Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

Aren't you sick and tired of choosing from hundreds of samples each time you require to create a Transfer under the Uniform Transfers to Minors Act - Multistate Form? US Legal Forms eliminates the wasted time countless American people spend searching the internet for suitable tax and legal forms. Our professional group of attorneys is constantly upgrading the state-specific Templates collection, so it always has the appropriate documents for your scenarion.

If you’re a US Legal Forms subscriber, just log in to your account and then click the Download button. After that, the form may be found in the My Forms tab.

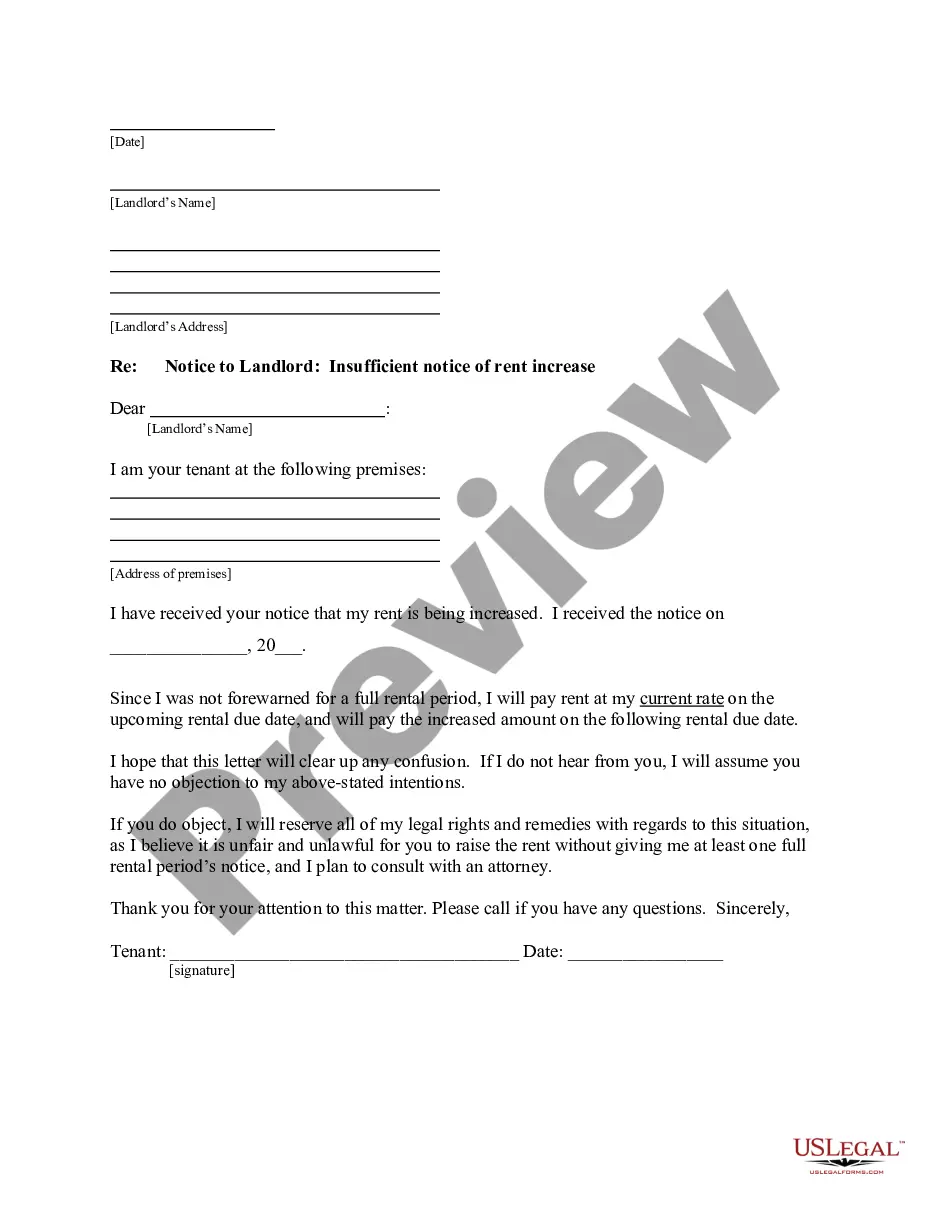

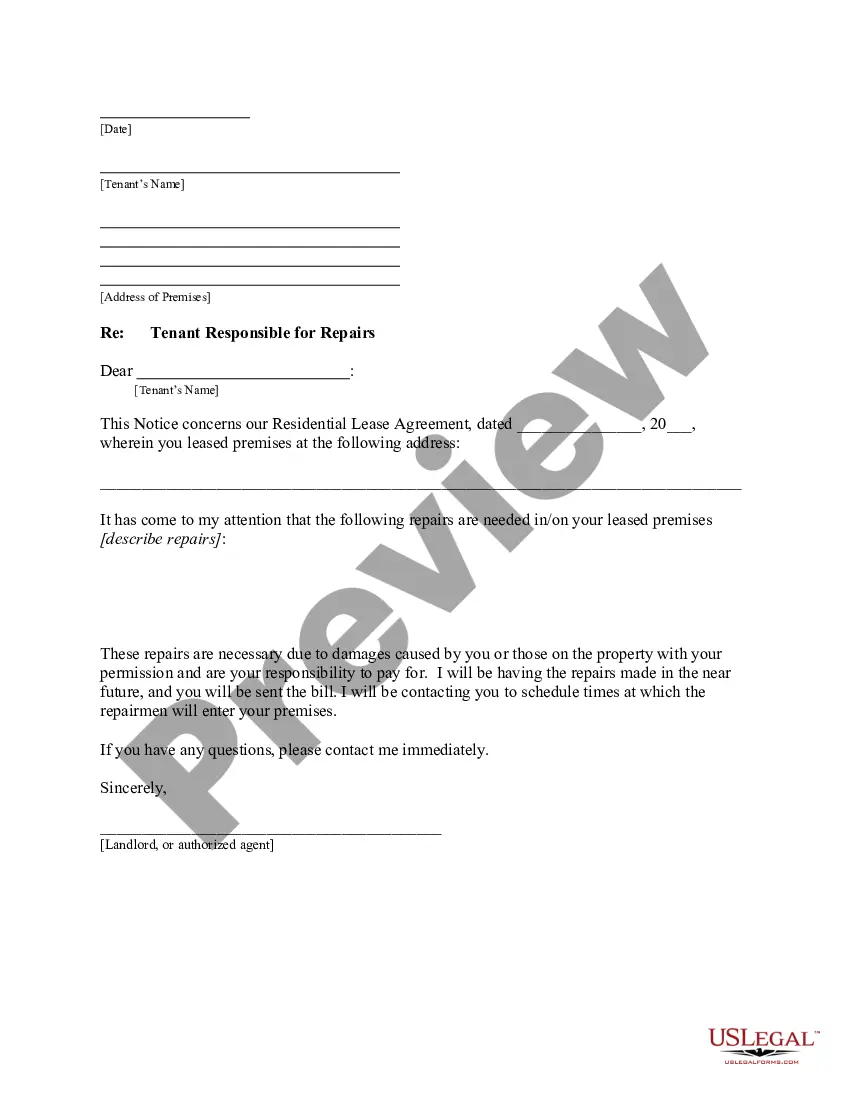

Users who don't have an active subscription need to complete quick and easy steps before having the capability to download their Transfer under the Uniform Transfers to Minors Act - Multistate Form:

- Make use of the Preview function and look at the form description (if available) to make sure that it is the proper document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the proper template to your state and situation.

- Make use of the Search field at the top of the web page if you need to look for another document.

- Click Buy Now and select a preferred pricing plan.

- Create an account and pay for the service using a credit card or a PayPal.

- Get your document in a convenient format to complete, create a hard copy, and sign the document.

When you have followed the step-by-step guidelines above, you'll always have the ability to sign in and download whatever document you require for whatever state you need it in. With US Legal Forms, finishing Transfer under the Uniform Transfers to Minors Act - Multistate Form templates or any other legal documents is easy. Begin now, and don't forget to recheck your examples with certified lawyers!

Form popularity

FAQ

Generally, the UTMA account transfers to the beneficiary when he or she becomes a legal adult, which is usually 18 or 21. However, the age of adulthood may be defined differently for custodial accounts, like UTMAs or 529 plans, depending on your state.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

When the child reaches the age of majority specified by the state, control of the account must be transferred to them. The age of majority varies by state but is generally between 18 and 25.

UGMA and UTMA accounts allow parents to save money and invest, maintain full control until their child is an adult. UTMA stands for Uniform Transfers to Minors Act, and UGMA stands for Universal Gifts to Minors Act. Both accounts allow you to transfer financial assets to a minor without establishing a trust.

There is no ability to transfer a UGMA or UTMA account to another child or to change beneficiaries. You are not supposed to use a UTMA-529 or UGMA-529 account conversion to change the beneficiary either because that would equate to giving your child's money to someone else.

When children reach the age of majority, the account can be transferred into their name only with custodian consent. Otherwise, they can remove the custodian from the account at the age of termination.

Virtually all states have adopted some form of UTMA that allows you to make gifts to a minor to be held in the name of a custodian during the age of minority. On reaching the age of majority, usually 21 years, the minor is entitled to all assets held in the account.