short position.

Can I Short Sell Put Options? A put option allows the contract holder the right, but not the obligation, to sell the underlying asset at a predetermined price by a specific time. This includes the ability to short-sell the put option as well.

A put option (or put) is a contract giving the option buyer the right, but not the obligation, to sellor sell shorta specified amount of an underlying security at a predetermined price within a specified time frame.

The traditional way of shorting involves borrowing shares from your broker and selling them in the open market. Clearly, you want the value of the stock to decline, so you can buy the shares back at a lower price. Your profit is simply the price sold minus the price purchased pretty straightforward.

When you short a call option, you're selling it before you buy it. That turns the whole transaction around so that you make money only if the call option price drops prior to contract expiration. It's similar to shorting a stock except you have a deadline (when the contract expires).