Rhode Island Golf Pro Services Contract - Self-Employed

Description

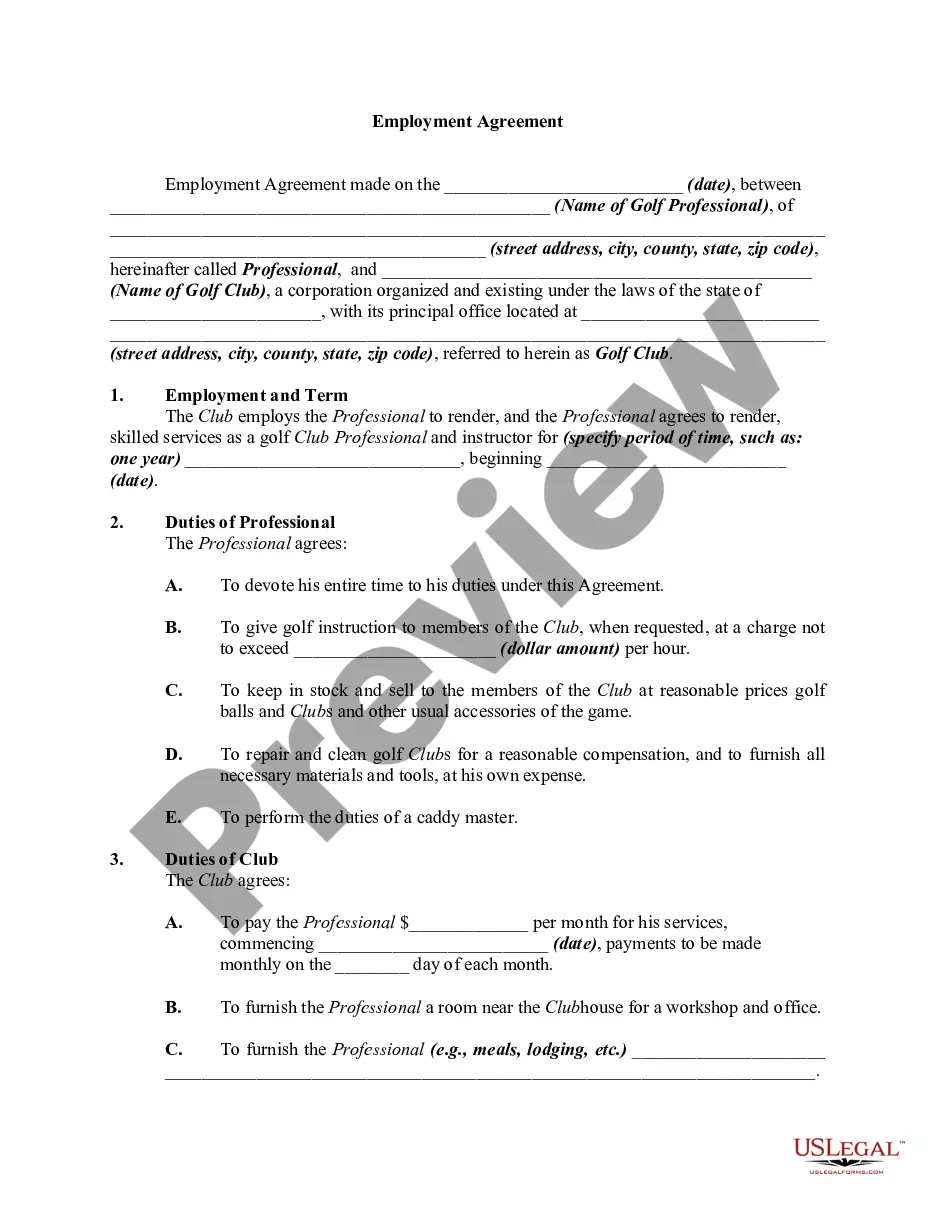

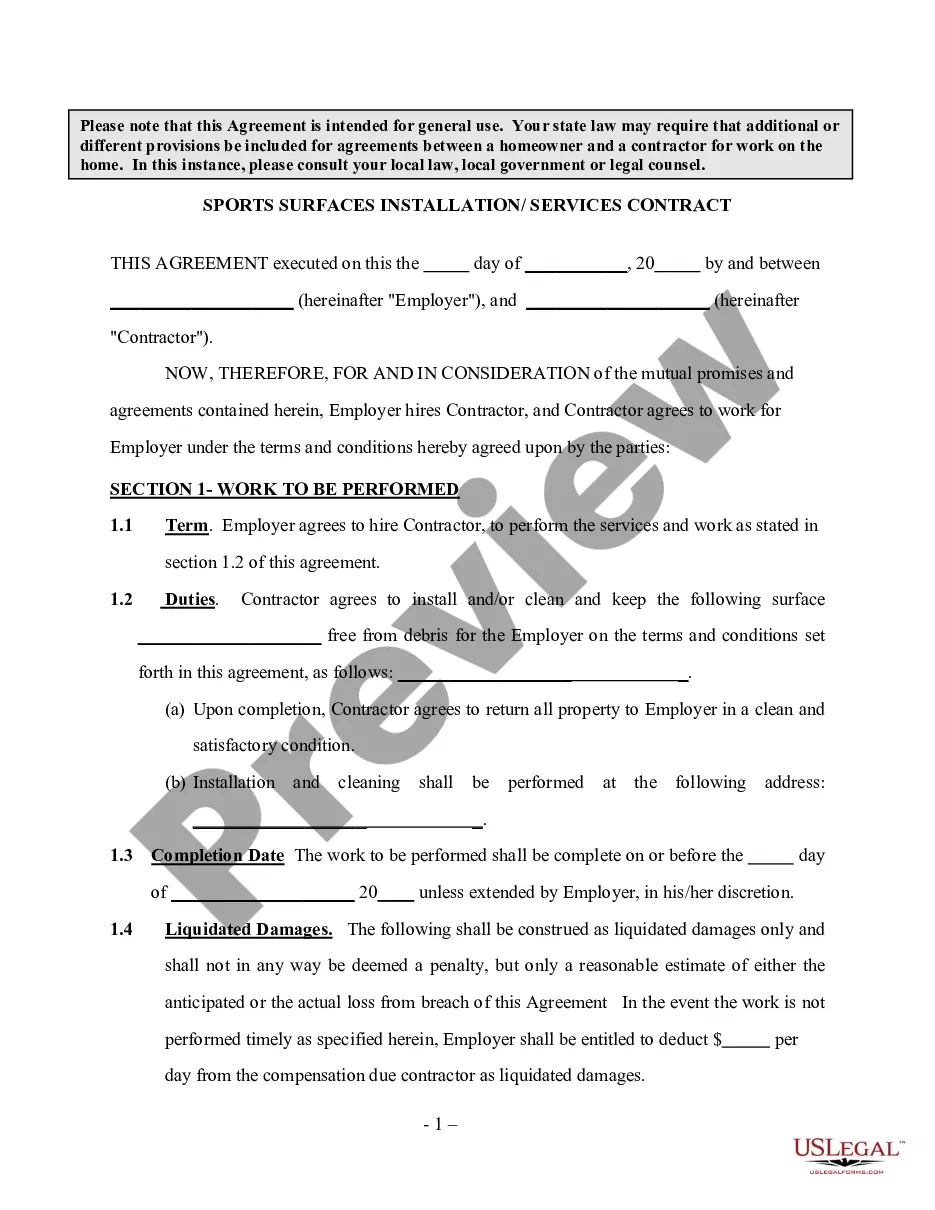

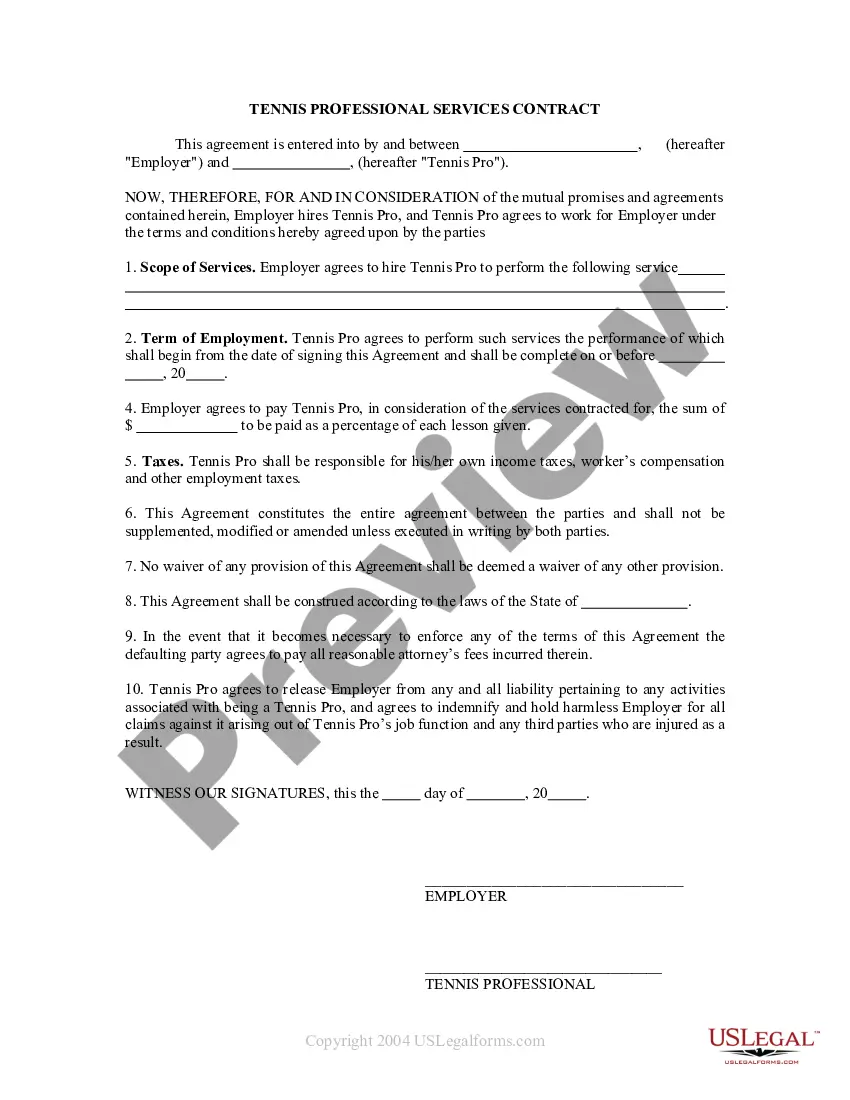

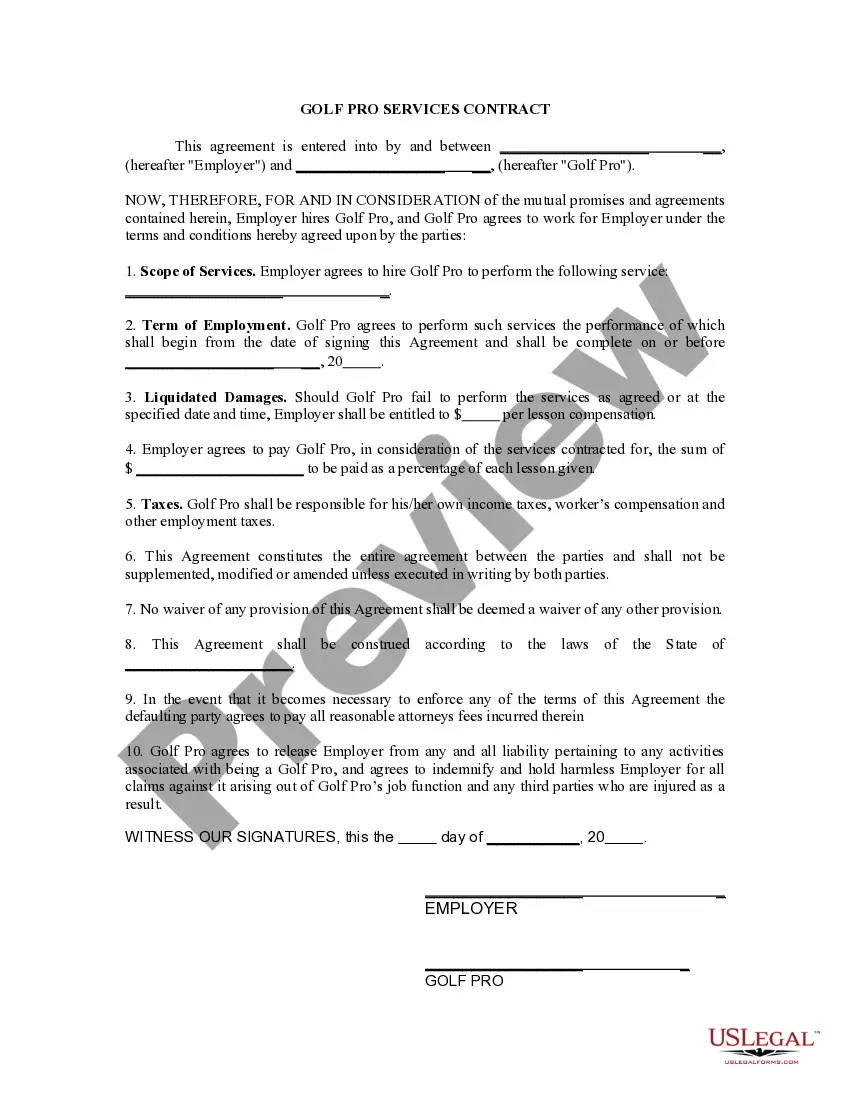

How to fill out Golf Pro Services Contract - Self-Employed?

If you want to be thorough, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and user-friendly search to locate the documents you require. Various templates for business and personal purposes are categorized by types and titles, or keywords.

Use US Legal Forms to find the Rhode Island Golf Pro Services Contract - Self-Employed with just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of your legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Rhode Island Golf Pro Services Contract - Self-Employed. Each legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account. Click the My documents section and choose a form to print or download again. Be proactive and download, and print the Rhode Island Golf Pro Services Contract - Self-Employed with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Rhode Island Golf Pro Services Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you have found the form you need, click the Download now button. Choose the payment plan you prefer and enter your details to register for an account.

Form popularity

FAQ

An independent contractor is someone who provides services to another party while maintaining control over how those services are accomplished. In the context of the Rhode Island Golf Pro Services Contract - Self-Employed, this means the golf professional operates their business independently, setting their own hours and methods of work. They are not classified as employees; therefore, they do not receive benefits like health insurance or retirement plans from the hiring entity. For clarity and compliance, consider using platforms like uslegalforms to outline your contract effectively.

To obtain a Rhode Island contractor license, start by gathering the necessary documentation that demonstrates your qualifications and experience in the field. You will need to complete an application form and submit it along with any required fees. It is also essential to pass the relevant exams that may pertain to your area of expertise. If you plan to work with a Rhode Island Golf Pro Services Contract - Self-Employed, ensuring your license aligns with the specifics of that contract can help you start your golf services career smoothly.

Filing taxes as an independent contractor requires completing a few additional steps compared to regular employees. You must report all income earned through your Rhode Island Golf Pro Services Contract - Self-Employed on your tax return, typically using Schedule C. Additionally, you may need to make estimated tax payments throughout the year. Consulting with a tax professional can help ensure you meet all tax obligations.

Becoming an independent contractor in Rhode Island involves several steps. First, you need to register your business with the state, which includes obtaining any necessary licenses. Then, you can draft a Rhode Island Golf Pro Services Contract - Self-Employed to outline your services, terms, and payments. Following these steps ensures a smooth transition into independent contracting.

To qualify as an independent contractor in Rhode Island, you must meet specific criteria, including demonstrating control over how you perform your services. This involves setting your schedule and methods while adhering to the terms outlined in your Rhode Island Golf Pro Services Contract - Self-Employed. Ensure you understand the definition of independent contractors under state law to align your practices with those requirements.

In Rhode Island, various services are subject to sales tax, including certain personal services and professional services. To understand which services are taxable, especially in connection with your Rhode Island Golf Pro Services Contract - Self-Employed, reviewing the Rhode Island Sales and Use Tax regulations is crucial. Consult a tax professional if you are unsure about specific services.

Yes, Rhode Island requires certain contractors to obtain a license, depending on the type of work you provide. As a Rhode Island Golf Pro Services Contract - Self-Employed, you may need to check the specific licensing requirements for golf-related services. It's essential to comply with state regulations to avoid potential penalties.

The RI 7004 form has not been discontinued; however, changes to forms can occur over time. For the most up-to-date information about tax forms relevant to independent contractors, including those involved in Rhode Island Golf Pro Services Contract - Self-Employed, you should check the Rhode Island Division of Taxation's website or consult with a tax professional.

Choosing between forming an LLC or working as an independent contractor hinges on your specific business needs. An LLC offers liability protection and more tax options, while working as an independent contractor may lead to simpler tax filing as a Rhode Island Golf Pro Services Contract - Self-Employed. Ultimately, consider consulting a legal or financial advisor to make the decision that suits you best.

Declaring yourself a professional golfer involves meeting certain criteria, including establishing a history of competitive play and obtaining training certifications. Additionally, securing contracts like the Rhode Island Golf Pro Services Contract - Self-Employed can formalize your status. Many aspiring pros use resources like uslegalforms to draft essential contracts that help clarify their professional standing.