South Carolina Certificate of Exemption

Description

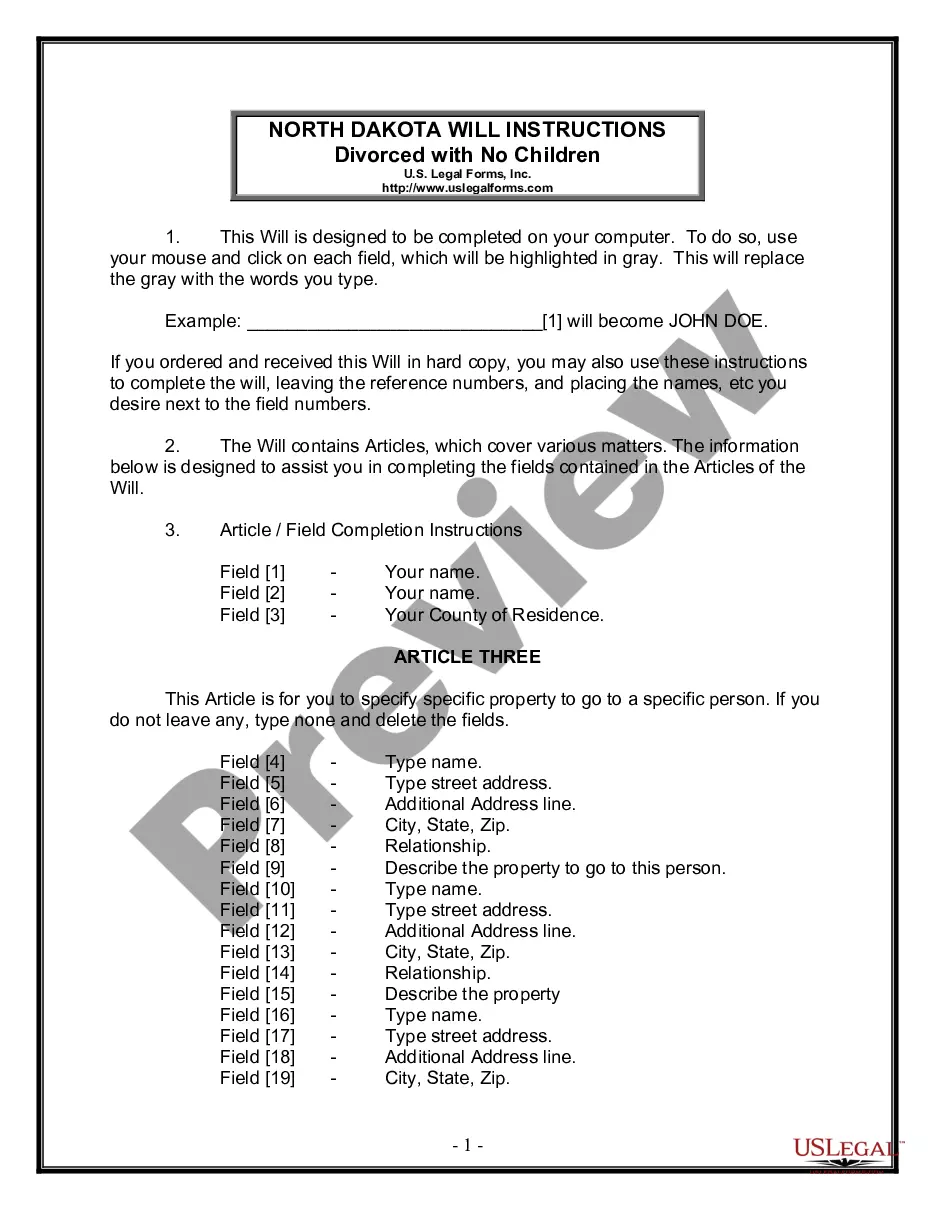

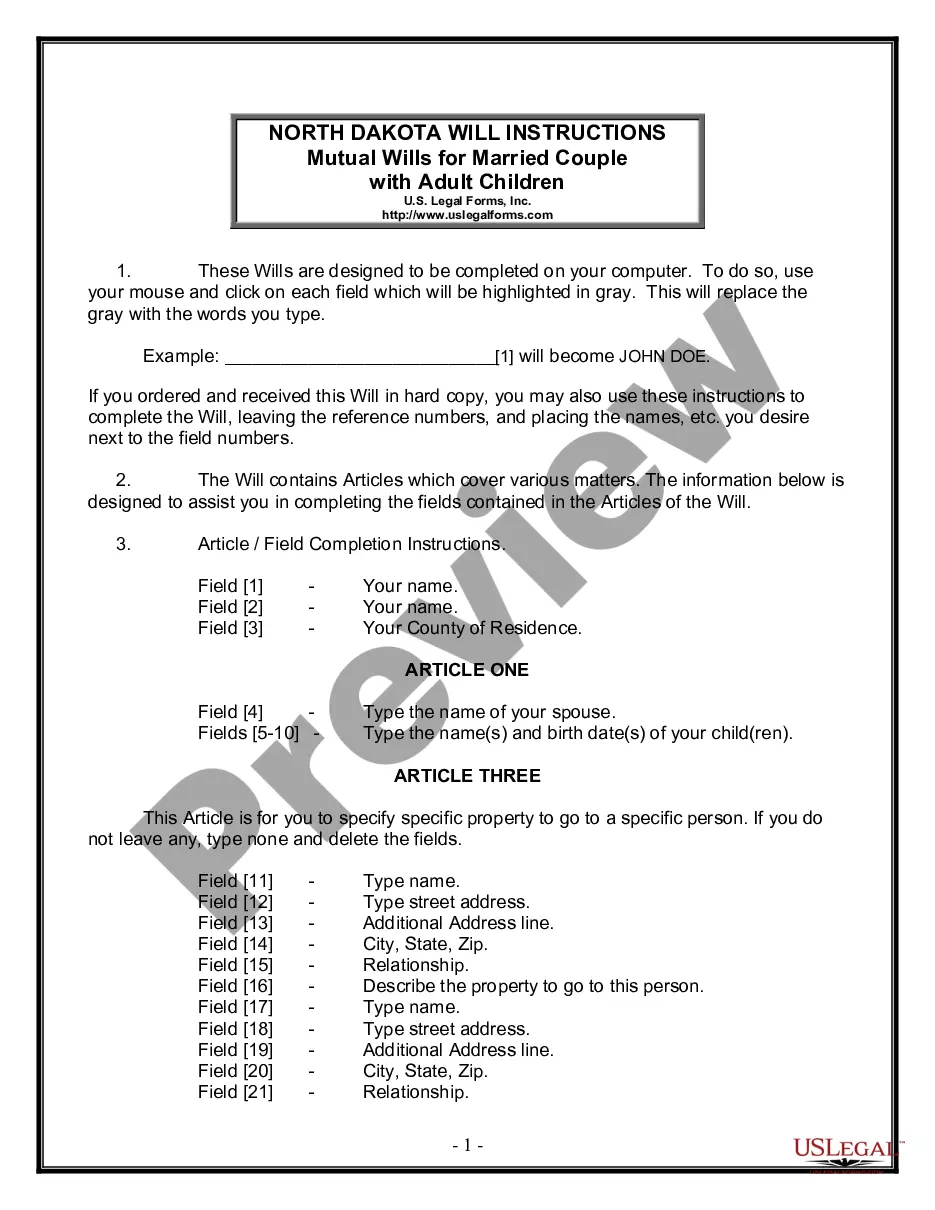

How to fill out South Carolina Certificate Of Exemption?

Creating papers isn't the most straightforward task, especially for those who rarely deal with legal paperwork. That's why we advise using accurate South Carolina Certificate of Exemption templates created by professional attorneys. It gives you the ability to avoid difficulties when in court or handling official organizations. Find the files you want on our site for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. As soon as you’re in, the Download button will immediately appear on the template web page. Right after getting the sample, it’ll be saved in the My Forms menu.

Users without an active subscription can quickly create an account. Follow this short step-by-step guide to get the South Carolina Certificate of Exemption:

- Make certain that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this form is what you need or return to the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

Right after finishing these simple actions, you can complete the sample in a preferred editor. Recheck completed info and consider asking a legal professional to examine your South Carolina Certificate of Exemption for correctness. With US Legal Forms, everything becomes much simpler. Give it a try now!

Form popularity

FAQ

Some goods are exempt from sales tax under South Carolina law. Examples include most non-prepared food items, prescription drugs, and medical supplies.

Homestead Exemptions can be filed at your County Auditor's Office. Some common documents used as proof of eligibility Include: a birth certificate or South Carolina Driver's License when applying for age. You will need documentation from the state or federal agency certifying the disability, if disabled.

As a result, many seniors pay no South Carolina income tax. In addition, homeowners at age 65 are exempt from property tax on the first $50,000 of the value of their legal residence, once they apply for the Homestead Exemption at their local county auditor's office.

Homestead Exemptions can be filed at your County Auditor's Office. Some common documents used as proof of eligibility Include: a birth certificate or South Carolina Driver's License when applying for age. You will need documentation from the state or federal agency certifying the disability, if disabled.

South Carolina Resale Certificates do not expire as long as the purchaser's business is in operation.

Contact your county assessor's office for an application for a farmland exemption. It must be filed annually by a specific date. If the farm use of the property changes, you must notify the assessor within six months. The assessor makes the decision as to whether or not your property is legitimately agricultural.

Diplomatic tax exemption cards that are labeled as Personal Tax Exemption are used by eligible foreign mission members and their dependents to obtain exemption from sales and other similarly imposed taxes on personal purchases in the United States.

To be considered a farm for the Alberta Farm Fuel benefit (and be eligible to use marked or "purple" fuel) the farm business must have $10,000 or more of gross annual farm production. This $10,000 minimum production threshold is also required for most other provincial and federal-provincial farm programs.

1. The area of the land is more than 5 contiguous acres and is used to produce field crops, is in a crop rotation, raises and/or grazes stock for a for-profit venture.Land used for the grazing of horses that are primarily used for personal use or pleasure will not qualify.