South Carolina Option to Purchase Stock - Long Form

Description

How to fill out Option To Purchase Stock - Long Form?

You might dedicate time on the internet hunting for the legal document template that complies with the state and federal criteria you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily download or print the South Carolina Option to Purchase Stock - Long Form from my services.

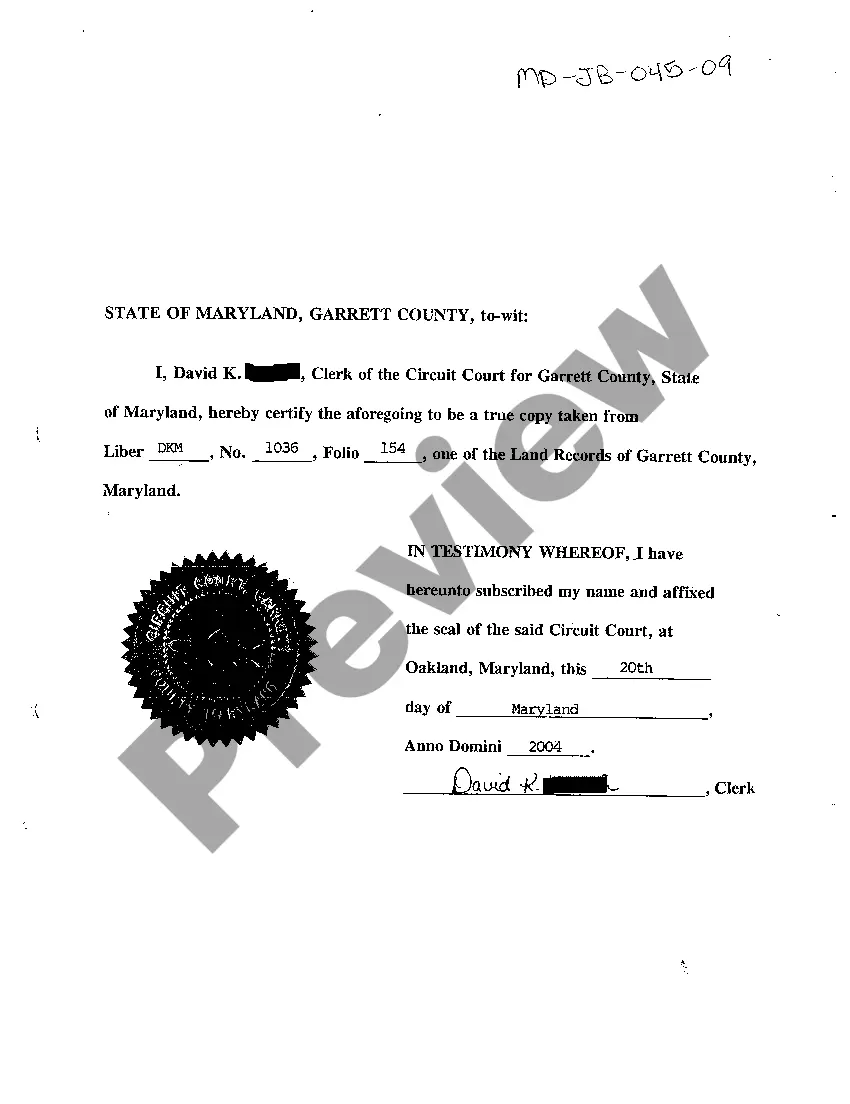

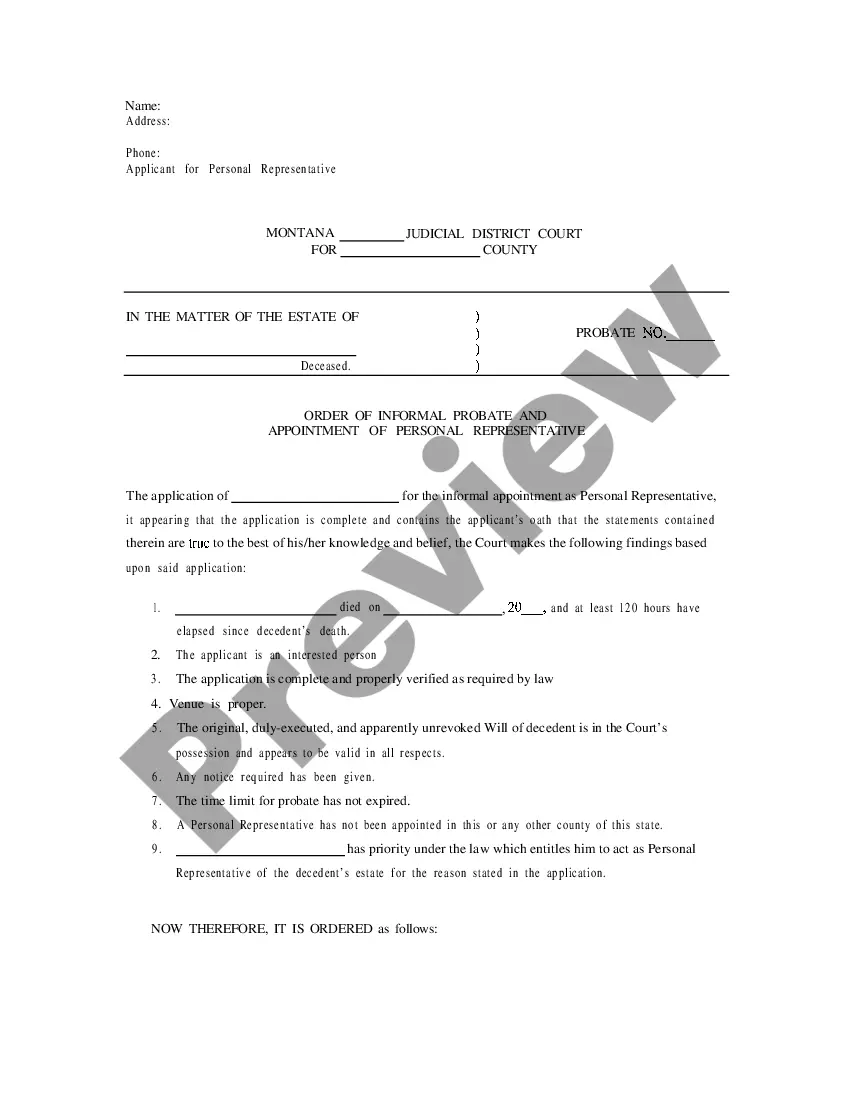

If available, use the Review button to examine the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the South Carolina Option to Purchase Stock - Long Form.

- Every legal document template you purchase is yours for a prolonged period.

- To acquire another copy of any purchased form, visit the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/city of your choice.

- Check the form details to make certain you have selected the appropriate template.

Form popularity

FAQ

To make a South Carolina PTE election, you need to file Form 3465 with the South Carolina Department of Revenue. This form allows your entity to be treated as a pass-through entity for state tax purposes. You must also ensure that your election is made on time to avoid penalties. Consider using uslegalforms to guide you through this process seamlessly and efficiently.

Yes, land contracts are legal in South Carolina. They serve as agreements between buyers and sellers for purchasing real estate. It's important to structure these contracts correctly to ensure compliance with state laws. Using a reliable resource like USLegalForms can help clarify the specifics of your land contract.

Section 121 of the tax code in South Carolina mirrors the federal exclusion of capital gains on the sale of a primary residence. This legislation is key for South Carolinians as it allows for significant tax savings when selling their homes. Understanding how Section 121 applies at both the state and federal levels helps potential sellers maximize their financial outcomes during real estate transactions.

Section 121 of the tax code allows homeowners to exclude capital gains from the sale of their primary residence from federal income taxes, up to specific limits. For individuals, this maximum exclusion can reach $250,000, while married couples can potentially exclude up to $500,000. Utilizing Section 121 benefits South Carolinians selling their homes, as it provides significant financial relief and encourages investment in local property.

Code 121 refers to a specific section of the tax code that addresses the exclusion of capital gains on the sale of a primary residence under certain conditions. This code is vital for homeowners in South Carolina who wish to take advantage of potential tax savings when selling their property. Understanding how Code 121 works allows you to navigate the complexities of property transactions more effectively.

Contracts to buy and sell come in all kinds of arrangements. One of the lesser-known varieties of contracts is known as an "option contract." In a typical option contract, the seller agrees to keep an offer open for a certain amount of time. A potential buyer has to give the seller some payment in exchange.

An option contract is an enforceable contract and is legally binding. In a real estate transaction, an option contract benefits the buyer. The seller is obligated to the contract to sell once the offer to sell is made.

Importance of an Option ContractThey should always be in writing because at their most basic form they are the promise of one party to take an agreed upon action in the future, and over time, misunderstandings can arise as the original terms and intent of the agreement.

Define an option-to-buy. An option is an enforceable contract in which the optionor (seller) gives the optionee (buyer) the right to purchase the property before a determined time for a stated price and terms.

In an option contract, the seller is the optionor and the buyer is the optionee. It is a unilateral contract in that the seller is obligated to sell, but the buyer has the option to buy. When created, an option contract is a unilateral contract. But when the buyer exercises the option, it becomes a bilateral contract.