Rhode Island Letter of Transmittal

Description

How to fill out Letter Of Transmittal?

You can devote hrs on the Internet attempting to find the legitimate record design which fits the state and federal specifications you will need. US Legal Forms offers a huge number of legitimate types which are evaluated by experts. It is possible to obtain or printing the Rhode Island Letter of Transmittal from the service.

If you have a US Legal Forms bank account, you may log in and click on the Download switch. Next, you may full, edit, printing, or indicator the Rhode Island Letter of Transmittal. Each and every legitimate record design you get is yours forever. To have yet another copy for any purchased develop, proceed to the My Forms tab and click on the related switch.

If you work with the US Legal Forms site the first time, keep to the straightforward recommendations beneath:

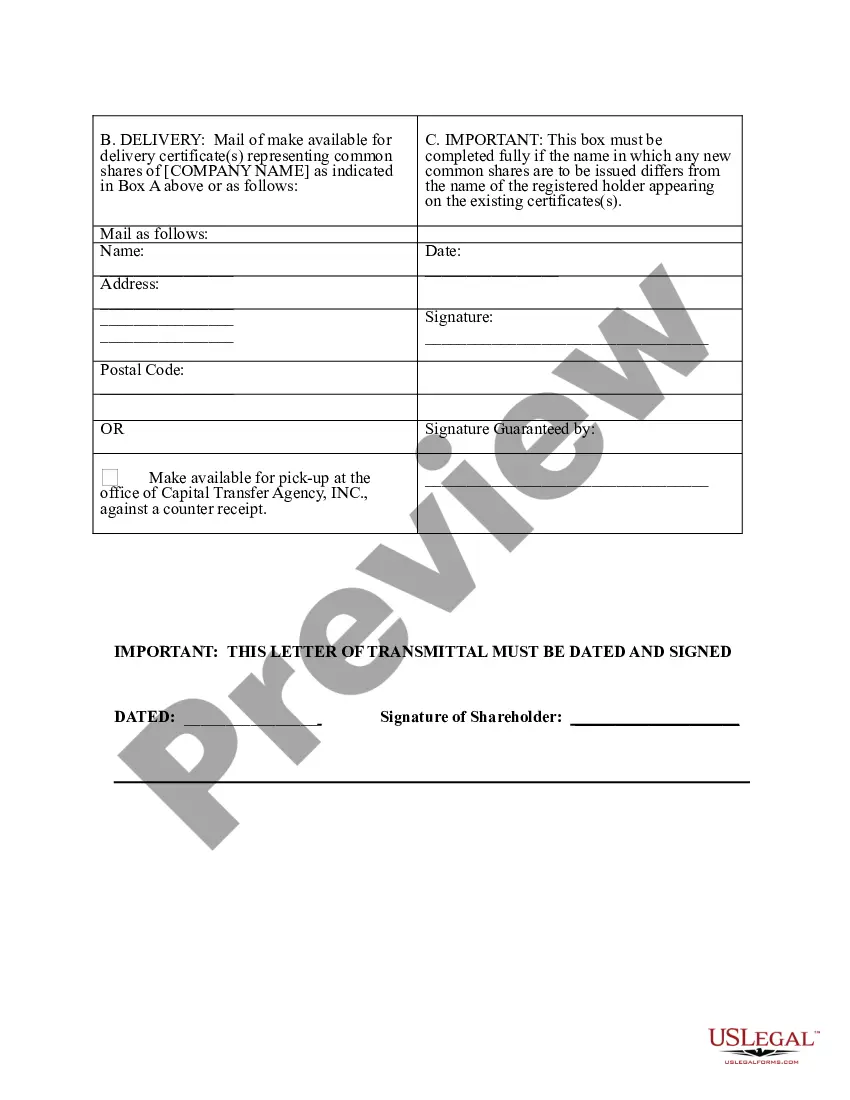

- First, make certain you have chosen the proper record design to the state/area of your choosing. Look at the develop explanation to make sure you have picked the proper develop. If offered, make use of the Preview switch to search with the record design as well.

- If you wish to find yet another version of your develop, make use of the Search area to obtain the design that meets your requirements and specifications.

- After you have identified the design you would like, just click Purchase now to proceed.

- Select the pricing strategy you would like, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal bank account to cover the legitimate develop.

- Select the structure of your record and obtain it to the system.

- Make changes to the record if needed. You can full, edit and indicator and printing Rhode Island Letter of Transmittal.

Download and printing a huge number of record templates utilizing the US Legal Forms web site, that offers the biggest variety of legitimate types. Use specialist and condition-certain templates to handle your organization or person requires.

Form popularity

FAQ

Most employers need to file Form 941 even if no wages were paid. However, there are a few exceptions, including employers of seasonal employees, household employees, or farm employees. However, other IRS forms may be required.

Exceptions to this filing requirement are for seasonal employers who don't pay employee wages during one or more quarters, employers of household employees and employers of agricultural employees. Employers of agricultural employees typically file Form 943 instead of Form 941.

In general, any employer who withholds taxes from employee payroll checks is required to fill out a 941 four times a year, even if you have no taxes to report.

Employers use Form 941 to: Report income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of Social Security or Medicare tax.

Form RI-941 will be used by Quarterly payers to accompany the Quarterly withholding payment, as well as serve as a Quarterly Reconciliation. For those Quarterly payers, Form RI-941 replaces Form WTQ (RI-941Q) previously used.

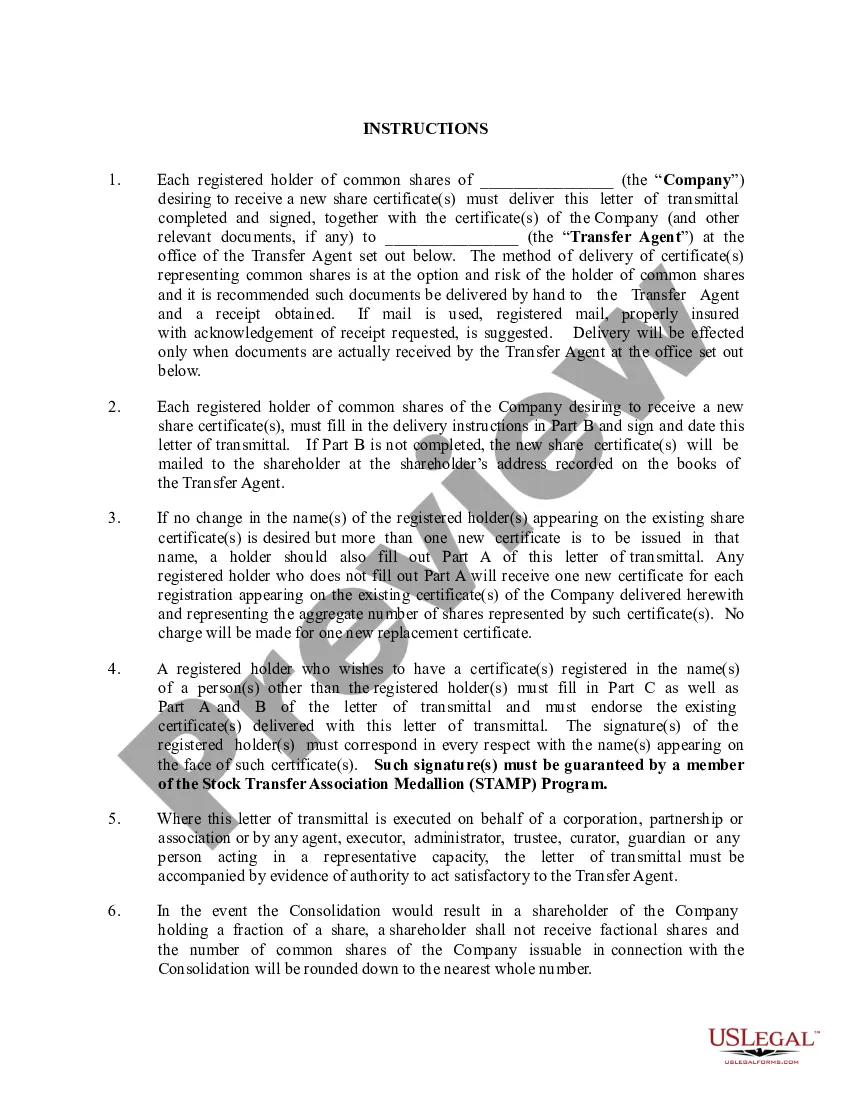

How to fill out a transmittal form: Begin by gathering all the necessary information and documents that are required for the transmittal form. ... Fill out the sender's information accurately and completely. ... Proceed to fill out the recipient's information, ensuring accuracy and completeness.

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation.

State of Rhode Island Division of Taxation. Form RI-W3 - Transmittal of Wage and Tax Statements. INFORMATION FOR EMPLOYERS FILING TRANSMITTAL OF WAGE AND TAX STATEMENTS.