Rhode Island Cook Services Contract - Self-Employed

Description

How to fill out Cook Services Contract - Self-Employed?

US Legal Forms - one of the largest libraries of legal documents in the United States - provides a vast selection of legal form templates that you can download or create.

Through the website, you can find numerous forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest versions of forms such as the Rhode Island Cook Services Contract - Self-Employed in seconds.

If you already have an account, Log In and download the Rhode Island Cook Services Contract - Self-Employed from the US Legal Forms collection. The Download option will appear on each form you view. You can access all previously saved forms from the My documents section of your account.

Complete the transaction. Use your Visa, MasterCard, or PayPal account to finalize the payment.

Choose the format and download the form onto your device. Edit. Fill out, modify, and print the saved Rhode Island Cook Services Contract - Self-Employed.

Each template you add to your account has no expiration date and is yours indefinitely. So, if you wish to download or create another version, simply go to the My documents section and click on the form you need. Access the Rhode Island Cook Services Contract - Self-Employed with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some basic steps to help you get started.

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Read the form description to ensure you have chosen the right document.

- If the form doesn’t meet your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

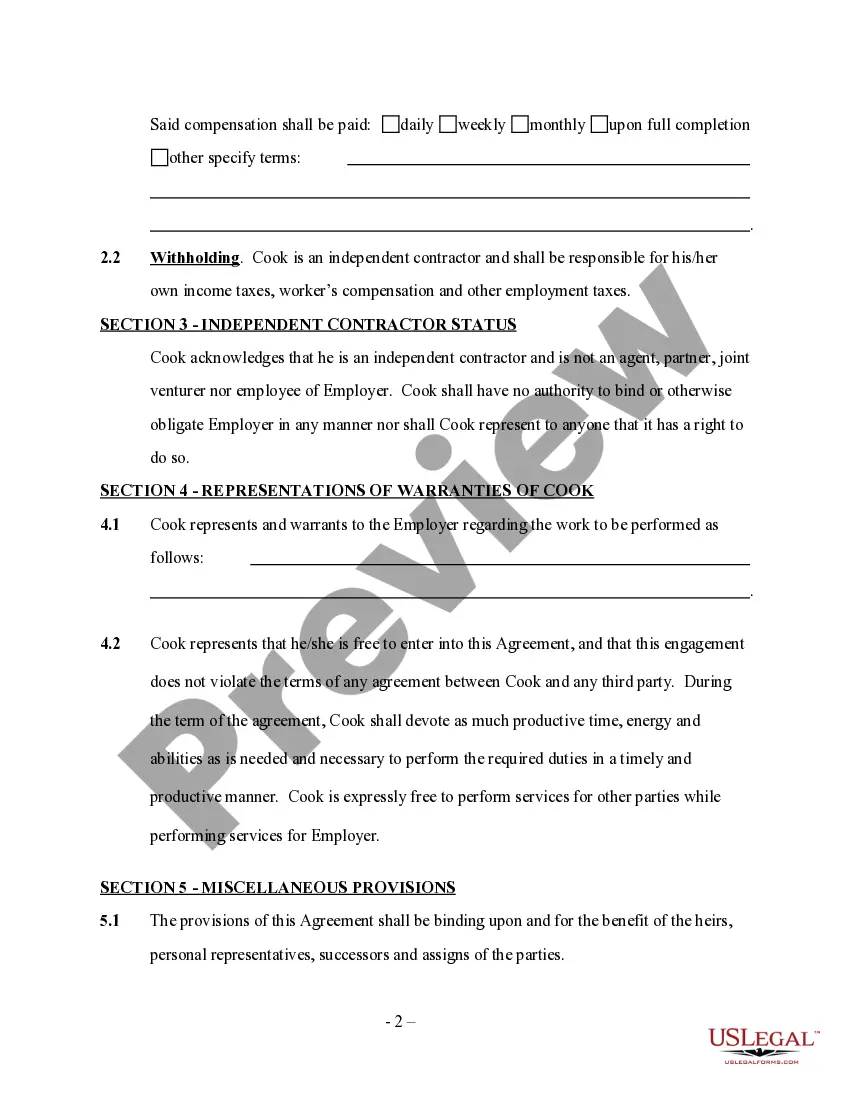

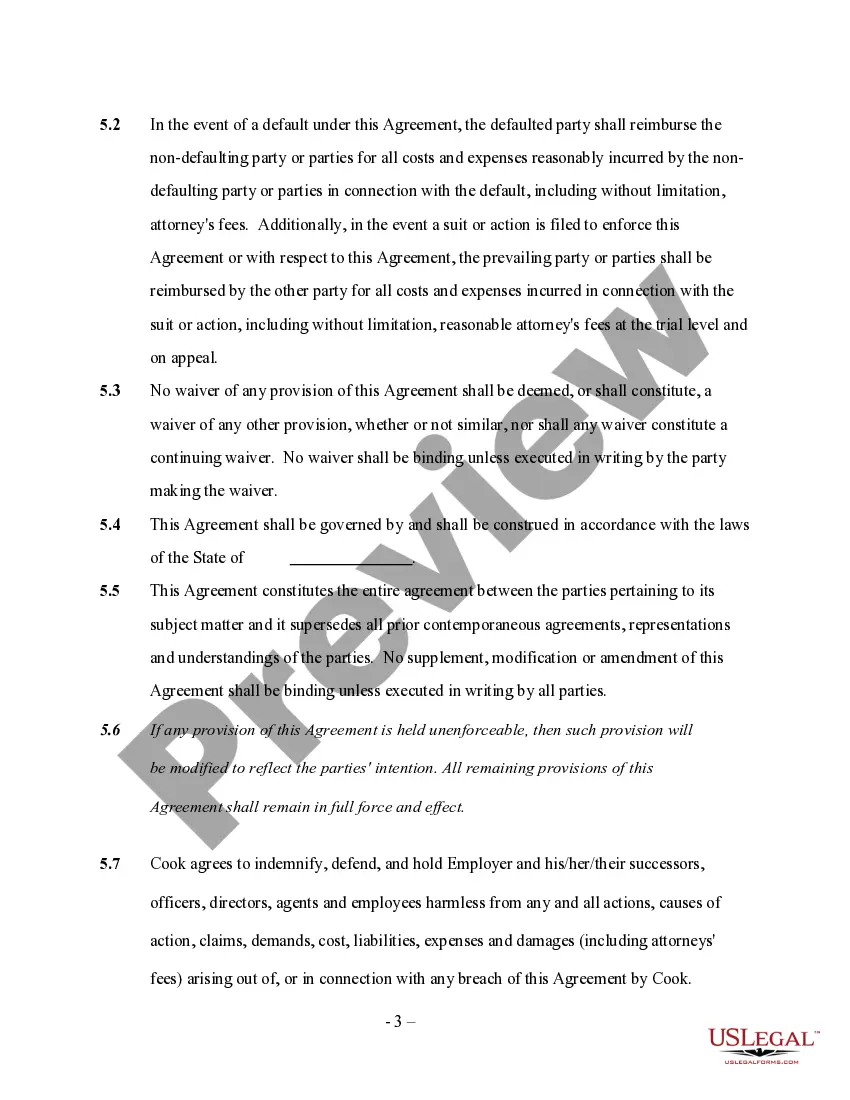

An independent contractor is an individual who provides services to a client under a contract. Unlike an employee, an independent contractor has the freedom to control how they complete their work. In the context of a Rhode Island Cook Services Contract - Self-Employed, it is important to note that you will manage your own schedule and can work with multiple clients. Understanding this distinction helps you navigate your rights and obligations as a self-employed cook in Rhode Island.

While it is possible to freelance without a contract, it is not recommended. A Rhode Island Cook Services Contract - Self-Employed protects both you and your clients by outlining project details and payment terms. Engaging in freelance work without a contract increases the risk of miscommunication and financial disputes down the line.

In Rhode Island, self-employment tax consists of Social Security and Medicare taxes, which total about 15.3% of your net earnings. It’s essential to account for this tax when setting prices for your services. A Rhode Island Cook Services Contract - Self-Employed can help ensure you’re structured correctly for tax purposes, promoting better financial practices.

To set up as a self-employed contractor, start by choosing a business name and registering it. Then, obtain any necessary permits or licenses in Rhode Island. Using a Rhode Island Cook Services Contract - Self-Employed will aid in defining your services and responsibilities, providing a professional framework for your business.

Self-employed individuals operate their own business, while contracted workers perform specific services for clients under agreed-upon terms. A Rhode Island Cook Services Contract - Self-Employed helps clarify your role, expectations, and payment structure in such arrangements. Understanding this distinction is vital when setting your business structure.

While you can receive 1099 forms without a formal contract, it is not advisable. A Rhode Island Cook Services Contract - Self-Employed clarifies your status and protects your rights in case of any disputes. Having a written agreement strengthens your professional relationship and ensures both parties understand their responsibilities.

If you do not have a contract, you risk potential issues with payments and project details. A Rhode Island Cook Services Contract - Self-Employed clearly defines your services and payment agreements, minimizing disputes. Without it, resolving misunderstandings can be difficult and may result in lost income or damaged relationships.

Yes, having a contract is essential if you are self-employed. A Rhode Island Cook Services Contract - Self-Employed provides legal protection and outlines the expectations between you and your clients. Without a contract, you may face misunderstandings or disputes regarding the scope of work and payment terms.

Yes, you can sell food from home in Rhode Island, but you'll need to comply with specific regulations. This typically includes obtaining a food processor license and following safety guidelines. Utilizing a Rhode Island Cook Services Contract - Self-Employed can assist in defining your relationship with customers and in setting clear expectations about your home-cooked offerings.

Starting a catering business in Rhode Island involves several steps, including developing a business plan, obtaining relevant permits, and ensuring compliance with health codes. You should also market your services effectively to attract clients. Using a Rhode Island Cook Services Contract - Self-Employed can help you establish trust and professionalism as you begin to build your client base.