Rhode Island Term Nonparticipating Royalty Deed from Mineral Owner

Description

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

Are you within a placement where you need to have paperwork for either organization or specific uses almost every time? There are tons of authorized record web templates available on the net, but finding kinds you can rely isn`t straightforward. US Legal Forms delivers thousands of type web templates, just like the Rhode Island Term Nonparticipating Royalty Deed from Mineral Owner, which are composed to meet federal and state needs.

Should you be already knowledgeable about US Legal Forms site and possess a free account, simply log in. Next, you can acquire the Rhode Island Term Nonparticipating Royalty Deed from Mineral Owner format.

If you do not offer an accounts and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you want and ensure it is for your appropriate area/area.

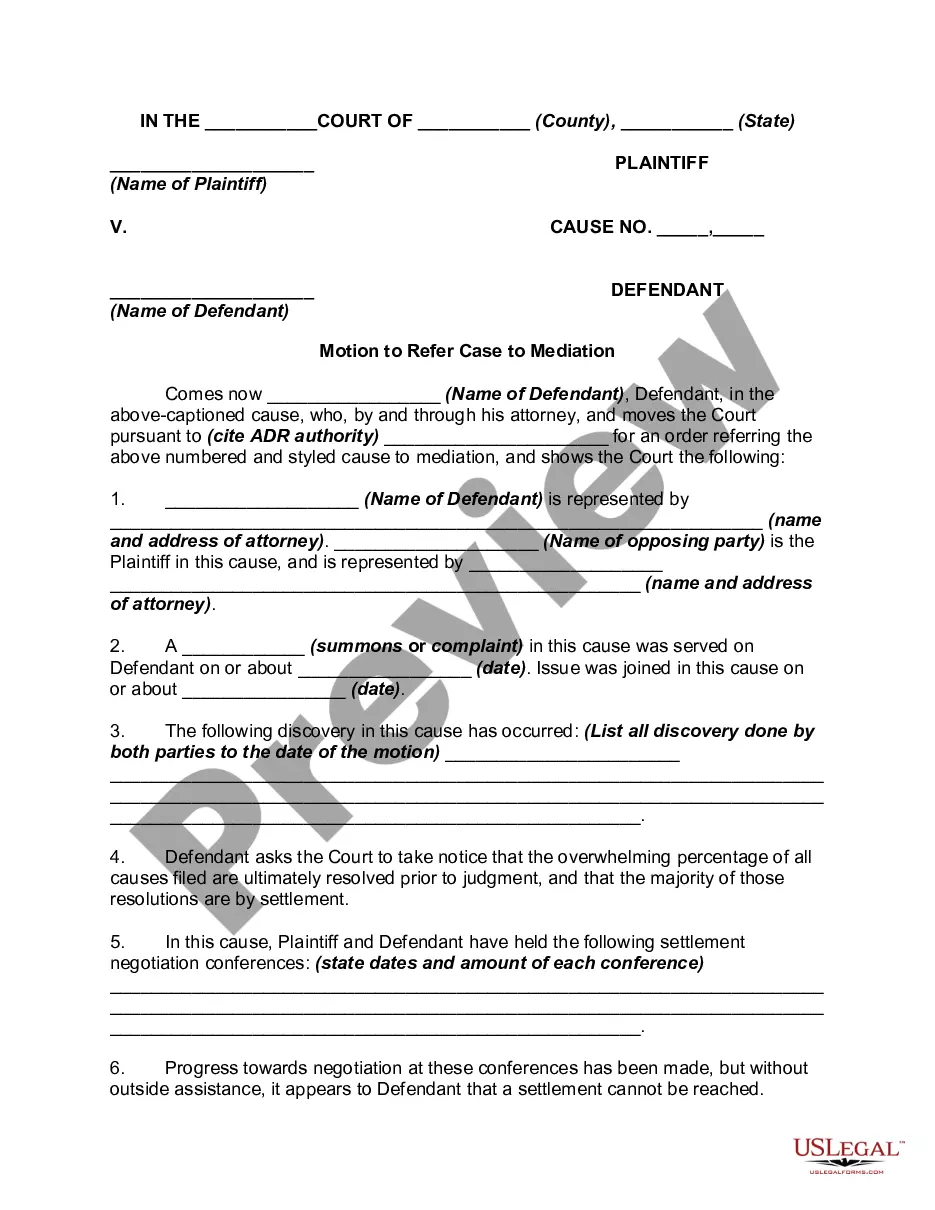

- Take advantage of the Review switch to examine the form.

- Look at the information to actually have chosen the proper type.

- If the type isn`t what you`re seeking, utilize the Lookup field to find the type that suits you and needs.

- If you get the appropriate type, simply click Buy now.

- Opt for the prices strategy you need, submit the required details to generate your account, and pay for your order making use of your PayPal or credit card.

- Decide on a practical document formatting and acquire your duplicate.

Find all of the record web templates you might have bought in the My Forms food selection. You can aquire a extra duplicate of Rhode Island Term Nonparticipating Royalty Deed from Mineral Owner anytime, if possible. Just go through the essential type to acquire or print out the record format.

Use US Legal Forms, one of the most extensive variety of authorized types, to conserve time as well as avoid faults. The support delivers appropriately made authorized record web templates that can be used for a selection of uses. Make a free account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

The easiest way to buy mineral rights is through a reputable auction house. The quality and price of mineral rights sold at auctions vary widely. You will find rip-offs with a 60-year return on investments (ROIs) as well as high-quality assets at a reasonable market price.

Avoid Increased Tax Assessments. By selling your mineral rights, you can effectively transfer the burden of future property taxes associated with those rights to the buyer. This can be particularly beneficial if your property's mineral reserves are substantial and would otherwise result in increased tax assessments.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.