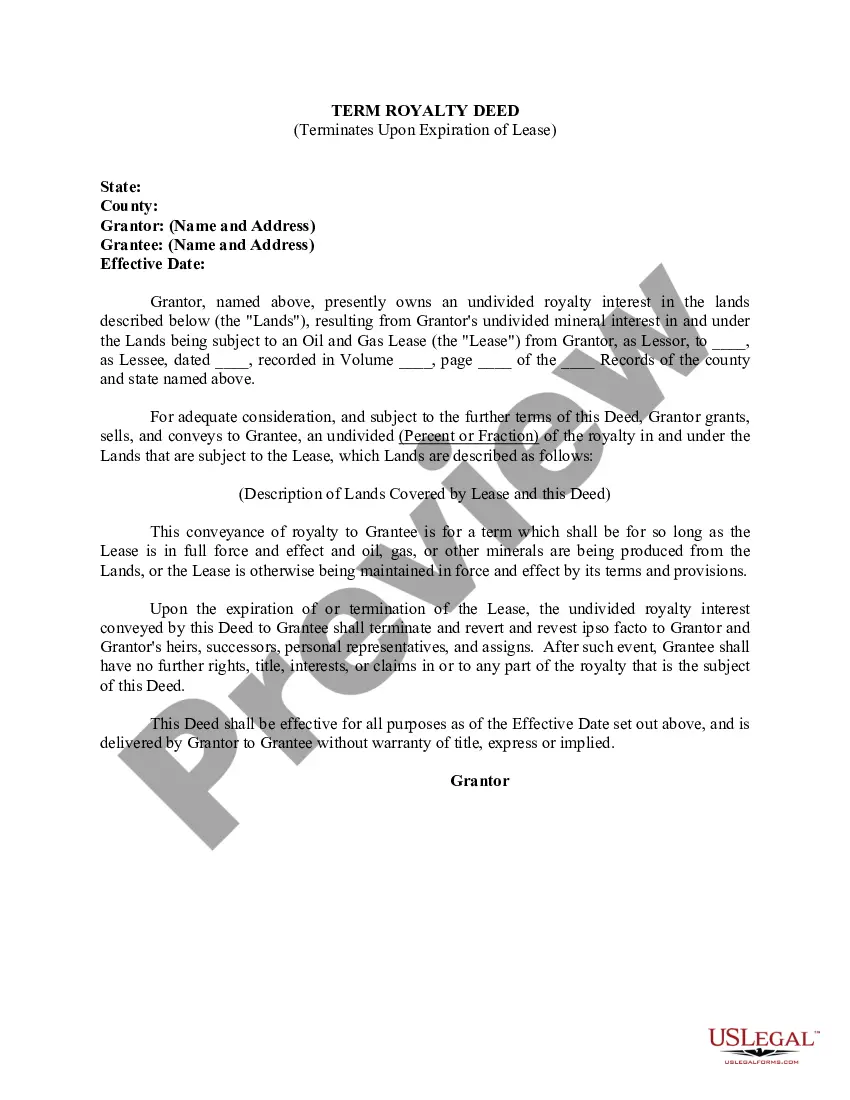

Rhode Island Term Royalty Deed for Term of Existing Lease

Description

How to fill out Term Royalty Deed For Term Of Existing Lease?

You can devote hours on the web trying to find the authorized file design that fits the state and federal requirements you will need. US Legal Forms gives thousands of authorized forms which can be examined by pros. It is possible to down load or produce the Rhode Island Term Royalty Deed for Term of Existing Lease from my support.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Down load button. After that, you are able to complete, edit, produce, or signal the Rhode Island Term Royalty Deed for Term of Existing Lease. Every single authorized file design you buy is your own for a long time. To obtain an additional backup of the obtained form, check out the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms internet site the very first time, follow the simple directions below:

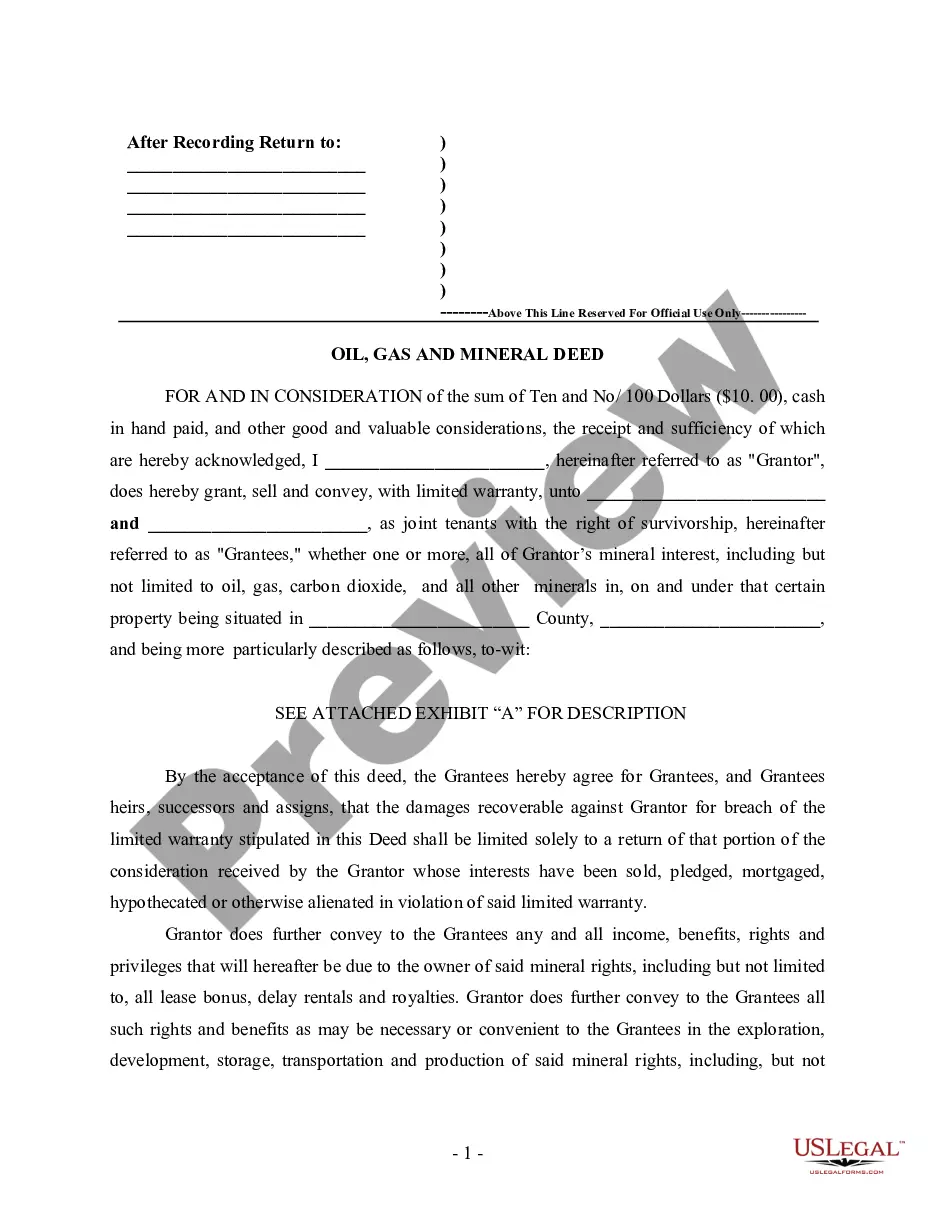

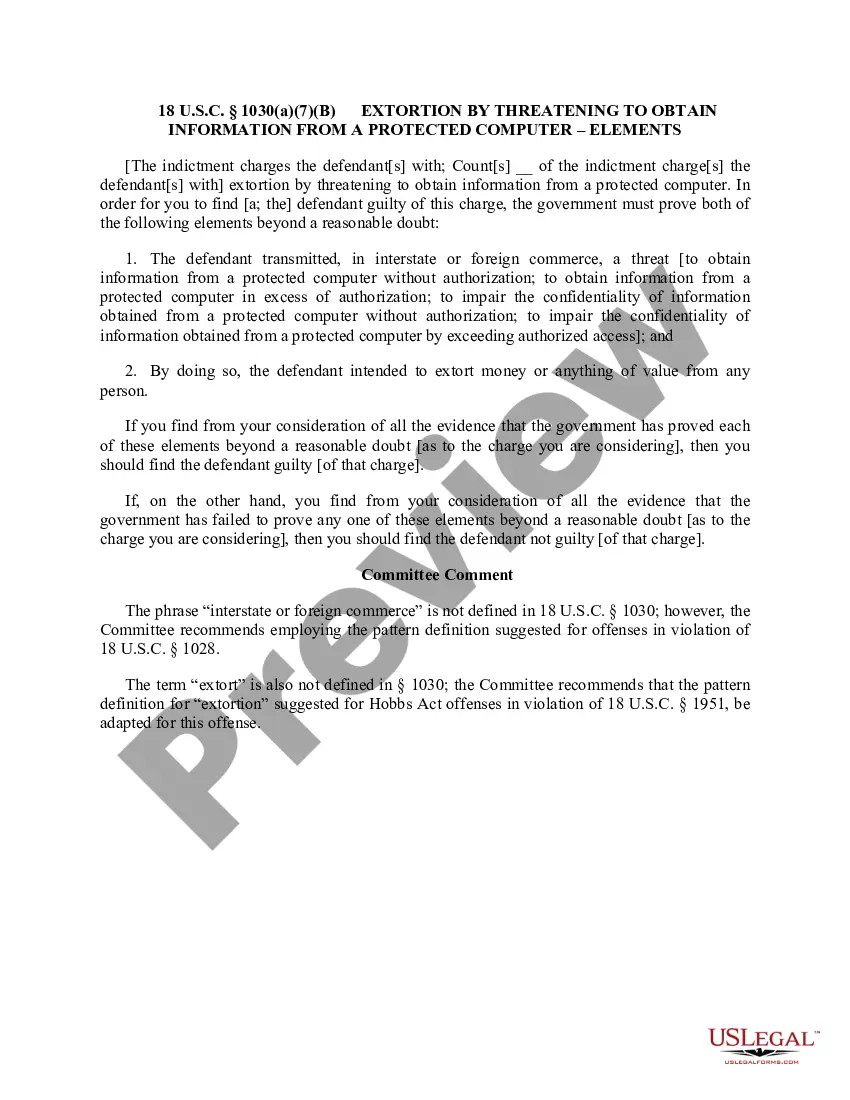

- First, be sure that you have chosen the right file design for the state/town that you pick. Look at the form information to ensure you have chosen the appropriate form. If accessible, use the Review button to appear from the file design as well.

- If you would like locate an additional version in the form, use the Research area to get the design that suits you and requirements.

- Upon having discovered the design you need, just click Purchase now to continue.

- Pick the costs program you need, enter your references, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your credit card or PayPal accounts to cover the authorized form.

- Pick the structure in the file and down load it for your system.

- Make changes for your file if necessary. You can complete, edit and signal and produce Rhode Island Term Royalty Deed for Term of Existing Lease.

Down load and produce thousands of file layouts while using US Legal Forms website, that offers the biggest selection of authorized forms. Use expert and state-distinct layouts to tackle your organization or person requirements.

Form popularity

FAQ

(a) In a sale of real property and associated tangible personal property owned by a nonresident, the buyer shall deduct and withhold on the payments an amount equal to six percent (6%) of the total payment to nonresident individuals, estates, partnerships, or trusts, and seven percent (7%) of the total payment to ...

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment.

Every part-year individual who was a resident for a period of less than 12 months is required to file a Rhode Island return if he or she is required to file a federal return.

The Rhode Island non-resident withholding law mandates that anytime a non-resident of Rhode Island sells real estate, the buyer must withhold a certain amount of the purchase price from the net proceeds of the sale and turn the withholdings over to the Rhode Island Division of Taxation.

If an approved Certificate of Withholding Due has not been obtained prior to the closing, the buyer must withhold 6% of the seller's net proceeds (7% if seller is a nonresident corporation).

The basic exemption of Rs 3 lakh and Rs 5 lakh is available only for resident senior citizens and resident super senior citizens in the old tax regime. Hence, as an NRI, even if you are a senior citizen, when your income in India exceeds Rs 2.5 lakh, you will be liable to file your return of income in India.

If you are a Rhode Island resident and you are required to file a federal return, you must also file a Rhode Island return. Even if you are not required to file a federal return, you may still have to file a Rhode Island return if your income exceeds the amount of your personal exemption.

Most types of U.S. source income received by a foreign person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if an Internal Revenue Code Section provides for a lower rate, or there is a tax treaty between the foreign person's country of residence and the United States.