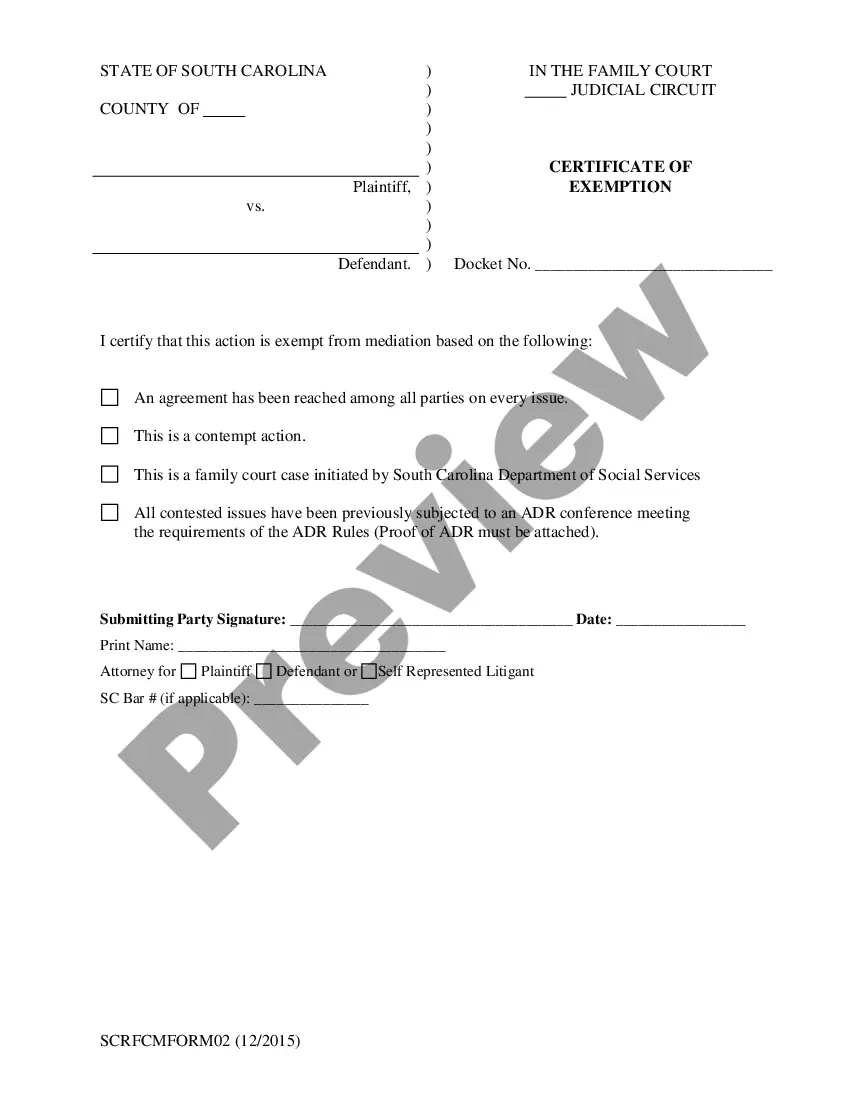

The South Carolina Certificate of Exemption is a document issued by the South Carolina Department of Revenue that exempts certain purchasers from paying sales tax on certain purchases. There are three types of South Carolina Certificates of Exemption: the Exempt Organization Certificate, the Resale Certificate, and the Governmental Entity Certificate. The Exempt Organization Certificate is issued to tax-exempt organizations such as religious, charitable, and educational organizations. The certificate allows these organizations to purchase items tax-free for their own use. The Resale Certificate is issued to sellers who are purchasing items for resale. The certificate allows them to purchase items tax-free as long as the items will be resold and not used for other purposes. The Governmental Entity Certificate is issued to state and local governmental entities. This certificate allows them to purchase items tax-free for their own use.

South Carolina Certificate of Exemption

Description

How to fill out South Carolina Certificate Of Exemption?

If you’re looking for a way to appropriately complete the South Carolina Certificate of Exemption without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business situation. Every piece of paperwork you find on our online service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward guidelines on how to acquire the ready-to-use South Carolina Certificate of Exemption:

- Ensure the document you see on the page corresponds with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your South Carolina Certificate of Exemption and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

To qualify for the special 4% property tax assessment ratio, the owner of the property must have actually owned and occupied the residence as his legal residence and been occupying that address for some period during the applicable tax year. Only an owner-occupant is eligible to apply for the 4% special assessment.

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.

How long is my South Carolina sales tax exemption certificate good for? There is no explicitly stated expiration period for these exemption certificate, the business the apply to must simply still be in operation.

An exemption or resale certificate is a form or document issued by a business to ensure sales tax is not applied to their invoice when they intend to resell their purchase. Sales tax is not used on these purchases because the applicable sales tax will be used on the final sale of the exchanged tangible property.

All Application for Exemption Certificate requests must be submitted on our free online tax portal, MyDORWAY, at MyDORWAY.dor.sc.gov. a MyDORWAY account to request Sales and Use Tax exemptions. If you do not have a Sales and Use Tax account, complete the Business Tax Application at dor.sc.gov/register.

Where do I apply? You must apply for the Homestead Exemption at your County Auditor's office. If you are unable to go to the Auditor's office, you may authorize someone to apply for you. Contact the County Auditor's Office for details.

Residents of South Carolina may be exempt from paying a portion of property taxes for the following criteria: resident of the state for a full calendar year and either over 65 years of age or permanently disabled or legally blind.

The Homestead Exemption is a complete exemption of taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind.