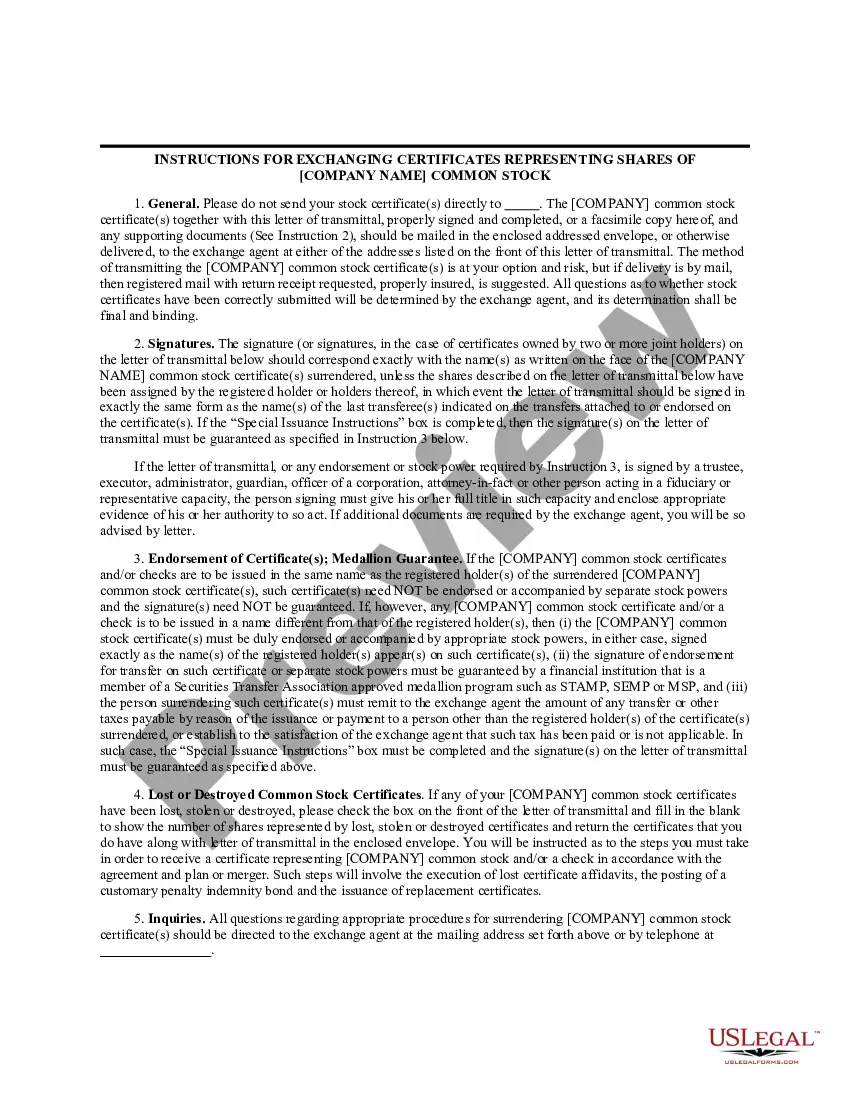

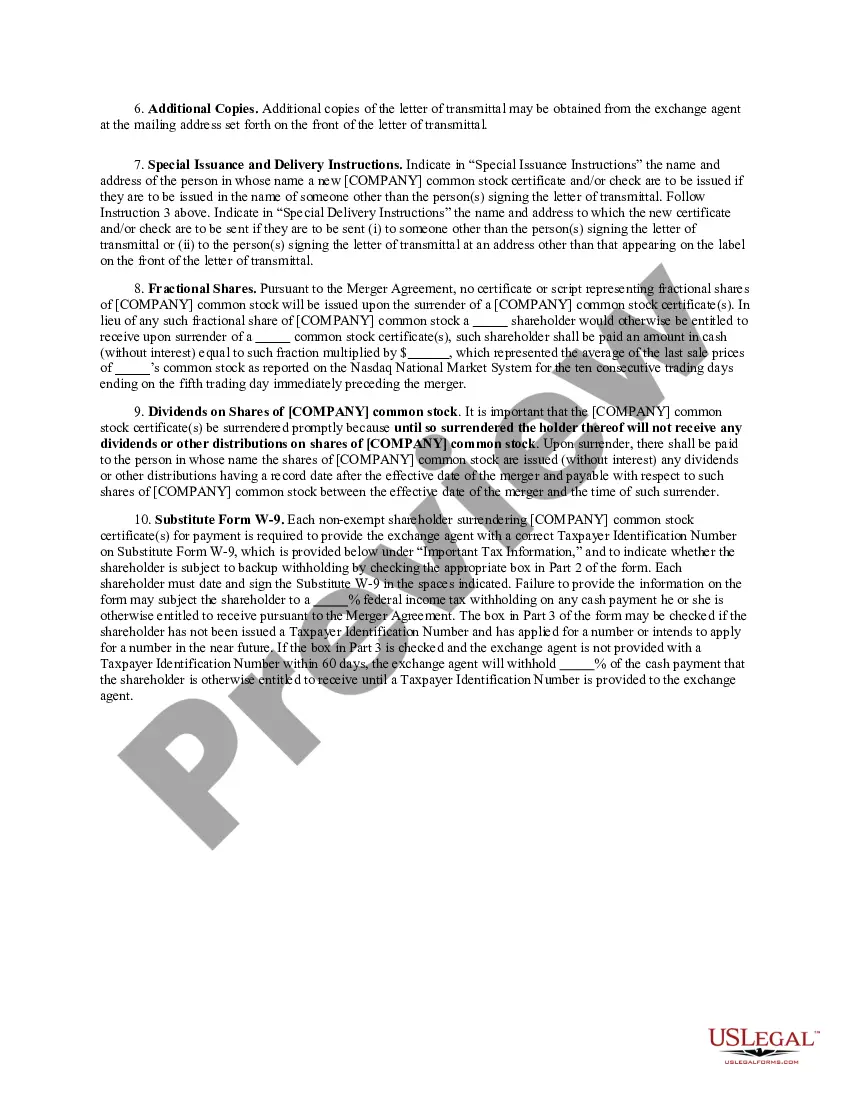

Rhode Island Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

US Legal Forms - among the most significant libraries of legal varieties in the USA - offers an array of legal document templates you are able to acquire or print out. Using the website, you can get a large number of varieties for company and individual purposes, sorted by classes, claims, or keywords and phrases.You will find the most up-to-date types of varieties like the Rhode Island Letter of Transmittal within minutes.

If you already possess a registration, log in and acquire Rhode Island Letter of Transmittal from the US Legal Forms catalogue. The Download option will appear on every kind you see. You get access to all formerly saved varieties in the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, listed here are basic directions to get you started out:

- Be sure to have selected the correct kind for your personal area/region. Click the Preview option to examine the form`s information. See the kind explanation to ensure that you have selected the proper kind.

- In the event the kind does not match your demands, make use of the Lookup industry at the top of the display to discover the one that does.

- When you are happy with the form, verify your option by clicking on the Purchase now option. Then, choose the pricing prepare you like and supply your credentials to sign up for an accounts.

- Process the deal. Use your charge card or PayPal accounts to perform the deal.

- Choose the format and acquire the form on your gadget.

- Make modifications. Fill out, modify and print out and indication the saved Rhode Island Letter of Transmittal.

Every template you put into your money lacks an expiry date and is yours for a long time. So, if you want to acquire or print out another copy, just check out the My Forms segment and then click on the kind you will need.

Get access to the Rhode Island Letter of Transmittal with US Legal Forms, one of the most substantial catalogue of legal document templates. Use a large number of specialist and express-specific templates that satisfy your business or individual needs and demands.

Form popularity

FAQ

The personal income tax rate in Rhode Island is 3.75%?5.99%. Rhode Island does not have reciprocity with other states.

Provide your name, address, filing status, and Social Security number. Your employer needs your Social Security number so that when it sends the money it withheld from your paycheck to the IRS, the payment is appropriately applied toward your annual income tax bill.

If too much money is withheld throughout the year, you'll receive a tax refund.

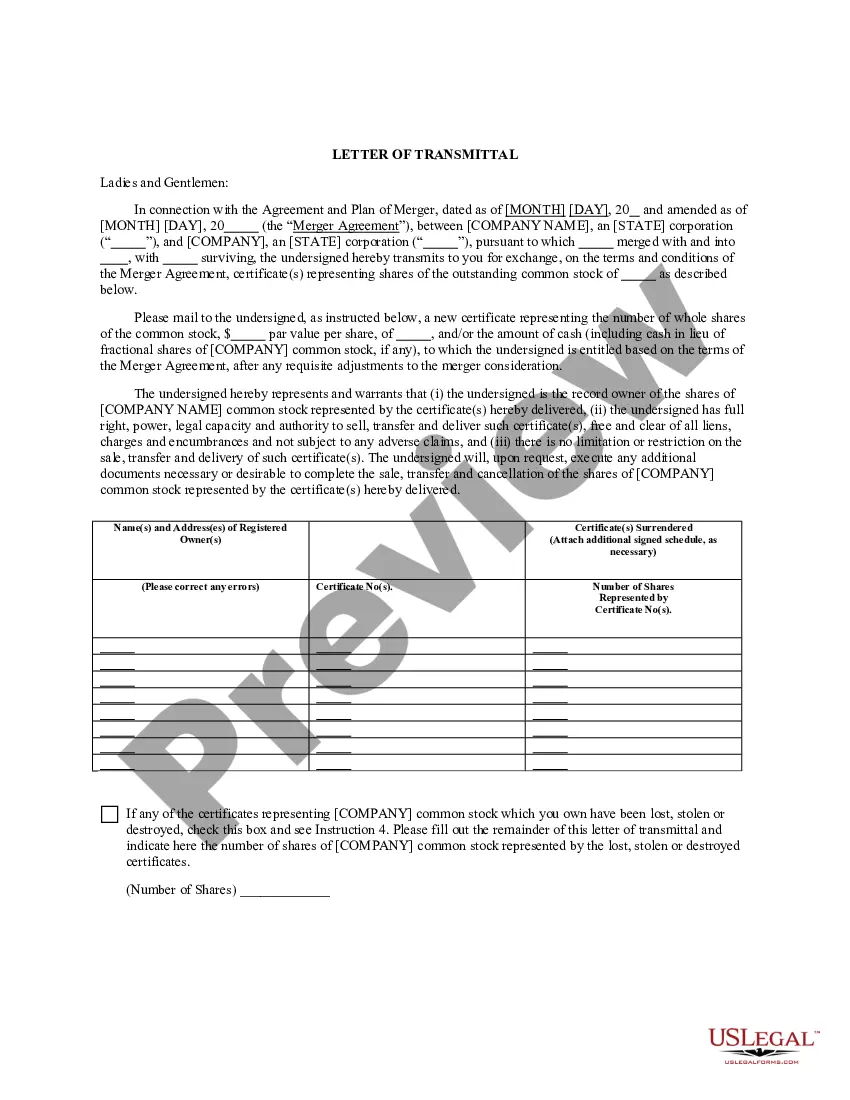

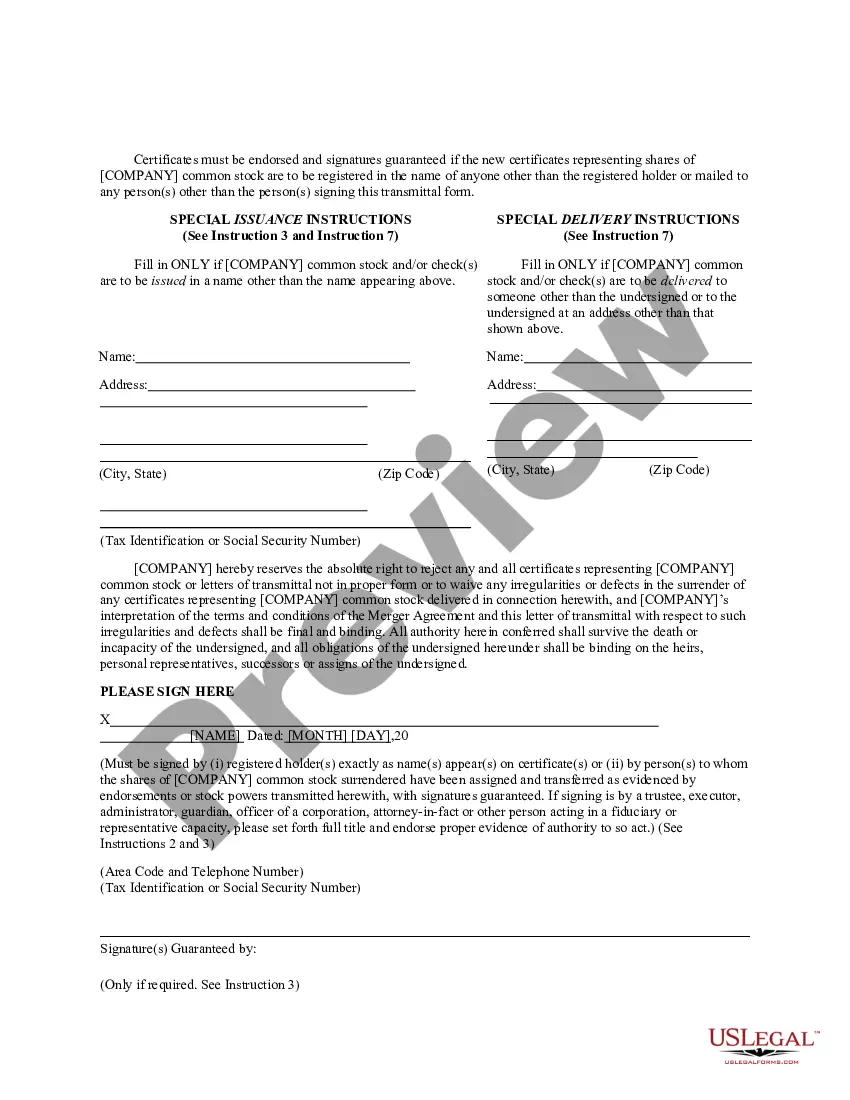

How to fill out a transmittal form: Begin by gathering all the necessary information and documents that are required for the transmittal form. ... Fill out the sender's information accurately and completely. ... Proceed to fill out the recipient's information, ensuring accuracy and completeness.

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

State of Rhode Island Division of Taxation. Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS.

Form RI-941 will be used by Quarterly payers to accompany the Quarterly withholding payment, as well as serve as a Quarterly Reconciliation. For those Quarterly payers, Form RI-941 replaces Form WTQ (RI-941Q) previously used.

For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.